SuperEx丨SEC delays spot Ethereum ETF options decision & FTX 2.0 relaunch rumors fail

#SEC #Ethereum ETF #FTX

Last week, two significant events occurred in the crypto space that may seem unrelated to most participants but have actually impacted many:

- SEC delays spot Ethereum ETF options decision

- FTX 2.0 relaunch rumors fail

In this article, we will analyze and interpret the impact of these two developments, one by one.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

The SEC’s delay in the decision on spot Ethereum ETF options has introduced significant uncertainty to the market.

According to documents from October 11, the U.S. SEC once again postponed its decision on spot Ethereum ETF options. The document states that the SEC delayed its decision on the proposed rule change, which would allow the Cboe exchange to list options tied to several popular spot Ethereum ETFs. The deadline for the ruling has been moved from October 19 to December 3. Bloomberg Industry Research Analyst James Seyffart noted that BTC ETF options are likely to launch in the U.S. in the first quarter of 2025.

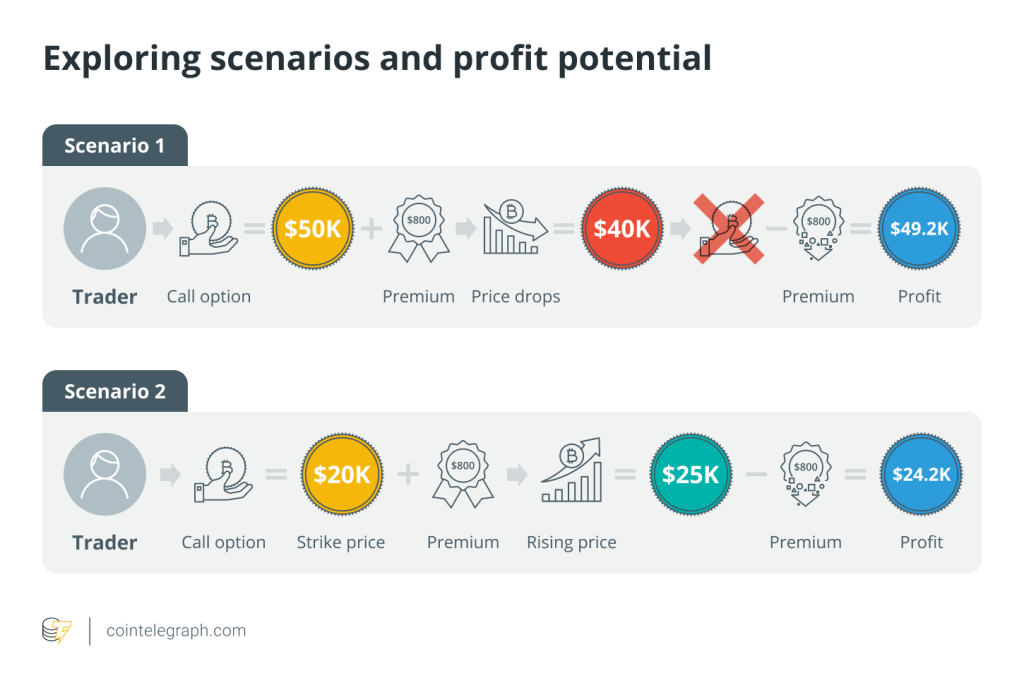

Spot Ethereum ETF options could provide investors with more flexible risk management tools and further advance the financialization of crypto assets. The expansion of the options market is viewed as a key step in attracting institutional investors, so the SEC’s delay undoubtedly adds more uncertainty to the market.

Investors have reacted to this news in mixed ways. On one hand, the options market is seen as an important milestone in the maturity of cryptocurrencies, especially for institutional investors who are looking to hedge risks using more complex financial instruments. On the other hand, the SEC’s repeated delays have caused confusion regarding the regulatory stance, particularly on when financial innovation in the crypto space will receive approval from regulators.

This delay not only affects the Ethereum options market but also raises broader concerns about the progress of crypto products toward regulatory compliance. In the short term, Ethereum’s volatility may increase, and investors need to carefully manage this uncertainty.

The failure of the FTX 2.0 relaunch rumors has also dealt a blow to market sentiment.

Despite rumors that FTX 2.0 might be relaunched, the plan was ultimately dismissed. FTX CEO John J. Ray III had stated in June 2022 that the company had begun seeking interested parties to restart the FTX.com exchange, with a potential rebranding. However, FTX attorney Andrew Dietderich informed the judge during a January 2024 hearing that no investors willing to fund the project had been found, leading to the shelving of the relaunch plan.

Since FTX’s collapse, the market has held mixed feelings about its potential revival. On one hand, many affected users hoped for a relaunch to recover some of their losses. On the other hand, the collapse of FTX brought widespread distrust within the industry, severely damaging its reputation and brand image. Recent rumors about the FTX 2.0 relaunch briefly reignited hope in the market, but with the rumors ultimately debunked, many investors are once again left disappointed.

If FTX 2.0 had successfully relaunched, it could have brought some capital back into the market and helped restore confidence. However, it is now clear that the path to revival is fraught with challenges. Not only would it require significant financial support, but it would also need to rebuild user trust and address the lingering legal issues. As a result, the future of FTX remains highly uncertain, and investors will need to keep a close watch on further developments.

Conclusion: While these two events may seem irrelevant to the average investor, they have in fact had a significant impact on overall market sentiment and future expectations. The SEC’s delay in approving spot Ethereum ETF options has further extended the road to regulatory compliance for the crypto market, while the collapse of FTX 2.0 relaunch rumors has further dampened confidence. In the coming period, the crypto market is likely to continue facing volatility and uncertainty. Investors should remain cautious and closely monitor relevant policies and platform developments.

Responses