3 Bitcoin price metrics point to overheated conditions and a potential BTC correction

Bitcoin price is hitting back-to-back all-time highs, but a few indicators are suggesting that BTC is oversold.

The crypto market displays strength as Bitcoin (BTC) price sets a new all-time high at $72,800 on March 11.

Data from Cointelegraph Markets Pro and TradingView shows that BTC rose from an opening at $69,032, soaring 5.7% to set a new year-to-date high of $72,850 on Monday, March 11.

This remarkable performance from Bitcoin has led to concerns regarding a sell-off triggered by profit-booking at higher levels.

Here are three technical and market indicators that point to a possible BTC price correction in the short-term

TD sequential indicator flashes a sell signal on the 12-hour timeframe

Independent analyst Ali spotted BTC price trading above $71,700, warning short-term traders that a reversal could be in the offing.

Ali posted the following chart showing that the TD sequential indicator had sent a sell signal in BTC’s 12-hour chart.

“Since early February, every time this indicator suggested selling, the price of $BTC dropped by 1.6% to 3.5%. This trend is something short-term traders should watch closely!”

The TD sequential indicator is an oscillating trend-following chart overlay indicator that is used to determine short-term trend reversals based on changes in intraday highs and lows.

In this case, the indicator predicts that the BTC price could drop from the current level, dropping as much as 3.5%, to trade around $70,000.

Bitcoin price shows an “overheating signal”

Bitcoin price has been on an “up only” trend since Jan. 23, after the “sell-the-news” effect of spot Bitcoin ETFs faded. These new BTC investment funds have seen massive capital inflows since their debut on Jan. 11, with assets under management reaching $55.3 billion on March 11.

This has led to the appearance of “overheated signals” in the Bitcoin market. Analysts at CryptoQuant are warning that BTC could experience major corrections soon despite exploring new all-time highs.

On March 8, the blockchain analytics firm posted a series of posts on the X social network showing some metrics supporting “potential overheating.”

The firm mentioned another metric showing miners being overpaid as realized profits reached the highest levels since December 2023.

“Miners are now deemed extremely overpaid, with profitability hitting its highest level since December 2023.”

CryptoQuant also highlighted that traders’ unrealized profit margins had reached 57%, which is historically associated with upcoming corrections as traders are bound to book profits in the long run.

“Additionally, short-term holders have begun selling at the highest profit margins since February 2021, potentially heralding increased selling pressure,” added CryptoQuant.

Related: BTC price blasts through $70K — 5 things to know in Bitcoin this week

Meanwhile, data from IntoTheBlock shows that 100% of Bitcoin holders are now in profit, potentially increasing the chances of profit-booking sell-offs in the short term.

Bitcoin’s RSI is overbought on multiple timeframes

Coinglass‘s heatmap shows that BTC’s RSI is displaying overbought conditions in four out of five timeframes. Higher intervals display higher RSI values. Bitcoin’s RSI is now at 88.34 on the weekly, 79.34 on the daily, 74.81 on the four-hour, and 70.74 on the hourly timeframe.

This is corroborated by data from TradingView, which shows BTC’s RSI at 89.2, 79, 72 and 70 on weekly, daily, 12-hour and four-hour timeframes, respectively.

Overbought conditions generally describe recent movements in the price of an asset, and reflect an expectation that the price trend may correct in the near future.

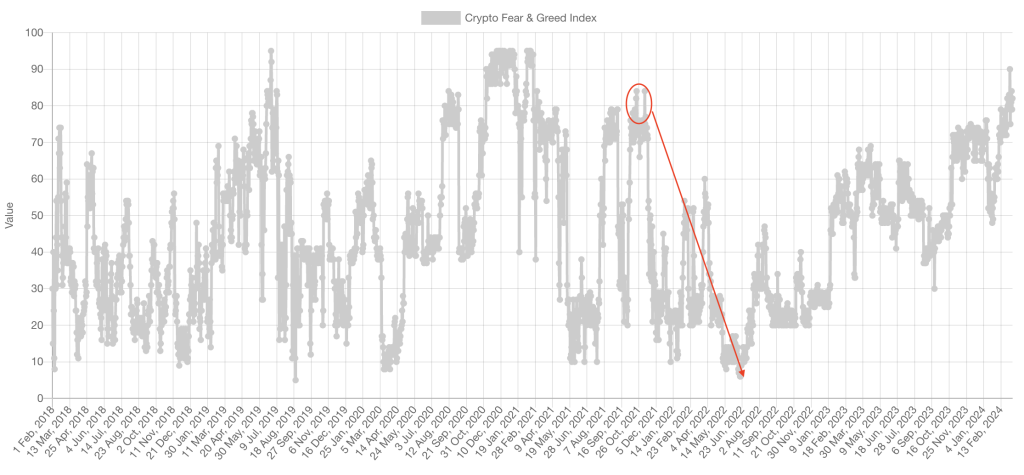

Additional data from Alternative, a platform that tracks “emotions and sentiments” surrounding Bitcoin, showed that the Crypto Fear and Greed Index at 82 – “extreme greed” conditions.

Alternative notes, “When investors get too greedy, the market is due for a correction. Note that the last time this index was above 80 was at the height of the 2021 bull market, just before BTC dropped down from its then-all-time high of around $69,000 and tumbled toward $15,000 during the 2022 bear market.

Even though these metrics are cautioning market participants to manage risks, it is important to note that RSI conditions do not guarantee a trend reversal. Crypto prices are highly volatile, and BTC could continue to rally, fueled by increasing demand and the upcoming supply halving.

Responses