Bitcoin whales copy classic bull market moves as BTC price eyes $72K

Bitcoin sets a positive tone into the U.S. holiday weekend as a Coinbase-induced BTC price dip fails to keep bulls back for long.

Bitcoin (BTC) sought higher levels at the week’s last Wall Street open as bulls refused to succumb to market nerves.

BTC price sets up resistance retest

Data from Cointelegraph Markets Pro and TradingView followed resurgent BTC price action as it passed $71,000.

Flash volatility characterized the day prior as an ongoing legal battle between United States exchange Coinbase and regulator the Securities and Exchange Commission (SEC) sent Bitcoin below key $69,000 support.

The weakness did not last long, however, as buyers stepped in to fuel an ongoing attempt to snatch liquidity near all-time highs.

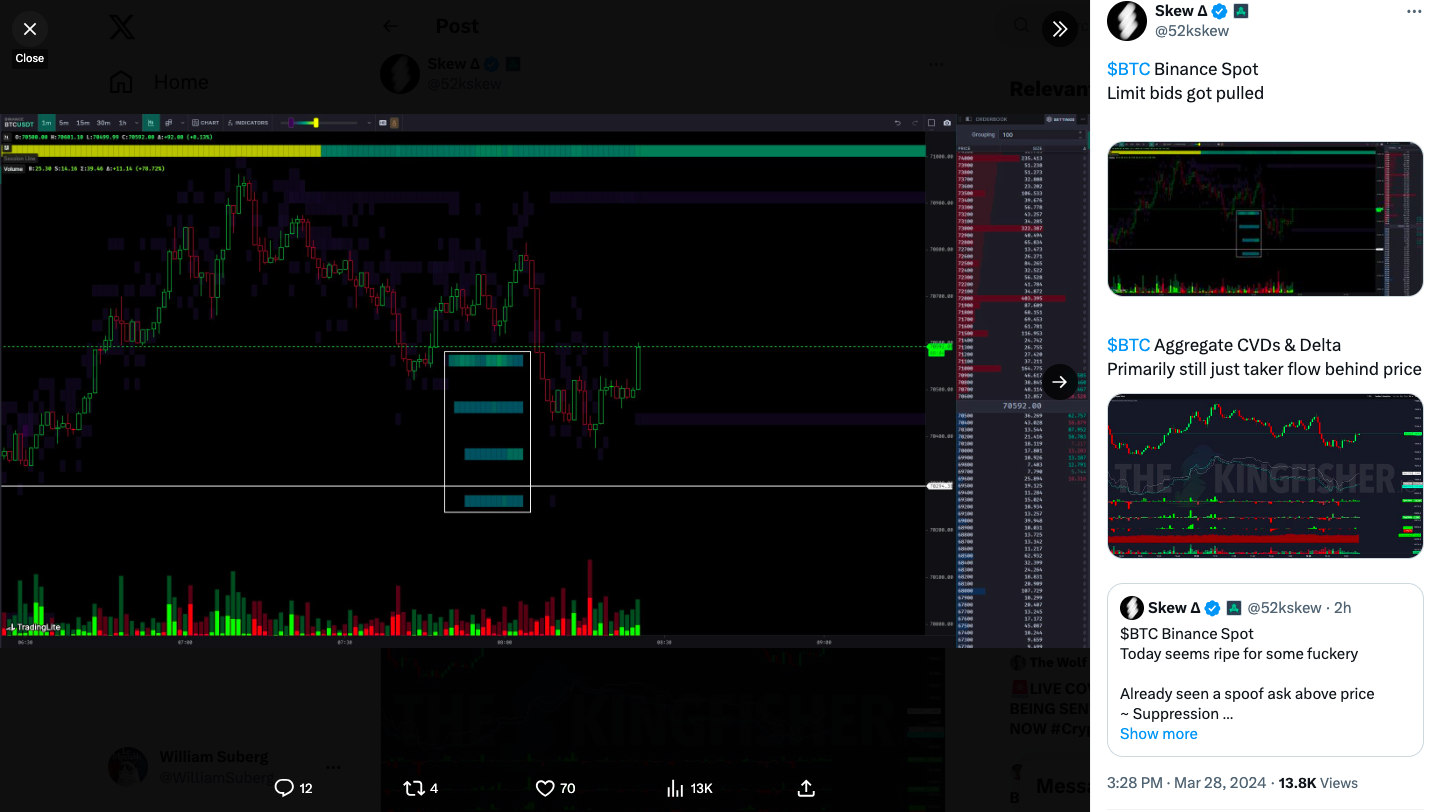

On the day, popular trader Skew warned that fakeout price behavior could result from manipulative liquidity moves. Among these was fresh bid support between $70,200 and $70,600, all of which was subsequently removed from the Binance order book.

With all-time highs still acting as a clear price ceiling, fellow trader Daan Crypto Trades considered where price discovery could take Bitcoin should sellers be beaten out.

“Break all time high and low $80Ks should follow shortly afterwards I think,” he summarized to followers on X (formerly Twitter).

An accompanying chart showed near-term trendline support in the form of the 200-period simple and exponential moving averages (MAs) on 4-hour timeframes.

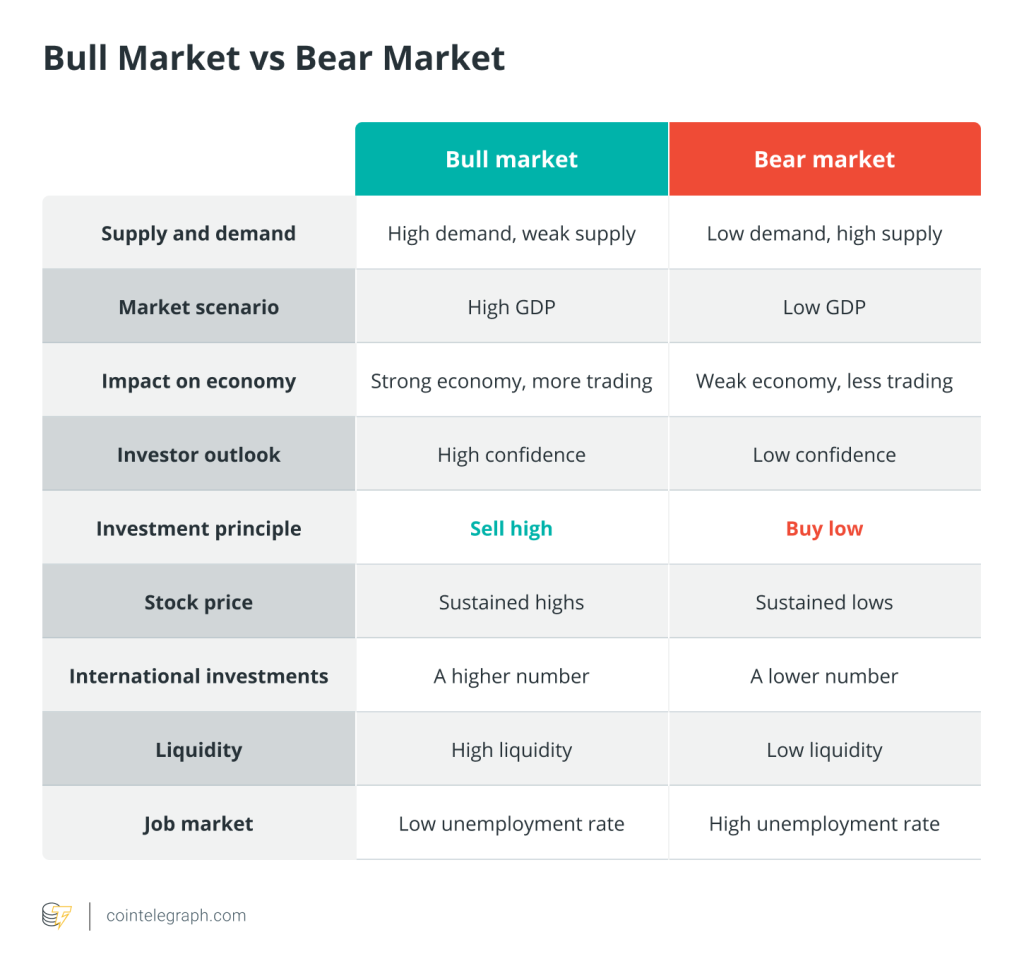

Bitcoin whales sell to “TradFi”

