Bitcoin price flash crash raises chance of BTC dip to $54K

Bitcoin price drops more than 2% in an hour, leading to $127 million in long liquidations.

Bitcoin (BTC) price fell over $2,000 in 1 hour on May 10 as a sudden wave of volatility disrupted an otherwise quiet market.

Data from Cointelegraph Markets Pro and TradingView showed that leveraged long traders were caught offside as BTC price suddenly dropped from a high of $63,494 on May 10 to an intra-day low of $60,308.

At the time of writing, the losses were still mounting, with the flagship cryptocurrency having lost more than 2.5% of its value over the last 24 hours.

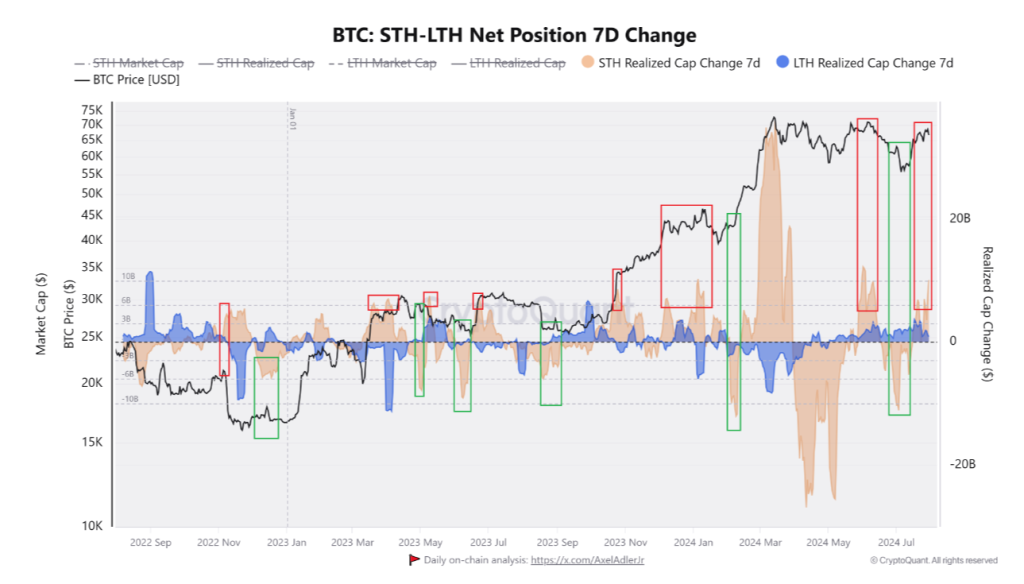

“The final accumulation is happening,” said MN Capital’s founder, Michaël van de Poppe, reacting to what has become a familiar event in short time frames for Bitcoin since the halving.

Van de Poppe explained that this includes the “low volatility” and choppy price action BTC has displayed since Feb. 29 and that the latest crash saw Bitcoin drop “back to the important area of support.

“Not holding? Then we’re looking at $52-55K, which would be the final stage of the correction.”

Meanwhile, popular trader Daan Crypto Trades said that BTC’s flash crash to $60,000 on May 9 was a quick move to “punish those longs that aped in above $63K.”

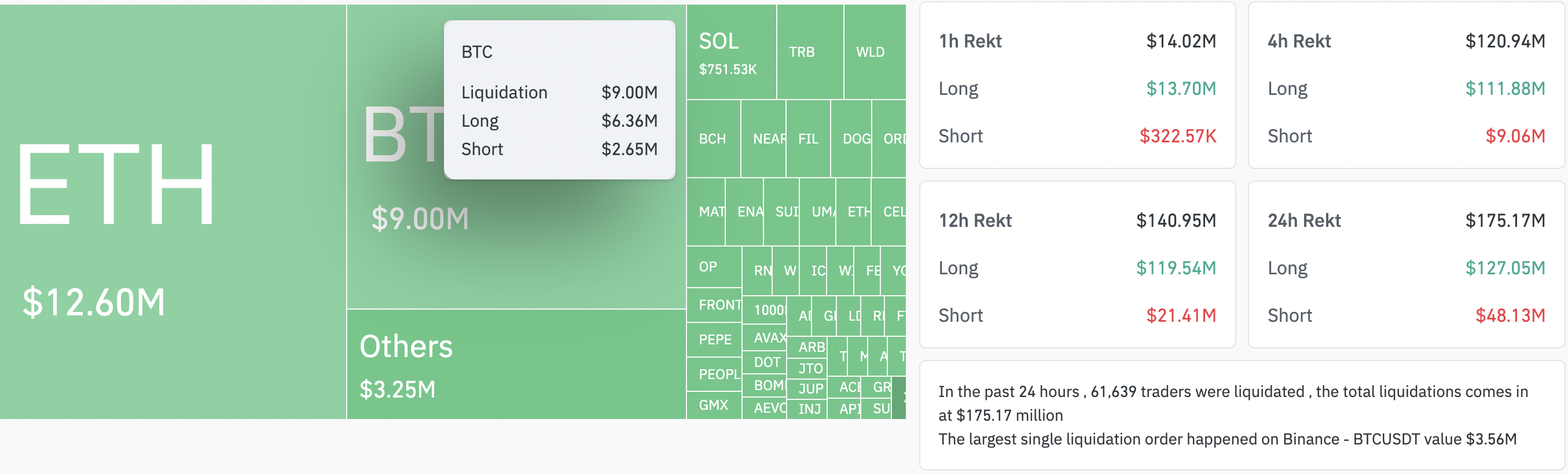

However, those betting on a continuation of BTC’s recovery above $64,000 lost big on Friday, May 10, as the downturn liquidated $127 million in long positions worth amid a 24-hour total wipeout of $175.17 million, according to data from Coinglass.

With the latest drawdown, $9 million BTC leveraged positions have been liquidated over the last hour alone, with $6.36 million of these being longs.

Responses