Bitcoin derivatives, explained: expiry futures, perpetual futures and options

Derivatives are tradable contracts that derive their value from an underlying asset. In the case of cryptocurrency derivatives, the underlying asset is, in most cases, Bitcoin (BTC), or other top cryptocurrencies.

In general, derivatives are sophisticated, generally high-risk financial instruments that are useful for managing risk via hedging.

Traditional derivatives

While traditional markets have been using various forms of derivatives for thousands of years, their modern varieties can be traced back to the 1970s and 80s, when the Chicago Mercantile Exchange and Chicago Board of Trade introduced expiry futures.

The most common types of derivatives include futures, forwards, and options, which are based on a variety of assets, including stocks, currencies, bonds, and commodities. Given the sheer number of derivatives available today, the market’s size is difficult to determine, with estimates ranging from trillions to over a quadrillion dollars.

Bitcoin futures

Among crypto derivatives, Bitcoin futures were the first to go mainstream and remain the most traded in terms of volumes. BTC futures were being traded on smaller platforms as early as 2012, but it wasn’t until 2014 that growing demand prompted major exchanges, namely CME Group Inc and Cboe Global Markets Inc, to follow suit.

Today, Bitcoin futures are among the most popularly traded instruments in the space, with top exchanges like SPACEX recording billions of dollars in volume on a daily basis.

Source: theblock.co

What is Bitcoin expiry futures?

An expiry futures product is an agreement between two parties — generally two users on an exchange — to buy and sell an underlying asset (BTC, in this case) at an agreed-upon price (the forward price), at a certain date in the future.

While the finer details may vary from exchange to exchange, the basic premise behind expiry futures remains the same. Here, two parties agree to lock in the price of an underlying asset for a transaction in the future.

For convenience, most exchanges don't require expiry futures holders to receive the actual underlying asset (such as barrels of oil, or gold bars) once the contract expires and support cash settlements instead.

However, physically-settled Bitcoin futures, such as those offered by Bakkt, are growing in popularity, since actual Bitcoins can be transferred with relative ease compared to most commodities.

How does a Bitcoin expiry futures product work?

Let’s walk through a BTC futures trade on SPACEX. First of all, the weekly futures market just means that the contract holder is betting on the price of Bitcoin over one week. SPACEX also offers bi-weekly, quarterly, and bi-quarterly time spans for futures.

So, if Bitcoin is trading at $10,000 today and Adam believes the price will be higher next week, he can open a long position with a minimum of one contract (each contract represents $100 in BTC) on SPACEX’s weekly futures market.

When someone buys Bitcoin and holds it (goes long), they're counting on the price going higher, but can't make gains if the price drops. Shorting, or selling an asset today in the expectation that it'll reduce in price tomorrow, is how traders make earnings from price declines.

For this example, we'll assume Adam opens 100 long contracts (100 x $100 = $10,000), which collectively represent his commitment to purchase 1 BTC on the settlement date next week (8 a.m. UTC every Friday on SPACEX) for that price — $10,000.

On the flip side, we have Robbie, who believes Bitcoin’s price will be lower than $10,000 next week and wants to go short. Robbie commits to sell 100 contracts, or 1 BTC, on the settlement date next week for the agreed upon price of $10,000.

The exchange matches Adam and Robbie and become the two parties entering into an expiry futures agreement. Adam commits to buying 1 BTC at $10,000 and Robbie commits to selling 1 BTC at $10,000 when the contract expires.

Bitcoin’s price one week later, on the settlement date, will determine whether these two traders see gains or losses.

One week passes and Bitcoin is trading at $15,000. This means that Adam, who had agreed to purchase 1 BTC for $10,000, makes a gain on his contract, earning $5,000. Adam, as agreed, only needed to pay $10,000 for 1 BTC, which he can immediately sell for its current market value of $15,000.

Robbie, on the other hand, loses $5,000, since he has to sell his 1 BTC for the agreed-upon price of $10,000, even though it’s now worth $15,000.

Depending on the asset Adam and Robbie used, SPACEX settles the contract in stablecoin Tether (USDT) or BTC, crediting Adam’s or Robbie’s account with the realized gain or loss.

Since expiry futures agreements reflect the expectations of market participants, indicators such as the BTC long/short ratio can provide a quick view of general sentiment. The BTC long/short ratio compares the total number of users with long positions versus those with short positions, in both expiry futures and perpetual futures.

BTC long/short ratio. Source: okx.com

When the ratio stands at one, it means an equal number of people are holding long and short positions (market sentiment is neutral). A ratio higher than one (more longs than shorts) indicates bullish sentiment, while a ratio below one (more shorts than longs) indicates bearish market expectations.

Why do people buy and sell BTC via expiry futures agreements?

Why would someone enter into an expiry futures agreement to buy or sell Bitcoin instead of trading BTC directly on the spot market? Generally, the two answers are risk management and speculation.

Managing risk

Expiry futures have long been used by farmers seeking to reduce their risk and manage their cash flow by making sure they can get commitments for their produce ahead of time, at a pre-arranged price. Since farm produce can take time in preparation, it makes sense for farmers to want to avoid market price fluctuations and uncertainties in the future.

Bitcoin’s volatility and price swings also bring the need for active risk management, especially for those who rely on the digital asset for regular income.

Miners’ revenue depends on the price of Bitcoin and their monthly costs. While the former can fluctuate wildly on a daily basis, the latter remains largely fixed, making it difficult to project earnings with certainty.

What's more, increasing competition in the mining space gives rise to new, non-price related challenges, such as hardware redundancy due to increasing difficulty. The only way for miners to continue operating in such an environment with minimal risk is to hedge with derivatives like futures.

Speculation

However, risk management or hedging is different from speculation, which is also one of the main drivers behind Bitcoin expiry futures. Since traders and speculators aim to benefit from price volatility in either direction (up or down), they need the ability to bet each way — long or short.

Expiry futures give pessimists an avenue to impact market sentiment. This phenomenon is discussed in detail by the Federal Reserve Bank of San Francisco in its research titled How futures trading changed Bitcoin prices.

Lastly, Bitcoin futures are popular because they allow for the use of leverage. This is where traders can open positions larger than their deposits, as long as they maintain an acceptable margin ratio — determined by the exchange. The use of leverage doesn't alter any of the conditions associated with a derivative and only serves to amplify risk and reward.

When the market is bullish, expiry futures appreciate in value and can sell at a premium over the spot price, and vice versa. This difference, called the basis, is another good indicator to assess market sentiment.

BTC Basis. Source: okx.com

When the basis is positive (bullish), it means the futures price is higher than the actual spot price. When the basis is negative (bearish), it indicates that the futures price is lower than the spot price.

Bitcoin perpetual futures

In addition to the standard futures discussed above, Bitcoin markets also support perpetual futures, which, true to their name, are contracts without an expiry date.

Since there's no settlement date, neither of the parties has to buy or sell. Instead, they're allowed to keep their positions open as long as their account holds enough BTC (margin) to cover them.

However, as opposed to standard futures, where the price of the contract and the underlying asset ultimately converge when the contract expires, perpetual futures have no such reference date in the future. Perpetual futures use a different mechanism to enforce price convergence at regular intervals, called the funding rate.

The purpose of the funding rate is to keep the price of a contract in line with the underlying asset’s spot price, discouraging major deviations.

It's important to note that the funding rate is a fee exchanged between the two parties of a contract (the long and short parties) — not a fee collected by the exchange.

If, for instance, the value of a perpetual futures contract keeps rising, why would shorts (people on the selling side) continue to keep a contract open indefinitely? The funding rate helps balance such a situation. The rate itself varies and is determined by the market.

How do BTC perpetual futures work?

For example, if a perpetual futures contract is trading at $9,000 but the spot price of BTC is $9,005, the funding rate will be negative (to account for the difference in price). A negative funding rate means that the short holders must pay the long holders.

If, on the other hand, the price of the contract is higher than the spot price, the funding rate will be positive — long contract holders must pay short contract holders.

In both these instances, the funding rate promotes the opening of new positions which can bring the contract’s price closer to the spot price.

Funding rate payments are made every eight hours on most exchanges, including SPACEX, as long as contract holders keep their positions open. Gains and losses, on the other hand, are realized at the time of daily settlement and are credited to holders’ accounts automatically.

Funding rate data, as shown below, can be used to quickly assess market trends and performance over any period of time. Again, a positive funding rate tells us that the market is generally more bullish — the perpetual futures price is higher than spot prices. A negative funding rate indicates bearish sentiment, since it means the perpetual futures price is lower than the spot price.

BTC perpetual futures funding rate. Source: okx.com

Bitcoin options

Like Bitcoin futures, options are also derivative products that track Bitcoin’s price over time. However, unlike standard futures — where two parties agree on a date and price to buy or sell the underlying asset — with options, you literally purchase the “option” or right to buy or sell the asset at a set price in the future.

Even though crypto options are newer than futures, Bitcoin options reach an all-time high of over $1 billion in 2020, in terms of Open Interest (OI). OI denotes the total value (in USD, generally) of outstanding options contracts that are yet to be settled. An increasing open interest generally indicates an inflow of fresh capital into the market.

