2 on-chain metrics suggest Bitcoin at its ‘best moment to buy’

One crypto analyst says Bitcoin’s just undergone one of the “healthiest market resets” he has seen in a long time.

Bitcoin (BTC) could be entering into an attractive buy zone according to two popular metrics used by cryptocurrency analysts to track on-chain trading activity.

The metrics, market value to realized value (MVRV) and the open interest (OI) weighted funding rate, could suggest Bitcoin is at an attractive entry point for traders.

“This is the best moment to buy Bitcoin,” pseudonymous trader Mister Crypto told his 94,100 X followers in an April 23 post on X.

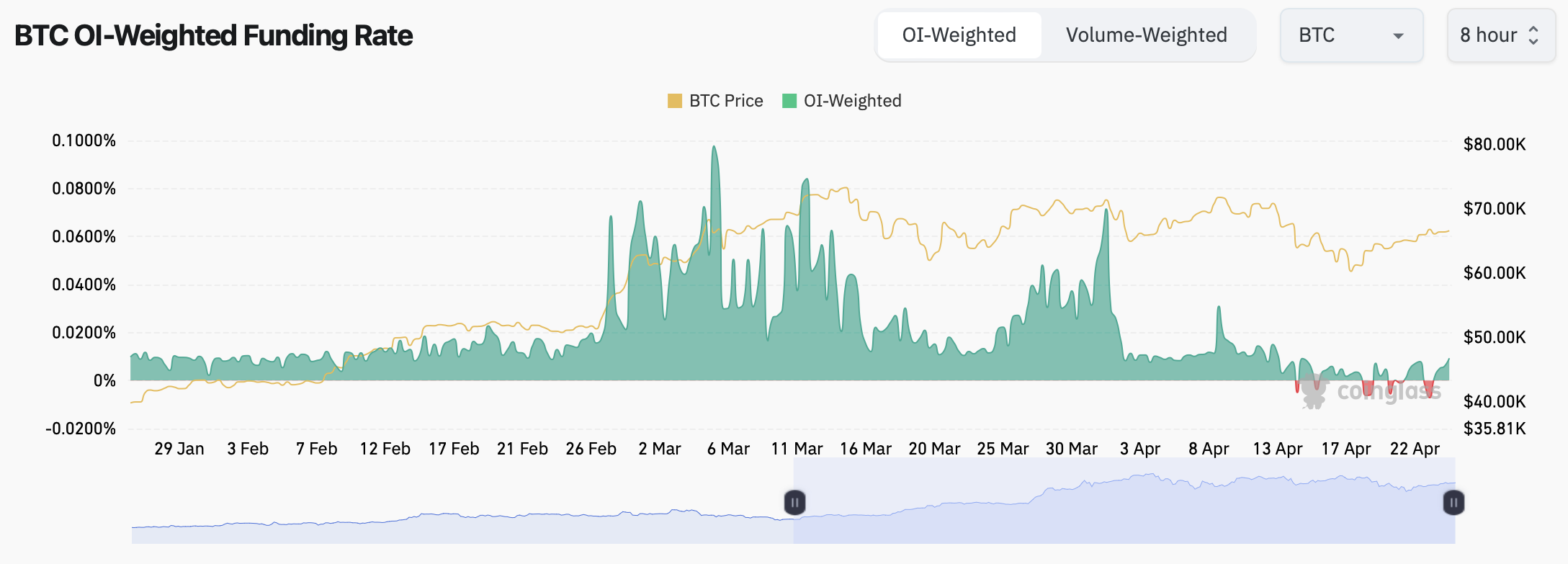

Bitcoin’s OI weighted funding rate— which represents the cost of holding Bitcoin futures positions — just breached positive territory on April 24, after 24-hours in the negative zone, posting 0.0093%, as per CoinGlass data.

Despite the upswing, it is still significantly lower than the 0.0714% recorded at the beginning of April, a correction that analysts view as favorable for the market.

“One of the healthiest market resets I have seen in a long time,” on-chain analyst Checkmate declared in an April 24 post.

