Solana struggles to recapture $200, but DApp and derivatives markets remain bullish

SOL price struggles to rally above $200, but on-chain and derivatives metrics point to a healthy market.

Solana’s native token SOL (SOL) experienced a 12.8% increase from March 24 to March 26, only to face a downward correction to $186 afterward. Despite this, investors remain hopeful, citing the surge in activities such as memecoins and airdrops on the Solana network as key factors that could maintain SOL’s positive trajectory and potentially elevate its price above $200.

SOL price succumbed to Bitcoin’s correction and a stricter regulatory environment

In a broader context, the cryptocurrency market faces potential vulnerabilities, particularly after Bitcoin (BTC) failed to hold above the $71,000 mark on March 26. This failure is seen as an indicator of dwindling investor confidence, especially concerning the outflows from spot Bitcoin exchange-traded funds (ETFs). Should institutional investors further reduce their stakes in listed crypto assets, the outlook for SOL and other alternative coins could darken.

Further pressure on SOL’s valuation could stem from recent legal actions by the U.S. Justice Department, which has brought criminal charges against KuCoin exchange and two of its founders. The U.S. Commodity Futures Trading Commission has accused KuCoin of offering unregulated and unlicensed derivatives contracts to U.S. clientele. Prosecutors maintain that the exchange facilitated transactions involving over $5 billion in “suspicious and criminal proceeds.”

Overlooking the short-term implications of Bitcoin’s spot ETF flows and regulatory uncertainties, the price of SOL tends to respond favorably to growth within the Solana ecosystem. The successful performance of Solana SPL tokens, highlighted by the popularity of memecoins, has bolstered the blockchain’s attractiveness to new projects, thereby sustaining demand for the SOL token.

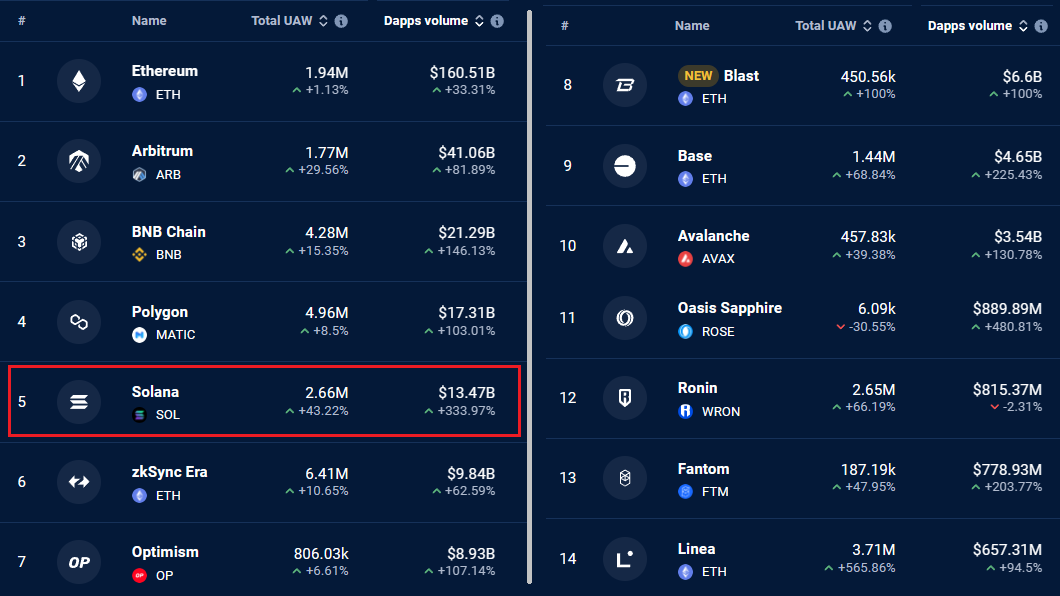

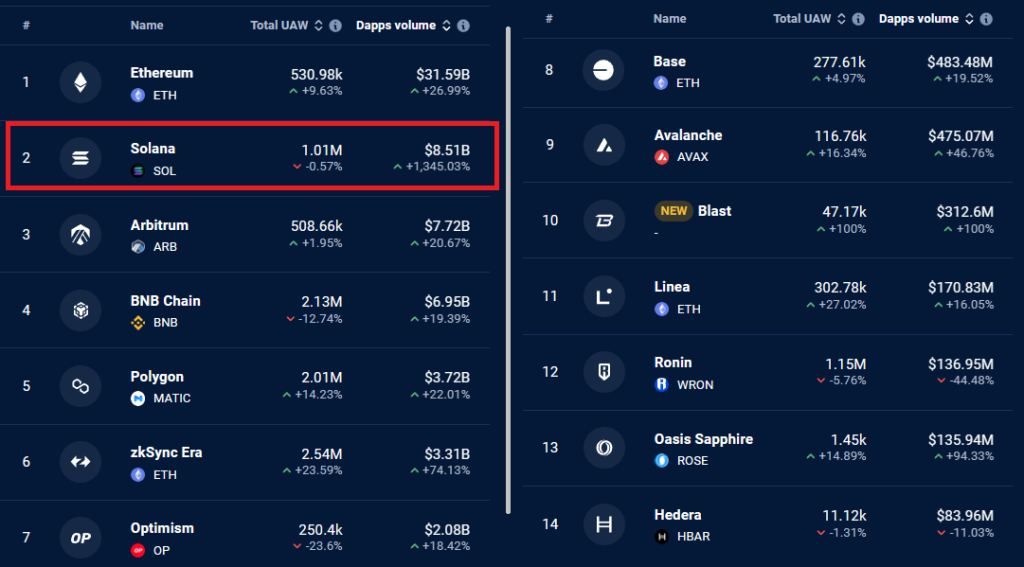

A 30-day analysis of the Solana network reveals significant increases in user activity and volume, presenting a challenge to a bearish stance on SOL. Solana has notably narrowed the gap with its direct competitor, the BNB Chain (BNB), according to available data.

This data highlights that Solana’s decentralized application (DApp) volumes saw a 334% increase in the 30 days leading up to March 26. In comparison, its competitors, BNB Chain and Arbitrum recorded growth rates of 146% and 82%, respectively. Moreover, the Solana network’s active addresses surged by 43% to 2.66 million over the same period, outperforming the growth rates of BNB Chain’s 15% and Arbitrum’s 30%.

Derivatives markets reflect inflows to cryptocurrencies and bullish leverage demand for SOL

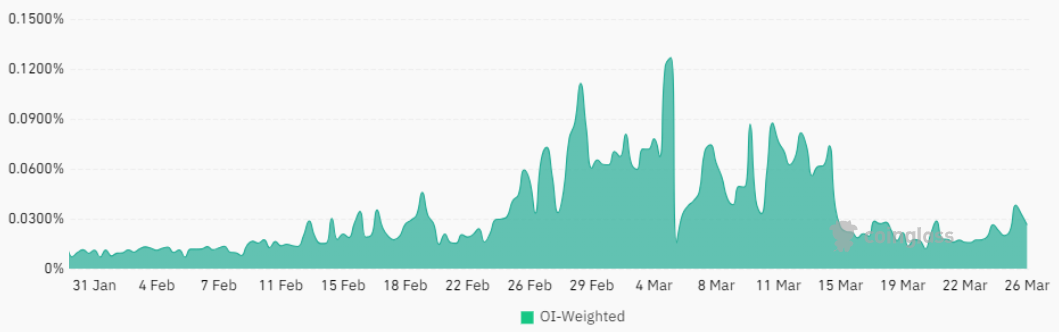

Forecasting the flows of spot Bitcoin ETFs and the market’s response to a stricter regulatory landscape is impossible, so investors should focus on derivatives trading metrics to gauge market sentiment. Specifically, the behavior of perpetual contracts, often called inverse swaps, offers insights. These contracts include an embedded rate to balance leverage. Notably, a negative rate signals stronger demand from short sellers.

Recent observations highlight a strong leverage demand for bullish positions on SOL, seemingly undeterred by the token’s inability to surpass the $195 mark on March 26.

Related: Where is Bitcoin heading next? Market experts chime in

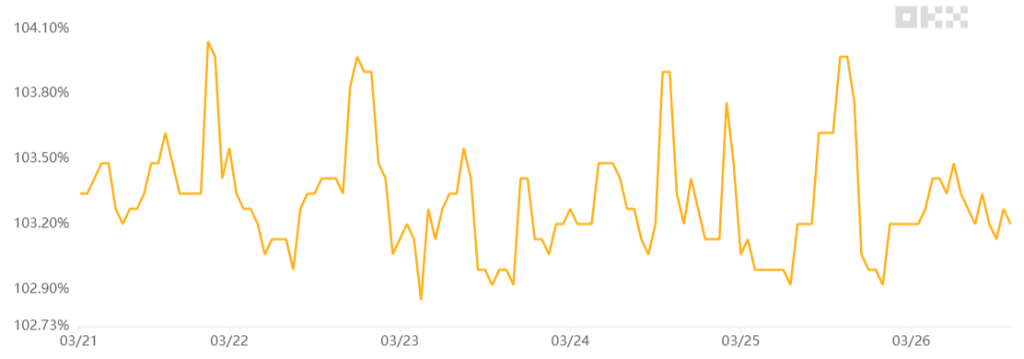

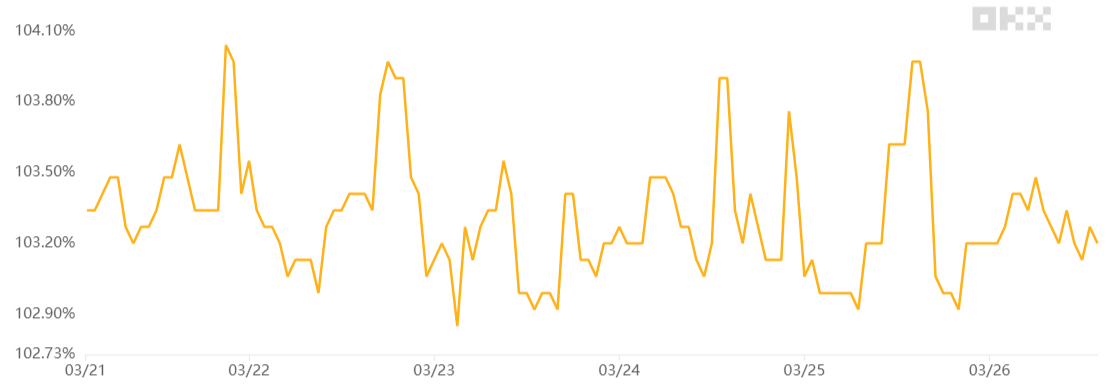

To further validate whether the inclination toward leveraged long positions mirrors the broader market sentiment, examining the demand for stablecoins in China can be enlightening. This is because such demand serves as an indicator of retail investors’ movements within or outside the cryptocurrency markets. The premium on USD Coin (USDC) transactions, when compared to the official U.S. dollar rate, is particularly telling.

On March 26, the USDC premium in China maintained a level above 3%, indicating a strong demand for converting the local CNY into the USDC stablecoin. This trend suggests sustained interest in cryptocurrencies within China, thereby supporting the optimistic outlook in SOL’s derivatives markets. Although it remains uncertain when SOL will breach the $200 threshold, the current on-chain and derivatives metrics suggest a healthy market environment.

Responses