SEC Chairman Gary Gensler Responds to 11 Key Questions about Cryptocurrencies in a Public Interview

#SEC #Cryptocurrencies #SuperEx

With only four days left until Donald Trump’s inauguration as President of the United States, the markets and policies remain in a state of flux. Amidst this turbulence, the outgoing SEC Chairman Gary Gensler’s candid responses to 11 key questions about cryptocurrency in back-to-back interviews with CNBC and Yahoo Finance have added fuel to the fire. On January 14th, Gensler tackled topics ranging from his policy legacy to the future of cryptocurrency regulation, offering a window into the state of capital markets and crypto’s uncertain path forward. Below, we break down his insights and explore their implications.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

1. SEC’s Actions in the Final Days of Gensler’s Tenure

When asked whether the SEC would take more actions against companies like Robinhood and private equity firms, Gensler emphasized the commission’s mandate to protect investors and ensure market integrity. “Regardless of leadership changes, our role is to ensure capital markets work for the public,” he stated, reinforcing that upholding market trust benefits all stakeholders.

Takeaway: The SEC’s actions signal a consistent regulatory stance that transcends individual leadership, offering a sense of stability amid market uncertainty. This highlights that regulatory frameworks are designed to maintain continuity and uphold investor confidence, regardless of political or administrative shifts.

2. Potential Reversals of Gensler’s Policies by the Next Administration

Gensler expressed confidence in the reforms enacted during his tenure, particularly the shortening of the settlement cycle and privacy notification measures. While acknowledging the potential for change under new leadership, he argued that these policies reduce costs and promote market integrity, making them unlikely to be undone.

Takeaway: Gensler’s optimism highlights the enduring impact of key SEC reforms, despite shifts in political leadership. These changes serve as foundational improvements to market efficiency and transparency, which are likely to persist as industry standards.

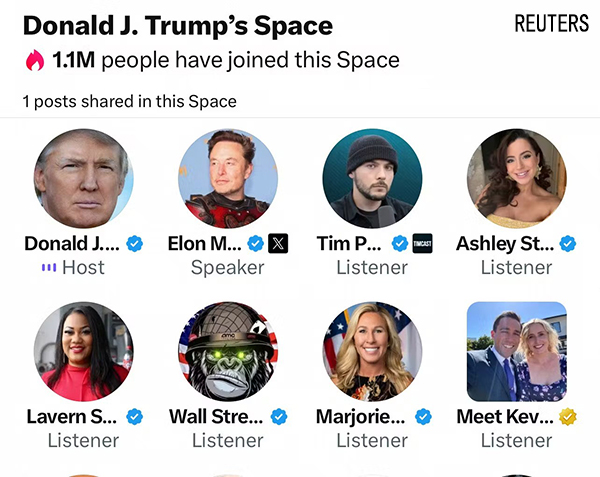

3. Crypto’s Role in Trump’s Election Victory

Dismissing claims that crypto supporters played a significant role in Trump’s election win, Gensler likened financial markets to highways, where rules apply equally to all vehicles. He stressed that compliance is essential for building trust, regardless of whether the “vehicle” is a hybrid, electric car, or cryptocurrency.

Takeaway: Gensler’s analogy underscores the SEC’s commitment to ensuring a level playing field across all asset classes, including crypto. This reinforces the idea that innovation must coexist with compliance to foster sustainable growth and trust in financial ecosystems.

4. Legal Challenges During Gensler’s Tenure

Despite losing four out of five court challenges to SEC rules, Gensler attributed these outcomes to a rapidly evolving legal landscape. He highlighted the SEC’s success in implementing 46 significant reforms, emphasizing the commission’s adherence to legislative mandates.

Takeaway: The SEC’s reform achievements demonstrate its resilience and ability to navigate legal hurdles. This persistence exemplifies the importance of adapting regulatory strategies to align with dynamic market and judicial environments.

5. Approval of Spot Bitcoin and Ethereum ETFs

Gensler addressed the approval of spot Bitcoin and Ethereum ETFs, acknowledging that these products provide investors with better protections and lower costs. However, he emphasized the need for disclosure and compliance for other cryptocurrencies, many of which remain unregulated.

Takeaway: While ETFs offer a safer entry point for crypto investors, the broader market’s lack of compliance poses significant risks. This calls for a balanced approach where innovation in financial products is supported by robust regulatory oversight.

6. The Future of Bitcoin

When questioned about Bitcoin’s long-term viability, Gensler refrained from making predictions but acknowledged its speculative nature. Drawing parallels to gold, he noted Bitcoin’s role as a “highly volatile asset” that has captured global attention.

Takeaway: Gensler’s cautious stance reflects the uncertainty surrounding Bitcoin’s future while recognizing its established presence in financial markets. Investors should remain vigilant and informed when navigating such speculative assets.

7. Personal Stance on Cryptocurrencies

Gensler revealed that he has never owned any cryptocurrency, maintaining a neutral position throughout his tenure. This detachment underscores his regulatory focus on fairness and compliance rather than personal investment.

Takeaway: Gensler’s impartiality reinforces his credibility as a regulator. This neutral stance strengthens public trust in his leadership and ensures that regulatory decisions are free from personal bias.

8. Views on Prediction Markets

Addressing the broader concept of prediction markets, Gensler described them as extensions of capital markets, emphasizing the importance of meaningful disclosures to enable informed decision-making.

Takeaway: Transparency remains a cornerstone of Gensler’s regulatory philosophy, extending to emerging market sectors like prediction markets. This approach ensures that participants have access to critical information to evaluate risks and opportunities effectively.

9. Criticism of the SEC’s Litigation Approach

Responding to accusations of over-reliance on litigation, Gensler argued that the SEC’s actions are grounded in existing laws. He highlighted the need for compliance in the crypto sector, which often operates on sentiment rather than fundamentals.

Takeaway: Gensler’s defense underscores the SEC’s commitment to enforcing rules, even in uncharted territories like crypto. This reflects the necessity of upholding legal frameworks to prevent exploitation and maintain market integrity.

10. Biggest Risks Facing the Market

Gensler identified policy uncertainty and leverage in capital markets as significant risks. He also pointed to the transformative impact of AI, which, while enhancing productivity, introduces new challenges.

Takeaway: Emerging technologies and economic transitions present both opportunities and risks for investors. A proactive approach to understanding these dynamics is essential for navigating an evolving financial landscape.

11. Reflections on Regret

Looking back, Gensler wished for earlier completion of key reforms and better anticipation of legal challenges. He acknowledged the difficulty of navigating a rapidly changing judicial landscape.

Takeaway: Gensler’s reflections highlight the challenges of balancing ambition with pragmatism in regulatory leadership. This underscores the importance of continuous learning and adaptation in policymaking.

Conclusion

Gary Gensler’s tenure as SEC Chairman has been marked by bold reforms and unwavering commitment to market integrity. His final interviews reveal a regulator deeply invested in fostering trust and compliance, particularly in the burgeoning crypto sector. As the SEC transitions to new leadership, the legacy of Gensler’s policies will likely influence the future direction of both traditional and digital financial markets. For investors and market participants, his insights offer valuable guidance in navigating an era of uncertainty and transformation.

Responses