Bitcoin’s 2028 halving price target is $435K, historical data suggests

While the halving is associated with Bitcoin bull cycles, the current rally is mainly driven by ETF inflows, argues Bybit’s Yang.

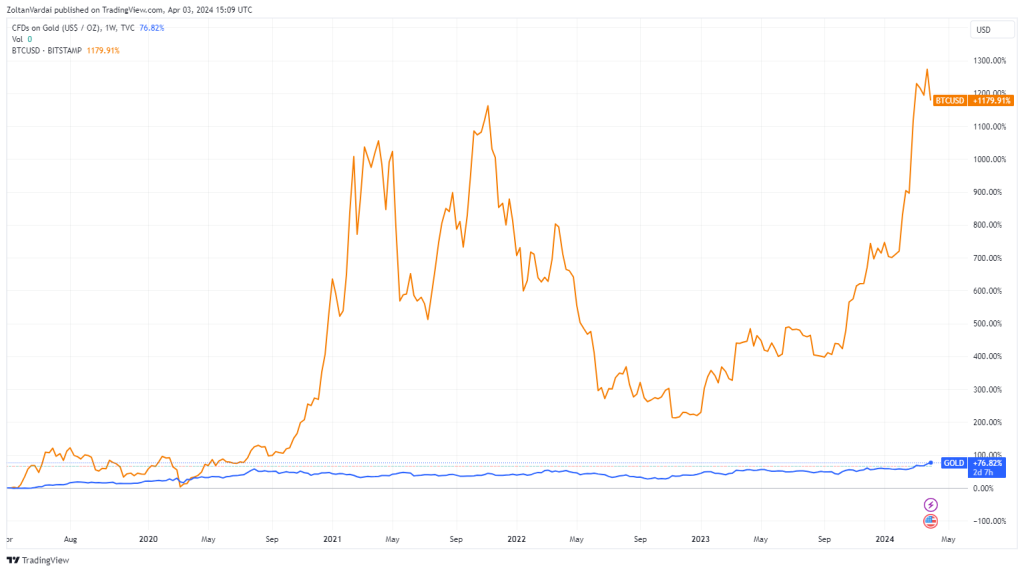

Bitcoin price (BTC) rallied approximately 650% since the last Bitcoin halving in 2020. If history repeats, Bitcoin could reach the $435,000 price level before the 2028 halving.

Is BTC price headed to $435K by 2028 halving?

Bitcoin price rose around 658% since the last Bitcoin halving in 2020, according to TradingView data, currently trading around the $66,000 mark.

The 2024 Bitcoin halving will happen in less than three weeks. If historical chart patterns were to repeat, Bitcoin’s current $66,000 price would reach $434,280 per unit if it performs similarly to the current cycle by the 2028 halving.

Nonetheless, Bitcoin’s post-halving rallies have seen diminishing returns throughout the years. Until the first halving in 2012, Bitcoin increased from having virtually no value to $12.5, an over 12,400% increase. Bitcoin price gained 5,200% to $650 by the 2016 halving and 1,200% to $8,500 by the 2020 halving.

Related: How high can Bitcoin go? New BTC price prediction sees cycle top at $180K

Thus, Bitcoin’s average price rallies fell by 45% each cycle to the current 658%. If this diminishing returns’ trend repeats, Bitcoin will deliver a 360% rally during the next cycle, resulting in a roughly $303,600 BTC price at the 2028 halving.

Bitcoin halving or ETFs having a bigger impact?

Bitcoin’s recent price surge is unrelated to the upcoming halving and mainly attributed to the inflows into spot Bitcoin exchange-traded funds (ETFs), argues Hao Yang, head of financial products at Bybit, who told Cointelegraph:

“Considering Halving and price trends, from a very rigorous quantitative point of view, there is no evidence supporting a positive correlation between Halving event and BTC price. But history can be interpreted in many different ways, I certainly hope 435K by 2028 but won’t put too much into it.”

A six-figure BTC price appears even more possible if Bitcoin ETFs overtake gold ETFs, which is something that could happen in the next two years, according to a Feb. 26 research report from Bloomberg analyst Eric Balchunas.

Additionally, Bitcoin ETFs are growing at a much quicker pace than gold ETFs did when they first appeared in 2004. In fact, Bitcoin is “speedrunning” gold’s price by fivefold, says Sam Wouters, the head of contact at River, who wrote in a March 29 X post:

“Bitcoin is basically just 5x speedrunning gold’s trajectory. The last 10 years of Bitcoin look a bit like a squished version of gold’s last 50. No wonder some people get salty.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses