Bitcoin clings to $65K — More losses ahead for BTC price?

Bitcoin price briefly dipped below the $65,000 mark as long-term BTC holders started selling. Can BTC price close the week above $65,600?

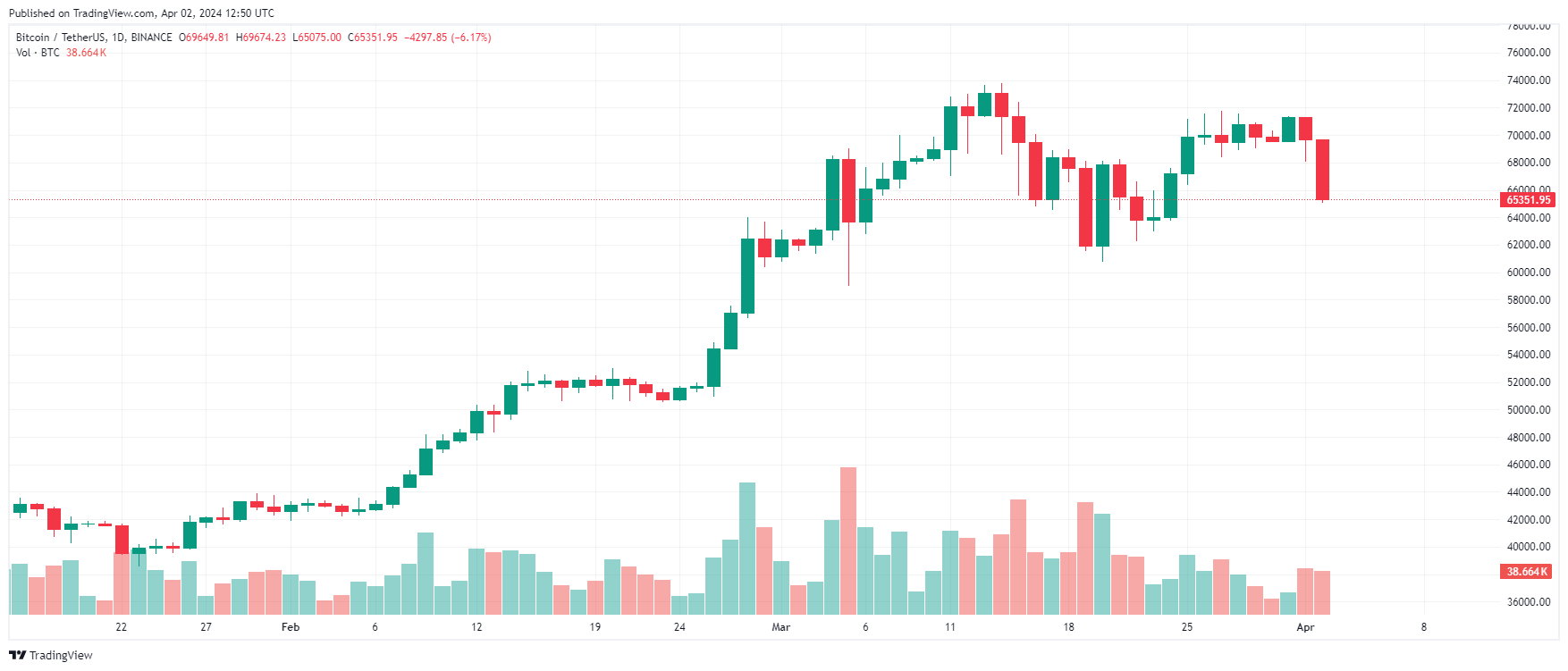

Bitcoin’s (BTC) price fell over 7.1% during the past day, slipping below the $65,000 mark for the first time since March 24.

The current week, or the 14th week of the year, is historically one of the worst weeks for Bitcoin’s price performance. BTC price fell an average of 8.33% on the 14th week of the year, according to Coinglass data.

Bitcoin price must sustain $65,000

Bitcoin price fell over 6% in the past 24 hours, reaching a daily low of $64,610 at 1:35 pm (UTC), while trading volume for the world’s largest cryptocurrency rose over 75% during the day to $46 billion, according to CoinMarketCap data.

Bitcoin failed its post-breakout retest and the price momentum will continue slowing down as the Bitcoin halving approaches, argues popular crypto analyst Rekt Capital, in an April 2 X post:

“Bitcoin has failed its post-breakout retest. Bitcoin could still technically recover above the old all-time high of ~$69,000 before the new weekly candle close is in.”

Bitcoin’s price needs to be sustained above the $65,600 weekly range low to avoid further losses, added Rekt Capital.

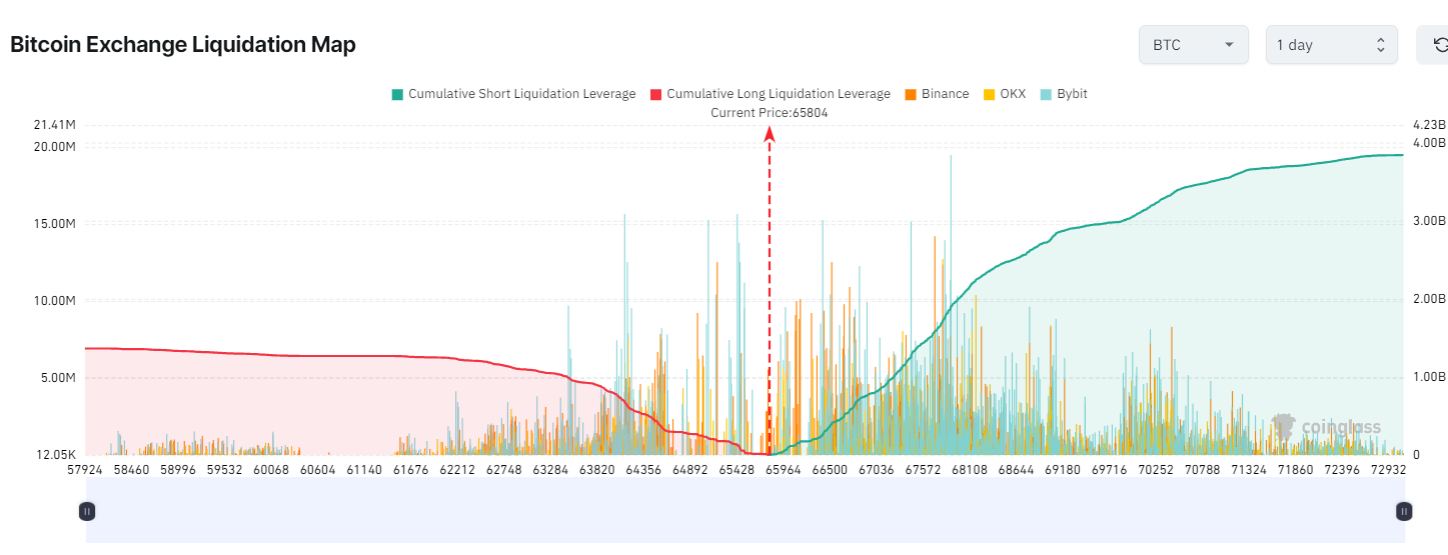

Over $249 million worth of long leveraged positions would be liquidated across all exchanges, if Bitcoin price fell to to the $65,000 mark, according to Coinglass data.

Following the correction, Bitcoin has reset multiple key metrics that previously suggested the price was overheated, including the relative strength index (RSI), which fell to 48 on the daily timeframe, suggesting that Bitcoin is no longer overbought, according to Tradingview.

Related: Over $6B worth of BTC moved by 5th-richest Bitcoin whale

The RSI is a popular momentum indicator used to measure whether an asset is oversold or overbought based on the magnitude of recent price changes.

Bitcoin’s price correction can be mainly attributed to newcomers who entered the Bitcoin market in the past two months since the approval of the United States’ spot Bitcoin exchange-traded funds (ETFs), according to Andrey Stoychev, the head of Prime Brokerage at Nexo. He told Cointelegraph:

For fresh adopters, Bitcoin’s move from $40,000 then to the current $65,000 potentially signifies an over 50% return in as little as 60 days – a sure profit-taking signal in the investment world. It’s important to remember that market corrections are part of every market dynamic.

Stoychev expects a short-term correction thanks to new latecomers who want to invest in Bitcoin. He said:

“Bitcoin bull markets have come with returns, as three out of the first four cycles have surpassed previous highs. Looking back at 2020, Bitcoin surged 250% in just four months after breaking a new all-time high, suggesting a potential trajectory toward $231,000 if history repeats itself in this cycle.

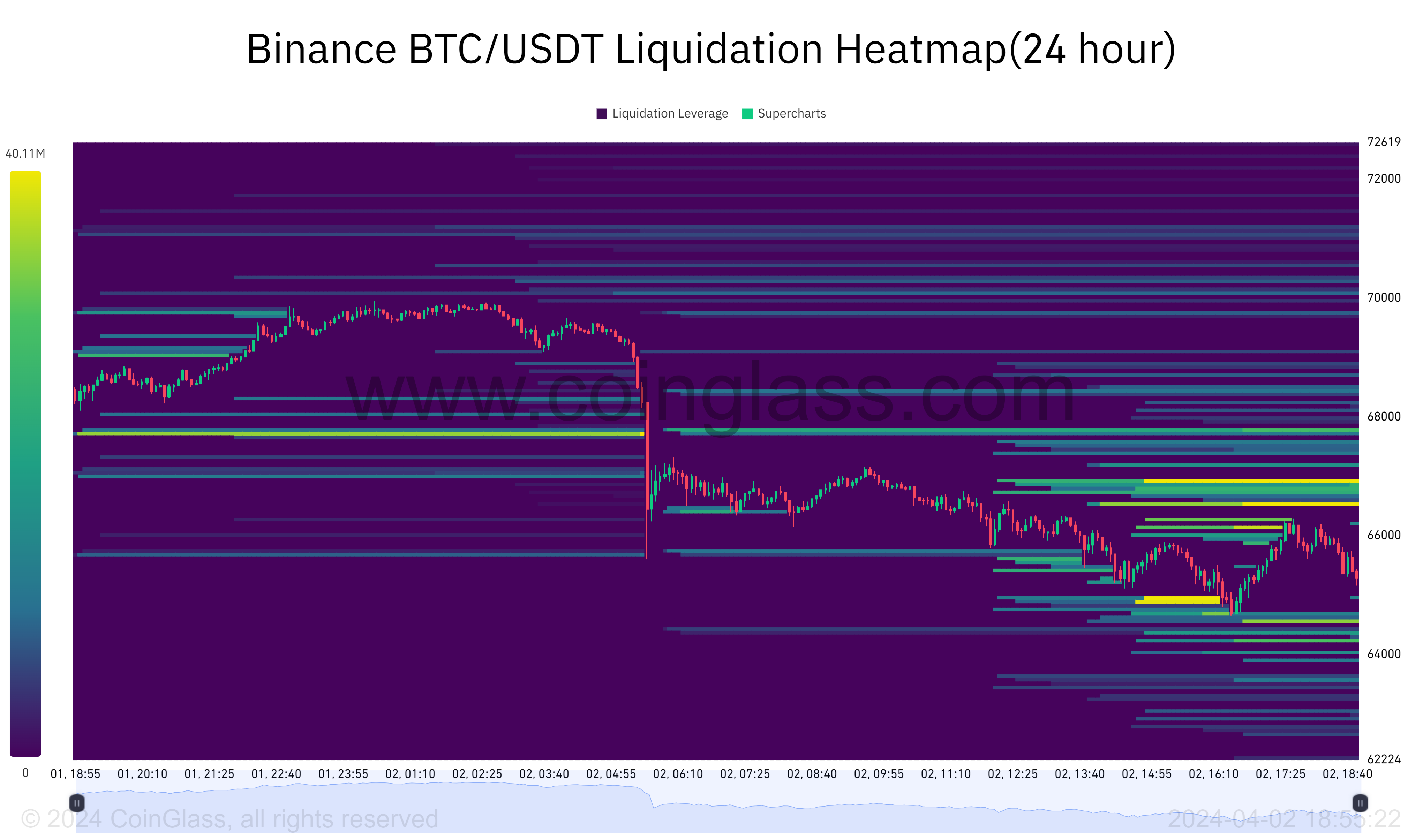

Traders should be watching the $64,000 mark, with over $17.21 million worth of Bitcoin futures liquidation leverage on Binance, the world’s largest exchange. An additional $9.92 million worth of BTC stands to be liquidated at the $63,500 mark, according to Coinglass data.

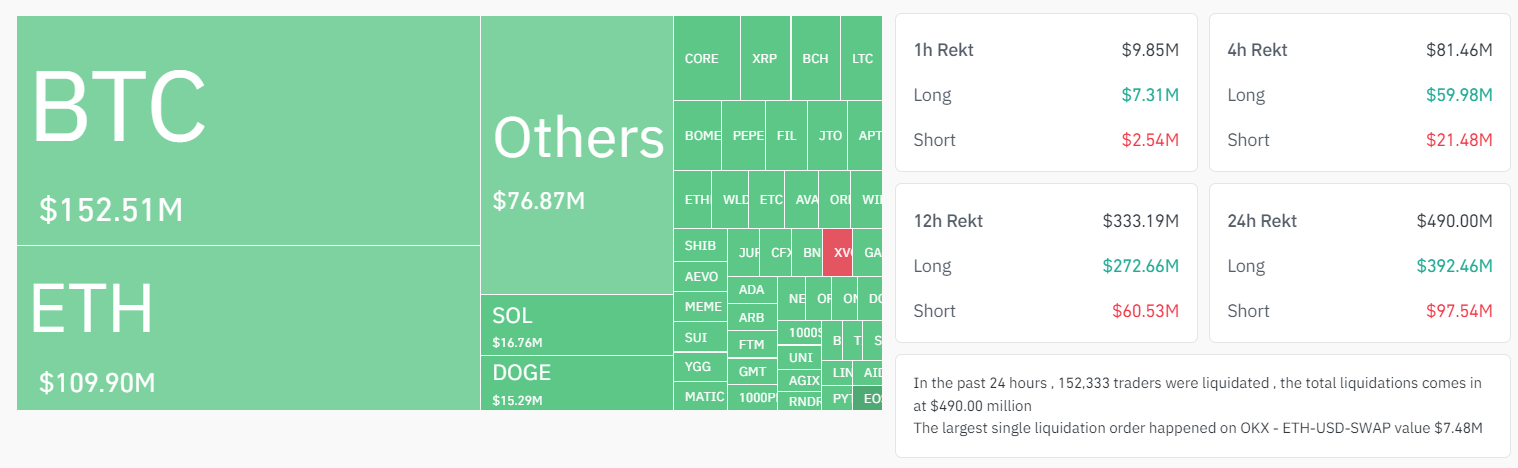

Bitcoin long liquidations reach $109M as holders start selling

Over $152.5 million worth of leveraged Bitcoin positions were liquidated in the past 24 hours, with $109.11 million worth of long positions, according to Coinglass data.

Bitcoin’s sudden drawdown caused over $165 million of leveraged crypto liquidations in less than two hours, early morning on Tuesday.