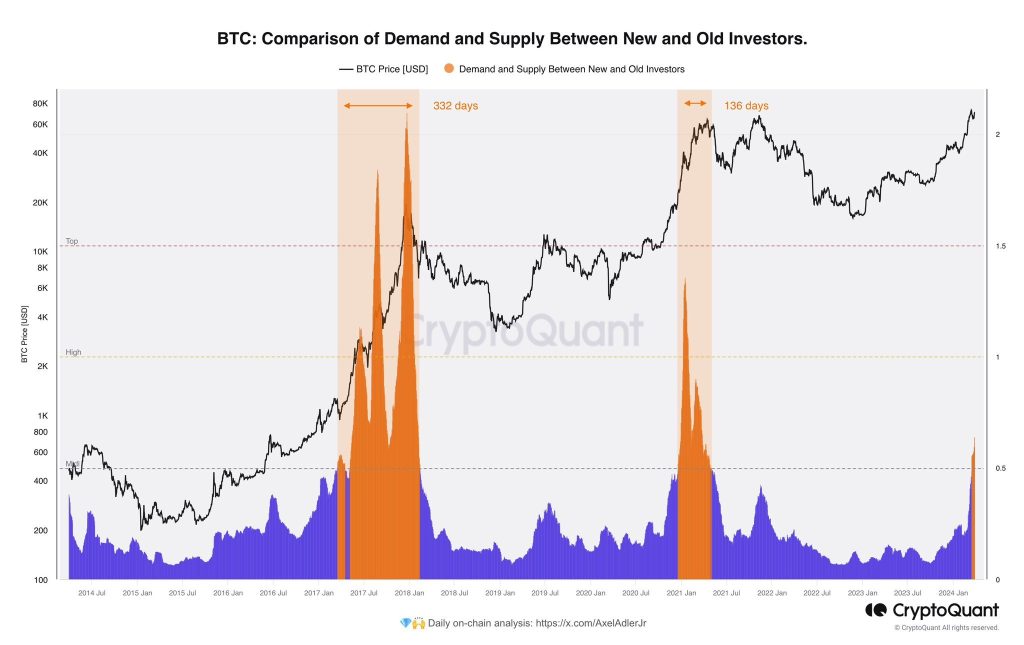

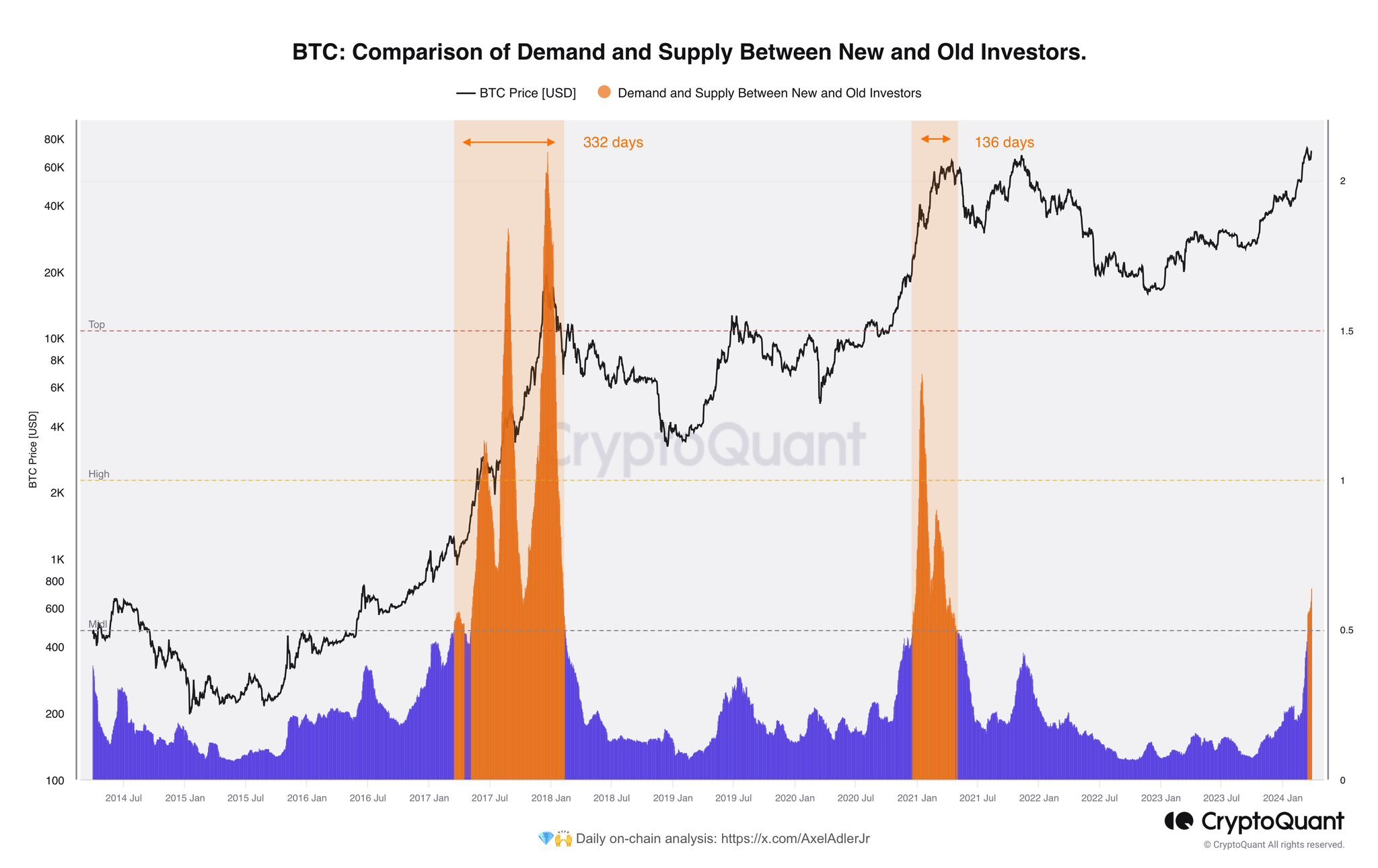

Analyzing on-chain BTC flows, meanwhile, Ki Young Ju, CEO of on-chain analytics platform CryptoQuant, highlighted a shift in ownership among the biggest Bitcoin hodlers.

Related: Bitcoin ‘sell-side liquidity crisis’ sees BTC move for the first time since 2010

Under current conditions, he revealed, long-term investors with significant exposure — Bitcoin whales — were offloading coins, while new whale entities were steadily buying up the supply.

These were institutions, Ki suggested, with the U.S. spot Bitcoin exchange-traded funds (ETFs) removing hundreds of billions of dollars’ worth of BTC from the market every day.

“Old whales are selling Bitcoin to new whales(TradFi), not retail investors,” he concluded.

“This can be clearly observed on-chain.”

A chart showed the consequences of major on-chain ownership shifts — a run-up to all-time highs, as witnessed in both the 2017 and 2021 bull markets.

As Cointelegraph reported, mainstream interest in Bitcoin has trended down in recent weeks despite new all-time highs.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses