Bitcoin faces $52K ‘brick wall’ at Bitfinex as BTC price erases 4% dip

Bitcoin could see trouble cracking through newly-laid ask liquidity above $50,000, the latest analysis concludes.

Bitcoin (BTC) faces a new battle to overcome “densely packed” resistance as $50,000 becomes the BTC price focus.

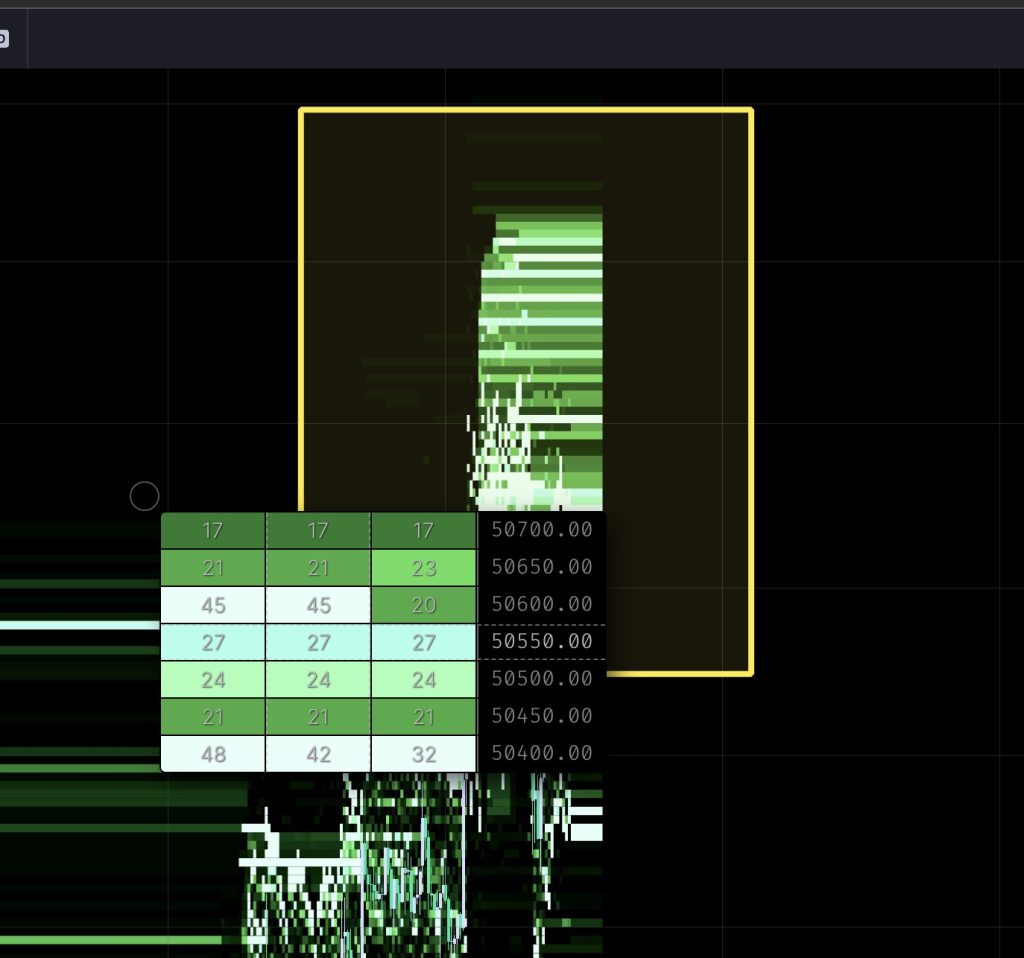

In a thread on X, popular analyst Cole Garner spotlighted crypto exchange Bitfinex.

Bitfinex entity on the radar as ask liquidity mushrooms

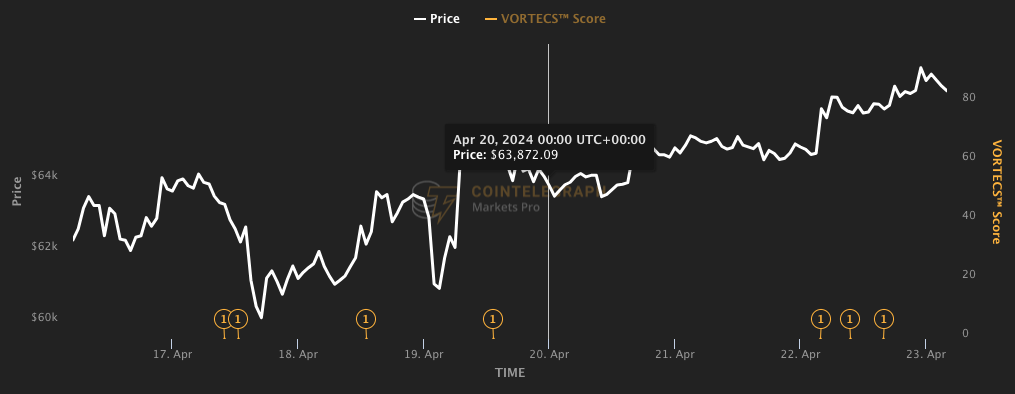

Despite dipping nearly 4% on Feb. 13 due to surprise United States inflation data, Bitcoin has already canceled its losses and even set a new two-year high.