BTC options open interest. Source: theblock.co

Calls and puts

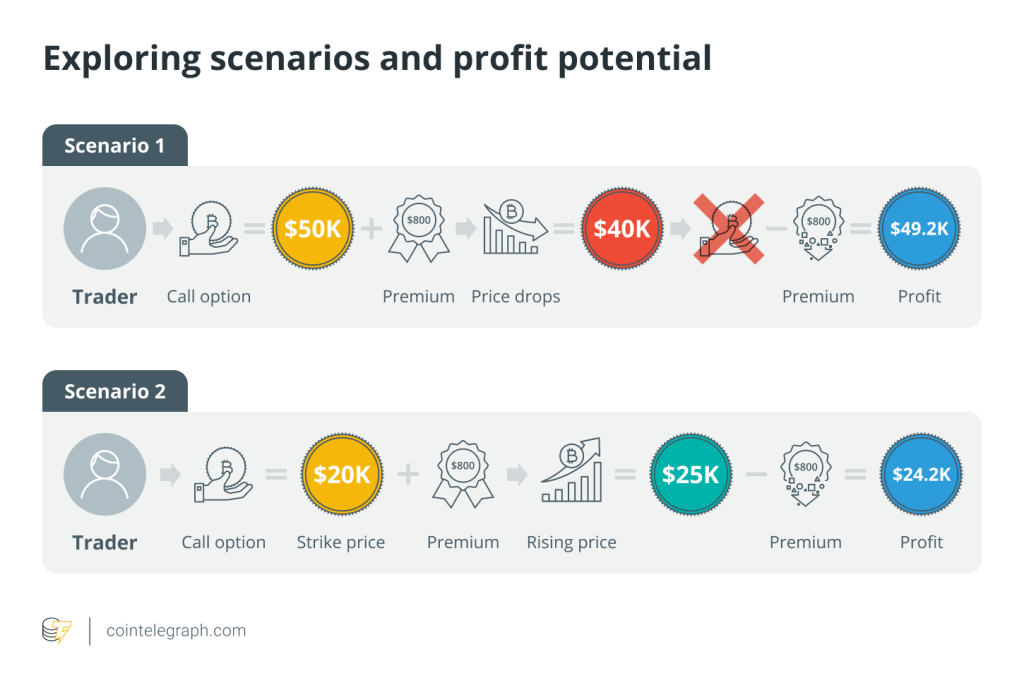

There are two types of options contracts, call options and put options. Call options give the holder the right to buy an underlying asset at a set date (expiry), and put options give the holder the right to sell it. Each option, depending on associated conditions, has a market price, called the premium.

Options contracts also come in two forms: American and European. An American option can be exercised — meaning the holder buys or sells — at any time before the expiry date, while a European option can only be exercised on the expiry date. SPACEX supports European options.

Owning an option means that if the holder decides not to exercise their right to buy or sell on the expiry date, the contract simply lapses. The holder doesn’t have to make good on it, but they do lose the premium — the price they paid for the contract.

Options are also cash-settled for convenience, but carry very different risks compared to futures. With futures, either party’s risk and reward is unlimited (Bitcoin’s price can go anywhere before settlement). But with options, buyers have unlimited potential gains and limited loss, whereas option sellers have unlimited potential loss and very limited gain (as explained below).

How does a Bitcoin options contract work?

If Bitcoin is trading at $10,000 today, and, this time, Robbie believes the price will be higher at a certain date in the future (let’s say a month later), he can buy a call option. Robbie’s call option has a strike price (the price at which BTC can be bought in the future) of $10,000 or lower.

If a month later Bitcoin is trading at $15,000, Robbie can exercise his call option and buy Bitcoin for $10,000 and make an instant gain. On the other hand, if Bitcoin is trading at $9,000 a month later, Robbie can just let his option lapse.

However, we haven’t considered the option premium in either of these instances. The premium is what Robbie will pay to buy the call option — the option’s market price. If the premium is $1,500, Robbie will pay $1,500 today to have the right to buy Bitcoin at $10,000 a month later.

This means, for Robbie, the real break even price is $10,000 + $1,500 = $11,500 — so Bitcoin needs to be higher than $11,500 for him to make a gain. If Robbie chooses to let his option lapse, he'll only have lost his $1,500 premium.

So in effect, while Robbie’s potential for growth is unlimited (or, rather, only limited by Bitcoin’s price), his loss is limited by the premium he paid. In no instance can Robbie lose more than the premium in this contract.

Then we have Adam, who believes Bitcoin will drop in price over the next month. He can buy a put option, with a strike price of $10,000. This means he'll have the option to sell Bitcoin at $10,000 in a month from now, regardless of the spot price.

After a month, if Bitcoin is trading lower than $10,000, let’s say at $8,000, Adam stands to gain by exercising his option — selling BTC for $2,000 higher than the market price. If BTC is trading higher than $10,000, he can just let his option lapse.

Adam, too, will have to pay the premium to purchase this option, and, like Robbie, the premium is also the maximum amount he is risking in this contract.

On the flip side, we have option sellers or contract writers, who are counterparties to Robbie and Adam and have agreed to sell them call and put options respectively. These sellers are essentially promising to sell and buy BTC on demand, in exchange for the premiums paid by Robbie and Adam.

In terms of risk, the options seller’s earnings are limited by the premium they charge. However, their losses are potentially unlimited, since they'll have to buy or sell BTC if the option is exercised, no matter how large the difference between the spot price and the strike price is. This can be further explained via the SPACEX Bitcoin Options Market view below.

Source: okx.com

Call and put options for a September 25, 2020 expiry date are shown in the chart above. The blue circle marks options contracts with a strike price of $11,000, meaning that the holder of a call option for this contract will be able to buy Bitcoin at $11,000 on September 25, whereas the holder of a put option will be able to sell it for the same. The green and red circles denote the mark price, which is an average-based indicator of market valuations, whereas the “Bid1” and “Ask1” figures reflect the current market offers.

If Robbie were to buy this call option today, he'd pay the best ask – which is $1,373.08 in the screenshot above – as premium to reserve the right to buy Bitcoin at $11,000 on September 25. Similarly, Adam would pay $2,712.90 to buy his put option for the right to sell Bitcoin at $11,000 on September 25.

The difference in these premiums is representative of market sentiment, where the counterparty agreeing to buy Adam’s Bitcoin believes it to be a riskier bet than the one agreeing to sell to Robbie.

Open Interest by Strike is another dataset that can reveal the market’s outlook at a glance, as shown in the chart below.

BTC Options Open Interest by Strike. Source: Skew.com

This chart shows the value (in BTC) of unexpired options (call + put) at various strike prices. As seen above, most market participants have options contracts at a strike price of $10,125, followed by $7,250 and $11,250. Looking at this data highlights the three most common strike prices as prices in-play for Bitcoin — and expected ranges in the near future.

Why do people buy and sell BTC via options contracts?

Options contracts, like futures, are also tools for risk management, but are a bit more flexible since they're not accompanied by any obligations for buyers.

We can once again discuss Bitcoin miners as potential beneficiaries of these contracts, where they can purchase put options to secure a certain rate for their mined BTC in the future. However, unlike futures contracts, where the miners would be obliged to sell their BTC regardless of the price, here they can choose not to sell if Bitcoin rises significantly.

Speculation remains another reason behind the use of options, because they allow conservative market participants to make their bets with much smaller sums at risk (the premiums) compared to futures.

Derivatives and Bitcoin’s legitimacy

Derivatives such as futures and options support the underlying asset’s price discovery — the market’s determination of price — by giving the market tools necessary for expressing sentiment. For instance, without derivatives, Bitcoin traders were largely relegated to buying and holding the asset itself, which created a bubble in 2017, as prices skyrocketed to all-time highs.

It was only after Bitcoin futures were launched by CME and Cboe that the market shorters were able to pop the bubble.

As much as the subsequent crash and “crypto winter” of 2018 hit the market hard, it also promoted maturity and growth, as prices leveled out, allowing technology and adoption to be at the forefront once again.

Meanwhile, the launch of regulated derivatives, such as Bitcoin Options by Bakkt, are helping legitimize the crypto space and attract institutional involvement.

Ultimately, for Bitcoin to become a widely accepted asset class, many argue, it needs a transparent market that isn't easy to manipulate.

Achieving this will require an influx of new capital, increased liquidity, reduced volatility, organic price formation, and the trust of large-scale institutional users. Each quality derivative product has the potential to take Bitcoin a step closer to such legitimacy.

SPACEX Insights presents market analyses, in-depth features, and curated news from crypto professionals.

Follow SPACEX Insights on Twitter and Telegram.

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Here you can find 81930 additional Info on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] There you can find 39896 more Info on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Here you can find 26115 more Info to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Here you will find 47047 additional Information to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Here you will find 43022 additional Info to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] There you will find 43687 additional Info to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Here you will find 57777 additional Information to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/trading/1671/ […]

… [Trackback]

[…] There you will find 55957 additional Information to that Topic: x.superex.com/academys/trading/1671/ […]