Bitcoin price breaks above $66K — Has BTC flipped bullish again?

Bitcoin is back above $65,000 just days after the halving, suggesting that the drawdown period for BTC price may be over.

Bitcoin’s (BTC) price broke above the crucial $65,000 mark, suggesting that price action could turn bullish just two days after the Bitcoin halving.

Bitcoin breaks above $65,000 resistance

Bitcoin reclaimed the $65,000 mark on April 22, which could signal a change in market sentiment that could lead to the end of the current price correction, according to Kristian Haralampiev, structured products lead at Nexo. He told Cointelegraph:

“Traditional finance markets opened relaxed on the back of tension in the Middle East, with risk-on assets going up, while gold opened lower. The increase in open interest across derivatives, along with higher levels of leverage and positioning in the options markets suggests a catch-up rally may be in the making.”

Bitcoin reclaiming the $65,600 mark on the four-hour chart could signal that BTC price is turning bullish, according to an April 22 X post by popular crypto analyst Trader Alan:

“This breakout is associated with “higher lows into the resistance” pattern and [relative strength index] RSI breakout simultaneously. This tells us the buying power has developed and a strong LTF bottom has formed. This leads to further bull run.”

As Bitcoin price performed a weekly close above the crucial $65,600 mark, it is acting as the main resistance level for BTC, according to an April 22 X post by popular analyst Rekt Capital, who wrote:

“Bitcoin is currently in the process of trying to perform this reclaim. A successful reclaim here would enable BTC for a move towards $67,150 which would be the next reclaim BTC would need to make successful for price to revisit the $69,000 via the green path.”

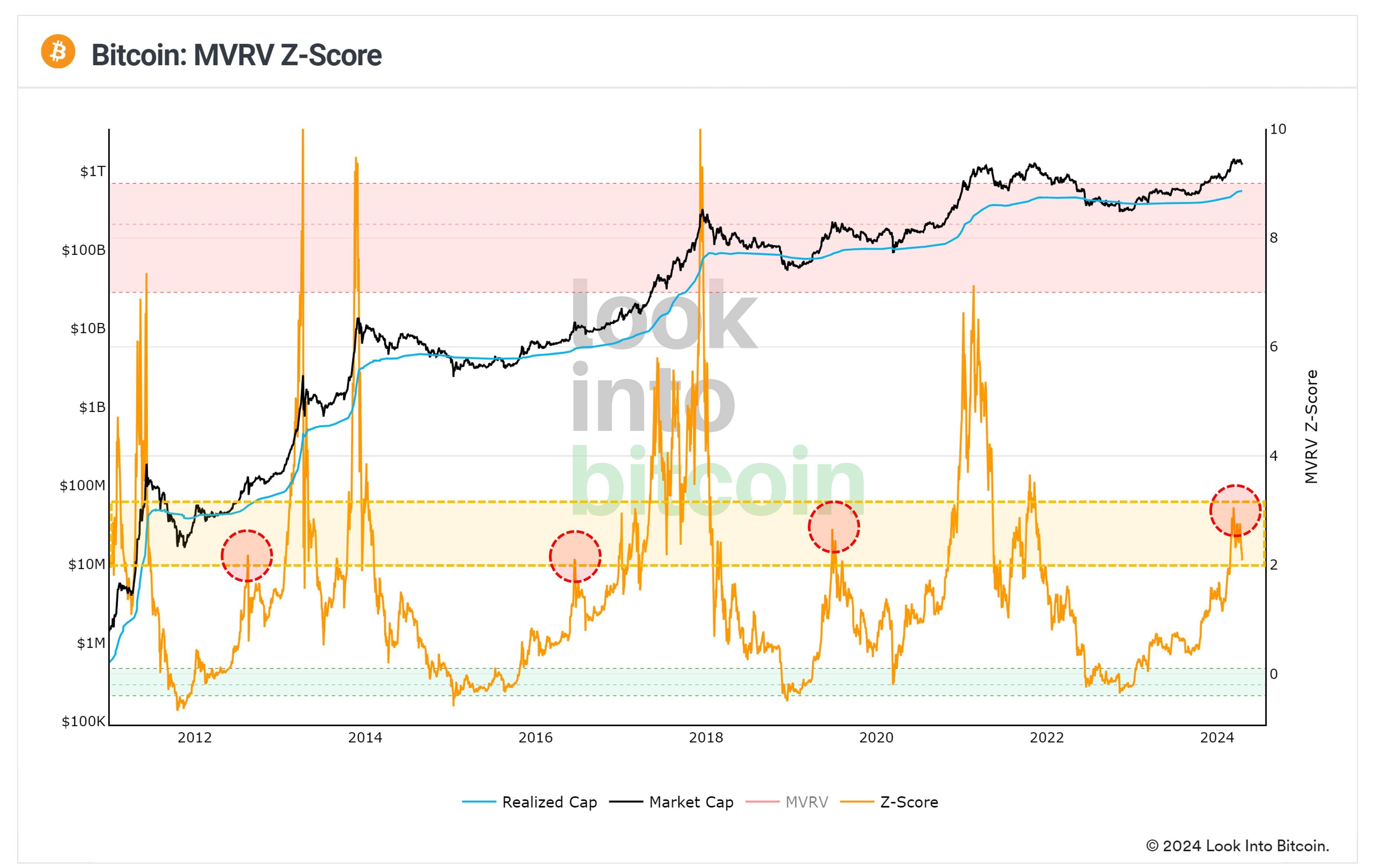

Bitcoin’s MVRV-Z metric resets

Following the past week’s correction, Bitcoin’s MVRV Z-score, a technical indicator used to assess whether an asset is overbought or oversold, saw a healthy correction, falling to 2.08 on April 17, suggesting that Bitcoin is no longer overbought, according to LookIntoBitcoin.

The indicator suggests a healthy upward trend, in line with previous bull cycles, according to Philip Swift, the founder of LookIntoBitcoin, who wrote in an April 22 X post:

“Bitcoin MVRV Z-Score has once again had a mid-cycle pause between 2 and 3. The cooling off over the past month has been very healthy, and similar to previous cycles.”

Related: New Bitcoin whales, ETFs are up only 1.6% in unrealized profit — Is the BTC bottom in?

BTC needs to reclaim $69K to confirm breakout

Despite this week’s positive price action, it’s too early to confirm the end of the current correction due to the decreased market depth, which could result in more price volatility, according to Jag Kooner, the head of derivatives at Bitfinex. He told Cointelegraph:

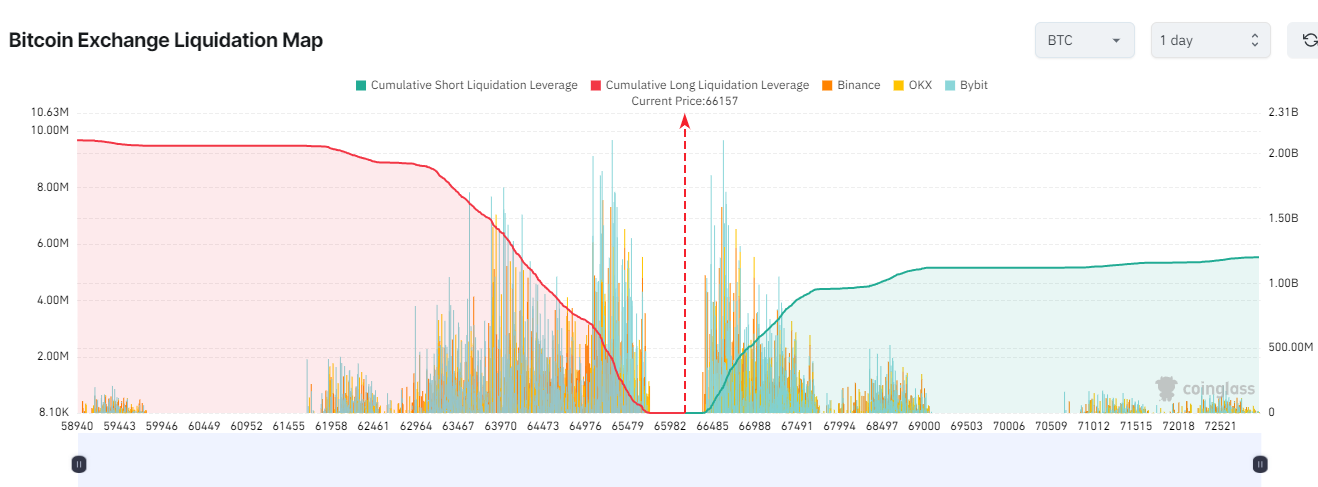

“While we broke out of our lower timeframe range, it is important to remember that after a mass liquidation event amounting to over $2 billion in liquidations in 2 days starting April 12th, the market depth is considerably lower than a few weeks ago. This means there is a lower open interest and fewer spot orders, so it’s easier for smaller orders to move the market.”

Kooner noted that he is optimistic about Bitcoin’s price action in the short term, but warned of another potential liquidation as more leverage starts re-entering the markets.

To confirm a decisive move towards new highs, Bitcoin first needs to overcome the $69,000 mark, according to Nexo’s Haralampiev:

“Key levels to confirm the bullish sentiment and price movement are in the $69,000 – $70,000 bracket. Eventually, price action above these levels could lead to an attempt from BTC to break out to all-time high levels, should market sentiment and positioning continue to intensify.”

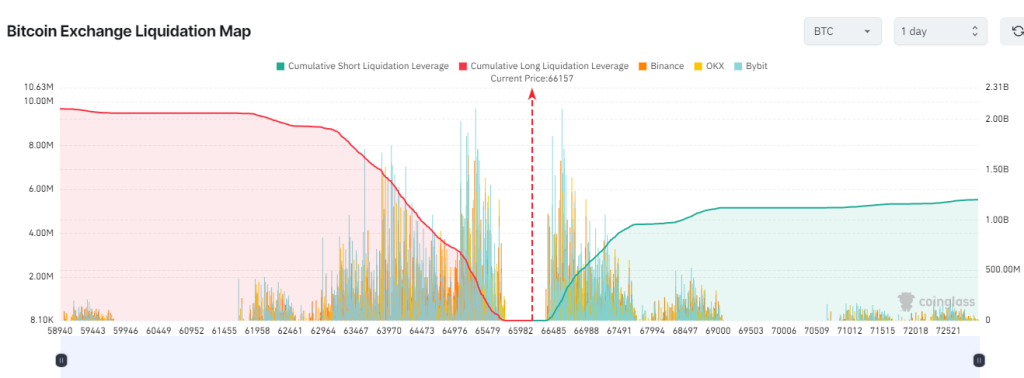

Bitcoin is facing significant resistance at the $67,000 mark, with over $553 million worth of cumulative short-leveraged positions across all exchanges.

A potential move above the $69,000 mark would liquidate over $1.12 billion worth of short-leveraged positions, according to Coinglass data.

Related: Top five BTC miners not selling despite Bitcoin halving

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses