SuperEx丨Educational Guide: How to Identify Powerful Meme Coin Market Makers

#SuperEx #US #Crypto

Recently, certain entities within the MEME coin market have been targeted by joint operations involving U.S. government agencies like the FBI and SEC. These operations have investigated crypto companies and market makers suspected of market manipulation. Several companies and individuals have been charged and pleaded guilty. As a result, short-term investment sentiment in the MEME market has taken a hit. So, how can investors learn from this and identify strong market makers in the MEME coin space?

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

First, what are the key indicators of a strong market maker?

Financial Strength: Strong market makers often possess significant capital, allowing them to sustain long-term operations. To assess this, look at the project’s early investors, the capital backing it, and the percentage of holdings held by large wallet addresses. These factors can help gauge the market maker’s financial strength.

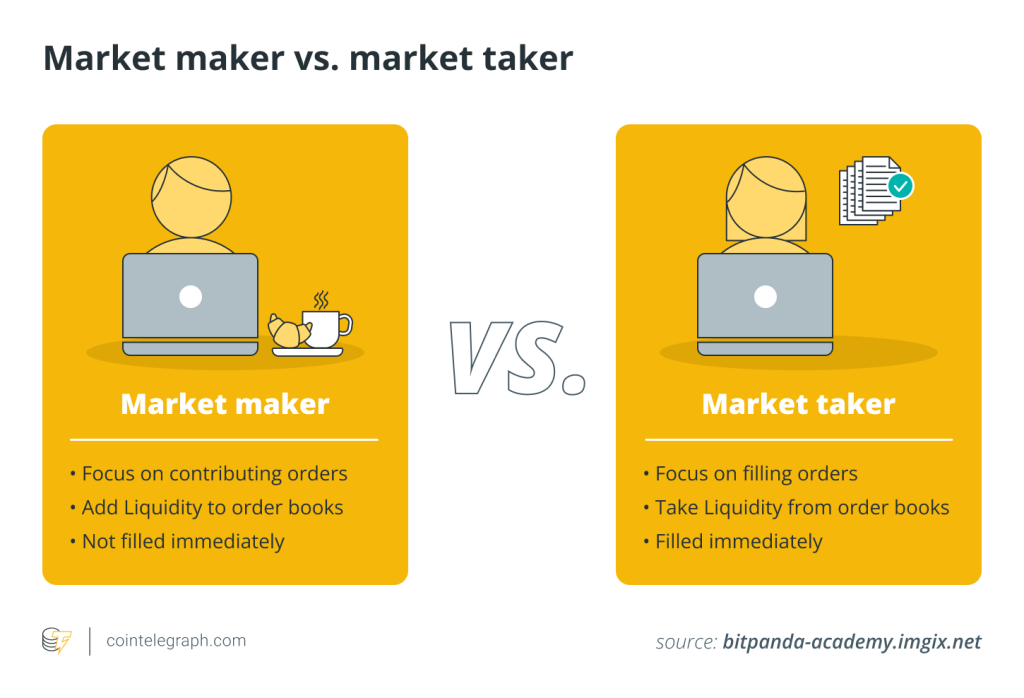

Market Liquidity: Liquidity is a critical factor when evaluating the strength of a MEME coin market maker. Strong players can maintain sufficient liquidity to keep the price stable. Analyzing token trading depth and activity levels can help determine if liquidity is being manipulated.

Community Support: A strong market maker often fosters a stable community foundation to maintain market confidence. An active, loyal, and sizable community usually provides the market maker with the leverage to sustain their operations. Monitoring social media activity and community engagement is key to assessing the strength of the market maker.

Project Transparency: Strong market makers typically collaborate with trustworthy teams and provide relatively transparent operational information. In contrast, if a project’s team and development progress are shrouded in vagueness, or if there’s little mention of actual use cases, it could signal a weak market maker.

A strong market maker typically follows specific goals and strategies in their operations. For instance, they may stage periodic price increases to attract retail investors and then gradually take profits through controlled price pullbacks. Investors can observe these behaviors and identify strong market makers based on the following key indicators:

Unusual Price Stability: Tokens under the control of a strong market maker often exhibit unnatural price stability, especially during volatile market conditions when most cryptocurrencies experience significant fluctuations. This could be due to high-frequency trading algorithms maintaining the price within a narrow range.

Consistently High Trading Volume: A high and sustained trading volume without significant spikes or drops could indicate market-making activities. Market makers need trading volume to generate profits, and they may engage in wash trading (buying and selling the same asset to create the illusion of activity) to artificially inflate volume.

Deep Order Books: Large buy and sell orders near the current price level in the order book suggest that market makers are maintaining liquidity. Such depth prevents small trades from causing large price swings.

Price Movements Contrary to Market Trends: If the price of a MEME token moves against the broader market trend without any clear reason, it could indicate manipulation. Market makers may use strategies like layering or spoofing to mislead other traders about the token’s supply and demand.

Unusual Trading Patterns: Look for patterns where the price rises steadily without a pullback, or where sharp price increases are followed by immediate stabilization. These patterns could be the result of artificial manipulation.

Frequent Whale Activity: Large transactions, often involving millions of tokens being transferred in and out of exchanges, may signal the presence of whales (large holders) or market makers. This is especially true if these trades coincide with price stability or potential manipulation.

Appendix: How U.S. Agencies Carried Out a Joint Sting Operation

The FBI created a fake cryptocurrency project called NexFundAI, successfully luring and gathering evidence against market makers like Gotbit, ZM Quant, CLS Global, and MyTrade MM. These market makers were accused of participating in market manipulation and fraud. The involved crypto companies, including Saitama and Robo Inu, used false advertising and wash trading to inflate token prices before selling them at high prices for profit. The U.S. Securities and Exchange Commission (SEC), the FBI, and the Department of Justice (DOJ) launched a joint legal action against these companies and individuals. The goal was to use legal means to combat illegal activities in the crypto market and recover illicit profits.

In Conclusion: Investors should stay calm, avoid blindly following market trends, and keep a close eye on regulatory developments and market shifts. Only by doing so can they navigate the turbulent MEME market with confidence.

Responses