SuperEx | Trillion-Dollar Financial Giant BNY Mellon Enters BTC Market, Challenging Coinbase

#BTC #BNY #crypto

According to a report by Bloomberg News on September 24, BNY Mellon has made a significant move into the crypto asset custody market, particularly in the custody of Bitcoin (BTC) and Ethereum ETFs, after obtaining an exemption from the SEC (U.S. Securities and Exchange Commission).

The report states that BNY Mellon received a waiver under SEC Staff Accounting Bulletin №121 (SAB 121) during a review by the Chief Accounting Office.This waiver allows the bank to categorize the crypto assets held by its clients differently, meaning they do not need to treat these assets as company liabilities.

The report states that BNY Mellon received a waiver under SEC Staff Accounting Bulletin №121 (SAB 121) during a review by the Chief Accounting Office.This waiver allows the bank to categorize the crypto assets held by its clients differently, meaning they do not need to treat these assets as company liabilities.

The initiative to provide custody services for spot BTC and Ethereum ETFs could significantly disrupt the current market landscape, as Coinbase currently oversees most of Wall Street’s crypto ETFs, including those from major asset management firms like BlackRock, which manages approximately $10 trillion in assets.

At present, Coinbase is positioned as the leader in digital asset custody for these funds, but BNY Mellon’s entry may increase competition and offer clients more choices.

So, what is BNY Mellon’s strategic intention behind this move, and how will it challenge Coinbase’s market position?

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

BNY Mellon’s Strategic Intent in Expanding into the BTC Market

BNY Mellon’s entry into the BTC market is not a sudden move but rather a carefully thought-out strategic plan. The bank has not only launched BTC custody and trading services for institutional investors but also entered into deep collaborations with several blockchain technology companies, with plans to roll out a series of crypto asset products for retail investors in the coming months. The intentions behind these actions can be summarized as follows:

Diversifying Assets and Enhancing Risk Resistance: Amidst increasing global economic volatility, BNY Mellon aims to introduce digital assets such as Bitcoin to further diversify its asset management portfolio, providing clients with more diversified investment options and enhancing its risk resistance capabilities.

Responding to Changing Investor Demand: According to recent market data, over 60% of institutional investors have shown strong interest in Bitcoin and its derivatives. BNY Mellon’s entry into the market is precisely to meet this explosive growth in demand.

Strengthening Competitiveness and Market Share: Competition between traditional financial giants and emerging cryptocurrency platforms is intensifying. BNY Mellon hopes to quickly establish a dominant position in the crypto market, thereby securing a more favorable position in the future financial landscape.

Challenging Coinbase: An Analysis of BNY Mellon’s Advantages and Disadvantages

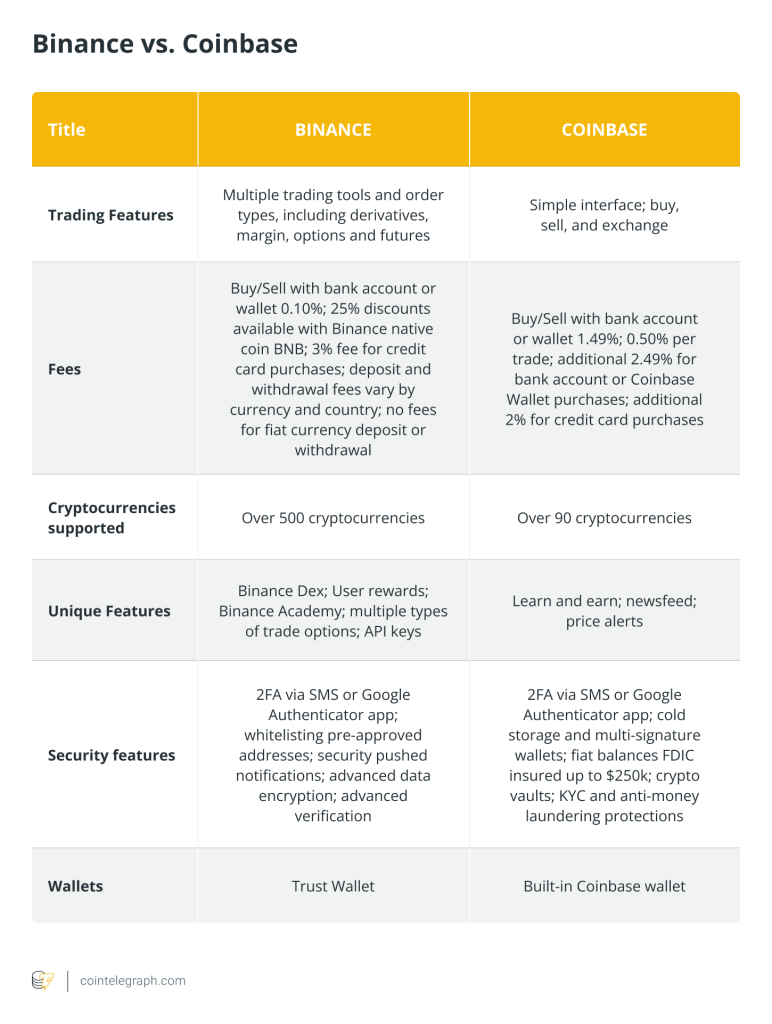

With BNY Mellon entering the Bitcoin market, direct competition with Coinbase will be inevitable. As one of the world’s largest cryptocurrency exchanges, Coinbase has a solid foundation in both retail and institutional markets. So, what advantages will BNY Mellon leverage to compete with Coinbase?

Advantages:

Trust and Experience of a Traditional Financial Institution: As a traditional financial giant with over 200 years of history, BNY Mellon has extensive experience in asset custody and investment management, making it easier to gain the trust of traditional investors.

Institutional Client Resource Advantage: Compared to Coinbase, BNY Mellon has strong influence among traditional institutional clients. Its close ties with major global financial institutions, hedge funds, and pension funds can help it quickly establish a market advantage in institutional BTC custody and trading services.

Disadvantages:

Lagging in Technology and Compliance: Compared to Coinbase, BNY Mellon’s investment in blockchain technology started relatively late, which may result in shortcomings in trading efficiency and user experience. Moreover, as a traditional financial institution, BNY Mellon may face more restrictions when dealing with cryptocurrency compliance issues.

Lower Brand Recognition: In the crypto space, Coinbase has already established a strong brand image and user recognition as a pioneer. As a new entrant, BNY Mellon will need time to improve its recognition and acceptance among crypto investors.

Future Outlook: Can BNY Mellon Disrupt Coinbase’s Market Position?

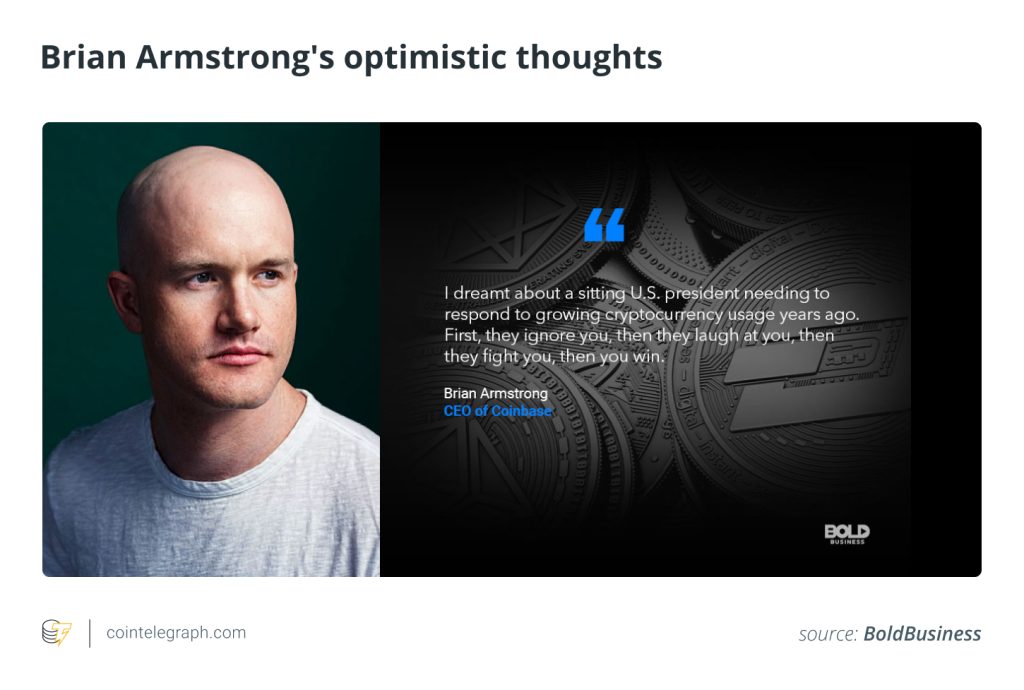

Although BNY Mellon’s recent move is impressive, it will still face many challenges in displacing Coinbase’s market position in the short term. From a long-term perspective, BNY Mellon’s entry will intensify market competition and may lead more traditional financial institutions to follow suit, further promoting the adoption of Bitcoin and other digital assets.

For Coinbase, BNY Mellon’s involvement is both a challenge and an opportunity. On one hand, Coinbase needs to accelerate its own technological innovation and compliance systems to cope with competition from traditional financial institutions. On the other hand, BNY Mellon’s entry will increase overall market participation and liquidity, which will benefit the overall healthy development of the market in the long run.

Conclusion

SuperEx will continue to monitor the dynamic competition between BNY Mellon and Coinbase in the BTC market. Regardless of how the future evolves, this clash between traditional finance and the emerging crypto space will bring more highlights and investment opportunities to the market. We firmly believe that with the entry of more traditional financial giants, the future of the Bitcoin market will welcome broader development prospects.

Responses