Bitcoin braves US PPI miss at $52K as Fed rate cut odds fall further

Bitcoin bulls get no help from the latest U.S. macro data as $52,000 forms sturdy BTC price resistance.

Bitcoin (BTC) stuck to $52,000 at the Feb. 16 Wall Street open as the latest United States macro data ran above expectations.

PPI offers no relief for Bitcoin, risk assets

Data from Cointelegraph Markets Pro and TradingView showed stagnant BTC price action into the week’s last tradfi trading session.

Following hot on the heels of the Consumer Price Index (CPI) print two days prior, the Producer Price Index (PPI) numbers for January added to the U.S. inflation headache.

Year-on-year, PPI came in at 0.9% — fractionally lower than a month prior but still 0.3% above market forecasts.

Together with “hot” CPI, the result thus made markets even more timid about when the Federal Reserve could ease fiscal policy this year.

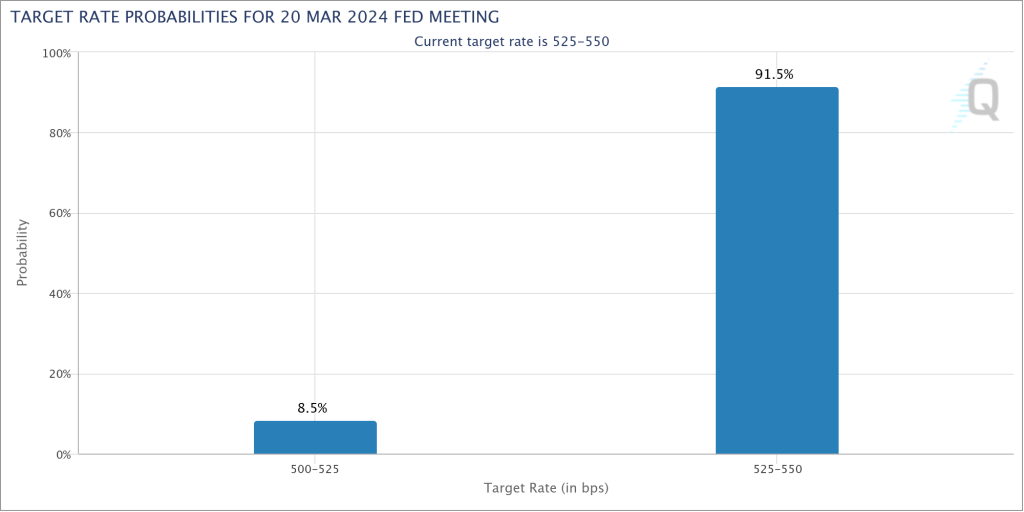

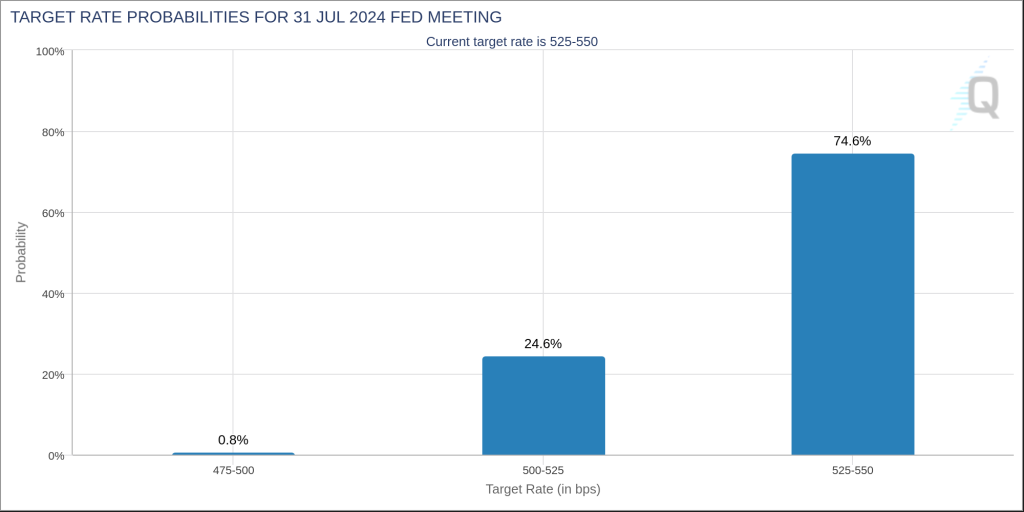

Per data from CME Group’s FedWatch Tool, the odds of the Fed cutting interest rates at its March meeting were at 8.5% at the time of writing — less than half the 17.5% chances at the start of the week.

“A March interest rate cut is likely completely ruled out after this data,” trading resource The Kobeissi Letter wrote in part of a response on X (formerly Twitter), reinforcing its reaction to CPI.

“Furthermore, a May rate cut has become questionable as well.”

$BTC 4H

Choppy price action here with a lot of inside bar closes basically within the same intraday balanceoften there's a fakeout before the real expansive move

4H 21EMA ~ $51K

Weekly open & main 4H trend ~ $48K – $47K

(key HTF area & systematic area) pic.twitter.com/G75BeREfnE— Skew Δ (@52kskew) February 16, 2024

Bitcoin itself hit $52,884 on Bitstamp the day prior, its highest level since late November 2021, but bulls faced pressure from sellers.

Analyzing 4-hour timeframes, popular trader Skew noted the significance of the 21-period exponential moving average (EMA), currently at around $51,000.

“Choppy price action here with a lot of inside bar closes basically within the same intraday balance,” he wrote.

“Often there’s a fakeout before the real expansive move.”

Analyst eyes BTC dip if ETF inflows “dry up”

The U.S. spot-Bitcoin exchange-traded funds (ETFs) saw net inflows of nearly half a billion dollars on Feb. 15.

Related: Bitcoin bears beware — BTC’s rally above $52K is much healthier than before

This added to an impressive week in which the ETF products saw a “second wind” — an expansion of interest more than one month after their initial launch.

Despite removing much more BTC than that added to the supply per day, however, the ETFs are making some market observers nervous.

In his latest analysis, Venturefounder, a contributor at on-chain analytics platform CryptoQuant, suggested that a slowdown in ETF interest could leave Bitcoin susceptible to a major retracement.

“Bitcoin ETF net inflow flatline/normalize is where the next 20-30% correction will start.” part of X commentary read alongside a summary of flows so far.

A previous post outlined potential BTC price floor levels, these extending all the way down to $34,000.

Possible scenarios if #Bitcoin ETF demand dries up in the next few weeks (by mid March 2024), and a correction does come:

Applying both 2021 #BTC local top fractals

First pump to $58k, then correction could stop at any of these levels: $52k, $47k, $42k, $38k, $34k (worst case) pic.twitter.com/OVmlTyJVr0

— venturefoundΞr (@venturefounder) February 16, 2024

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses