Uniswap (UNI) hits 2-year high as fee share proposal deadline approaches

DEX users’ support of a fee share proposal for Uniswap appears to be backing UNI’s rally to a two-year price high.

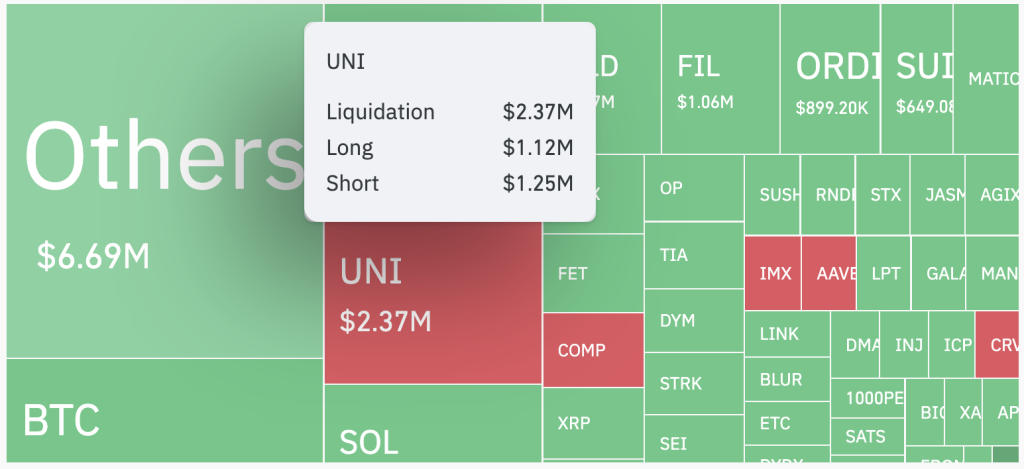

UNI (UNI), the governance token of the Uniswap decentralized exchange, has rallied 46% to trade above $17, levels last seen in January 2022.

UNI’s performance is accompanied by a 120% leap in trading volume over the last 24 hours to $1.18 billion. Its market capitalization has increased by 44% over the past week to $9.4 billion, making it the 16th-largest cryptocurrency by market capitalization.

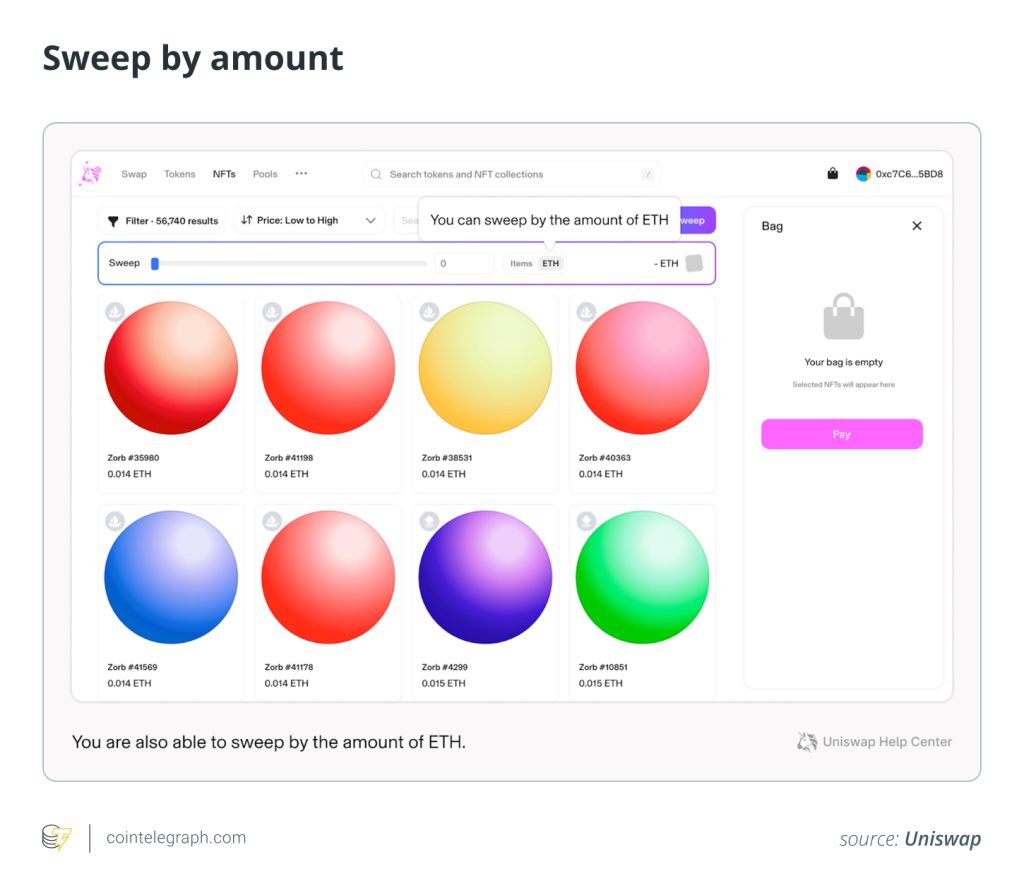

This follows a proposal by the Uniswap Foundation to upgrade the protocol’s governance for fee redistribution with an aim to increase community involvement. The upgrade will particularly focus on distributing the protocol fee to holders of the UNI token.

The Uniswap Foundation announced this earlier in a Feb. 23 post on X, saying that the “upgrade would reward UNI holders who have staked and delegated their tokens.”

The proposal involves enhancing the owner of the mainnet UniswapV3Factory contract to allow for permissionless and programmatic collection of protocol fee revenue.

Members of the Uniswap community have welcomed this move, as it enhances the governance structure of the Uniswap protocol, providing UNI tokenholders with a more active role in decision-making processes.

Snapshot voting for the proposal commenced on March 1 and will remain open until March 7.

According to the Uniswap Foundation, the proposal has received significant support from the community. As of 11:00 pm ET, the proposal has 55 million UNI 100% agreeing to the upgrade.

Whale accumulation and increasing network activity increase demand for UNI

Data from blockchain analytics platform Lookonchain shows that a whale accumulated UNI tokens worth more than $12.5 million over the previous 48 hours.

More data from Token Terminal shows an increase in Uniswap’s network activity. According to the chart below, the number of daily users increased from around 75,000 in October 2023 to 168,106 on March 2.

Related: What 15% BTC price crash? Bitcoin bulls charge higher as $67K returns

This points to increasing adoption of the Uniswap ecosystem, which drives up demand for UNI tokens.

Uniswap price hits 26-month highs

UNI jumped over 143% from a low of $7 on Feb. 23 to reach an intraday high of $17.03 on March 6, according to data from Cointelegraph Markets Pro and TradingView.

The relative strength index (RSI) was facing upward, and the price strength at 87 validates the buyers’ dominance in the market.

These buyers will try to push the UNI higher to retest the high at $17 before making an attempt to confront resistance from the $20 level.

On the other hand, the RSI painted overbought conditions for UNI, hinting at a possible trend reversal, which can put an end to the token’s bull rally.

Responses