Solana gains 34.5% in a week, and network metrics support further gains

Can SOL sustain the momentum after breaking above a 23-month high? Decentralized application volumes surged, but there’s a catch.

Solana’s native token, SOL (SOL), hit its highest point in 23 months on March 1 and is currently trading up 34.5% in one week. While Solana maintains its position as the fourth-largest cryptocurrency, excluding stablecoins, it has been narrowing the gap with the third-place competitor, BNB (BNB). The key question is: What fueled SOL’s rally, and, critically, can this outperformance compared with competitors be sustained?

SOL’s price had been attempting to solidify the $100 support over the past couple of months. Therefore, it would be inaccurate to claim that the bull run commenced before Feb. 23. In reality, SOL experienced a modest 2% increase between Dec. 23, 2023, and Feb. 23, 2024, whereas Ether (ETH) witnessed a 25.5% uptick during the same period, and Tron (TRX) achieved gains of 31.5%. Essentially, whatever triggered the decoupling in favor of SOL occurred in the past week.

In addition to the substantial gains on SOL, a few Solana SPL memecoins saw a notable surge in demand in the past week. Bonk recorded a 110% increase since Feb. 23, while DogWifHat (WIF) experienced a significant rally of 250% during the same period. It’s worth noting that this trend wasn’t confined to Solana network tokens alone, as Dogecoin (DOGE) and Shiba Inu (SHIB) also registered gains of around 51% since Feb. 23. However, it is likely that some of this demand spilled over from these popular tokens, impacting SOL, as traders sought gains on decentralized exchange (DEX) listings.

A report published in The New York Times on Feb. 27 claimed that Sam “SBF” Bankman-Fried, the convicted former CEO of the failed FTX exchange, had been reportedly recommending prison guards to invest in SOL. SBF was found guilty of seven counts of fraud and conspiracy in a trial that concluded on Nov. 2, 2023. Although there is no way to know whether SBF’s opinion held any relation to SOL’s gains, the timing of the article publication raises the possibility.

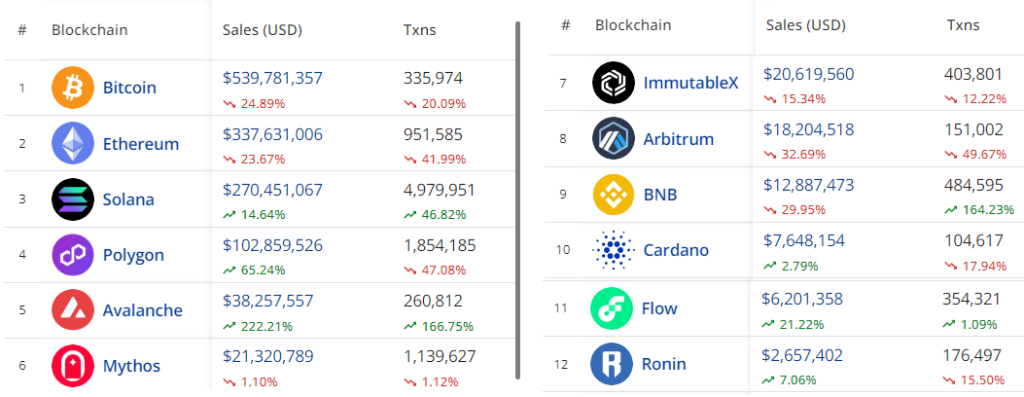

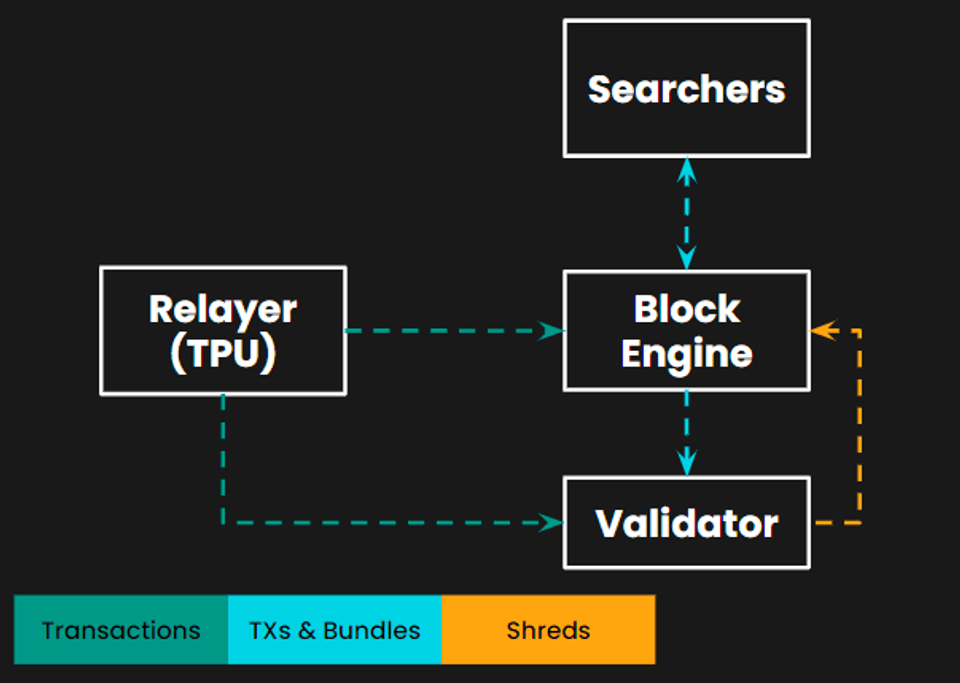

To assess whether the recent surge in SOL’s price has been accompanied by increased demand for the token, beyond mere speculation, one should analyze Solana network metrics. At the core of this ecosystem, SOL is required for DEX trading, staking solutions, nonfungible token (NFT) marketplaces, and other decentralized applications (DApps) such as gambling, games and social networks.

The total value locked (TVL) in Solana’s smart contracts can impact SOL’s price. A higher TVL suggests increased user activity and demand for Solana-based DApps, potentially driving demand and influencing the price positively.

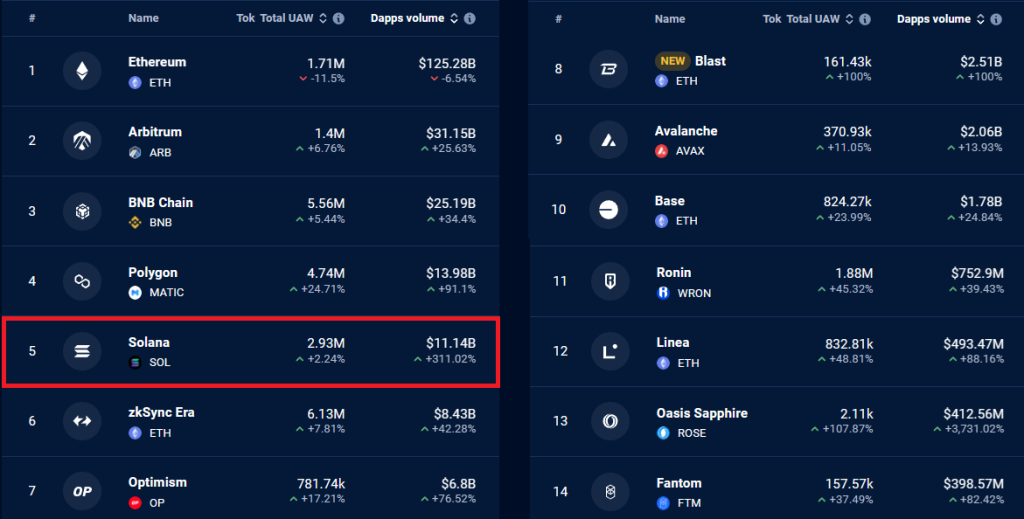

Solana’s recent data reveals a noteworthy accomplishment: Its TVL has reached the highest level since November 2022 at 40.7 million SOL, marking a 30% increase year-to-date in 2024. To provide context, Ethereum’s TVL in ETH terms increased by 15% during the same period, and BNB Chain recorded a 12% uptick in BNB deposits since Dec. 31, 2023. This underscores Solana’s success in attracting more activity for DApps compared with other platforms.

Related: Crypto derivatives’ daily trading volumes reach record highs

Further exploration into the impact of this TVL growth on the Solana network reveals that certain DApps can effectively manage substantial volumes and a large user base without necessitating significant deposits.

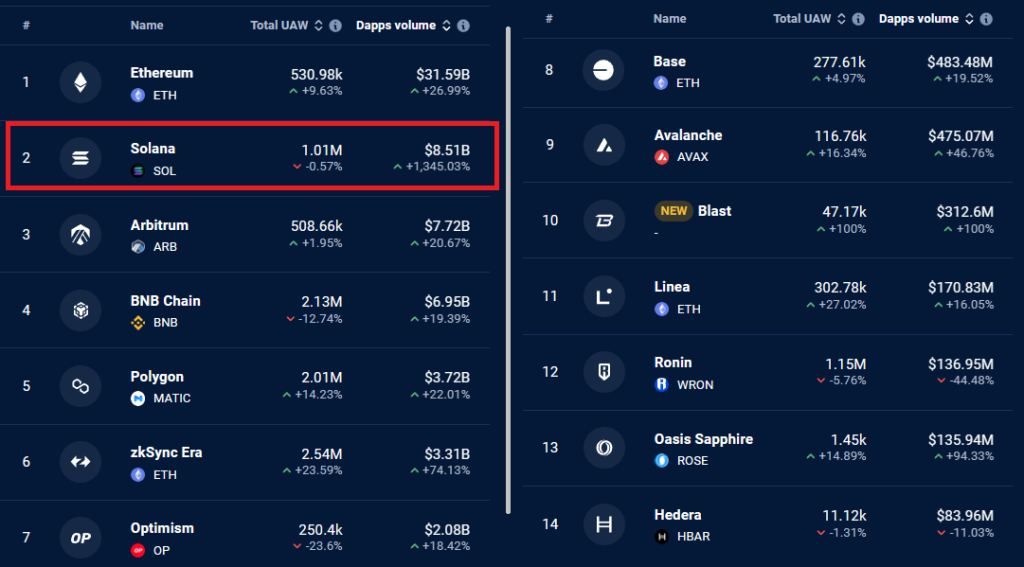

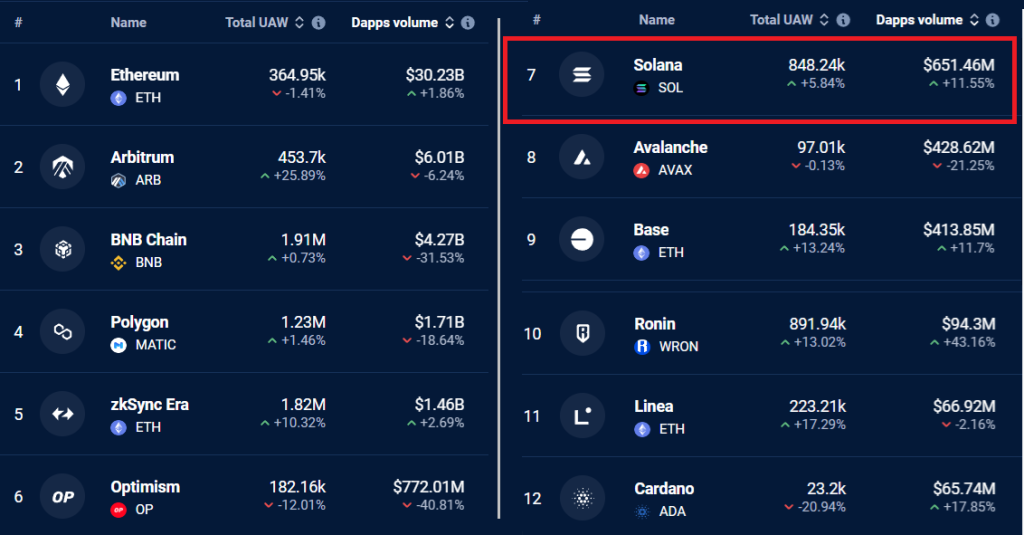

Solana’s notable surge is predominantly centered around the OpenSea NFT marketplace, contributing to a substantial weekly volume of $7.8 billion, as reported by DappRadar. Even when excluding this, other Solana DApps have witnessed significant volume increases. For instance, the Jito staking solution saw a remarkable 102% surge in just one week, while the cross-chain liquidity exchange Saber experienced a noteworthy 130% increase in volume during the same period.

Solana’s success partly stems from the struggles faced by other competing blockchains dealing with sudden spikes in transactions. For instance, the Avalanche network encountered a block production halt on Feb. 23 due to inscription-related issues. While Solana has had its own challenges, such as a five-hour outage on Feb. 6, acknowledging these problems reduces the negative impact, shedding light on the widespread scalability challenges in the industry. Still, network metrics show no evidence that the SOL token is reaching some kind of peak.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Responses