Insanely bullish facts and figures about how the bull market may play out

Bitcoin is currently priced at $68,300, a mere 1% off its all-time high of $69,000.

Bitcoin (BTC) enthusiasts had no shortage of bullish commentary on social media platform X amid a meteoric rise in the price of BTC over the last week — which is now fast approaching a new all-time high price of $69,000.

As at the time of publication, Bitcoin is trading at $68,300, up 7% over the last 24 hours, according to CoinGecko.

However, much of the commentary over the past day has been centered around the behavior of Bitcoin after notching a new all-time high.

Bitcoin once doubled its ATH in 10 days

In March 2013, Bitcoin rallied 158% from $34 to $88 over the month, which included a 10-day span that saw its price double, Bitcoin analyst Dylan LeClair noted in a March 4 X post.

Several months later, in November 2013, Bitcoin surged from $200 to $1,000 after it surpassed its previous all-time high set a month earlier, according to CoinGecko.

A similar pattern emerged again in December 2020. According to CoinGecko, Bitcoin broke its previous high of $19,665 on Dec. 16, 2020, then doubled just 23 days later on Jan. 8.

It ended up continuing to rally up to $63,580 by April 14, 2021 — marking a 222% or three-fold increase in 120 days, CoinGecko data shows.

Bitcoin halving is not even here yet

The price surge in late 2020 was bolstered by the halving event that occurred a few months beforehand in May 2020, according to Jaran Mellerud, co-founder and chief strategist of Hashlabs Mining.

However, more than a month before the 2024 scheduled halving, Bitcoin has already neared its all-time high.

Mellerud previously told Cointelegraph he expects Bitcoin to make a huge run a few months after the upcoming halving, scheduled to occur on April 20, 2024.

Bitcoin index hits 90 — Extreme Greed

Meanwhile, Bitcoin’s score on the Crypto Fear & Greed Index has increased to 90 out of 100 — its highest score since February 2021. There has also been a resurgence in “Bitcoin” Google searches over the last two weeks as Bitcoin’s price blew past $50,000 and $60,000.

The Crypto Fear & Greed Index is weighted on a mix of data sources, including volatility, market momentum and volume, social media, Bitcoin dominance and Google Trend data.

The company behind the index, however, warns that when investors are too greedy, it could mean the market is due for a correction.

Bitcoin demand is only getting stronger with ETFs

Unlike previous bull markets, Bitcoin demand is now also being driven by the recently launched spot Bitcoin exchange-traded funds (ETFs) in the United States.

The Bitcoin ETFs have recorded $7.35 billion in net inflows since Jan. 11, according to BitMEX Research, citing data from March 1.

BlackRock’s iShares Bitcoin Trust (IBIT) has been the best performer, reaching the $10-billion asset milestone faster than any ETF in U.S. history last week.

In a Feb. 14 interview with CNBC, U.S. investor Ric Delman predicted Bitcoin ETF flows will have reached at least $150 billion by the end of 2025.

Delman backed up his figure by citing a recent survey that revealed 77% of independent financial advisers want to add Bitcoin to their existing portfolios at an average allocation of 2.5%. He then multiplied this by the size of the financial advisory sector ($8 trillion).

If @ricedelman is right that $150 billion will flow into the bitcoin ETFs by end of next year, things are going to get very crazy pic.twitter.com/ziBPQuxyNb

— Pomp (@APompliano) March 2, 2024

“And that’s just independent advisers,” Delman said. “It excludes the wirehouses; it excludes the regional broker dealers; it excludes the institutional investors.”

Recently, Bitwise chief investment officer Matt Hougan said there could be an “even bigger wave” of institutional capital to come once the “major wirehouses” start offering Bitcoin ETF trades.

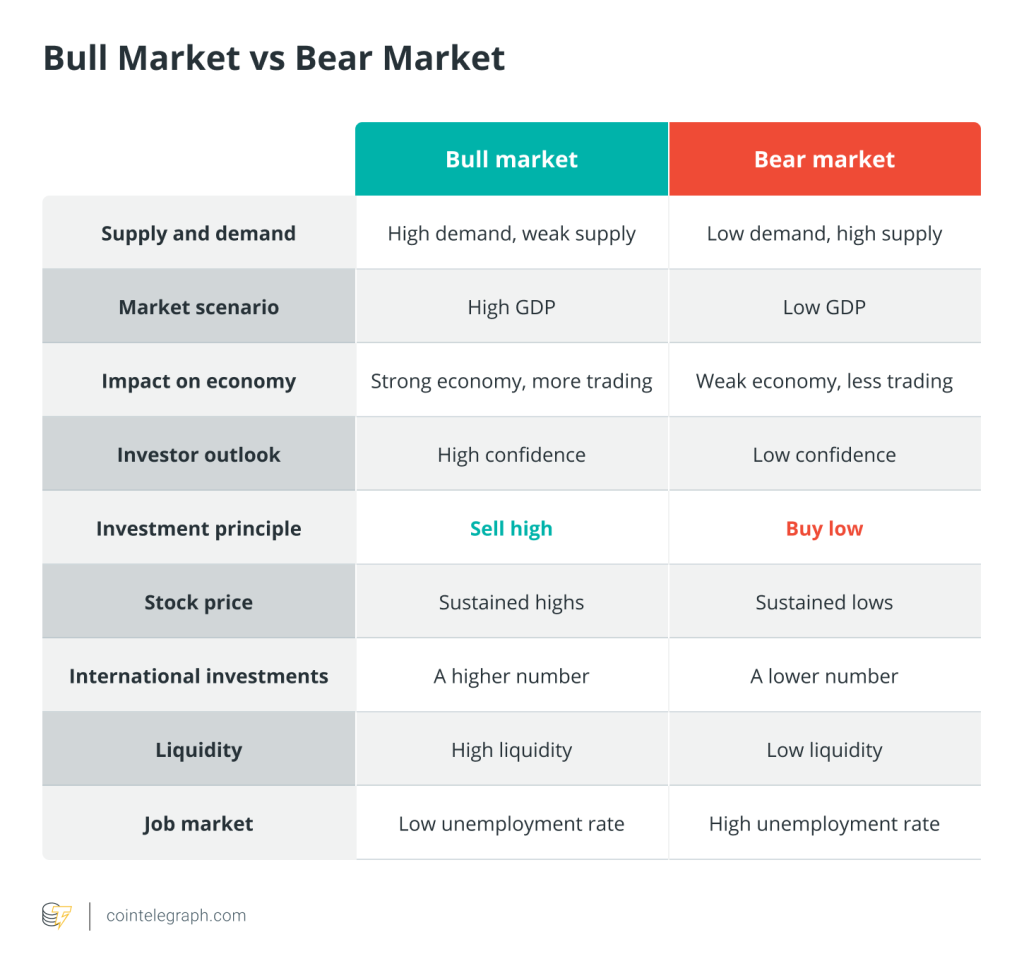

Others, including Hougan, have also pointed to the ratio of Bitcoin bought by ETF issuers relative to the Bitcoin mined. Some days, the ratio can reach upward of 10, suggesting that Bitcoin demand is exceeding supply.

Hougan referred to this demand-supply dynamic as “off the hook.”

“There’s too much demand and not enough supply,” Hougan said, adding that it would likely push Bitcoin’s price “substantially higher.”

Related: How Bitcoin ETFs could impact the average investment portfolio

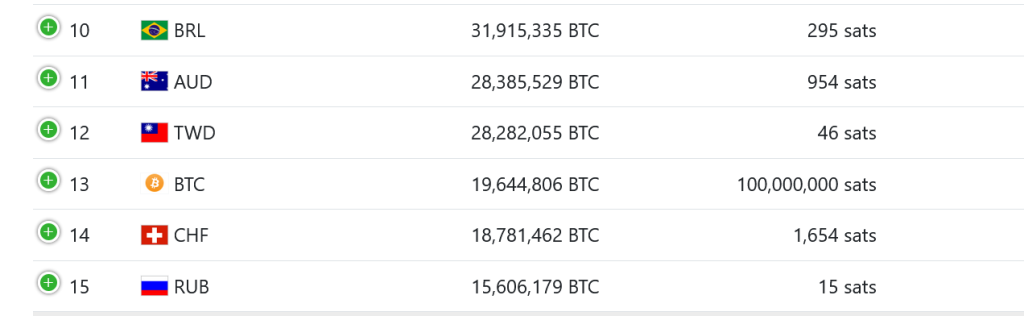

Meanwhile, Bitcoin is now the ninth-largest asset by market capitalization and is only 0.9% away from flipping Silver, which boasts a market cap of $1.356 trillion, according to Companies Market Cap.

Bitcoin is rising up the ranks when compared to the valuations of state-issued currencies, too, having recently surpassed the Swiss franc in 13th position, according to Fiat Market Cap.

Magazine: Big Questions: How can Bitcoin payments stage a comeback?

Responses