Why is Litecoin price up today?

Today’s Litecoin price surge comes after a significant influx of LTC supply into circulation and a rising hash rate ahead of Bitcoin’s halving event.

Litecoin (LTC) price is up today, hitting a fresh two-week high amid a broader cryptocurrency market rally.

On March 27, LTC’s price rose to around $99, up 9.25% in the last 24 hours. The crypto market was down 1.15% in the same period. Still, Litecoin is underperforming the broader crypto market on a year-to-date (YTD) timeframe, as shown below.

Let’s discuss the primary reasons behind Litecoin’s price rally today.

Litecoin traders are absorbing a $60 million LTC supply

Litecoin’s current price uptrend seems to be a classic response to the market dynamics that often follow when large quantities of previously inactive coins reenter circulation.

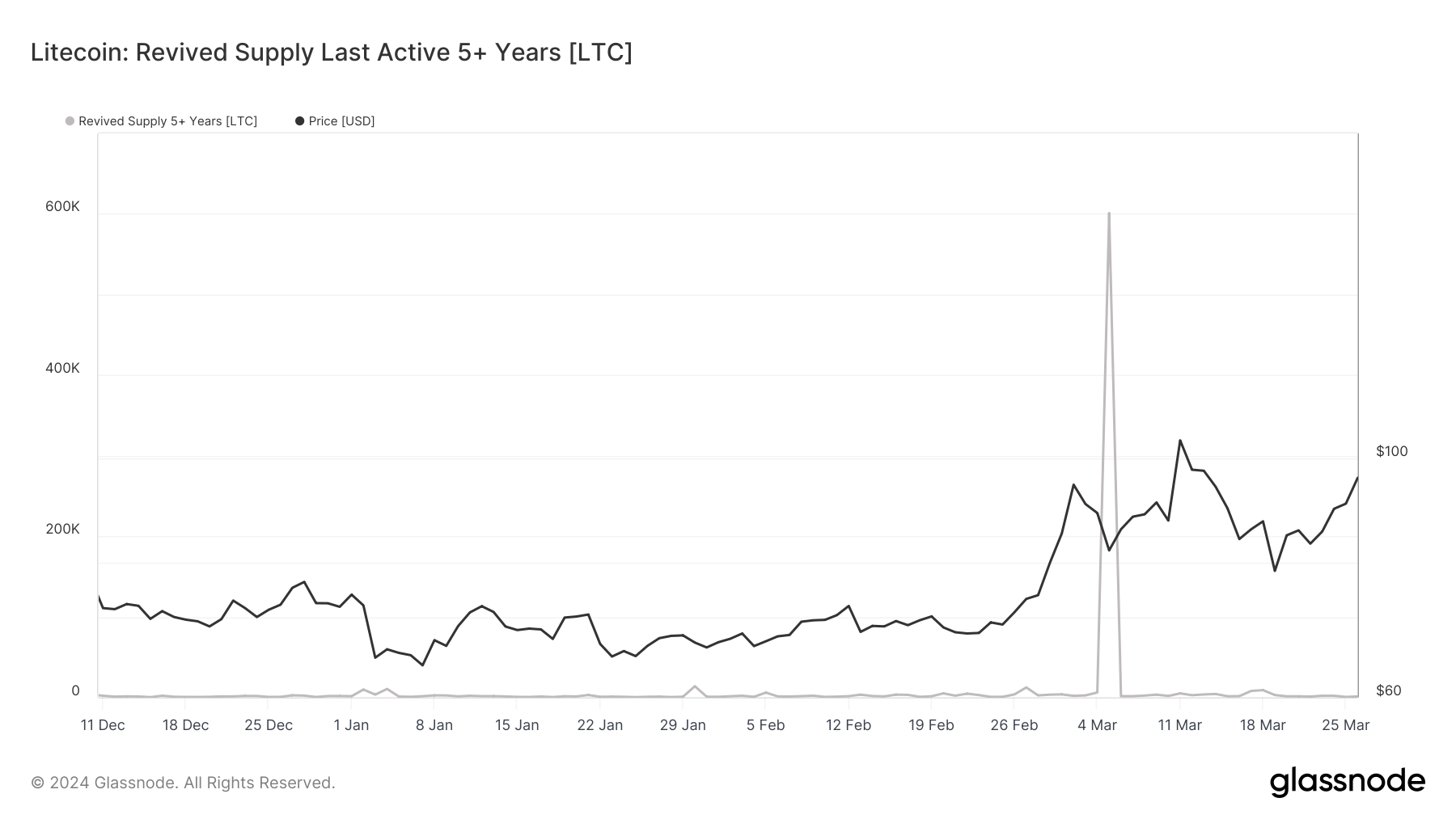

Notably, on March 5, the Litecoin market witnessed the return of over 600,000 LTC tokens — worth more than $60 million — into circulation after being untouched for at least 5 years, the highest daily jump on record, according to Glassnode data.

LTC’s price fell by over 19% on the same day but has rebounded 37.25% since, indicating that the Litecoin market has been absorbing the sudden influx of once-asleep tokens. Today’s price rally is part of the same rebound.

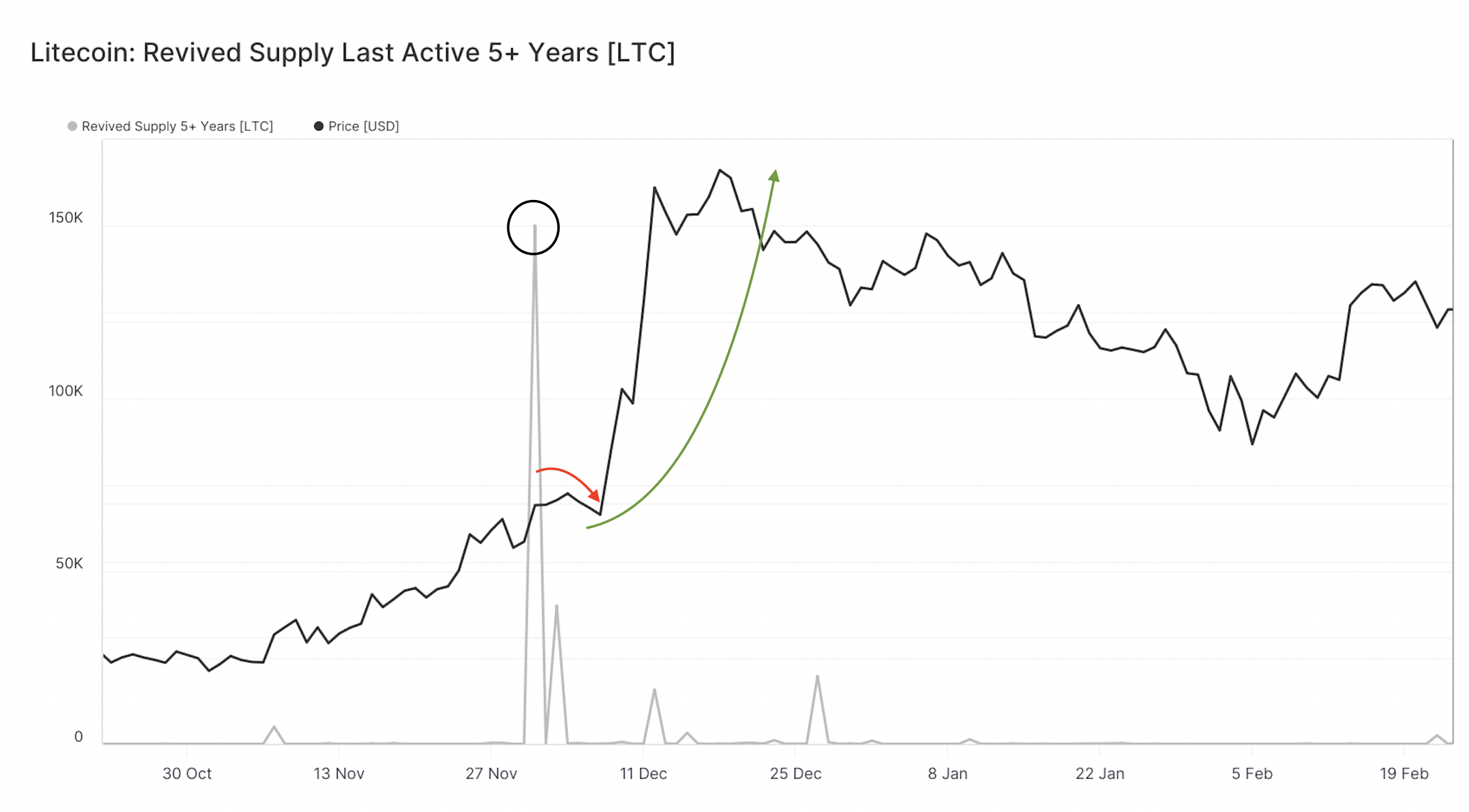

Interestingly, the absorption of revived LTC tokens is similar to what transpired ahead of the cryptocurrency’s 2017 bull run.

On Dec. 1, 2017, LTC’s price started correcting after the revival around 150,100 LTC tokens (~$150 million), the second highest on record as of March 27, 2024. The cryptocurrency rebounded by over 400% afterward to reach the record high of $420.

From the fractal analysis perspective, LTC may be poised for a comparable price surge in the near term.

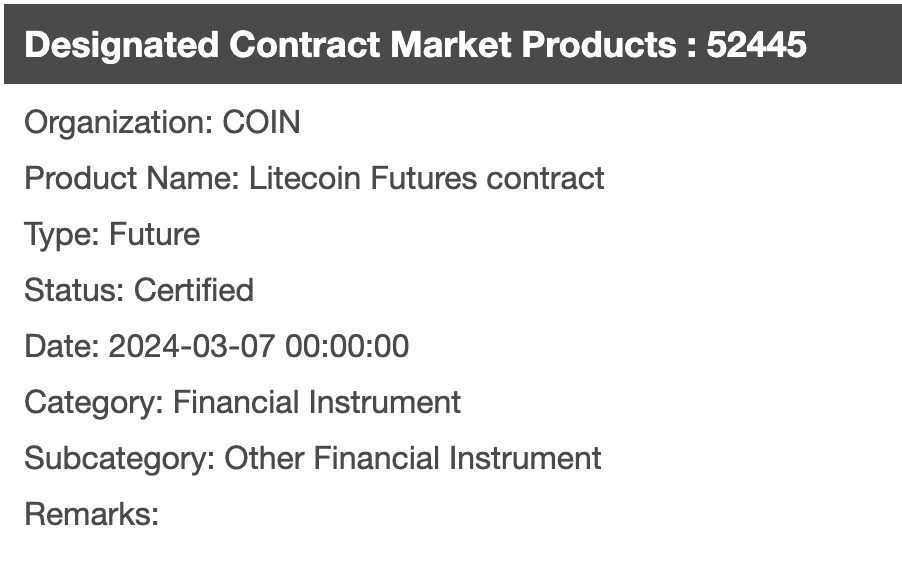

Coinbase’s Litecoin futures application

LTC’s price rally takes further cues from the potential launch of Coinbase’s cash-settled Litecoin futures contracts in April.

On March 7, Coinbase Derivatives filed an application with the U.S. Commodity Futures Trading Commission (CFTC), with a targeted launch date for Litecoin — as well as Dogecoin (DOGE) and Bitcoin Cash (BCH) — futures contracts starting April 1.

A cash-settled Litecoin futures product could attract institutional capital to the LTC market, as the market witnessed after the launch of CME Bitcoin futures in December 2017. That is likely one of the primary reasons behind LTC’s recent gains.

Litecoin’s network growth ahead of Bitcoin halving

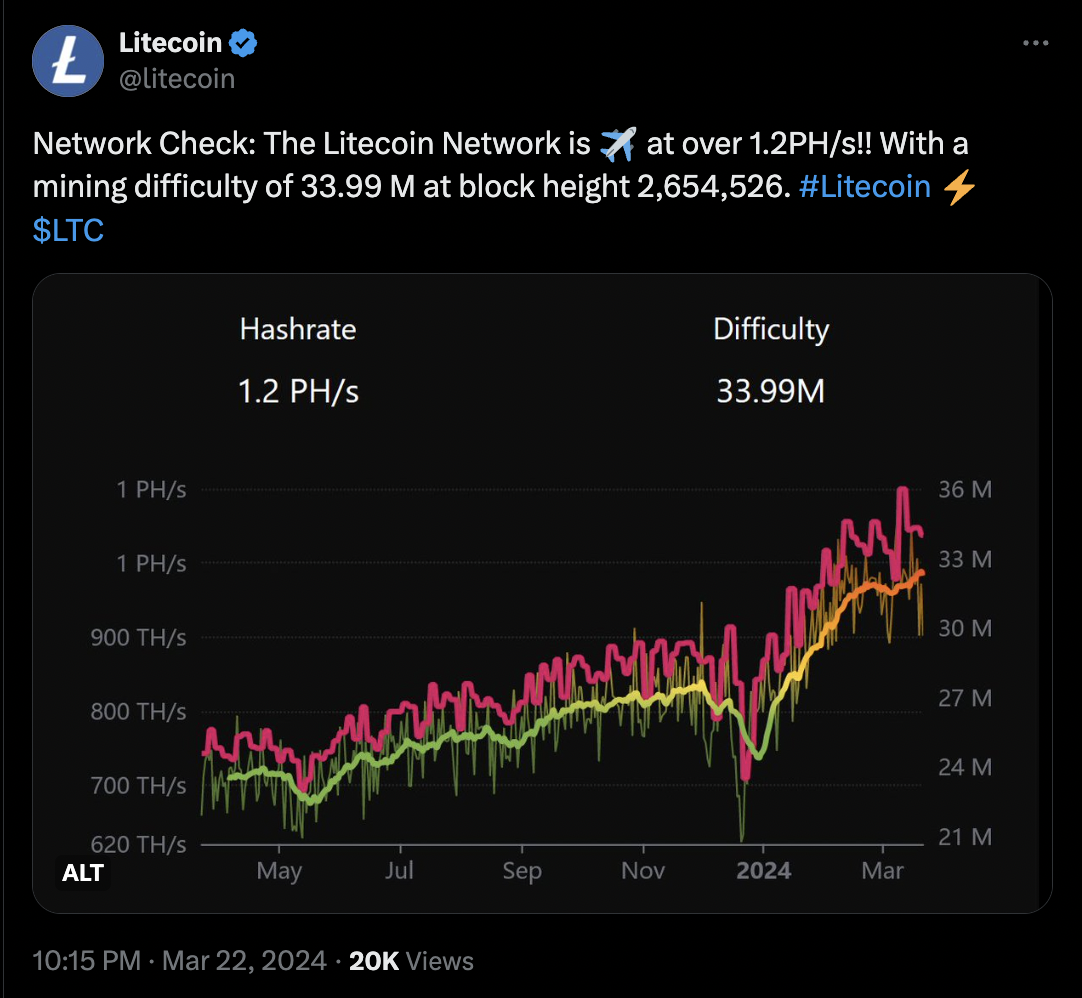

LTC’s recent gains further appear on the heels of Litecoin’s booming network health.

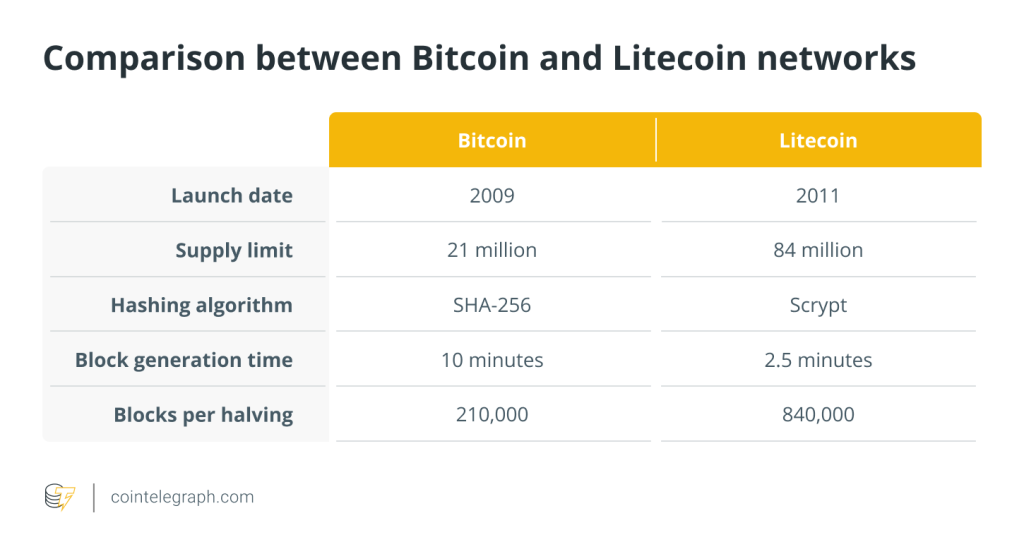

For instance, Litecoin’s hash rate reached a record high of 1.244 Peta-hash per second (PH/s) on March 22 and has been treading around the same level since. That is up 40% so far in 2024, indicating that proof-of-work (PoW) miners have been allocating more computational power for mining and securing the Litecoin blockchain.

The increasing hash rate indicates miners’ confidence in the profitability of cryptocurrency mining, particularly as Bitcoin approaches its fourth halving in April, set to cut BTC mining rewards by half. In turn, this optimism encourages traders to hold or buy LTC, driving up the price.

Related: Bitcoin whale accumulation suggests pre-halving BTC rally will continue

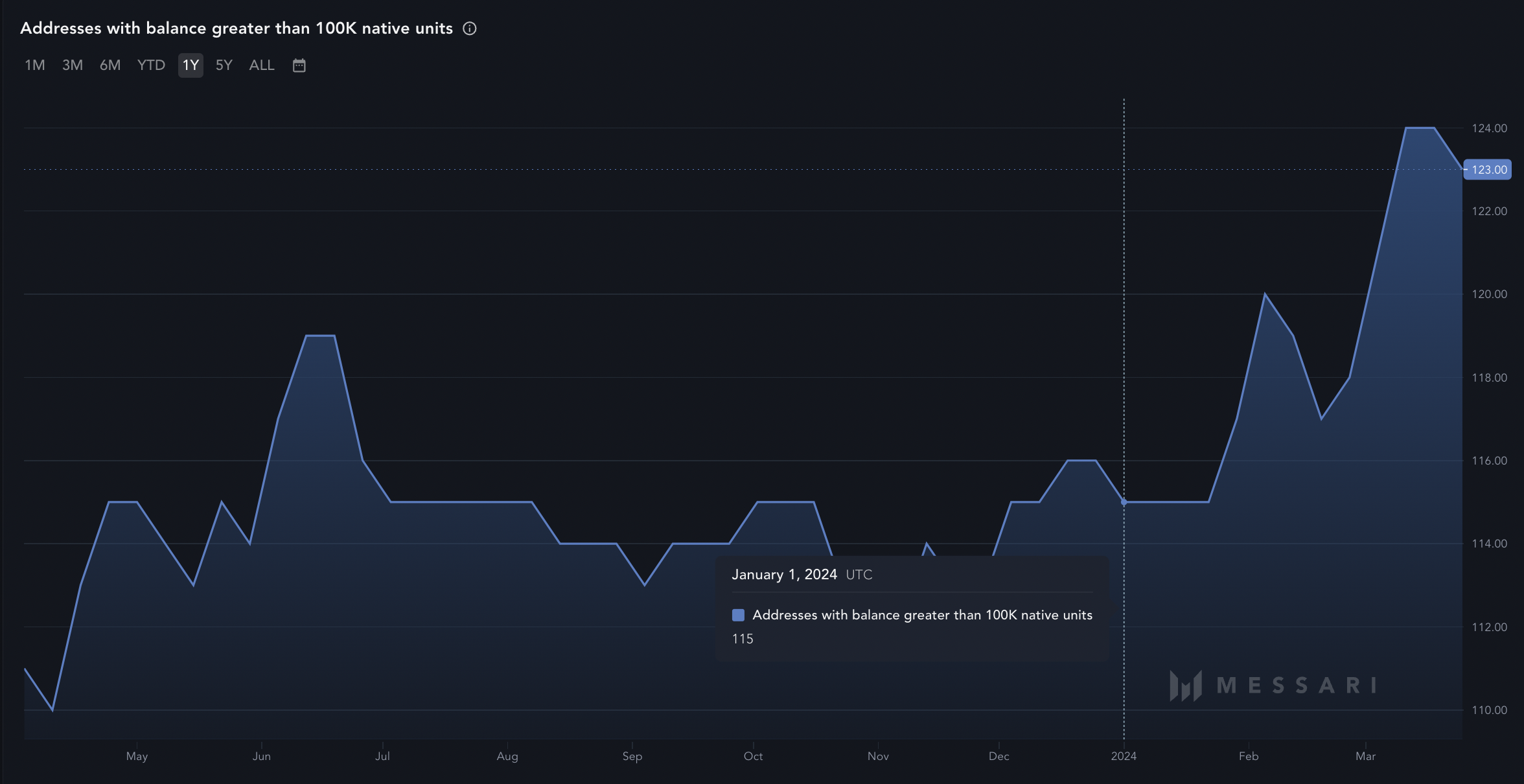

For instance, the number of richest Litecoin entities — those holding at least 100,000 LTC — have been rising throughout 2024, indicating accumulation in anticipation of a bull run.

LTC price technical analysis

Litecoin’s rally has picked momentum after breaking above its multi-year descending trendline resistance, as shown below.

Two key indicators suggest LTC can grow further. First, the weekly Relative Strength Index (RSI) remains within the neutral range of 30-70 and is on an upward trend. Second, the increase in trading volumes alongside the price ascent signals strong trader support for the upward movement.

A case of bullish continuation could see LTC’s price rising toward the 0.236 Fibonacci retracement line at around $127.25 — up 30% from current price levels — by April. Conversely, a retreat from current price levels could have the price retest the descending trendline resistance at $75.50 as support.

The $75.50-support aligns with Litecoin’s 50-week exponential moving average (50-week EMA; the red wave in the chart above).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses