SuperEx丨Microsoft plans to invest in Bitcoin to mitigate profit erosion caused by inflation.

#SuperEx #Microsoft #Bitcoin

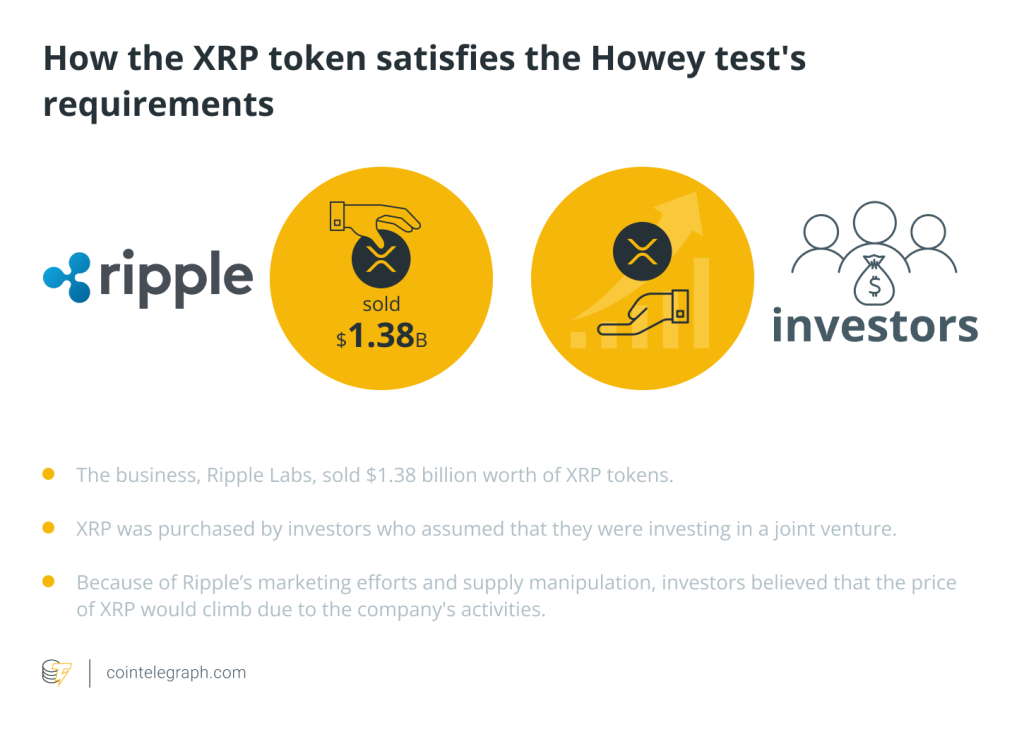

On October 27th, according to the documents filed by the U.S. Securities and Exchange Commission (SEC) on Thursday, Microsoft, the software giant with a market capitalization exceeding $3 trillion, will hold a vote on the “Evaluation of Bitcoin Investment” at its shareholders’ meeting to be convened on December 9th. The proposal was put forward by the National Center for Public Policy Research, which is conservative and related to Project 2025. The center described Bitcoin as “an excellent, if not the best, inflation hedge tool”, which is an important reason for presenting this proposal to Microsoft.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

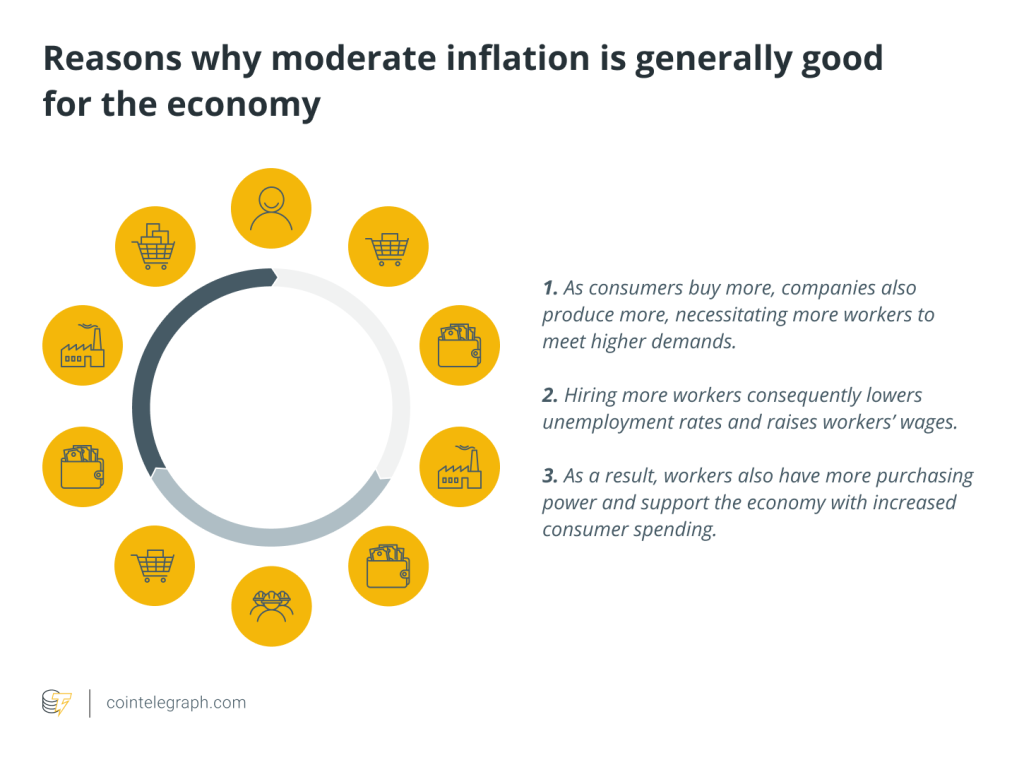

In the SEC filings, Microsoft pointed out that during periods when inflation persists and is usually quite severe, the company’s financial situation depends not only on its own operating conditions but also on the accumulation of profits from its own business operations.

Companies that invest their assets wisely can (and often do) increase shareholder value more than those that don’t but have higher profits. Therefore, it is the company’s responsibility to maximize shareholder value by striving to increase profits and protecting these profits from depreciation.

According to the analysis of several financial institutions, Microsoft’s consideration of Bitcoin as a hedging tool undoubtedly represents a new attempt by traditional technology giants to combat inflation. With the continuous interest rate hikes by the Federal Reserve and the continuous fermentation of global supply chain issues, enterprises, while facing shrinking profits, have also begun to gradually attach importance to alternative investment channels. Recently, the “digital gold” characteristics of Bitcoin have attracted the attention of a large number of institutional investors, making Bitcoin a potential choice for hedging against inflation.

The potential of Bitcoin as an anti-inflation tool cannot be ignored. Over the past decade, despite the significant price volatility of Bitcoin, its overall increase has far exceeded that of most traditional assets, which has led many enterprises to re-examine the proportion of digital assets in their investment portfolios. Microsoft’s current proposal aims to resist the impact of currency depreciation and enhance its financial resilience through the rational allocation of Bitcoin. This not only means that Microsoft may allocate part of its cash reserves to Bitcoin but may also further prompt more technology companies to consider the investment value of crypto assets.

Another noteworthy phenomenon is that an increasing number of large companies have gradually begun to get involved in the digital asset field. Earlier this year, companies such as Tesla and MicroStrategy significantly increased their holdings of Bitcoin, driving up market enthusiasm. Microsoft’s discussion on Bitcoin investment this time may become a new catalyst for the cryptocurrency market, attracting more enterprises to enter this field.

However, Microsoft’s proposal is not without resistance. Some shareholders believe that the high volatility of Bitcoin’s price may affect the company’s financial stability and bring potential risks. Nevertheless, such disputes also, to some extent, indicate the wait-and-see attitude of traditional enterprises when facing the digital currency market. Judging from the voting results of Microsoft’s shareholders’ meeting, if the proposal is passed, Microsoft may become the next large company to use Bitcoin as a reserve asset, which will also have a profound impact on future corporate financial management strategies.

In conclusion, Microsoft’s Bitcoin investment proposal is not only a strategic choice to cope with inflationary pressure but also represents the trend of the times in which traditional enterprises are gradually accepting digital currencies.

Responses