Will Dogecoin skyrocket 7 months after the Bitcoin halving again?

The top memecoins are far from previous highs, yet retail investors may view them as fairer opportunities than VC-backed coins with high fully diluted valuations.

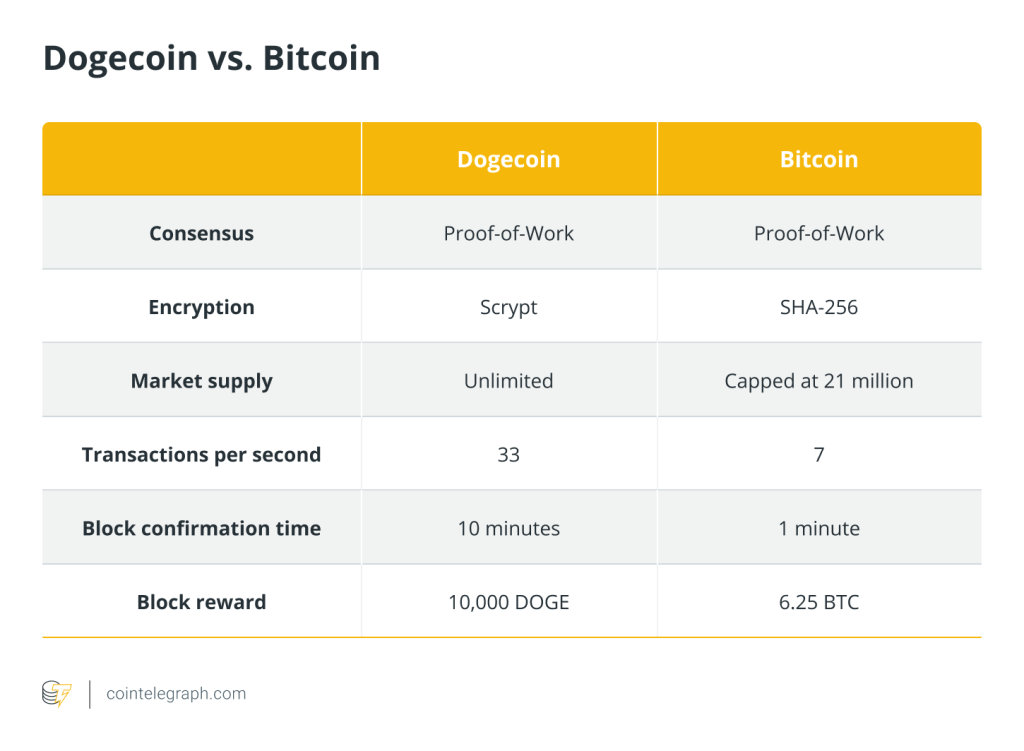

While Dogecoin (DOGE) price fell during the past month, historical data indicates that it could start its rally to new all-time highs around seven months after the Bitcoin halving.

Dogecoin price rally in November?

Dogecoin price is down nearly 8% on the daily chart and over 18% over the past month, but remains in line with the previous cycle’s price action, suggesting that it could be on track toward new all-time highs.

During the previous crypto bull market, Dogecoin started rallying in May 2020, or seven months after the 2020 Bitcoin halving, according to TradingView.

Dogecoin price rose to its all-time high of $0.73 on May 8, 2021, a year after the 2020 Bitcoin (BTC) halving. Dogecoin is currently 73% down from its previous all-time high.

If this pattern were to repeat, Dogecoin price would reach a new all-time high in April 2025. However, technical analysis is difficult to apply to memecoins as their value is speculative.

Memecoins are a “manic market” purely driven by greed, with little understanding of the high risks, according to Robby Greenfield, founder of Umoja Labs.

However, Greenfield expects some memecoins to maintain a high valuation. He told Cointelegraph:

“Some of these tokens, like DOGE and PEPE will continue to legitimize as exchanges like Coinbase introduce memecoin futures markets. Given the large, cult-like communities behind these assets, it’s likely that they will remain as higher-cap cryptos than even most legitimate project-backed tokens.”