“Rates holding strong. Bitcoin ready for liftoff,” Crypto Banter host Kyle Doops added in an April 24 post.

Related: $1M Bitcoin price still in play amid ‘macro liquidity surge’ — Arthur Hayes

The higher funding rates signal increased interest in long trades, reflecting a more bullish sentiment in the market.

The last time Bitcoin’s OI weighted funding rate peaked significantly in early March, Bitcoin reached an all-time high of $69,200 on the same day.

Just a week later, on March 14, it surpassed that milestone again, climbing to $73,835, as per CoinMarketCap data.

However, founder of the Capriole Investments fund, Charles Edwards, told Cointelegraph that while funding rates are a good indicator “broadly speaking,” it no longer carries the same level of certainty as it did a few years ago.

“2018 through 2020 and 2021, that sort of three year window it wasn’t talked about much. It wasn’t understood and it was a hundred percent hit rate metric, where if it went negative it was almost a hundred percent guaranteed, if you went long you would make money.”

Although now there are “so many more parties involved it’s a bit more of a complex metric to consider,” according to Edwards.

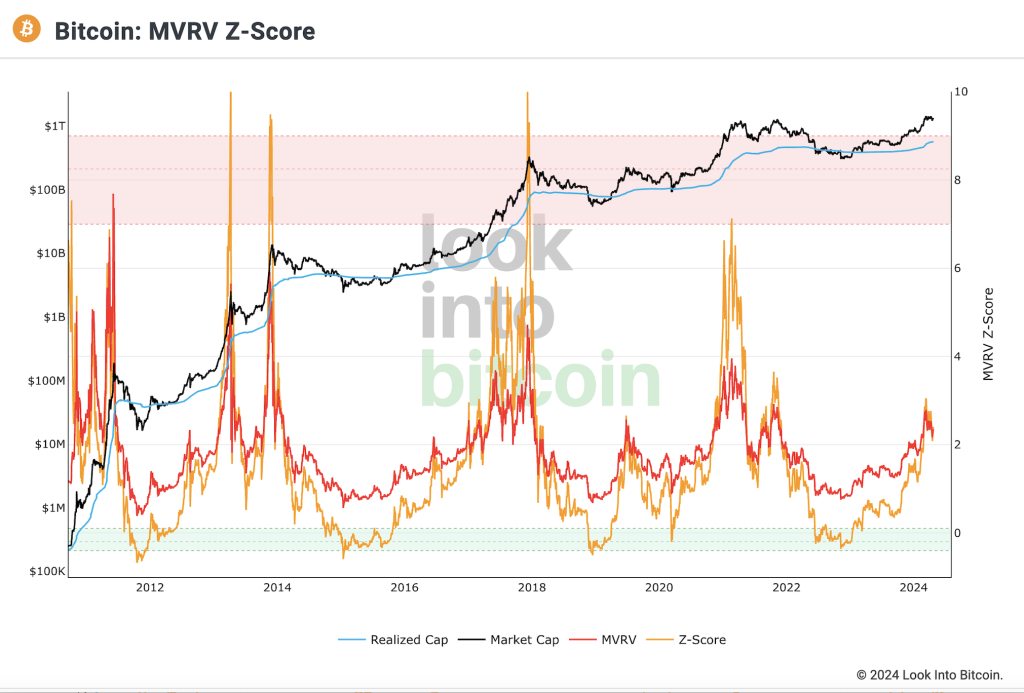

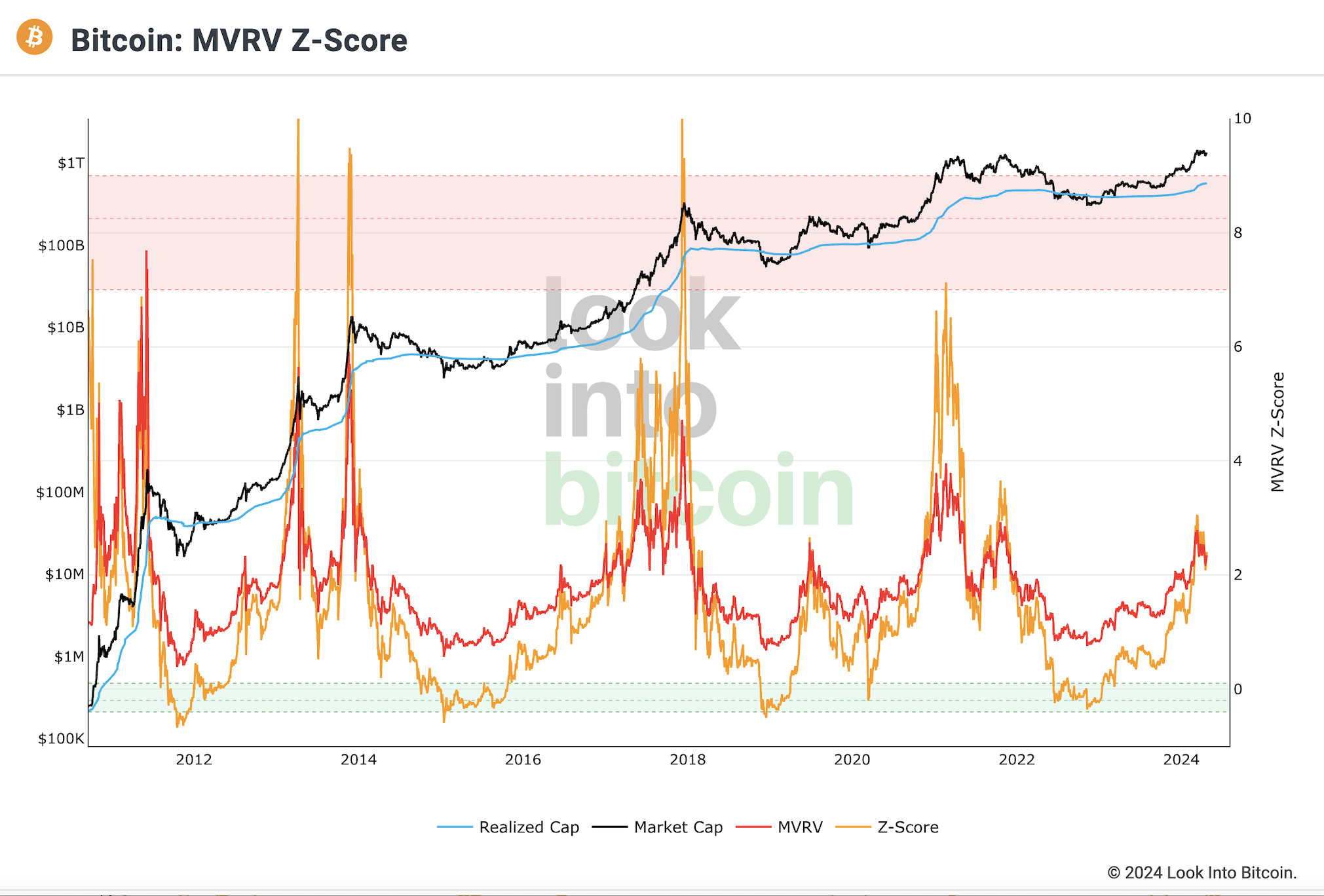

Meanwhile, the MVRV indicator — which aims to identify when Bitcoin is over or undervalued relative to its fair value — also suggests Bitcoin has headed further into favorable buying conditions.

At the time of publication, Bitcoin’s MVRV score is 2.32, down 6.45% since the start of April, as per LookIntoBitcoin data.

An MVRV score above 3.5 suggests that the market is almost at its peak, whereas below 1 suggests that the market has bottomed out.

Edwards pointed out that the current MVRV levels indicate “we’ve got quite a bit of leeway over the next year.”

However, he pointed out that the current buying opportunity is far less lucrative compared to those available as recently as two years ago.

“It’s not a deep value opportunity that it was a year ago or two years ago when it was way lower. But it’s also not screaming “over valuation” which is four, or five or six.”

Responses