Bitcoin price hits $64K as traders anticipate new all-time high before halving

Bitcoin price continues its parabolic rally with a swift move to $64,000. Is a new all-time high the next stop?

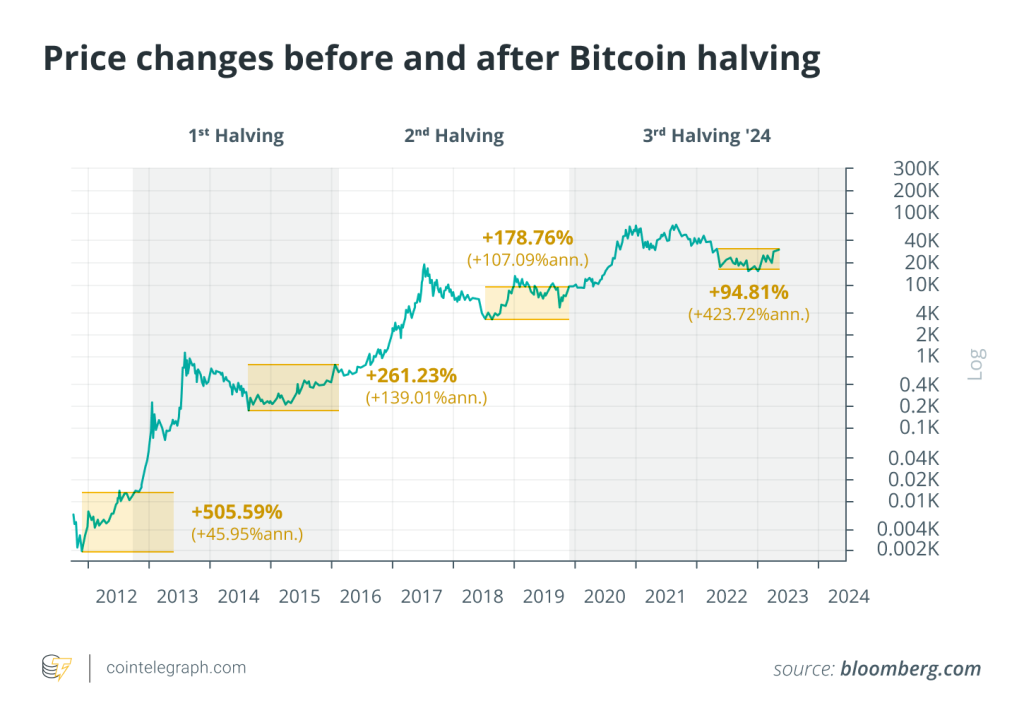

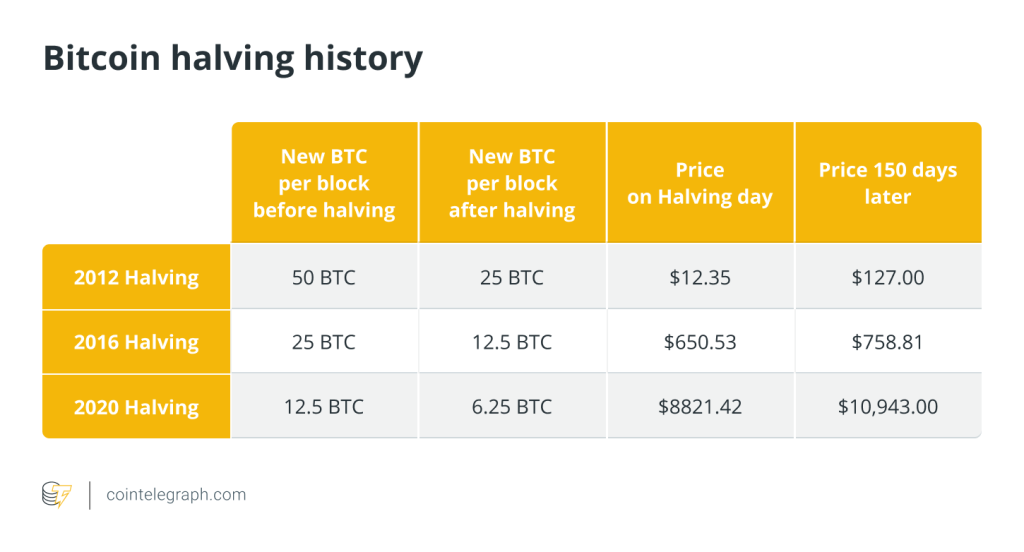

Bitcoin price rallied in excess of 10% to a new 2024 high at $64,000 on Feb. 28. The bulk of this month’s 50% price move is being attributed to investors’ anticipation of the upcoming supply halving event, which is typically followed by strong upside price action.

The steady inflows to the recently launched spot Bitcoin (BTC) exchange-traded funds (ETFs) are also thought to be playing a critical role in Bitcoin’s price action.

JEEZ: Only halfway through trading day and New Nine bitcoin ETFs have already broken their all time daily volume record w/ $2.6b. We got 4 btc ETFs in Top 20. $IBIT is #4 overall, it’s gonna trade more today than in its first two wks combined. This is officially a craze. pic.twitter.com/Wqez1rKrCg

— Eric Balchunas (@EricBalchunas) February 28, 2024

Some technical analysts have warned that Bitcoin’s market structure and high funding rates across the market are a sign of heavy leverage use and will eventually lead to a liquidation-driven correction.

I read many 200K forecasts. Just to note here that we are now close to resistance area between 65K-68K.

3 years ago I drew attention to that resistance. I again draw your attention to the horizontal resistance. https://t.co/aHNH1pDQoN pic.twitter.com/9VzwViYzMh

— Aksel Kibar, CMT (@TechCharts) February 28, 2024

Meanwhile, options analysts are disregarding calls that the price move is overextended, expressing their view that the current Bitcoin price rally has legs.

Citing key Bitcoin’s options markets, open interest and funding rate data, analyst Chris Newhouse said:

“From my perspective, the recent rally has aspects of a derivatives driven move combined with an undertone of spot demand off the back of record ETF inflows. Breaking through the $53K region showed relative strength, volumes were high, natural demand was there, and momentum traders had started to pile in to the trade.”

Related: Bitcoin breaches $60K for the first time in over 2 years

Independent market analyst Nunya Bizniz added to the bullish Bitcoin price perspective, noting that Bitcoin’s relative strength index (RSI) was above 70 and highlighting the fact that in previous market cycles, BTC price remained in an uptrend for at least 335 days after the RSI pushed through 70.

BTC monthly:

RSI at +70

Chart produced at @Travis_Kling’s request.

# of days from cross above 70 to cycle peak.

Average is around a year.

Many expect peak in Q4 2025, what if it’s comes early in Q1 2025.

“Left Translated” cycle with help from ETF’s?

❓ pic.twitter.com/X7xpVYpD7v

— Nunya Bizniz (@Pladizow) February 27, 2024

Was $64,000 the top?

Shortly after reaching $64,000, Bitcoin price flash crashed to $58,700, likely the result of a sell wall at this level and a clearing out of late leveraged longs. However, at the time of publishing, BTC had recovered nearly 5% of the downside move.

Bitcoin is currently less than 13% away from its all-time high, and many retail and institutional investors expect the record $68,900 level to be overtaken before the supply halving, which is scheduled to occur in roughly 52 days.

Responses