‘Mr. 100’ buys the Bitcoin dip for the first time since halving — Is the BTC bottom in?

Mr. 100, an entity previously identified as Upbit, has bought over $147 million worth of Bitcoin for the first time since the halving, suggesting an end to the current retracement.

The Bitcoin whale entity nicknamed “Mr. 100” has bought the Bitcoin (BTC) dip for the first time since the Bitcoin halving. Meanwhile, multiple market analysts suggest that the local Bitcoin bottom may be in as the price bounces from $56,000-lows.

2,500 BTC added for the first time since Bitcoin halving

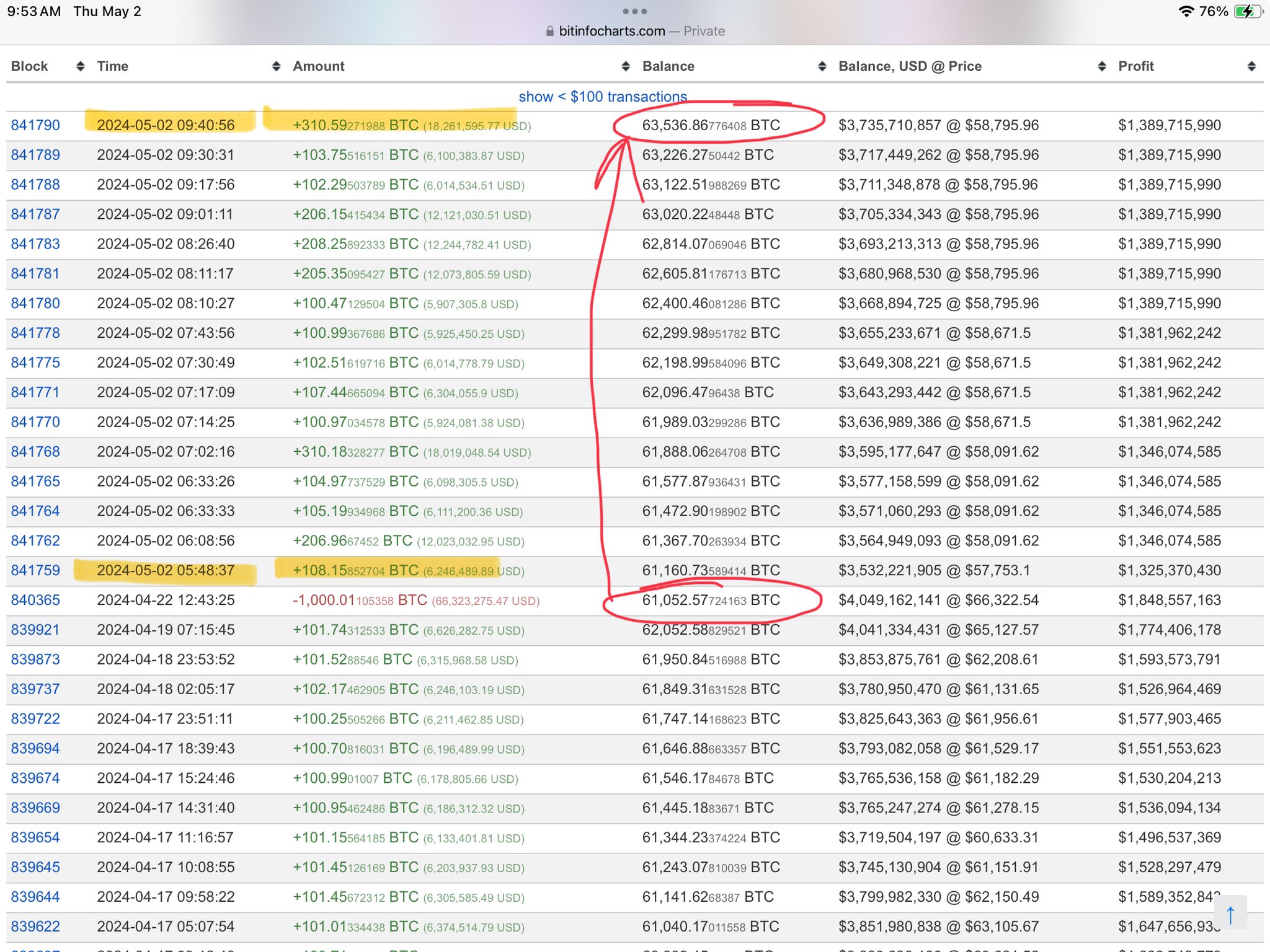

The Mr. 100 whale wallet has added 2,500 BTC worth over $147 million, around the $58,000 mark, according to a May 2 X post by HODL15Capital.

