Bitcoin accumulation phase ends as ETFs fuel new $100K BTC price target

Bitcoin has emerged from a mass accumulation phase in the past month — a classic move ahead of parabolic BTC price upside.

Bitcoin (BTC) is ending a year-long accumulation spree that began at the end of the 2022 bear market, data suggests.

Figures from on-chain analytics firm Glassnode show BTC in accumulation addresses declining for the first time since the first quarter of 2023.

Bitcoin accumulation wallets start shedding BTC

Bitcoin hitting all-time highs this week may have sparked an instant sell-off, but behind the scenes, hodlers are already busy taking profits.

Glassnode shows that coins held in so-called “accumulation addresses” — wallets with no outgoing transactions and at least two “non-dust” inbound ones — are dropping.

Beginning Feb. 11, the turnaround began breaking with a year-long tradition and came as BTC/USD returned to $48,000 — the top of a key long-term trading range.

Since then, accumulator balances have fallen 2.6% to 3,176,293 BTC ($212 billion) and show no sign of reversing.

Zooming out, the phenomenon can be seen to be far from bearish.

Despite declining exposure, accumulator wallets have historically spent long periods amassing coins at a discount — only starting to sell at the start, not the end, of parabolic uptrends.

Looking at balances throughout Bitcoin’s existence, a broader accumulation trend in place since mid-2018 remains entrenched, contrasting starkly with a huge reduction up to that point, which began in 2016, just as Bitcoin started to run to old $20,000 all-time highs.

$100,000 BTC price this year?

As Cointelegraph reported, the January launch of the United States spot-Bitcoin exchange-traded funds (ETFs) has had a unique impact on supply dynamics.

Related: El Salvador Bitcoin holdings hit record $164M as BTC profits pass $50M

Steady buying pressure has now led to phenomena never seen before, including hitting an all-time high before a block subsidy halving.

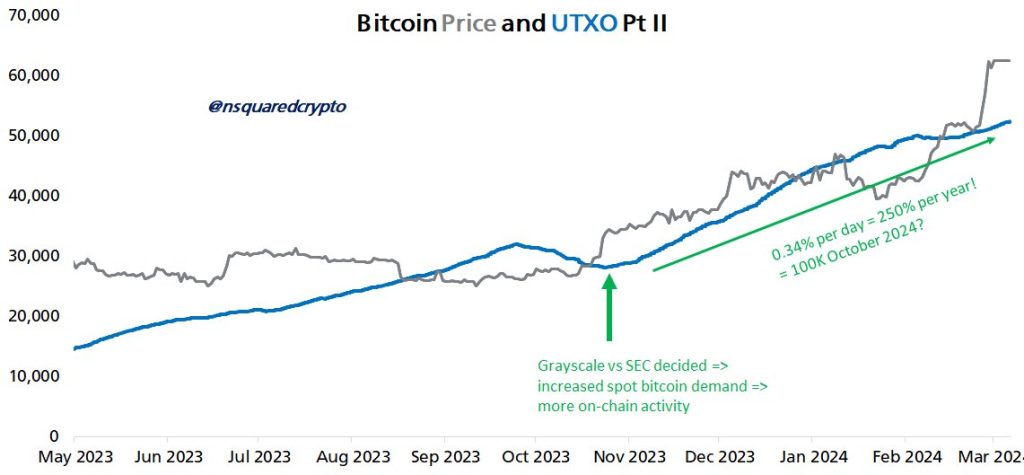

Analyzing the current trajectory, Timothy Peterson, founder and investment manager at Cane Island Alternative Advisors, suggested that ETF demand could propel Bitcoin to six figures as early as 2024.

“It appears that the Bitcoin Spot ETF approval launched an accumulation that, if sustained, puts $BTC at $100K by October 2024,” he told subscribers on X on March 7.

An accompanying chart compared unspent transaction output (UTXO) numbers to BTC price performance, noting growth of 0.34% per day.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses