SuperEx丨Delve deeply into the main thread of this bull market.

#SuperEx #crypto #web3

The cryptocurrency market is once again in the spotlight, with November 2024 marking the onset of a new bull run. This rally, however, is more than a price surge; it reflects a transformative shift across technology, market structure, participation, and global policy. In the previous articles, we have analyzed in detail the causes and trends of the current bull market. Today, through our meticulous observation of this bull market, we will sort out four main threads that are driving the development of the market.

- Technology-driven industry upgrading;

- Stratified performance of asset classes;

- Diversification of the structure of market participants;

- Driving force from regional policy hotspots.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

1. Technological Innovation: The Core Driver

1.1 High-Performance Chains and Layer 2 Scaling

Technological advancements underpin this bull market, with Layer 2 scaling solutions and high-performance chains taking center stage.

Ethereum Layer 2 Expansion: The adoption of EIP-4844 introduced Proto-Danksharding, reducing transaction costs and enhancing scalability. Total Value Locked (TVL) in Ethereum Layer 2 solutions has surged by over 50% since 2023, providing fertile ground for developers and users.

Solana’s Continued Dominance: With its high throughput and low transaction costs, Solana maintains a competitive edge. The blockchain’s daily active user count surpassed 2 million, with transaction volumes exceeding 100 million per day, accounting for 15% of all blockchain transactions globally.

1.2 The Rise of AI in Blockchain

The integration of AI with blockchain has emerged as a dominant narrative for this bull run.

AI-Driven On-Chain Data Analysis: AI enhances blockchain data processing, enabling applications like automated smart contract generation and on-chain credit scoring.

SocialFi and GameFi Synergy: AI-powered matchmaking and personalized experiences have revitalized these sectors. Platforms such as Friend.tech reported a 300% year-on-year increase in active users.

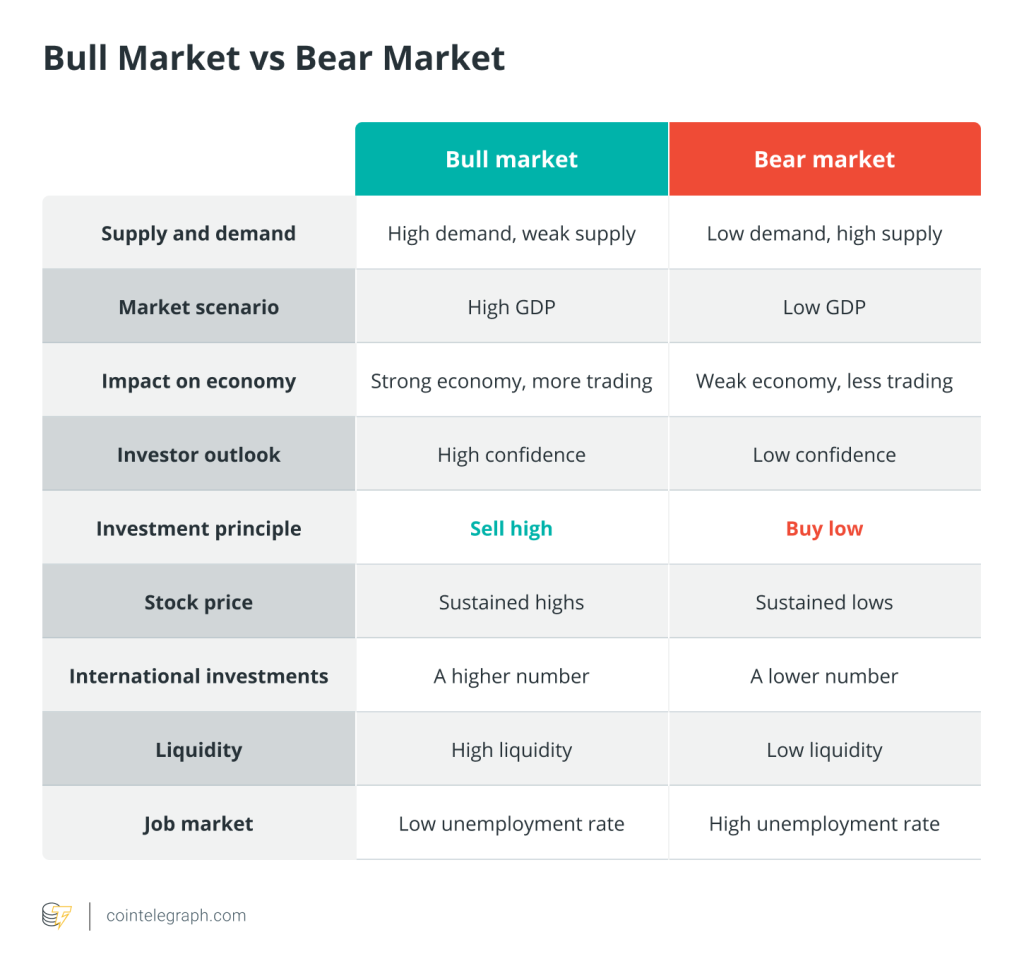

2. Asset Stratification: Clear Performance Layers

Asset behavior during this bull market has shown distinct stratification, with clear trends across different classes.

2.1 Core Assets: Stability Amidst Growth

Flagship cryptocurrencies like BTC and ETH provided a solid foundation for the rally.

BTC as Digital Gold: Expectations around Bitcoin ETF approvals drove its price past $100,000, representing an 80% annual gain. Institutional holdings of BTC grew by 20%, highlighting its appeal as an inflation hedge.

ETH’s Continued Relevance: Ethereum’s role in DeFi and NFT ecosystems remained critical. DeFi TVL rebounded to $150 billion, while blue-chip NFTs like CryptoPunks retained strong interest among high-net-worth investors.

2.2 Small-Cap Tokens and MEME Coins

MEME coins captured market enthusiasm, echoing the fervor of the 2021 NFT boom.

Social Media-Driven Hype: Tokens like PEPE and Shiba Inu saw exponential growth fueled by platforms like Twitter and Reddit.

High Volatility, High Rewards: While risky, these tokens drove significant trading activity, with daily volumes exceeding $3 billion, representing 18% of the total.

2.3 Emerging Sectors

New verticals like SocialFi and GameFi delivered promising results.

SocialFi platform Friend.tech grew its monthly trading volume by over 35%, boosting the sector’s TVL to $5 billion.

GameFi 2.0 projects leveraged AI to improve user engagement and refine economic models.

3. Participant Structure: A New Balance

The changing composition of market participants has been a defining feature of this bull run.

3.1 Institutional Influx

Institutional investors have significantly impacted the market this cycle.

ETF Approvals and Capital Inflows: BTC spot ETFs from BlackRock and Fidelity attracted over $15 billion in fresh capital, enhancing liquidity.

Diversification in Crypto Holdings: Beyond BTC and ETH, institutions explored Layer 2 tokens (e.g., ARB, OP) and GameFi assets.

3.2 Retail Enthusiasm

Retail investors remain a key driving force, particularly in high-volatility segments.

Small-cap and MEME coins were particularly popular among retail traders seeking quick gains.

Social media amplified Fear of Missing Out (FOMO), pushing MEME coin speculation to new heights.

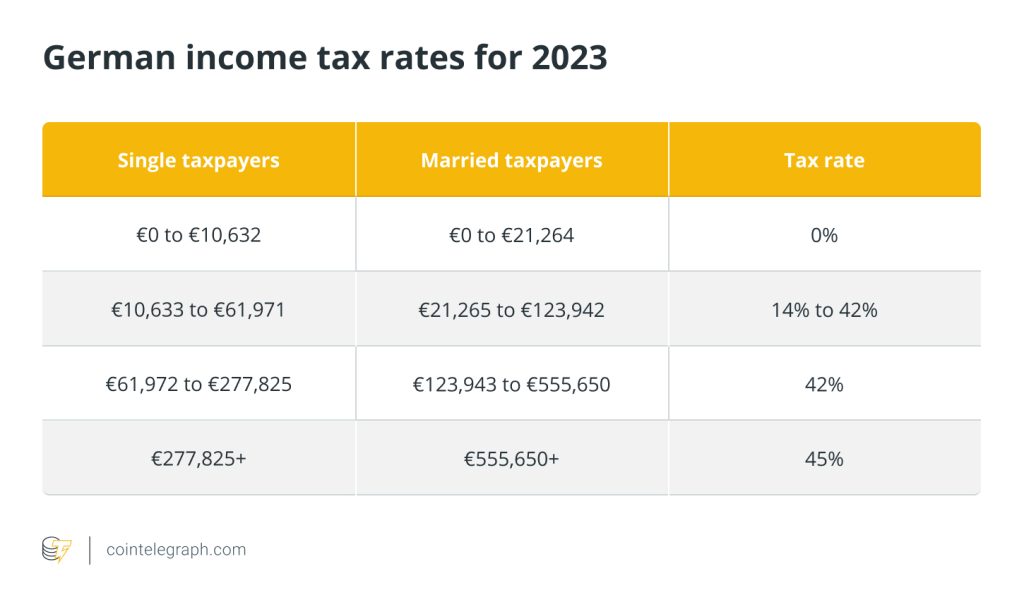

4. Regional Policy Hotspots: A Multi-Polar Bull Market

Geopolitical and regulatory developments have added unique dimensions to this bull market.

4.1 Asia’s Strategic Support

Asia renewed focus on blockchain innovation has fueled growth.

Policy Clarity: Supportive measures for blockchain adoption have fostered an innovation-friendly environment.

Hong Kong’s International Role: Hong Kong’s Web3 initiatives attracted global projects and exchanges.

4.2 U.S. Regulatory Shifts

Despite past regulatory challenges, 2024 has seen a pivot toward constructive engagement.

The SEC’s approval of BTC spot ETFs was a major catalyst for institutional adoption.

Coinbase’s collaboration with the U.S. government signaled a shift toward mainstream financial integration.

4.3 Europe’s Regulatory Framework

The EU’s implementation of the MiCA framework provided much-needed clarity, boosting confidence among institutional investors.

Finally In conclusion To conclude

The main trajectories of the 2024 bull market can be summarized as follows:

1. Technological Advancements: Innovations in Layer 2 solutions and AI integration have driven unprecedented growth.

2. Asset Stratification: Stable core assets provided a foundation, while MEME coins and emerging sectors added dynamism.

3. Participant Diversification: Institutions and retail traders collaborated to fuel market momentum.

4. Regional Policy Synergy: Asia, the U.S., and Europe contributed to a multi-polar growth narrative.

Looking ahead, several factors will shape the market’s trajectory: breakthroughs in privacy-preserving technologies, deeper integration of blockchain with AI, and evolving regional regulations. The 2024 bull market not only reflects the industry’s current maturity but also sets the stage for sustainable growth and innovation in the years to come.

Responses