Why is Dogecoin price down today?

Dogecoin price retracts as the wider crypto market corrects and traders choose to book profit.

Dogecoin (DOGE) price is down today as the wider crypto market undergoes a sharp correction.

DOGE price has dropped over 5.5% over the last 24 hours to an intraday low of $0.1712 on April 3, underperforming the crypto market, which fell by around 0.17% in the same period. The memecoin’s price followed a correction in Bitcoin (BTC) that has witnessed nearly a 7.7% retreat in the last two days.

Let’s take a closer look at the most likely reasons behind Dogecoin’s latest pullback.

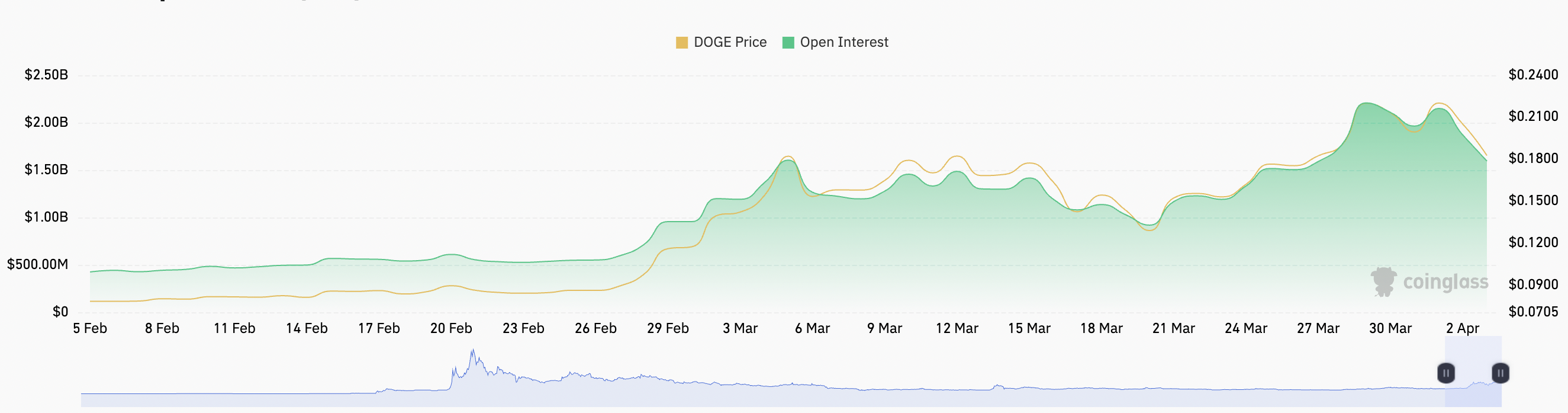

Dogecoin open interest drops below $2 billion

DOGE has posted tremendous gains recently, rising more than 11% between March 23 and March 28. The price then turned down on March 29 and currently trades 5.5% below its value a week ago.

DOGE’s decline over the last seven days also coincides with a drop in futures open interest (OI). Data from Coinglass shows that DOGE OI has fallen by 27.6% from $2.21 billion on March 28 to the current value of $1.60 billion.

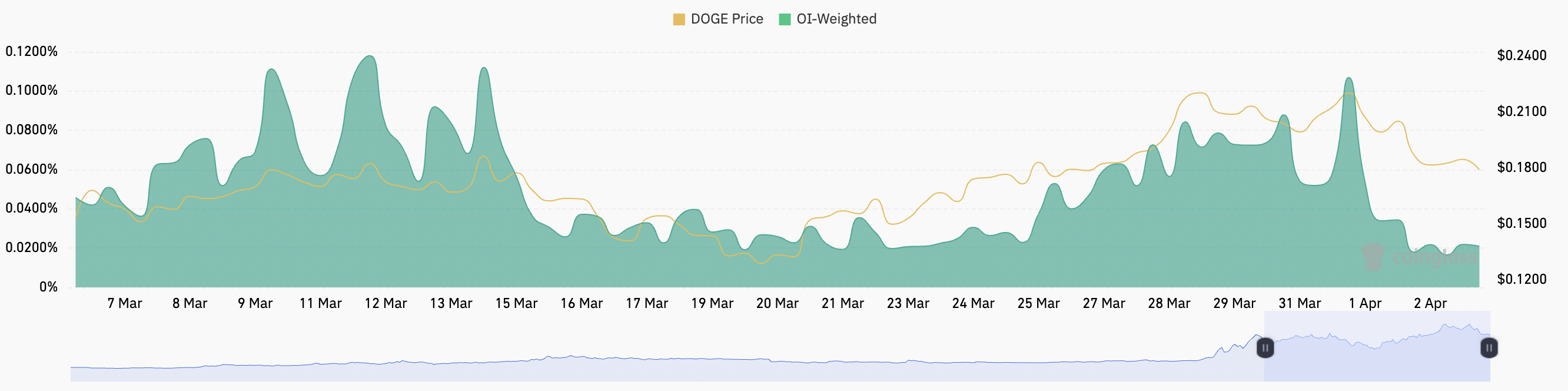

Additionally, the funding rate for Dogecoin perpetual futures contracts had reduced from 0.107% to 0.021% over the same time period.

Reducing funding rates and OI suggest that traders are generally bearish about the asset’s next direction, expecting prices to go lower.

This negative sentiment can lead to more selling pressure, potentially lowering the asset’s price if other market conditions align. This seems to be the case with DOGE’s downward move today.

Related: Second phase of crypto bull market about to start, says on-chain analyst

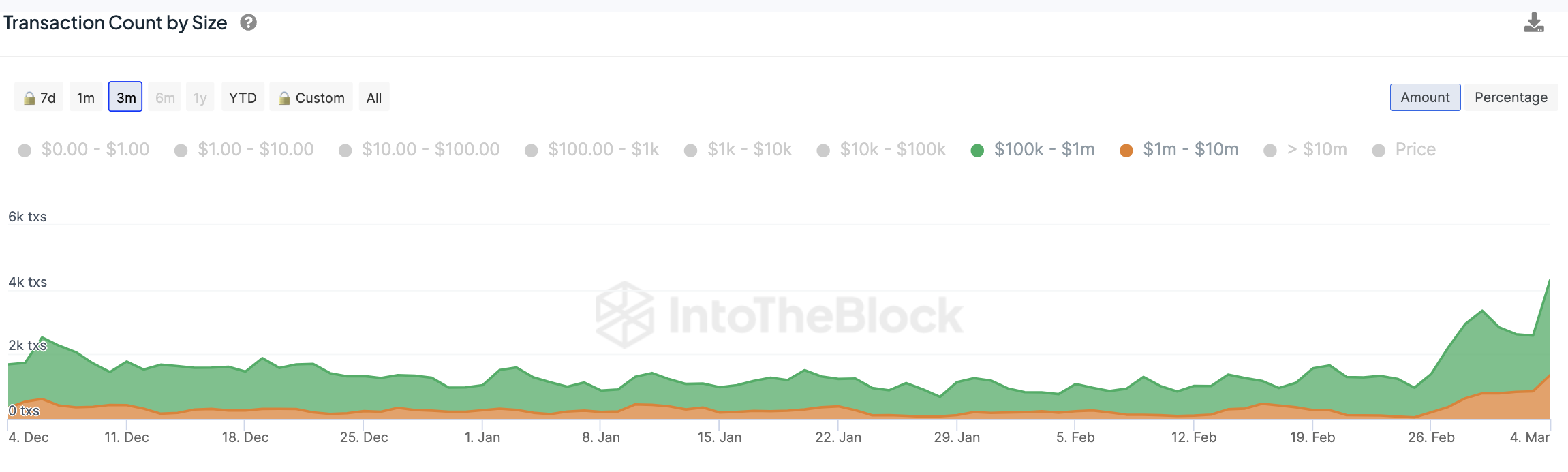

Whale activity backs DOGE’s correction

After the latest marketwide correction that saw millions of dollars liquidated, DOGE sank as low as $0.1712 and is currently 5% down on the weekly timeframe. However, the uptick in whale activity marks a bearish signal for Dogecoin.

Whale transactions are large transactions that involve the transfer of $100,000 or more worth of DOGE. According to on-chain data analytics firm IntoTheBlock, the number of DOGE transactions worth between $100,000 and $1 million has increased by more than 20% over the past seven days.

Similarly, the data also shows that the number of DOGE transactions larger than $1 million has increased by more than 200% in the last 30 days.

In an April 1 post on X market intelligence firm, Santiment shared the following chart saying,

“The top #memecoin by market cap (#8 market cap #crypto asset overall) is being powered by major dormant whales moving $DOGE back into circulation.”

This increase in dormant whale activity shows the long-term holders are now in profit after March’s rally in DOGE price and are now cashing in, validating the ongoing correction.

Bearish divergence

Dogecoin’s drop today precedes a period of growing bearish divergence between its price and the relative strength index (RSI).

Notably, DOGE’s price rallied between March 28 and March 31, forming higher lows. But, in the same period, its daily RSI dropped, forming lower lows.

As a rule of technical analysis, a divergence between rising prices and falling RSI indicates weakness in the prevailing uptrend, prompting traders to secure profits at local price highs.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses