Ether at $3,100 could liquidate $212 million worth of leveraged long positions

The crypto market liquidated over $624 million worth of leveraged positions in the past 24 hours, 83% of which were long positions.

The cryptocurrency market could see over $212 million of leveraged long positions liquidated if Ether’s (ETH) price falls below the $3,100 mark.

Ether dropped 9.3% to $3,254 in the 24 hours leading up to 10.40 am UTC. Ether is down over 18% on the weekly chart and falling to $3,100 would wipe over $212 million worth of long leverage, according to Coinglass data.

If Ether falls below the psychological $3,000 level, liquidations would reach $237 million.

The recent price volatility triggered a total of $624.4 million of liquidations in the past 24 hours. The recent price swings mainly liquidated long positions, or investors betting that the price would go up, wiping $514 million worth of long and $110 million worth of short positions.

OKX exchange saw the most liquidations at $90.8 million, followed by Binance’s $79.9 million, and Bybit’s $23.4 million in the past 24 hours, according to Coinglass data.

Related: Ether ETF is less likely than Bitcoin ETF was — Recharge Capital founder

Incoming crypto market recalibration: Bitfinex

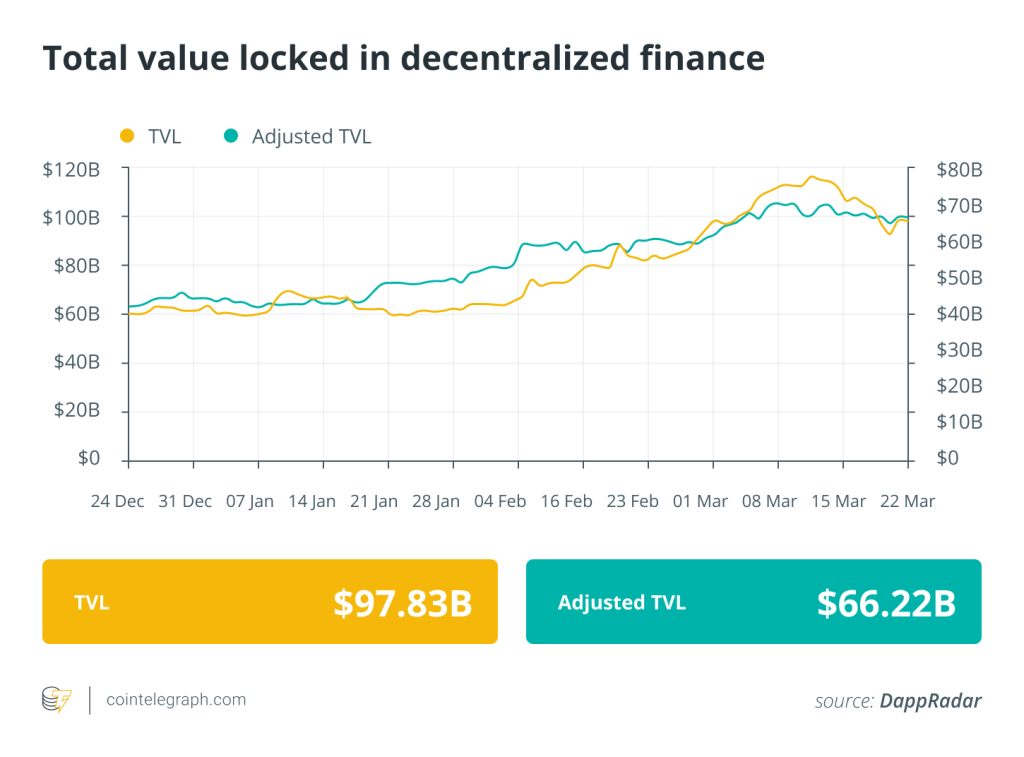

Bitcoin’s sharp pullback from March 14 may test institutional appetite, which could lead to a period of price recalibration in the wider crypto market, according to a Bitfinex Analyst report shared with Cointelegraph:

“We anticipate a period of market recalibration as investors seek equilibrium amidst unprecedented inflows into Spot Bitcoin ETFs. Conversely, the altcoin market’s resilience, evidenced by growing investment flows and record outflows of ETH, underscores a bullish narrative for Ethereum and Layer 1 blockchain projects. As the market evolves, the performance of large-cap altcoins will be instrumental in determining its trajectory.”

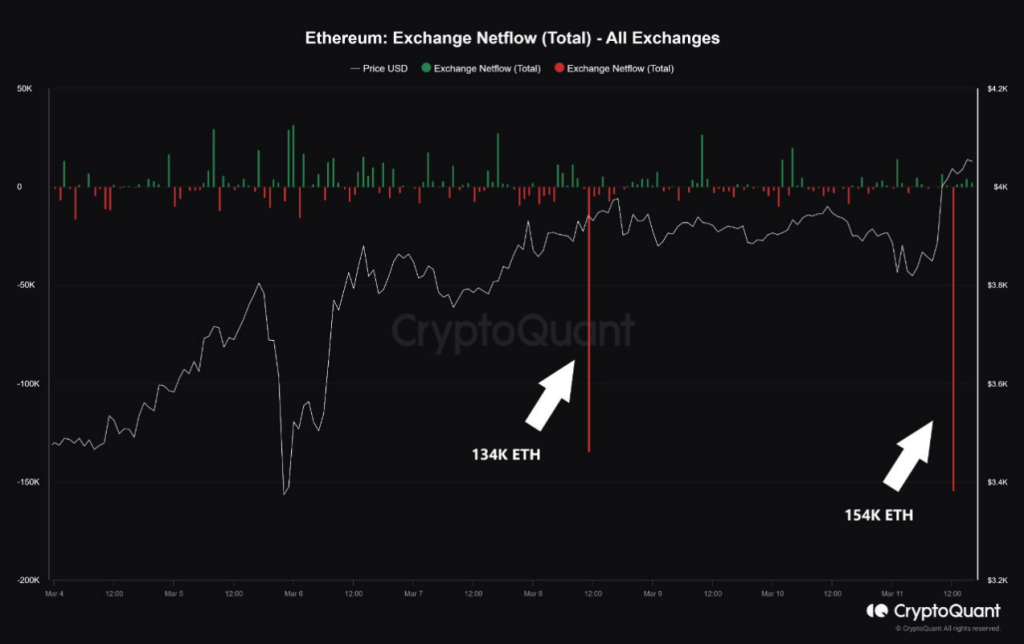

Ether net outflows from exchanges hit a new record high as 154,000 Ether moved off crypto exchanges on March 11. This reduces the available supply on exchanges and could potentially lead to upward price movement, according to Bitfinex:

“The recent netflow data indicates a potential short-term upward trajectory for Ether, however, we suspect this could be the traders moving their Ether off-exchanges to trade coins on an ERC-20 protocol or a Layer 2 like the Base mainnet.”

Related: Who is ‘Mr. 100’? Mysterious Bitcoin whale becomes 14th-biggest BTC holder

Responses