SuperEx丨2025: The Year of Explosive Growth for Web3 Application Layer

#SuperEx #2025 #Web3

In 2024, Web3 experienced a shift from financial applications to broader consumer applications, marking the maturation and further popularization of the Web3 industry. This signals the beginning of a new phase for the sector.

With continued innovation in blockchain technology, decentralized finance (DeFi), NFTs, and decentralized social networks, 2025 is widely expected to be the year when Web3 applications will experience explosive growth. This article will delve into the major transformations Web3 applications will undergo in 2025, from three aspects: technology, market, and policy environment, and how investors and developers can seize this historic opportunity.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

The Foundation for the Explosion of Web3 Applications: Comprehensive Maturity of Technology and Ecosystem

Evolution of Technological Foundations

- Cross-chain Technology Improvement

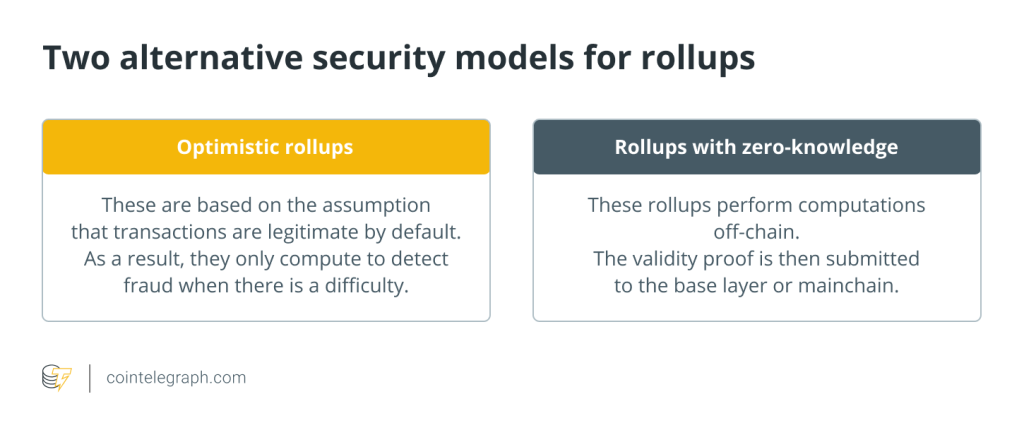

The explosion of Web3 applications depends on the support of underlying technologies. With the maturation of cross-chain technology, protocols such as Polkadot, Cosmos, and LayerZero have significantly enhanced interoperability between different blockchains. Cross-chain technology breaks the limitations of blockchain silos and provides more diversified options and a seamless user experience for the application layer. - Layer 2 Scalability Solutions

Layer 2 technologies like Arbitrum, Optimism, and zkSync made significant breakthroughs in 2024, greatly reducing transaction costs on blockchains while improving processing speed. This sets the foundation for improving the user experience of DApps (decentralized applications), enabling them to compete with traditional Web2 applications. - Account Abstraction and Enhanced Developer Tools

Account abstraction and the popularization of smart contract wallets allow users to easily use blockchain applications without managing complex private keys. This will attract more non-technical users into the Web3 ecosystem. Furthermore, new development toolchains like Hardhat, Foundry, and emerging smart contract languages such as Move and Sway are lowering development barriers and accelerating application development.

Thriving Ecosystem

- DeFi 3.0 and Integration with Real World Assets (RWA)

In 2025, DeFi will deeply integrate with real-world assets (such as real estate, carbon credits, and bonds), becoming an important part of the financial markets. DeFi protocols are transitioning from the “high-risk, high-reward” speculative model to a “low-risk, high-efficiency” asset management model, attracting more institutional and traditional capital. - NFTs Evolving from Collectibles to Functional Assets

The use of NFTs is expanding from art and profile pictures to gaming items, social identity markers, memberships, and intellectual property. Future NFTs will not only represent assets but also serve as important building blocks in the Web3 ecosystem, driving deeper integration with Metaverse and GameFi. - Rise of Decentralized Social and Content Platforms

Decentralized social protocols like Lens Protocol and Farcaster have begun to show their appeal. These platforms focus on user data sovereignty and enable content creators to directly monetize through token incentives, challenging the traditional Web2 platform model.

Market Drivers: User Demand and Capital Influence

Changing User Habits

- Widespread Adoption of Digital Identities

By 2025, more users will embrace decentralized identities (DID) as their primary form of online identity. This identity can enable cross-platform logins, protect privacy, and give users full control over their data. - Improved User Experience

As technology advances, the user interfaces and operational logic of Web3 applications will become simpler and more intuitive. This “user-friendly blockchain” experience will bring Web3 closer to ordinary people.

Capital Boost

- Increased Institutional Investment

According to statistics, venture capital entering the Web3 space grew by 45% in 2024, and many traditional enterprises are also entering Web3 by creating DAOs, issuing tokens, or partnering with blockchain projects. By 2025, these funds will focus on projects in the application layer, driving further innovation. - Game, Entertainment, and Sports Industry Involvement

The gaming industry has realized true asset ownership through NFTs, while the music and film industries are using blockchain to ensure transparent royalty distribution. The sports industry has strengthened its interaction with fans through token economies. The involvement of these industries not only brings new users but also provides Web3 applications with more extensive use cases.

The Policy Environment: Gradual Clarification

The prosperity of Web3 is closely tied to supportive policies. By the end of 2024, global regulatory frameworks for digital assets will continue to improve, providing Web3 applications with a stable legal environment.

- Acceleration of Compliance in the US and Europe

The US has clarified the regulatory scope of the SEC and CFTC over crypto assets, while Europe has implemented the MiCA (Markets in Crypto-Assets) regulation, providing clear compliance guidelines for Web3 entrepreneurs. - Innovation Push in Asia

Singapore, Hong Kong, Japan, and other regions continue to maintain an open stance on Web3 innovation, attracting global developers and capital through tax incentives and regulatory sandboxes. - CBDC and Web3 Integration

In 2025, central bank digital currencies (CBDCs) will begin to integrate with the Web3 ecosystem, offering more possibilities for decentralized finance and payment systems.

Seizing the Historic Opportunity of 2025: A Guide for Developers and Investors

Opportunities for Developers

- Deepening Vertical Markets

Developers can focus on niche markets, such as NFT + education, DeFi + insurance, decentralized social + data privacy, and create targeted solutions. - User Experience Focus

Successful Web3 applications will no longer rely on complex technologies as selling points but will attract users through exceptional user experiences. Features like one-click login, one-click payments, and multi-chain compatibility will be key competitive factors. - Cross-chain Compatibility and Interoperability

Building DApps that support multiple blockchains will be the future trend. Developers should leverage cross-chain protocols and standards to enhance product market appeal.

Opportunities for Investors

- Focus on Application Layer Projects

Investors should shift their focus from underlying protocols to the application layer, seeking projects that truly address user pain points and provide clear value. - Assess Team and Community Potential

The execution ability of the team and the engagement of the community will be key indicators for evaluating the value of Web3 projects. - Balancing Long-term Value and Short-term Trends

Investors need to balance investments in short-term trends (such as GameFi) and long-term value (such as decentralized storage) to diversify risks.

2025 will undoubtedly be a year of explosive growth for Web3 applications. The maturation of underlying technologies, changing user demands, capital support, and policy clarity provide the foundation for this prosperity. Whether you are a developer or an investor, now is the time to seize this historic opportunity and become a part of shaping the future of the internet.

Web3 is not an isolated technological field; it is a global social, economic, and technological revolution. Let us look forward to 2025 and witness how this transformation will change the way we live and work.

Responses