3 key Bitcoin price metrics hint at BTC gains above $48K

Bitcoin bulls are chasing a new year-to-date high. Cointelegraph explains what is behind the BTC price move.

Bitcoin price is up 6.28% over the last 24 hours and hit an intraday high at $48,200 on Feb. 9. Technical indicators, rallying spot Bitcoin exchange-traded fund (ETF) shares and on-chain data show that Bitcoin (BTC) has the strength to revisit the post-Bitcoin ETF approval high above $49,000.

Traders say the Bitcoin SuperTrend indicator shows a rare buy signal

Bitcoin’s monthly chart shows that the SuperTrend indicator flashed a bullish signal when it reversed from red to green and moved below $44,600 on Feb. 8.

This index overlays the chart while tracking BTC’s trend, like the moving averages. It incorporates the average true range in its calculations, which helps traders identify market trends.

Previous confirmations from the indicator were followed by a 1,336%, 1,9384%, and 713% rally from Bitcoin in 2013, 2017 and 2021, respectively.

According to the indicator, as long as the index is green and stays below the price, the price momentum tends to favor traders with a bullish bias.

Spot Bitcoin ETF shares continue to rally

As Bitcoin price climbed above $47,000 on Feb. 9, Bitcoin ETF shares gained approximately 4% on average.

Global X Blockchain & Bitcoin Strategy ETF gained the most, rising 6.6% over the last 24 hours, according to data from Coinglass.

In terms of spot Bitcoin ETF inflows, BlackRock’s iShares Bitcoin Trust maintains its top position in fund inflows with a total of $3.23 billion as of Feb. 8, per Bloomberg data.

The Fidelity Wise Origin Bitcoin Fund comes in second with inflows totaling $2.8 billion. The Bitwise Bitcoin ETF and ARK 21Shares Bitcoin ETF come third and forth with $696 million and $695 million in total inflows, respectively, as of Feb. 8.

A key thing to note is that the total inflows for the BTC ETFs have been greater than the net outflows from the Grayscale Bitcoin Trust for nine days in a row.

Yesterday the Spot #Bitcoin ETFs saw $403m net inflows.

While Grayscale sold only ~$100M worth of BTC.

It's not a good idea to be bearish right now imo. pic.twitter.com/1vlFcJExJ3

— The DeFi Investor (@TheDeFinvestor) February 9, 2024

This increase in the price of Bitcoin ETF shares and the positive netflow come when the Bitcoin price movement is expected to lead to a bull run.

Related: Bitcoin price nears $45.5K as altcoins tease ‘historic breakout’

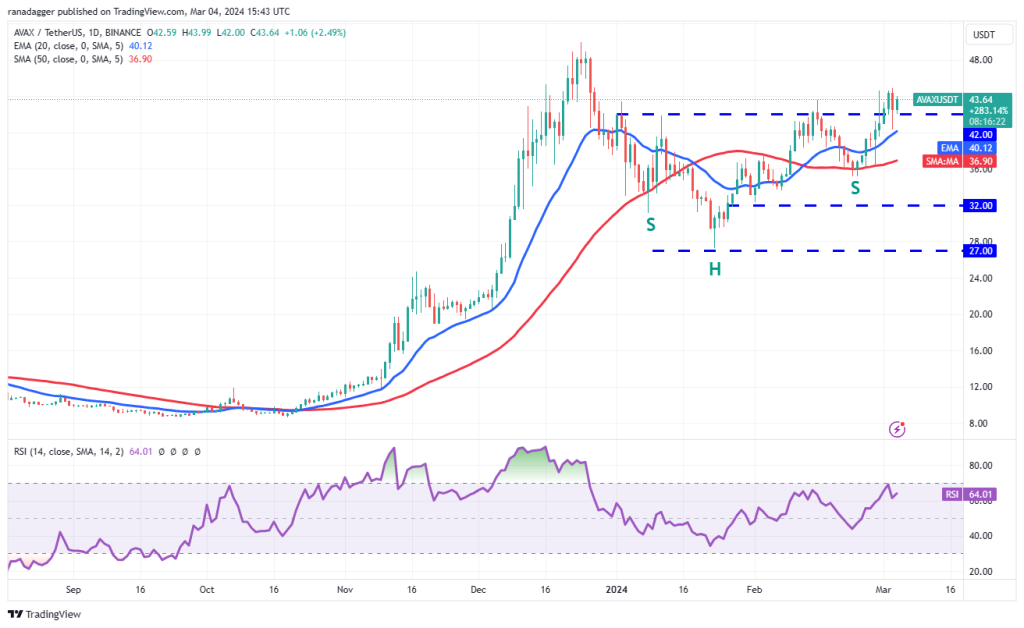

Bitcoin finds support in the $42,500 zone

Data from IntoTheBlock shows Bitcoin finding support around the $42,500 demand zone. The “in/out of the money around price” (IOMAP) model, which shows information for addresses that bought an asset within a certain price range, shows that this level lies in the $41,526–$42,942 price range, where approximately 1.01 million BTC was previously bought by roughly 2.61 million addresses.

When viewing the BTC/USD daily chart, one will note that this is where the 50-day exponential moving average currently sits, making it a strong line of defense for the bulls.

From a technical standpoint, the relative strength index maintained its upward trajectory, and the price strength at 71 supported the buyer’s dominance in the market.

In the short term, traders appear to be placing their Bitcoin price targets in the $48,000–$50,000 zone.

Other factors driving Bitcoin’s upside in 2024 include the influx of institutional investors and the halving event expected in April.

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] There you can find 92961 additional Info to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Here you will find 95449 more Info on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Here you can find 70269 additional Info to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Here you can find 40730 more Information on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] There you will find 55108 additional Information on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Here you can find 72050 more Info on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] There you can find 49200 additional Information on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Here you will find 82254 additional Info on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] There you can find 12592 more Info on that Topic: x.superex.com/academys/markets/4304/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/4304/ […]