Related: Bitcoin outperforms Tesla stock for the first time since 2019

Memecoins offer fairer market access?

Numerous cryptocurrencies have launched with a high fully diluted valuation (FDV) and significant venture capitalist (VC) allocation during 2024, prompting some analysts to argue that “money-hungry VCs” are bad for cryptocurrencies long term.

Thus, retail investors could be seeing memecoins with no VC allocations as the fairest market opportunity, according to Gianluca Sacco, chief operating officer at VALR. He told Cointelegraph:

“These tokens are being seen as the fairest opportunity to participate in the crypto market right now, while the communities around them are just a lot of fun to be involved in… Many feel burnt by high FDV, low issuance tokens that have historically been offered by token projects at deep discounts to insiders and VCs at the expense of retail users.”

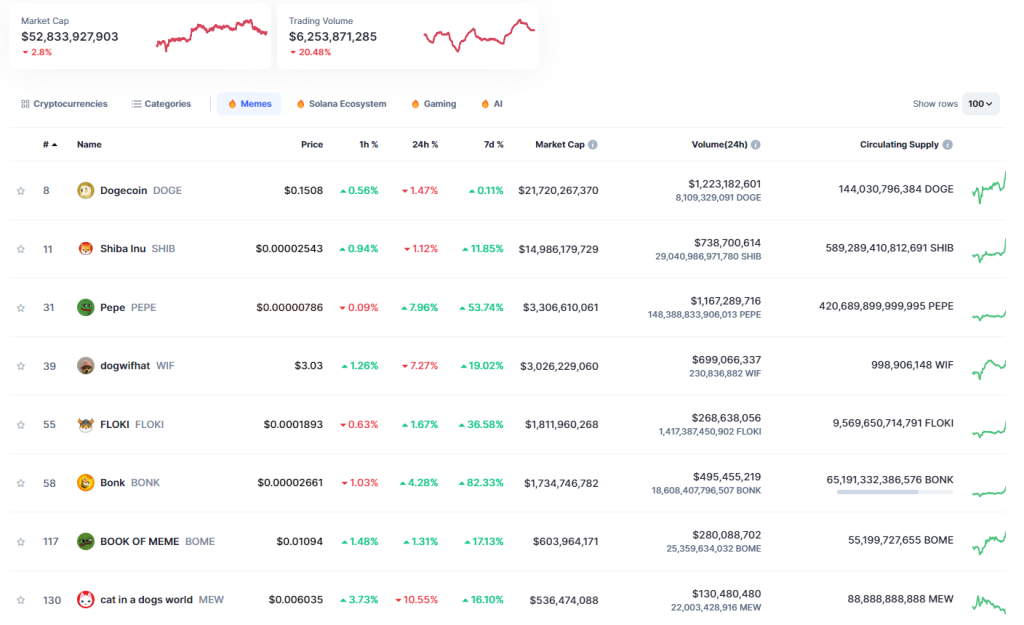

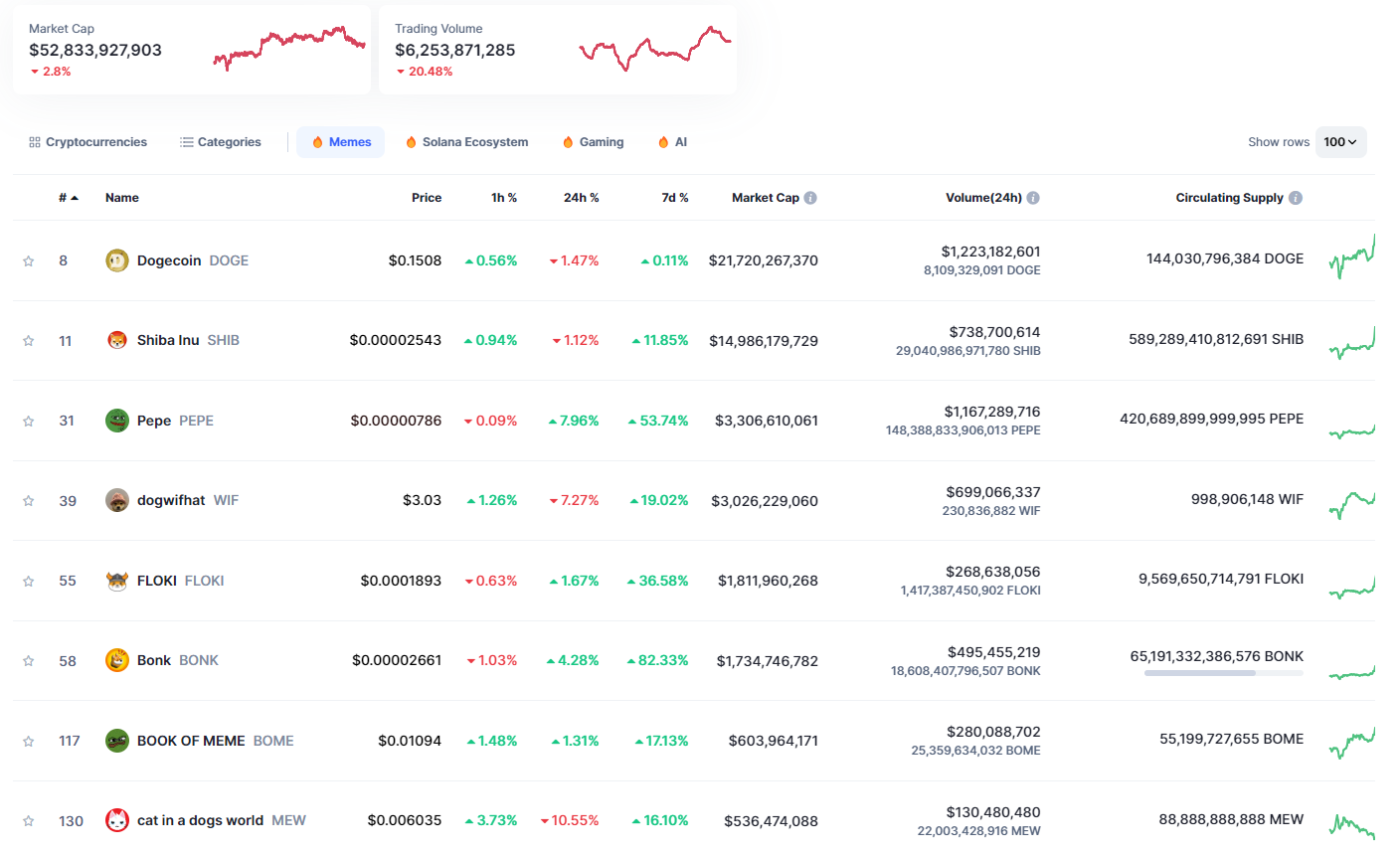

Other memecoins like Pepe (PEPE), Shiba Inu (SHIB), Dogwifhat (WIF), and Floki (FLOKI) saw double-digit gains during the past week, according to TradingView.

Yet, this only suggests a temporary surge of interest in some memecoins, not the resurgence of a memecoin “altseason,” according to Diane Dai, the CMO of Dodo. Dai told Cointelegraph:

“Despite the double-digit price increases, trading volume remains low, indicating insufficient market liquidity. The significant price fluctuations of memecoins are not enough to prove an influx of investors into the memecoin market after the halving event.”

The daily trading volume of memecoins fell over 17% in the past 24 hours to $6.58 billion. The market capitalization of memecoins was down 5.8% to $52.8 billion, according to CoinMarketCap data.

Related: Bitcoin price breaks above $66K — Has BTC flipped bullish again?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses