SuperEx丨FTX Officially Announces Bankruptcy Plan Activation, First Compensation to Be Completed Within 60 Days

#SuperEx #FTX #Cryptoexchange

Today, FTX officially announced that its bankruptcy plan took effect on January 3, 2025, local time. According to the previously disclosed details, the first round of compensation is expected to be completed within 60 days.

On January 3, 2025, FTX officially announced that its bankruptcy plan had taken effect. According to the disclosed details, the first round of compensation is expected to be completed within 60 days. This milestone marks a significant step forward for the embattled exchange and its creditors. To fully understand the implications of this announcement, it is essential to revisit the FTX saga, its far-reaching impact, and the potential outcomes of the compensation plan.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

The FTX Collapse: From Crypto Giant to Catastrophe

FTX was once one of the most prominent cryptocurrency exchanges globally, and its founder, Sam Bankman-Fried (SBF), was hailed as a visionary leader in the crypto industry. However, the sudden collapse of FTX in November 2022 shocked the market and left millions of investors in financial limbo.

How It All Began

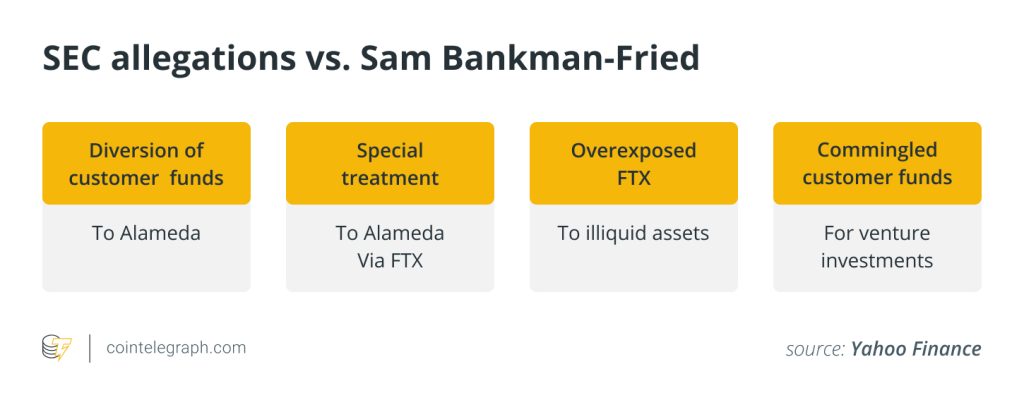

The downfall of FTX started with revelations about its sister company, Alameda Research. Reports surfaced that a significant portion of Alameda’s balance sheet was composed of FTT tokens (FTX’s native token), making its financial stability heavily dependent on FTT’s market performance.

This revelation prompted Binance, a rival exchange, to liquidate its FTT holdings, triggering a cascade of panic selling. Within days, FTT’s price plummeted by over 90%, and FTX faced a liquidity crunch as users rushed to withdraw funds. Despite desperate attempts by SBF to secure emergency funding, the efforts failed. On November 11, 2022, FTX filed for bankruptcy, and SBF stepped down as CEO.

The Ripple Effects of FTX’s Collapse

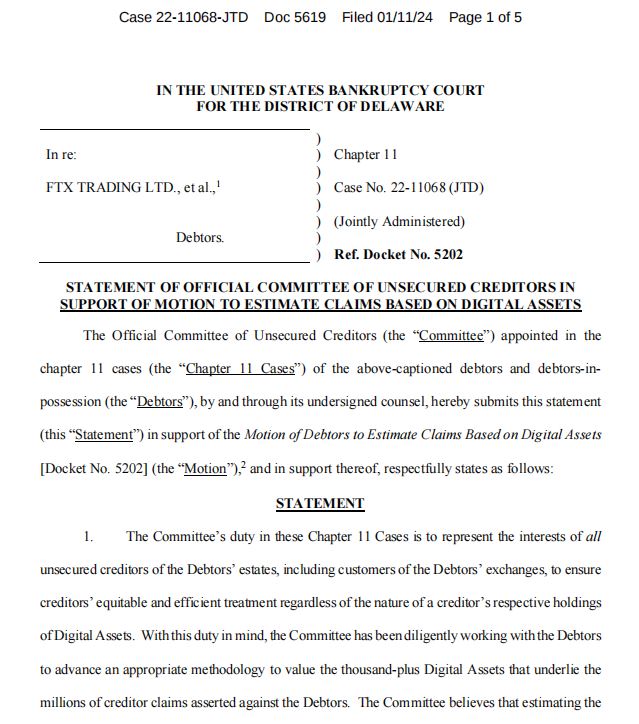

Impact on Investors

FTX’s bankruptcy directly affected millions of investors, ranging from retail users to institutional players. According to bankruptcy filings, FTX owed creditors over $8 billion, but its liquid assets were far from sufficient to cover these liabilities. Many users found their funds frozen, sparking widespread frustration and legal battles.

Industry-Wide Consequences

The FTX debacle had profound ramifications for the cryptocurrency industry. Trust in centralized exchanges (CEXs) plummeted, and the incident invited heightened regulatory scrutiny. In the aftermath, regulators such as the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) intensified their oversight of the crypto space.

The collapse also had a cascading effect on other companies. Many projects and firms that relied on FTX for liquidity or partnerships were left stranded, leading to a wave of closures and bankruptcies.

A Moment of Reflection

FTX’s collapse became a catalyst for industry introspection. The lack of transparency and centralized control at FTX highlighted systemic issues within the crypto ecosystem. In response, many exchanges began voluntarily publishing proof-of-reserves data, aiming to rebuild user trust.

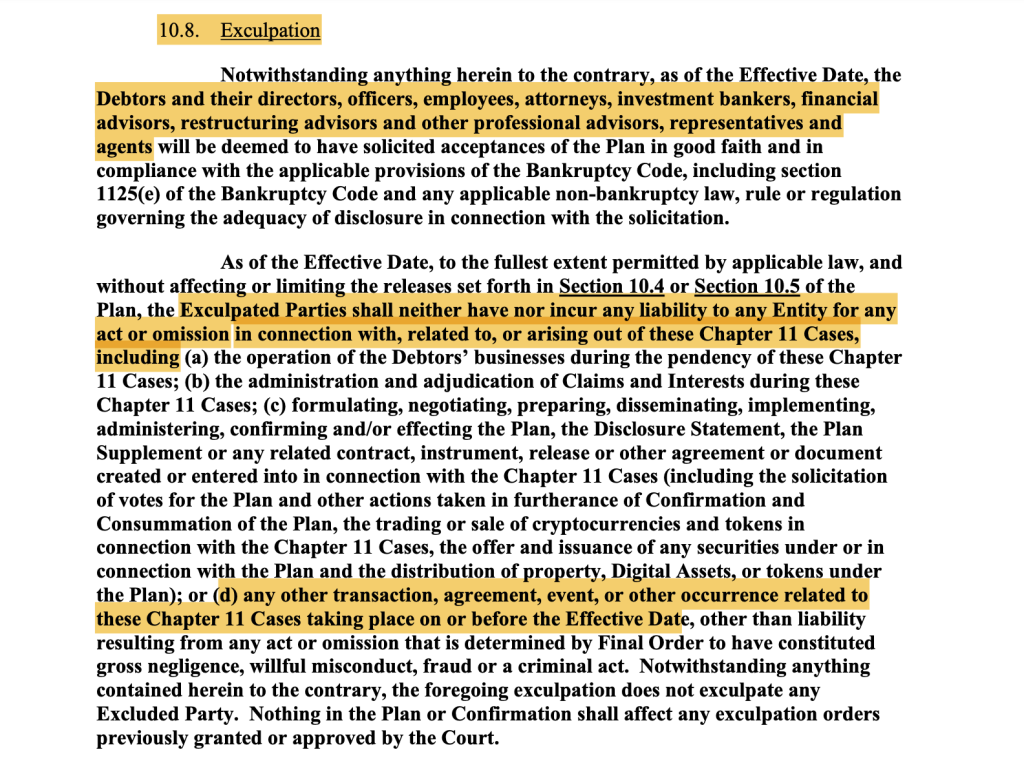

The Bankruptcy Plan and Its Implications

With the bankruptcy plan now in effect, the initiation of compensation offers hope to affected users and signals progress in resolving one of the largest financial crises in cryptocurrency history.

Significance for Creditors

For creditors, the activation of the bankruptcy plan is a long-awaited development. Reports indicate that the initial round of payouts will prioritize smaller creditors to alleviate the hardships faced by ordinary investors. While the exact repayment percentage remains uncertain, this marks the first tangible step toward restitution.

Rebuilding Trust in the Market

The enforcement of the compensation plan is also a symbolic victory for the crypto industry. It demonstrates that even in the face of a monumental collapse, legal and procedural frameworks can provide a path to justice and resolution. This may encourage users to return to the market, albeit with greater caution.

Potential for Industry Reinvigoration

The successful implementation of the compensation plan could serve as a turning point for the industry. It underscores the importance of asset protection and transparency and encourages other platforms to strengthen their financial and operational safeguards.

The Road Ahead: Lessons from the FTX Crisis

While the compensation plan is a positive step forward, the broader implications of the FTX collapse will continue to shape the industry for years to come.

Stricter Regulation and Compliance

The downfall of FTX exposed the vulnerabilities of unregulated or lightly regulated crypto platforms. Moving forward, global regulators are expected to accelerate the introduction of stricter rules. For example, the U.S. may expedite the Digital Asset Market Structure Bill, while the European Union further refines its Markets in Crypto-Assets (MiCA) framework.

Advancing Decentralization and Transparency

The FTX crisis has reignited interest in decentralized finance (DeFi) and self-custody solutions. Users are increasingly exploring alternatives to centralized exchanges, such as decentralized platforms and hardware wallets. Blockchain technology’s potential to enhance transparency and trust is gaining broader recognition, paving the way for new innovations.

Greater Awareness Among Investors

FTX’s collapse served as a wake-up call for investors, emphasizing the need for due diligence. Going forward, users are likely to scrutinize project fundamentals, reserve proofs, and governance structures before entrusting their assets to any platform.

Conclusion

The FTX saga is a stark reminder of both the potential and the pitfalls of the cryptocurrency industry. From its meteoric rise to its devastating fall, FTX’s story encapsulates the risks inherent in an unregulated and rapidly evolving market. However, the activation of its bankruptcy plan and the commencement of compensation signal a step toward accountability and recovery.

Responses