Prior to the Feb. 14 Wall Street opening, BTC/USD brought the $52,000 mark into play, per data from Cointelegraph Markets Pro and TradingView.

For market observers, however, there is a catch: bulls face a reshaped liquidity landscape, which could keep the market trapped below $52,000.

“Brick wall of asks on Bitfinex. Densely packed all the way up to $52.3,” Garner summarized.

“ETF flows could eat thru it, but bitfinex is replenishing the wall much faster than demand can swallow it. All price can do is bounce off that.”

His post referred to the tug-of-war between sellers and spot demand from the newly-launched U.S. spot Bitcoin exchange-traded funds (ETFs). Despite consuming many times more BTC than is added to the supply by block subsidies, the ETFs currently face a glut of liquidity in the key $50,000 zone.

“This is one entity. A distinct signature. We’ve seen this behavior many times. They walked the whole market up from $3k-$10k in 2020,” Garner continued.

“I’ve never seen them replenish in real time. This is new behavior.”

The focus is on Bitfinex and its sister firm, stablecoin supplier Tether. In the past, Bitfinex whale traders have exerted significant influence on spot price thanks to the volume of their trades. Nonetheless, the identity of the liquidity provider remains unknown.

Bitcoin ETFs aim for record daily inflows

Meanwhile, ETFs saw noticeable inflows for Feb. 13, passing $600 million, with BlackRock’s product accounting for nearly half a billion dollars on its own.

Related: Bitcoin OG who called 2021 all-time high sees $600K BTC price by 2026

Yesterday's ETF inflows with an insane $631 million with Blackrock being just a bit shy of half a billion.$GBTC outflows at $73 million.

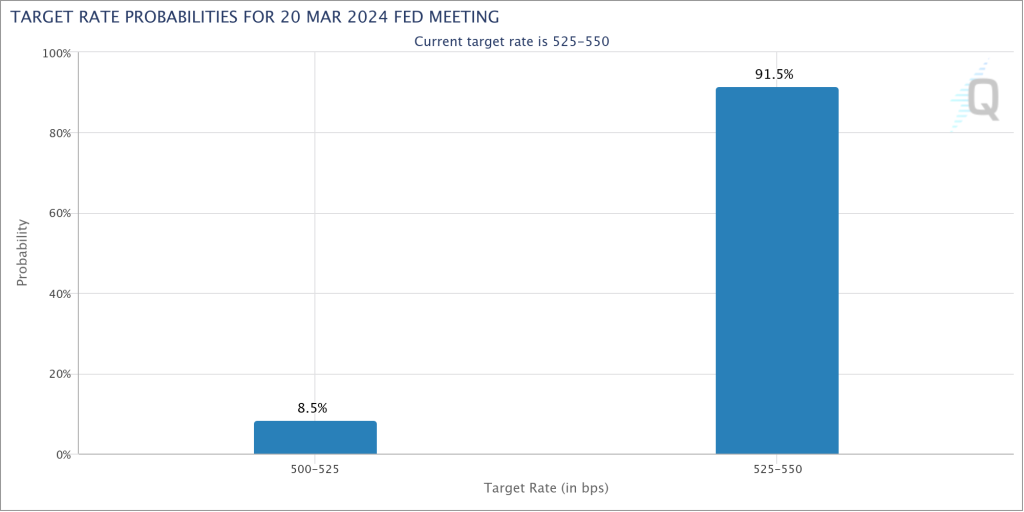

Price is down compared to Monday because of other markets crashing on CPI numbers which came in hot. Expected rate cuts now only in July… pic.twitter.com/dky7ogmYVr

— WhalePanda (@WhalePanda) February 14, 2024

The trend is helped by reduced outflows from the Grayscale Bitcoin Trust (GBTC), now at a fraction of their daily peak seen in January.

“But even as GBTC loses less Bitcoin now, these new funds keep buying just as much,” Thomas Fahrer, CEO of crypto-focused reviews portal Apollo, wrote in part of recent X coverage.

“This is very exciting to see! This means the new ETFs attracting fresh money to invest in Bitcoin, not just the same old investors moving their money around.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Here you can find 66402 additional Information to that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/markets/4415/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/4415/ […]