Bitcoin braces for Fed's Powell as trader says $65K key BTC price level

BTC price volatility continues within a narrow range — but some BTC price data shows the path toward all-time highs.

Bitcoin (BTC) saw flash volatility to bottom near $61,000 during May 14 as United States inflation data rolled in.

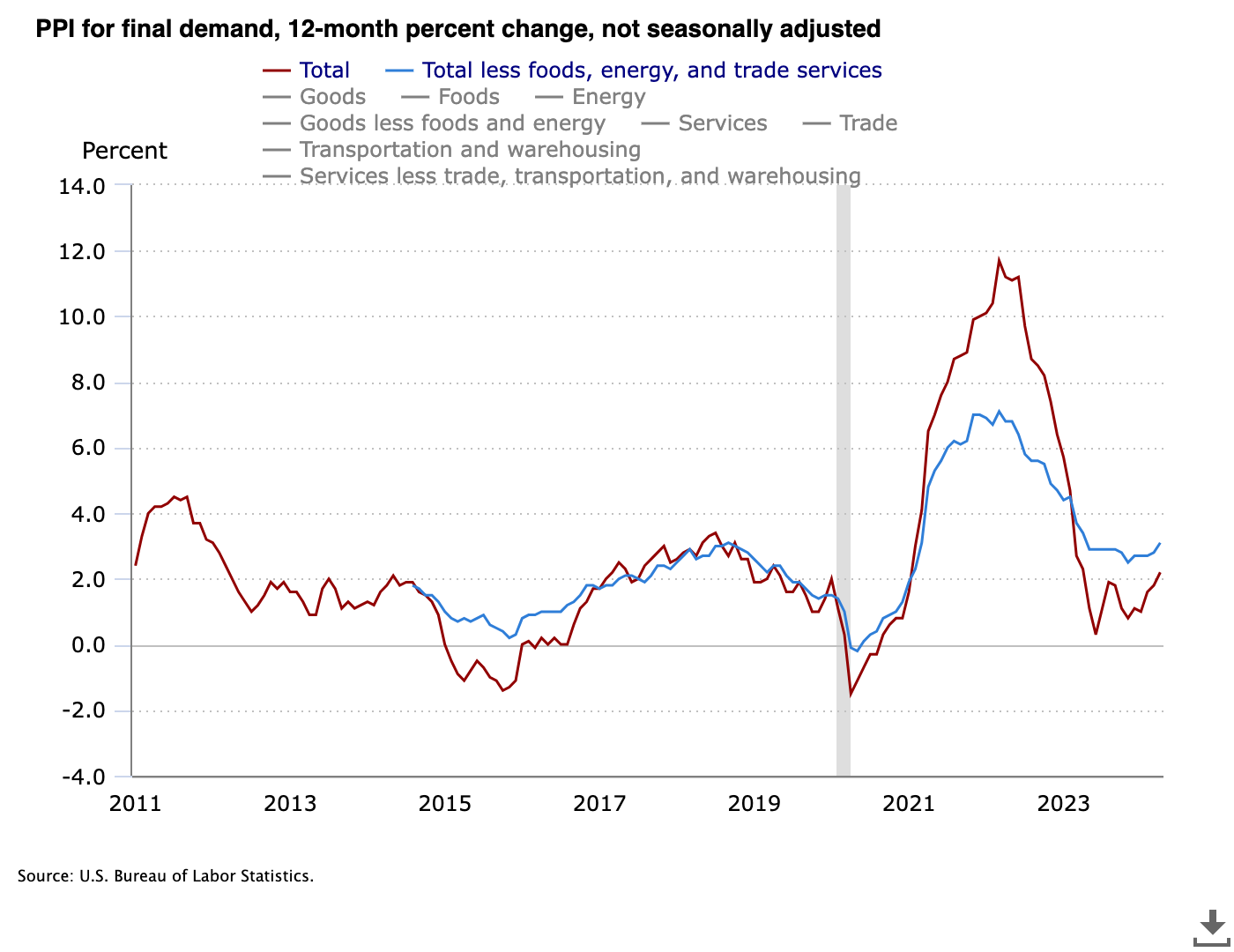

U.S. PPI conforms ahead of Powell speech

Data from Cointelegraph Markets Pro and TradingView charted ongoing choppy BTC price conditions into the Wall Street open.

The April print of the Producer Price Index (PPI) came in according to expectations at 2.2% — still a third consecutive monthly increase.

“For the 12 months ended in April, prices for final demand less foods, energy, and trade services increased 3.1 percent, the largest advance since climbing 3.4 percent for the 12 months ended April 2023,” an official press release from the U.S. Bureau of Labor Statistics confirmed.

While crypto markets avoided the implications of a significant PPI miss, the picture remained unfavorable to risk assets.

“PPI inflation is now up for 3 straight months for the first time since April 2022,” trading resource The Kobeissi Letter wrote in part of a response on X (formerly Twitter).

“Yet another sign the Fed can’t cut rates.”

Kobeissi referred to ongoing bets over how the Federal Reserve might approach reducing interest rates.

Fed Chair Jerome Powell was due to add to the mix of cues being eyed by markets during a speech set for 10 AM Eastern time.

“We expect Powell’s speech tonight to be carefully worded as always, resulting in a muted market reaction,” trading firm QCP Capital wrote in its latest update to Telegram channel subscribers.

QCP added that the May 15 print of the Consumer Price Index (CPI) “may be the catalyst to finally help the market pick a direction.”

BTC price “preparing for a new move higher”

Among Bitcoin traders, there was a sense of indecision as rangebound price moves continued.

Related: CPI meets $60K BTC price battle — 5 things to know in Bitcoin this week

As Cointelegraph reported, significant blocks of liquidity were returning to the order book to sandwich spot price ahead of the macro data and Powell appearance.

In some of his latest analysis, however, popular trader Jelle highlighted three conditions for BTC upside now having been met.

These included retesting the 100-day exponential moving average, currently at $60,409, as support. The moving average convergence/ divergence (MACD) indicator was now also bullish on daily timeframes, he noted.

Jelle added that $65,000 was the line in the sand for the bullish scenario to play out.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses