BTC price spikes to $53K, but resistance catches up with Bitcoin bulls

Bitcoin bulls see swift rejection after attempting to break a week-long BTC price trading range, while open interest remains above $22 billion.

Bitcoin (BTC) spawned flash volatility at the Feb. 20 Wall Street open as a classic “fakeout” burned traders.

Bitcoin sellers quickly snuff out $53,000 push

Data from Cointelegraph Markets Pro and TradingView followed BTC price action as it briefly pierced $53,000 before rejecting.

That rejection was strong, with BTC/USD giving back its entire day’s gains in under two hours, bottoming at $51,400.

At the time of writing, a modest recovery saw $51,700 as the focus.

Bitcoin futures open interest, a classic volatility catalyst, which hit its highest levels in 26 months at the start of the week, remained at over $22.5 billion, per data from CoinGlass.

Reacting to the failed attempt to breach $53,000, popular trader Jelle told X subscribers to zoom out.

And just like that, the lower-timeframe charts do not look very exciting anymore.

You have two options:

– Choose to let the LTF chart shake you out

– Ignore the noise, and stick to your long term plan.What’s it going to be?#Bitcoin pic.twitter.com/uGNfn3LV60

— Jelle (@CryptoJelleNL) February 20, 2024

“The trend remains to be upwards. This doesn’t mean that we are having an upwards trend in one-go,” Michaël van de Poppe, founder and CEO of trading firm MNTrading, continued.

Like others, van de Poppe referenced inflows to the spot Bitcoin exchange-traded funds (ETFs), which, due to a public holiday in the United States, only reopened for business on Feb. 20.

As Cointelegraph reported, Bitcoin has gained as the ETFs accrue BTC, with some traders adding exposure ahead of the Wall Street open in an attempt to capitalize on potential upside as a result.

“Similarly, the ETF inflow isn’t going to push Bitcoin’s price to $100K in 2 months,” van de Poppe nonetheless reasoned.

“Corrections do happen and with the current sentiment, they’ll be nasty and short-lived.”

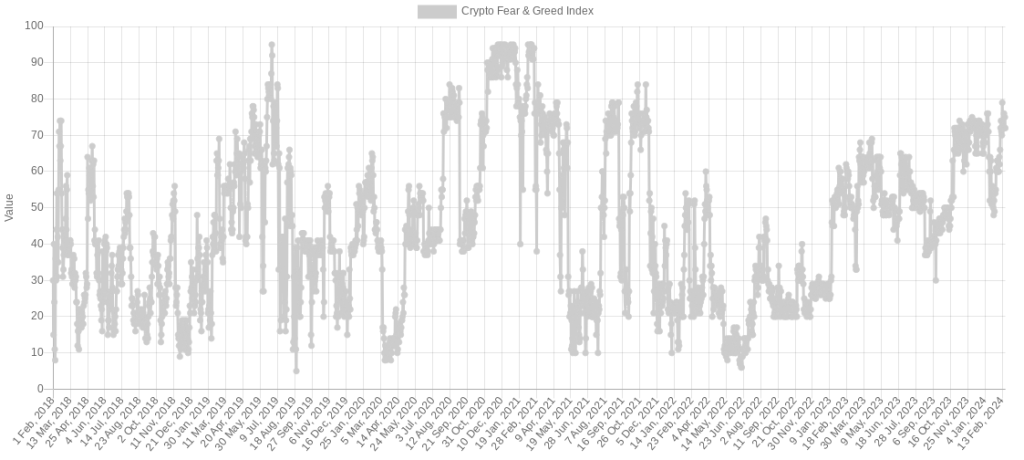

Per data from the Crypto Fear & Greed Index, “greed” is what currently characterizes the mood among crypto traders en masse. As Cointelegraph noted, the index recently hit its most “greedy” since just before Bitcoin hit its $69,000 all-time highs in Q4 2021.

Analyst’s “favorite” BTC price metric channels 2020 breakout

In an encouraging case of déjà vu, meanwhile, a historically accurate bull market indicator is giving fresh signals that more BTC price upside is due.

Related: Ethereum (ETH) price hits $3K for the first time since 2022

As noted by Caleb Franzen, senior market analyst at Cubic Analysts, the Williams %R Oscillator is repeating behavior seen just before Bitcoin first broke through $20,000 in late 2020.

A support retest looks to have been successful, he shared on X on the day, paving the way for potential continuation.

#Bitcoin just completed an A→B→C thrust for the 2-year Williams%R Oscillator (one of my favorite $BTC indicators).

A: break above overbought

B: fall below overbought

C: break above point AThe last time this happened was in October 2020, before price gained +390% in 6 months. pic.twitter.com/i5yjvQ2yGb

— Caleb Franzen (@CalebFranzen) February 20, 2024

As Cointelegraph reported, Franzen also used the oscillator as the basis for calling the end of the 2022 bear market.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses