SuperEx丨BTC Suddenly Plunges, Reasons Behind It?

#SuperEx #BTC #Crypto

On October 21st, Bitcoin’s price dropped to $67,000, wiping out the gains of the previous three days. Some analysts suggest one possible reason for this correction is that investors, concerned about the impact of traditional markets, have reduced their exposure to Bitcoin. Currently, BTC is hovering around $66,000, with market sentiment remaining unstable. This sudden drop caught many investors off guard, especially considering the relatively stable performance of Bitcoin earlier in the year, which had fueled optimism about its future trajectory. However, this rapid correction in just a few days reveals multiple underlying risks and pressures within the market.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

1. The Impact of Traditional Markets: Reduced Risk Exposure

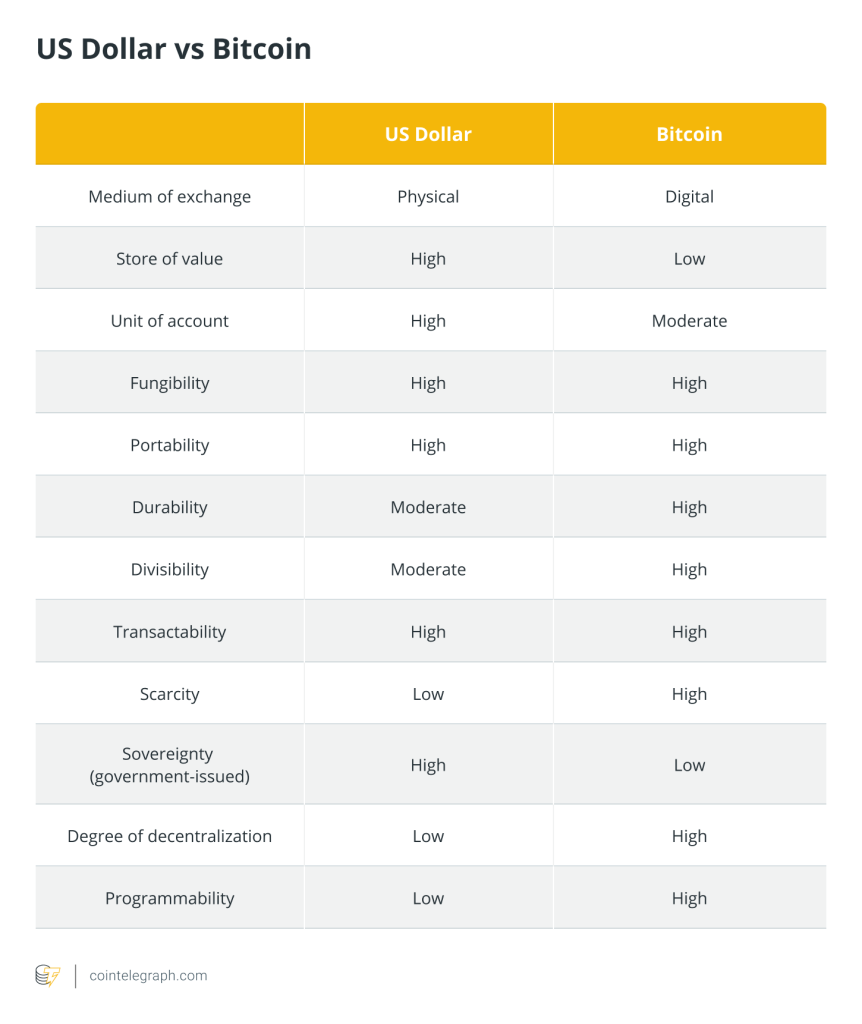

Recently, global traditional financial markets have experienced intense volatility, especially in U.S. stocks and bonds. Although Bitcoin is often regarded as “digital gold” with hedging properties, its highly volatile nature makes it one of the riskier assets. When traditional markets are under pressure, investors often reduce exposure to high-risk assets like Bitcoin in favor of more stable investments.

1.1. U.S. Stock Market Turmoil

In mid-October, the U.S. stock market experienced significant fluctuations, especially in the tech sector, triggering a chain reaction across the markets. Investors are increasingly worried about global economic slowdowns, interest rate policies, and future actions from the Federal Reserve, raising concerns about risk management. In this climate, Bitcoin, with its high volatility, became one of the first assets that investors pulled out of to adjust their portfolios. Some institutions and retail investors opted to reduce or exit their Bitcoin positions temporarily to hedge against potential risks.

1.2. Rising Bond Yields

As U.S. Treasury yields rose, the global appetite for high-risk assets declined. The U.S. 10-year Treasury yield reached key levels, prompting many investors to reassess their strategies. The allure of bonds became stronger, pulling capital out of high-risk assets like Bitcoin and further amplifying sell pressure.

2. Structural Market Factors and Short-Term Volatility

In addition to macroeconomic factors, Bitcoin’s structural market issues also intensified the extent of this correction. Unlike traditional stock markets, the liquidity and trading structures in the cryptocurrency market are more complex. This complexity, combined with the prevalence of high-leverage trading, further magnifies volatility.

2.1. Liquidation Pressure from Leveraged Trades

On-chain data indicates that Bitcoin’s price drop on October 21st and 22nd triggered a wave of leveraged trade liquidations. Leveraged trading plays a significant role in the Bitcoin market, but during market corrections, leveraged traders face forced liquidations, creating a domino effect that accelerates the price decline. This widespread liquidation amplified market volatility, causing sharp short-term fluctuations.

2.2. Lack of Liquidity

Moreover, some exchanges faced liquidity shortages during this correction, which further exacerbated the market’s volatility. Large sell orders couldn’t be absorbed quickly by the market, resulting in sustained selling pressure and rapid price drops. This highlights the ongoing liquidity challenges within the cryptocurrency market when facing extreme conditions.

3. Technical Analysis: Key Support Levels Broken and Sentiment Shift

The technical landscape also played a significant role in Bitcoin’s recent pullback. According to technical analysis, BTC broke through several critical support levels during the sell-off, which further fueled panic across the market.

3.1. Breaking of Key Support Levels

Bitcoin had been consolidating around $70,000, but as selling pressure mounted, the price failed to hold this support level, quickly breaking through $68,000 and $67,000. The breaking of these support levels dented market confidence, leading more investors to stop losses and exit their positions, pushing prices down further.

3.2. Rapid Shift in Market Sentiment

Sentiment in the crypto market often shifts more quickly and dramatically than in traditional financial markets. After Bitcoin’s rapid drop, market sentiment quickly turned to extreme fear. Negative discussions about the Bitcoin market surged across social media, further exacerbating the selling pressure. This widespread panic among investors created a self-reinforcing effect, accelerating the sell-off over the short term.

4. Pressure from Changing Global Regulatory Environment

Another long-term pressure facing the cryptocurrency market is the evolving regulatory landscape across the globe. Throughout 2024, governments worldwide have been tightening regulations on cryptocurrency, adding to market uncertainty.

4.1. U.S. Regulatory Scrutiny

The U.S. Securities and Exchange Commission (SEC) recently launched investigations into several cryptocurrency exchanges and has plans to introduce stricter regulatory frameworks. The SEC’s actions have heightened concerns about compliance, especially in the decentralized finance (DeFi) space, where regulatory uncertainty is casting a shadow. This has prompted some investors to withdraw from the crypto markets ahead of potential legal risks.

4.2. Global Compliance Tightening

Beyond the U.S., other countries are also ramping up cryptocurrency regulations. Nations like South Korea and the European Union have introduced new measures requiring exchanges to enhance user identification and anti-money laundering checks. The increase in global regulatory pressure adds to the market’s uncertainty, further impacting investor confidence.

5. Conclusion: Long-Term Opportunities Amid Short-Term Adjustments

While Bitcoin experienced significant price adjustments between October 20th and 23rd, this doesn’t necessarily alter Bitcoin’s long-term outlook. Historically, Bitcoin has undergone several sharp corrections, only for the market to recover and experience new surges afterward.

For long-term investors, this correction may present a buying opportunity. Although market sentiment is volatile in the short term, Bitcoin’s underlying value continues to be widely recognized. Investors should remain calm, carefully assess risks, and make informed decisions based on their strategies. Despite the current turbulence, Bitcoin is likely to continue serving as a hedge against global economic uncertainty, solidifying its role as “digital gold” in the future.

Responses