This represents the wallet’s first Bitcoin purchase since April 19, the day before the 2024 Bitcoin halving.

The given whale address has been continually receiving BTC since November 2022, when the FTX exchange collapsed. The wallet has been adding at least 100 BTC nearly every day since Feb. 14, except for the post-halving period.

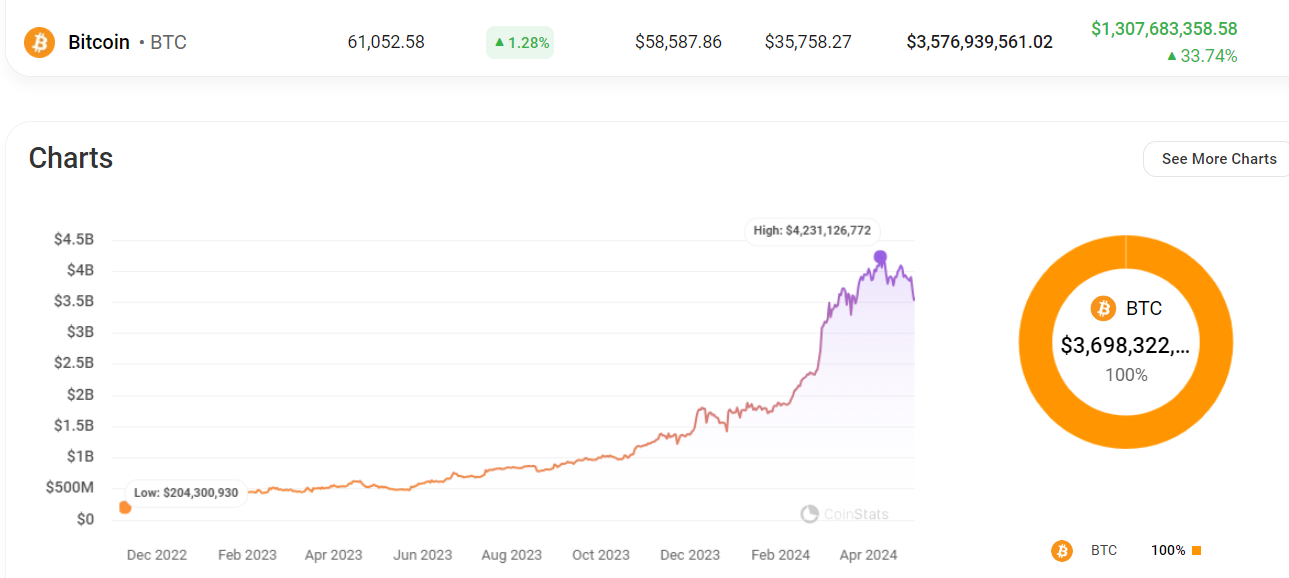

Mr. 100 is currently the 12th largest Bitcoin holder, with over 61,053 BTC, according to Bitinfocharts data.

The address is sitting on $1.3 billion in unrealized profit, up 33% on its all-time Bitcoin holdings, with an average buying price of $35,587 per BTC. The wallet is currently worth over $3.57 billion.

Related: Crypto on track to hit 1B users by end of 2025 — Analyst

Bitcoin price bottom may be in

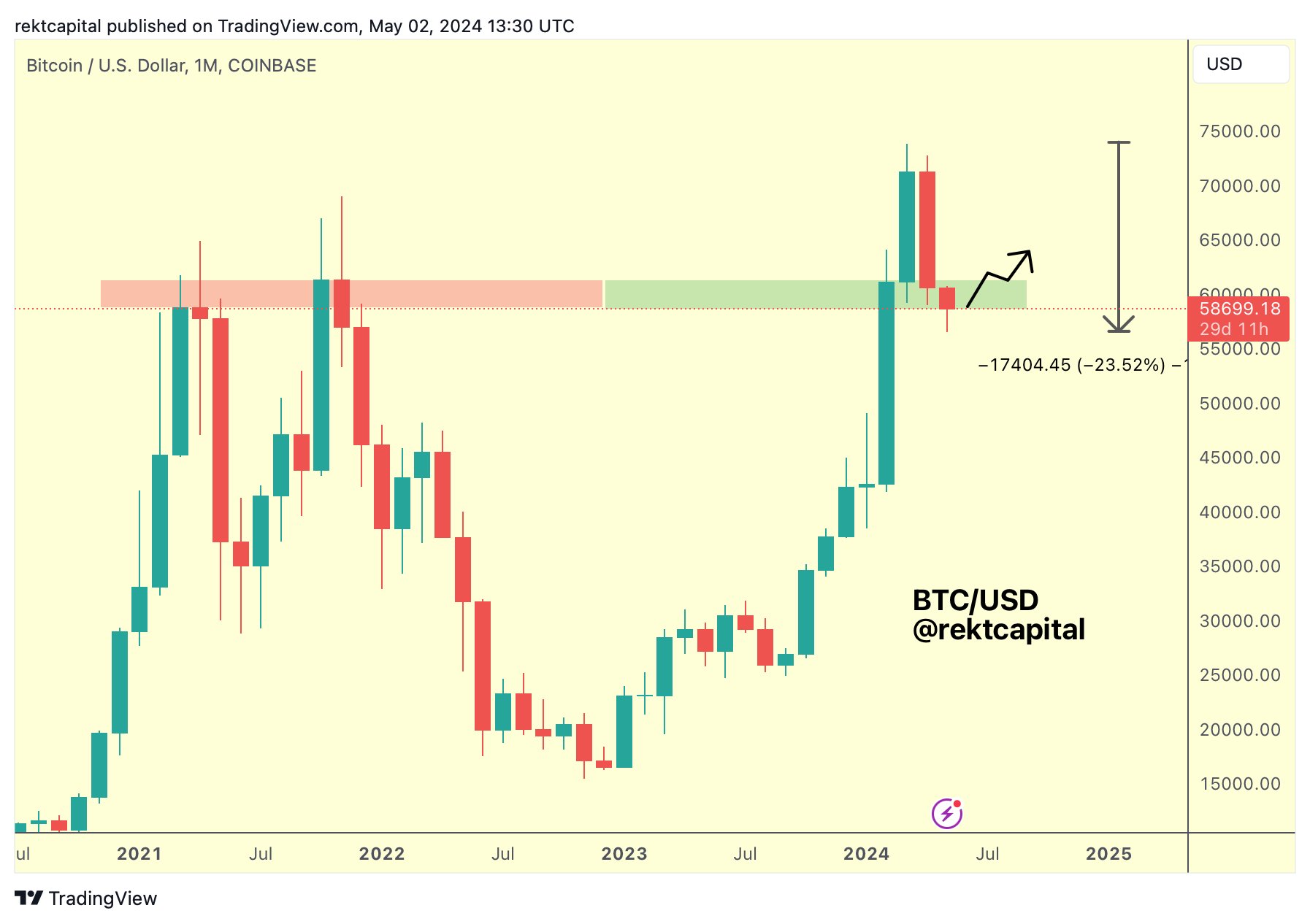

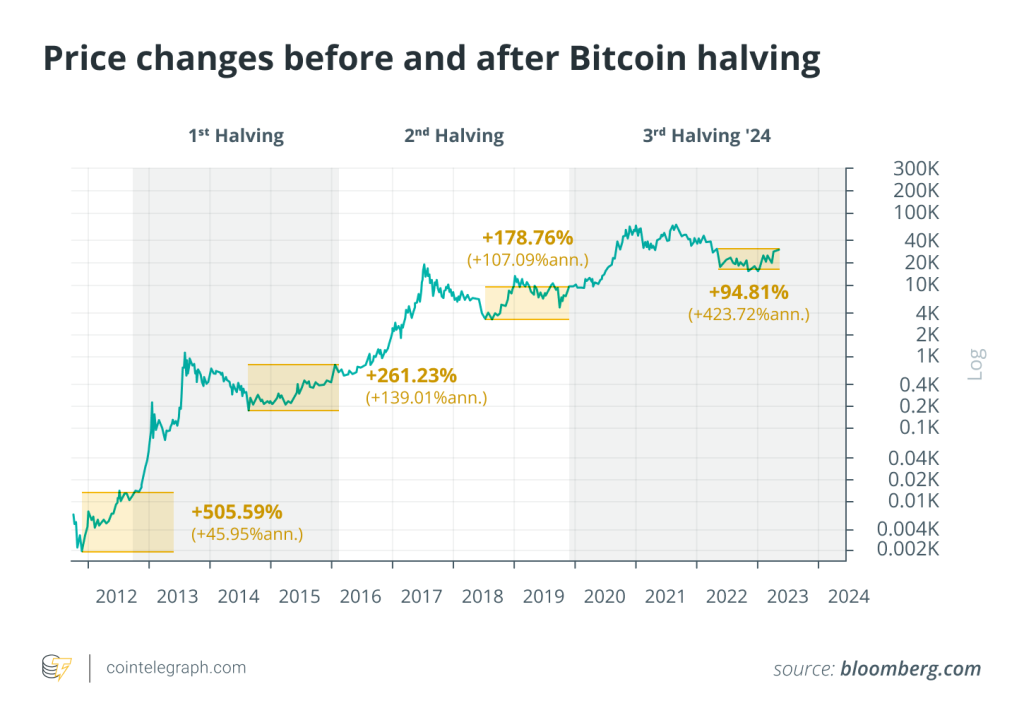

Bitcoin’s current correction is the longest and deepest retracement of the current cycle, according to popular Bitcoin analyst Rekt Capital, who said in a May 2 video analysis:

“Whenever we’d get close to a 20% downside, that was typically a fantastic buying opportunity before price reversals towards the upside. So if we’re deeper than 20%, it is an even better opportunity than we had this cycle, because the deeper we go the closer we get to a bottoming in Bitcoin’s price action.”

The analyst doesn’t expect much more downside action for Bitcoin, based on historical chart patterns.

While going lower seems unlikely, BTC price could consolidate for the next two months due to the challenging macroeconomic environment, according to Jag Kooner, head of derivatives at Bitfinex. He told Cointelegraph:

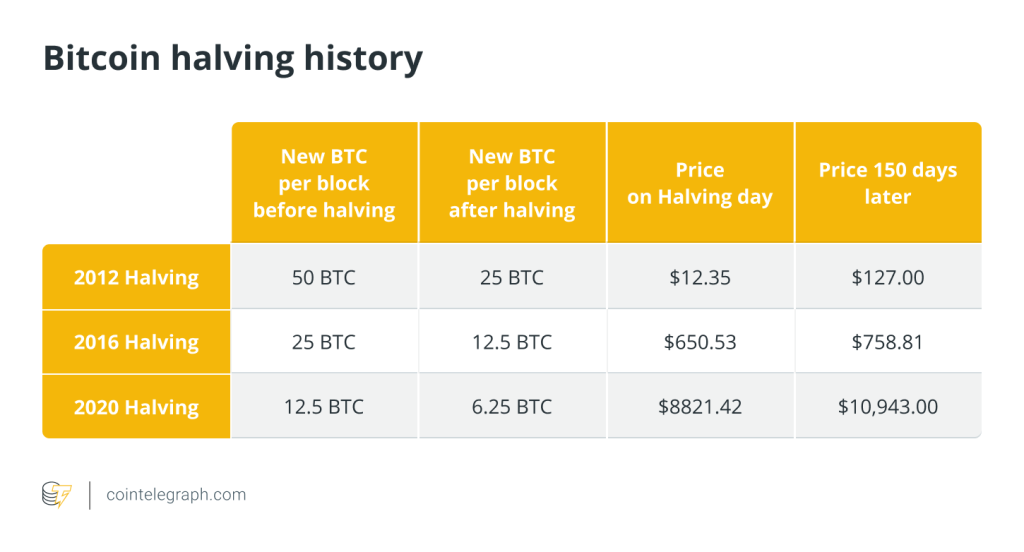

“We could see a 1-2 month consolidation in Bitcoin prices, trading in a range with swings of $10,000 on either side. We expect the positive impact of the halving, which has brought about a reduction in Bitcoin supply, will be seen in later months. At this point, the economy is also expected to be performing better, having achieved a soft landing and avoiding a recession, providing further impetus to crypto assets.”

On the weekly chart, the $52,000 mark acts as the “most important level” to watch as it’s a high timeframe (HTF) support-resistance level.

A weekly close above the $52,000 mark would suggest more upside is likely, according to an X post by crypto trader Marco Johanning.

Related: Hong Kong Bitcoin ETFs not enough to absorb US ETF selling pressure

Mr.100 confirmed as Upbit cold wallet: Crystal Intelligence

Cointelegraph previously confirmed that the “Mr.100” address belongs to Upbit exchange, with wallet forensics analysis from Crystal Intelligence.

The blockchain intelligence firm told Cointelegraph:

“We have found that the number and value of transactions associated with this wallet are indicative of a VASP-type service. Additionally, we can confirm with high accuracy that the incoming transactions originate from Upbit, and these have maintained a consistent value since the collapse of FTX.”

All the 14 secondary wallet addresses associated with the main wallet of Mr. 100 have passed Know Your Customer verification on Upbit exchange, wrote pseudonymous on-chain sleuth Mai in a March 15 X response:

“Mr.100 uses a small wallet address to buy $BTC. I find it very similar to what Upbit usually does with altcoins (ETH network). If we follow Upbit’s cash flow, we will see the coincidence.”

Related: Bitcoin down 20%+ from all-time highs — Is BTC price headed to $50K?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses