SuperEx丨2024 Global Ranking of Crypto-Friendly Countries: Regulation, Taxation, and Development Environment

#SuperEx #Crypto #Blockchain

The rise of cryptocurrencies has significantly impacted the financial and investment landscapes of most countries globally, becoming a force that can no longer be ignored. Many nations are actively aligning with crypto-standardization, adjusting their regulatory frameworks, and introducing legal measures to regulate the crypto industry. This includes implementing crypto-friendly policies to attract crypto businesses and investments. As of 2024, the number of such crypto-friendly nations is increasing.

According to research by Social Capital Markets, the most crypto-friendly countries globally are Dubai, Switzerland, and South Korea, with Dubai being the most supportive in terms of policies and business environment for the crypto industry. This is one reason why Dubai hosts the highest frequency of crypto summits worldwide. The report lists the top ten countries expected to have the greatest impact on the future of the crypto business, based on their regulatory policies, tax frameworks, and business environments.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Overview of Country Scores:

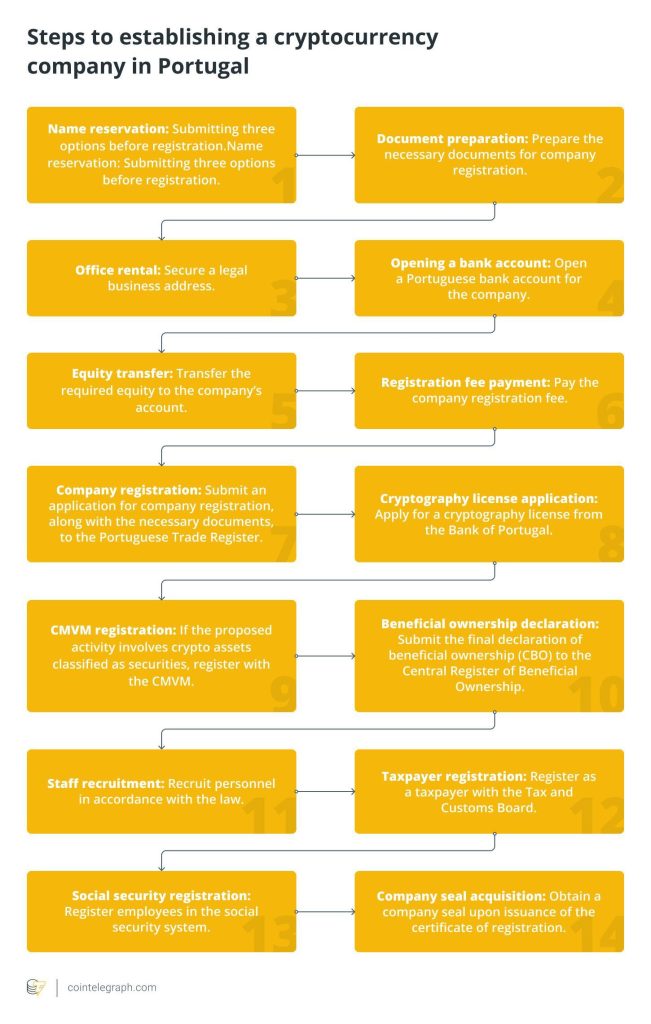

Dubai (Score: 79): Dubai leads the ranking with clear regulatory guidelines, zero capital gains tax, a 9% corporate tax rate, and low business licensing fees, making it the top destination for crypto enterprises.

Switzerland (Score: 74.5): Switzerland ranks second, with over 900 registered crypto companies. The long-term capital gains tax is just 7.8%, making it highly attractive for investors.

South Korea (Score: 73.5): South Korea ranks third and plays a pivotal role in the global crypto sector, with strong government support for blockchain innovation.

Singapore (Score: 72): Tied for fourth, Singapore’s government has provided $8.9 million in blockchain funding, offering robust support for crypto businesses.

United States (Score: 71): The U.S. leads globally in crypto adoption, with 5,968 businesses accepting crypto payments, scoring a perfect 20/20 in the adoption category.

Malta (Score: 59.5): Despite a 35% corporate tax rate, Malta’s friendly regulatory framework has attracted 15 authorized crypto firms to operate within its borders.

Portugal (Score: 51.5): Portugal has 108 businesses accepting crypto payments. Although the short-term capital gains tax is 28%, long-term investors benefit from relatively favorable conditions.

Brazil (Score: 66.5): While Brazil trails Dubai by 12.5 points, it remains a strong player in the global crypto ecosystem.

Germany (Score: 66.5): Tied with Brazil, Germany offers similar policy conditions for crypto businesses.(Data source: SocialCapitalMarkets.net)

These rankings highlight the different approaches countries are taking to foster the growth of crypto enterprises. Let’s now take a closer look at the future development trends in these crypto-friendly nations.

Future Trends in Crypto-Friendly Nations

Looking ahead, these crypto-friendly nations must build on their existing strengths while navigating the increasingly complex global regulatory environment. Dubai plans to further streamline its crypto licensing process to attract more international companies, while Switzerland continues to refine its tax policies to boost long-term capital appeal.

At the same time, South Korea is making significant strides in central bank digital currency (CBDC) development, aiming to integrate digital currencies into everyday life, which will further cement its role as a global crypto leader. Singapore will continue investing in blockchain research and incubation, striving to maintain its lead in tech innovation.

The United States, despite having stricter regulations, remains a key market for crypto businesses due to its large market size and growing adoption rates. Portugal, on the other hand, is working on lowering the tax burden for crypto enterprises to attract more innovators.

Countries like Malta and Germany, though facing higher tax rates, remain attractive due to their flexible regulatory policies and continuous support for innovation in the crypto sector.

Responses