US Election Update: Trump Plans to Create “Crypto Capital”

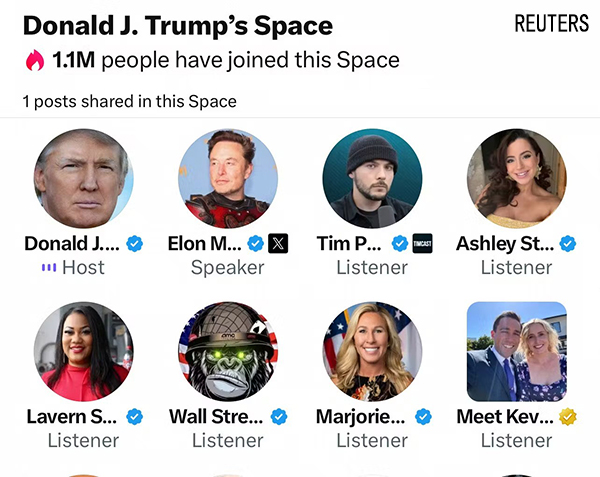

OnThursday, Donald Trump mentioned in a video posted via the X social media platform that if he is elected, he will make the United States the crypto capital of the world. While Trump did not release details of this plan, the video included a link to World Liberty Financial, a decentralized financial project that his son has been promoting.

The site’s metadata describes the project as a “cutting-edge” DeFi platform dedicated to connecting users with “the best tools for decentralized finance” for safe and high-yield crypto investments.

This is surely the best proof that Donald Trump is venturing further into the realm of digital assets.

The plan has garnered a lot of attention, not only because of Trump’s political clout, but also because of the far-reaching impact this strategy could have on the U.S. economy, technological innovation, and global financial markets. In this article, we will analyze Trump’s plan in depth, exploring its possible path of implementation and potential impact on all parties.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Trump’s announced plan aims to make the U.S. a global center for cryptocurrency and blockchain technology through a series of policy measures and market incentives. The realization of this goal is expected to include the following:

Optimization of the policy and regulatory environment: one of the core measures that Trump plans to pursue is improving the regulatory environment for cryptocurrencies and blockchain technology. This may include simplifying regulatory requirements for crypto assets, reducing compliance costs, and providing a clear legal framework to support the growth of crypto businesses.

Infrastructure development: Establishing dedicated “crypto tech parks” or “blockchain innovation centers” to provide technical support, capital investment, and business incubation services. These parks will attract global cryptotech companies and investors, and promote the research, development and application of cryptotechnology.

Tax incentives and financial support: the plan may include the provision of tax incentives, government funding and financial incentives to encourage investment and development of cryptocurrency and blockchain projects. This will reduce operating costs for startups and attract more investment into the crypto market.

International Cooperation and Competition:Trump may also promote cooperation with other countries and regions to facilitate the consolidation of the global crypto market and enhance U.S. competitiveness in crypto on the international stage.

Implementation Path and Challenges

Despite the ambition of Trump’s plan, its implementation process will face many challenges and complexities.

1. Policy and regulatory challenges

The U.S. crypto market currently faces regulatory challenges at multiple levels, including inconsistencies in federal and state regulation. Trump’s plan will need to harmonize these policy differences across the country and push for consensus in the legislative and executive branches. This may require extensive consultation and negotiation with Congress, the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and other regulators.

2. Building technology infrastructure

While the idea of establishing crypto tech parks and innovation centers is forward-looking, the practicalities of doing so will require addressing issues such as infrastructure development, funding allocation and resource allocation. This includes ensuring technical support and cybersecurity for the park while attracting sufficient investment and talent.

3. International cooperation and market competition

Globally, cryptocurrency and blockchain technologies are increasingly competitive. Trump’s plan will need to not only attract international businesses and investors, but also deal with competition with other crypto centers such as China, Singapore and Switzerland. Effective international cooperation will be key to realizing the success of the plan, but it also faces complex diplomatic and economic issues.

Potential impact

If Trump’s plan is implemented, it will have a multifaceted impact on the U.S. and globally.

1. Economic growth and innovation

By providing policy support and financial incentives, the U.S. may accelerate innovation and growth in the crypto industry. This will not only promote research and development of emerging technologies, but may also lead to substantial job creation and economic growth. The establishment of crypto tech parks has the potential to attract the world’s leading technology companies and investment organizations, thereby enhancing the U.S. position in the global technology industry.

2. Transformation of financial markets

As an important part of the global financial market, the rise of cryptocurrencies and blockchain technology may trigger changes in the financial industry. The U.S., if it becomes the crypto capital, may promote the integration of traditional financial institutions and regulators with the crypto market and drive innovation and improvement in financial services. Such changes could have a profound impact on the global financial market, altering the behavioral patterns of investors and consumers.

3 Evolution of policies and laws

Trump’s plan could trigger a policy and legal evolution in the U.S. crypto market. This includes updates to tax policies, investment rules and financial regulation of crypto assets. These changes will affect crypto market participants, including businesses, investors, and ordinary users, and may present new opportunities and challenges.

Conclusion

Trump’s plan to turn the United States into a “crypto capital” signals far-reaching thinking about the future of cryptocurrencies and blockchain technology. Despite the challenges of implementing this plan, its success could lead to profound changes in economic growth, technological innovation, and financial markets.

Responses