SuperEx丨Crypto Regulation in South Korea: Strengthening the Fight Against Illegal Practices

#SuperEx #Crypto #blockchain

The South Korean government has recently announced plans to enhance regulation of the cryptocurrency market, particularly concerning the rising issue of youth defaulting on loans due to investments in cryptocurrencies. In October 2024, a series of new policies were introduced, aimed at combating illegal trading activities and improving market transparency to protect young investors’ interests. These measures reflect the government’s heightened awareness of the potential risks associated with cryptocurrencies and aim to create a safer investment environment for the youth.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

The Appeal and Risks of Cryptocurrency

Firstly, we must acknowledge that the allure of cryptocurrency cannot be overlooked. Digital currencies like Bitcoin and Ethereum have attracted countless investors, especially among the younger generation, who aspire to achieve financial freedom through investing. However, this rapid rise often comes with significant risks. In a highly volatile market, many novice investors can easily find themselves facing financial ruin.

Moreover, many young people, lacking adequate understanding of financial markets, are blindly following trends and even taking on substantial loans to invest in cryptocurrencies. This alarming trend has drawn widespread concern, as recent surveys indicate a rising default rate among South Korean youth linked to cryptocurrency investments. Not only does this affect their personal credit, but it can also have long-lasting implications for their future.

New Regulatory Measures by the South Korean Government

In response to these issues, the South Korean government has rolled out a series of new regulatory measures in October 2024 aimed at tightening control over the cryptocurrency market. These policies primarily focus on several key areas:

Enhanced Identity Verification: All cryptocurrency exchanges must implement strict identity verification protocols to ensure the true identities of users. This measure aims to prevent money laundering and other illegal activities while enhancing market transparency.

Transaction Limits for Youth: The government has set transaction limits for young investors to reduce their risk exposure. This initiative is designed to protect these individuals from the dangers of excessive speculation.

Education and Awareness Initiatives: The government plans to launch a series of financial education programs to help young people better understand cryptocurrencies and their associated risks, thereby improving their investment literacy.

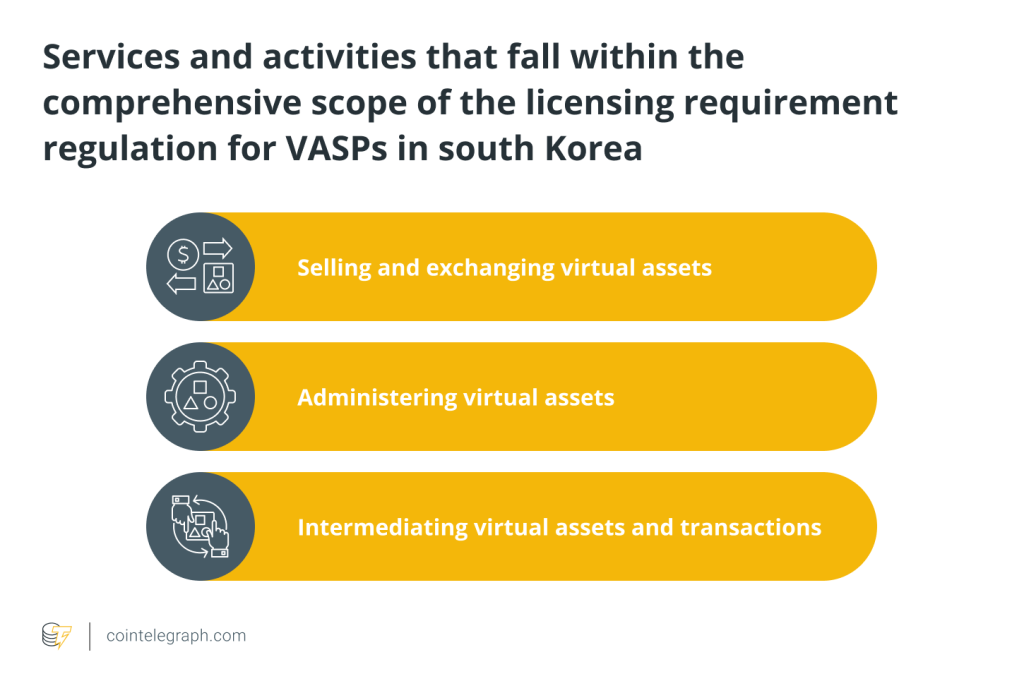

Crackdown on Illegal Platforms: There will be increased efforts to shut down unauthorized cryptocurrency trading platforms, ensuring that only licensed exchanges operate in the market.

Protecting Young Investors

These new policies undoubtedly aim to provide a protective shield for young investors. In a market filled with uncertainties, government intervention is necessary. Especially for teenagers, who may lack sufficient judgment and risk awareness, enhanced regulation can effectively reduce the financial losses stemming from investment mistakes.

However, relying solely on government regulation is not enough. Education from families and schools is equally crucial. Parents and teachers should help young people develop a correct understanding of money, emphasizing that investing is not a quick path to wealth but rather a process that requires patience and wisdom. Encouraging them to explore other investment options, such as stocks and mutual funds, can broaden their financial perspective.

Looking Ahead

As the cryptocurrency market continues to mature, regulatory frameworks will likely become more refined. The South Korean government’s efforts in this area may serve as a model for other nations. Globally, the regulation of cryptocurrencies remains a hot topic, with countries seeking a balance between protecting investors and fostering innovation.

In conclusion, the measures taken by South Korea to enhance cryptocurrency regulation represent a proactive response to the current market environment. Through these initiatives, the hope is to effectively curb the rising trend of loan defaults among young investors, enabling them to navigate their paths to financial success with greater rationality and stability. Additionally, with the combined efforts of the government, families, and society, we can help the younger generation thrive in the future financial landscape.

Responses