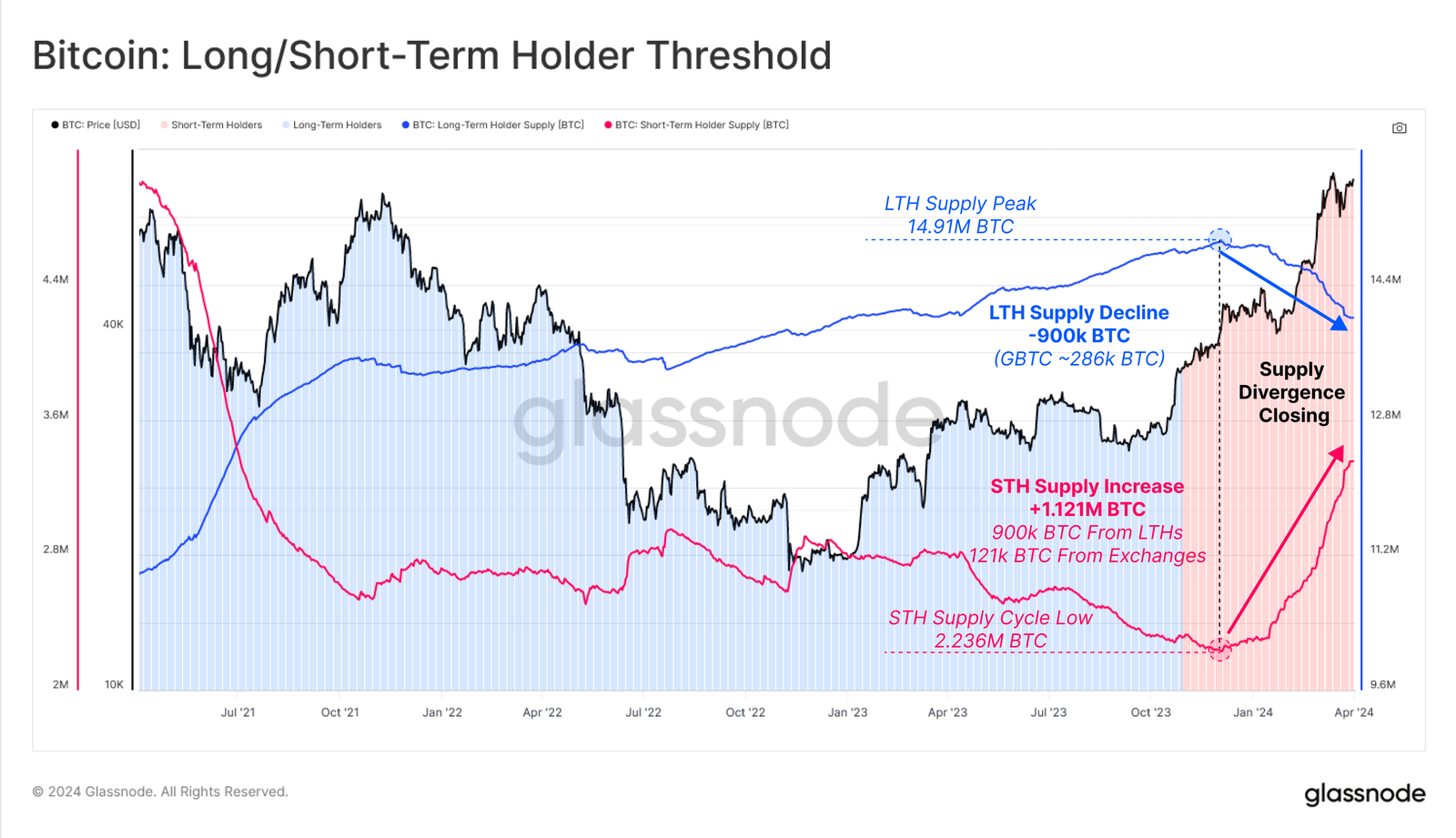

Meanwhile, the dormant Bitcoin supply has reawakened. Long-term holder (LTH) supply declined by 900,000 BTC since the peak of 14.91 million BTC in December 2023, with Grayscale accounting for a third, or 286,000 BTC, according to an April 2 report by Glassnode. The report noted:

“Conversely, the Short-Term Holder Supply has increased by +1.121M BTC, absorbing the LTH distribution pressure, as well as acquiring an additional 121k BTC from the secondary market via exchanges.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses