SuperEx丨Why is it necessary to continuously promote the expansion of the BTC concept?

#SuperEx #BTC #Crypto

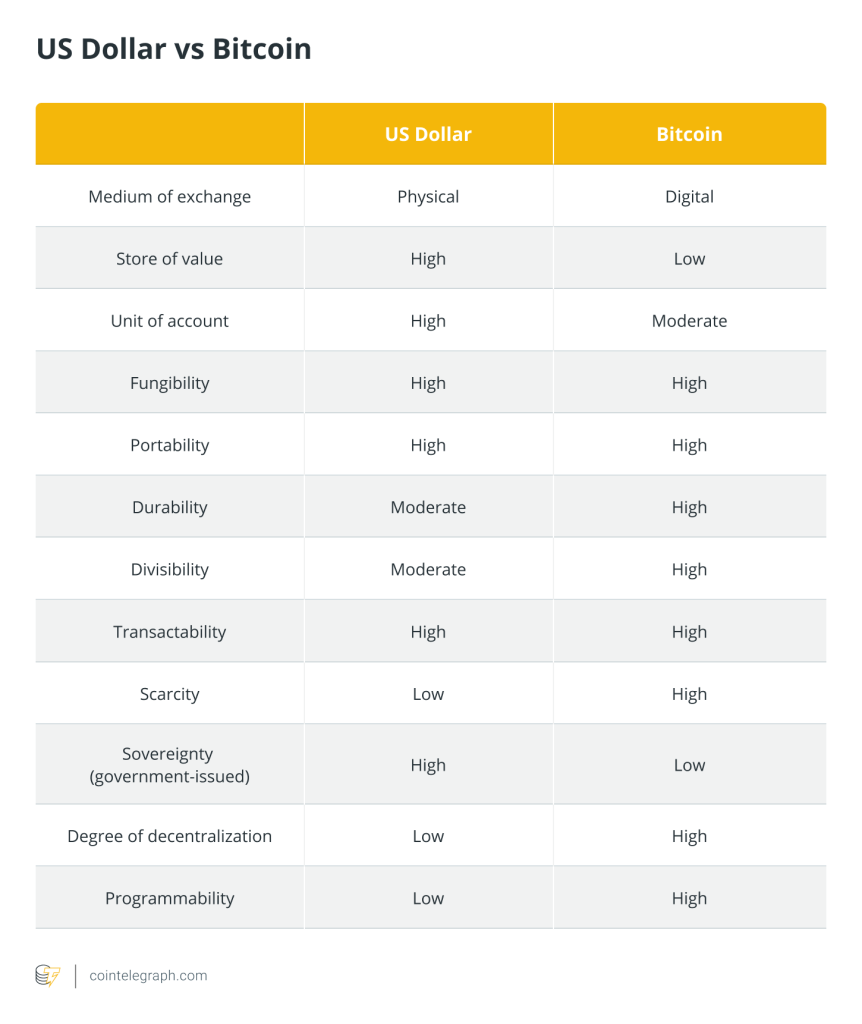

Bitcoin (BTC) has come a long way since its inception in 2009. It started as a peer-to-peer electronic cash system, a decentralized digital currency aimed at disrupting the traditional financial system. Over the years, Bitcoin has evolved into what is often referred to as “digital gold,” becoming a store of value and an asset class in its own right.

Despite this success, Bitcoin’s true potential remains largely untapped in many respects, and the concept of Bitcoin continues to expand as new technologies and use cases emerge.

Recently, new concepts such as Inscriptions and Runes have started gaining traction, signaling a shift towards expanding Bitcoin’s role beyond just a payment system or a store of value. These innovations open up new possibilities for Bitcoin, offering it new functionalities and applications that could significantly reshape its place in the broader cryptocurrency ecosystem. In this article, we will explore why it is essential to push for the continuous expansion of the BTC concept, focusing particularly on these new emerging technologies.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Inscriptions and Runes: Bitcoin’s Emerging Use Cases

Inscriptions and Runes represent two of the most promising developments within the Bitcoin ecosystem in recent years. These concepts are not just theoretical; they represent real innovations that have the potential to significantly expand Bitcoin’s capabilities.

1. Inscriptions: Turning Bitcoin into a Decentralized Content Storage Network

Inscriptions allow for the storage of non-financial data on the Bitcoin blockchain. Traditionally, Bitcoin has been known for its role as a transfer and store of value for monetary transactions. Its blockchain, however, has been limited to recording financial data, such as the sender and receiver addresses and the amount of BTC transferred. With the advent of Inscriptions, Bitcoin can now store much more than just transactional data — it can support text, images, video, and other forms of digital content.

The ability to inscribe data onto the Bitcoin blockchain opens up a wide range of new use cases. Artists can now permanently inscribe their works into the blockchain, ensuring authenticity and ownership, while protecting their intellectual property from tampering. In the same vein, digital identities, legal documents, and even entire databases can be permanently recorded on Bitcoin, creating a truly decentralized, immutable storage platform. This is in stark contrast to centralized platforms where data can be manipulated or lost due to server failures or hacking.

Inscriptions could also play a crucial role in sectors like supply chain management, digital rights management, and even decentralized social media, allowing individuals to preserve and share content in a secure, censorship-resistant manner. For Bitcoin to maintain its relevance and expand its role in the digital world, moving beyond merely being a payment system and establishing itself as a content and data storage platform is an essential step.

2. Runes: Bringing Smart Contracts to Bitcoin

Another key innovation that has emerged in recent years is Runes. Runes are essentially Bitcoin’s version of smart contracts, enabling programmability within the Bitcoin ecosystem. While Ethereum has long been known for its ability to run smart contracts, Bitcoin, by design, lacks this functionality. This has traditionally been seen as a limitation, as Bitcoin has been relegated primarily to simple transactions, without the ability to execute more complex logic or create decentralized applications (dApps).

Runes change this narrative by introducing a way to write and execute programmable scripts directly on the Bitcoin network. By leveraging Bitcoin’s inherent security, decentralization, and immutability, Runes offer a way to add smart contract functionality to Bitcoin without compromising the integrity of the network. This development allows Bitcoin to compete in the decentralized finance (DeFi) space, enabling more advanced financial applications, like lending, borrowing, and decentralized exchanges (DEXs), while retaining Bitcoin’s key advantages, such as its security and stability.

The potential applications of Runes are vast. For example, decentralized autonomous organizations (DAOs) could be built on Bitcoin, allowing decentralized governance in a secure and permissionless environment. Similarly, Runes could be used to facilitate tokenized assets, stablecoins, and even interoperability between different blockchains. By integrating programmability into Bitcoin, Runes significantly expand Bitcoin’s functionality, allowing it to be used for a wide variety of decentralized applications that were previously only possible on other blockchain platforms like Ethereum.

Why It’s Crucial to Keep Pushing for Bitcoin’s Conceptual Expansion

The emergence of Inscriptions and Runes highlights the importance of constantly pushing for the expansion of Bitcoin’s conceptual framework. Here are several reasons why it is crucial to keep evolving Bitcoin and pushing its capabilities further.

1. Meeting the Growing Demand of the Market

As the cryptocurrency industry matures, the demand for blockchain-based solutions is rapidly diversifying. Initially, Bitcoin was seen primarily as a digital currency for transactions, but over time, the market has shifted towards more complex use cases, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and even decentralized social media. Users no longer view Bitcoin solely as a store of value but as a potential multi-purpose platform.

Inscriptions and Runes represent Bitcoin’s response to this changing market demand. By enabling Bitcoin to store more types of data and run complex smart contracts, these innovations open the door to Bitcoin becoming a key player in a broader range of sectors beyond finance, including entertainment, governance, and digital identity. Expanding Bitcoin’s use cases will allow it to remain competitive with other blockchain networks, particularly those that have emerged as platforms for decentralized applications (e.g., Ethereum, Solana, and Polkadot).

2. Enhancing Bitcoin’s Practicality and Scalability

Although Bitcoin is the most widely recognized cryptocurrency, its practical use has traditionally been limited to peer-to-peer transactions and as a store of value. Bitcoin’s original design was not intended to support more complex applications, such as decentralized finance (DeFi) protocols or NFTs, which have become increasingly popular in recent years. The introduction of Inscriptions and Runes enhances Bitcoin’s scalability, making it capable of supporting more complex use cases while retaining its core features, such as decentralization and security.

Inscriptions turn Bitcoin from a simple digital currency into a platform for permanent, decentralized storage, while Runes bring programmability to Bitcoin, allowing for more complex transactions and automated processes. Together, these developments make Bitcoin more adaptable to the needs of a growing decentralized ecosystem. As the cryptocurrency market continues to evolve, Bitcoin must evolve with it, expanding its functionality and scalability to meet the demands of users and developers alike.

3. Ensuring Bitcoin’s Innovation and Long-Term Viability

For Bitcoin to remain relevant in the rapidly evolving blockchain space, it must continue to innovate. In the past, Bitcoin’s lack of programmability and limitations in transaction processing speed and scalability have made it appear less competitive compared to other smart contract platforms like Ethereum. However, the development of Inscriptions and Runes demonstrates that Bitcoin is not stagnant — it is evolving to meet the changing needs of the market.

The continuous expansion of Bitcoin’s concept, through innovative technologies like Inscriptions and Runes, ensures that Bitcoin remains at the forefront of blockchain technology. This ongoing innovation will allow Bitcoin to maintain its dominant position in the cryptocurrency market, positioning it as more than just a store of value but as a versatile, multifaceted platform with applications that span multiple industries.

Challenges and Future Outlook

While the introduction of Inscriptions and Runes represents a significant step forward for Bitcoin, these innovations are not without challenges. One of the key challenges is Bitcoin’s current scalability. While Inscriptions and Runes open up new possibilities, Bitcoin’s transaction throughput remains limited compared to other blockchain networks, particularly when dealing with large amounts of data or more complex transactions. As Bitcoin’s use cases expand, the network will need to scale to handle the increased demand for both storage and processing power.

Another challenge is Bitcoin’s energy consumption. As the Bitcoin network grows and becomes more complex with new features like Inscriptions and Runes, energy consumption could increase. Finding solutions to reduce Bitcoin’s environmental impact will be critical to its long-term sustainability.

Nevertheless, the potential for Bitcoin to continue growing and evolving remains strong. Innovations like Inscriptions and Runes point the way forward, showing that Bitcoin can adapt to new technologies and use cases without losing its core attributes — security, decentralization, and immutability.

Conclusion

The expansion of Bitcoin’s conceptual framework is not just an option — it is a necessity for its continued success and relevance in the rapidly changing blockchain landscape. Through innovations such as Inscriptions and Runes, Bitcoin is proving that it can evolve from a simple payment tool to a versatile, multi-functional platform with applications spanning a wide array of industries. While challenges remain, the future of Bitcoin is bright, with these new concepts paving the way for its continued growth and innovation. As the crypto market matures, Bitcoin’s role will only become more crucial, and by pushing the boundaries of its capabilities, we ensure that it remains a dominant force in the world of decentralized finance and beyond.

Responses