Bitcoin is likely to be flat until summer — so trade bravely

The crypto market hasn’t moved much since the launch of Bitcoin ETFs, and data indicates it may stay that way for the first half of 2024.

Since the end of January, the market has experienced a remarkable U-turn on its interest rate expectations, and that’s no surprise. On Jan. 31, we saw the first United States Federal Open Market Committee (FOMC) meeting of the year and, contrary to expectations, policymakers took a decidedly hawkish stance, all but ruling out the chances of an interest rate cut in March. Then, on the subsequent Friday, U.S. labor data came in far stronger than expected.

Now, 83.5% of market participants expect the Federal Reserve to hold rates at their current level of 5.25%-5.5% in March, according to the CME FedWatch Tool: a remarkable change of heart from just a week ago, when more than half of market participants were convinced that rate cuts were imminent. Indeed, even a May rate cut appears less certain now, with 70% of respondents to a recent CNBC Fed Survey forecasting a cut no earlier than June.

With the labor market as strong as it has been, this gradual loss of confidence in a March rate cut is to be expected. The January unemployment report revealed that the U.S. economy added a whopping 353,000 jobs for the month, nearly doubling analysts’ expectations of 185,000. Unemployment is sitting at 3.7%, a multi-year low. And while there’s some anecdotal talk of layoffs, we have yet to see any meaningful weakness filter through to the broader employment metrics.

In short, the U.S. economy is still going gangbusters, despite interest rates hovering at a 22-year high since July 2023. And so, as Federal Reserve Chairman Jerome Powell stated during the post-FOMC meeting press conference, the Fed will proceed with caution until members are certain that the threat of inflation has receded once and for all.

And it appears global markets have accepted this at face value. The S&P 500 index has barely moved since the FOMC meeting, while Bitcoin (BTC) has remained maddeningly stable between $42,000 and $44,000. In fact, we’re getting close to 150 days in a $5,000 BTC trading range.

But just because the Fed is holding doesn’t mean that the only option open to investors is to HODL. Sideways trading markets present the perfect opportunity to explore alternative investment strategies, and there are plenty of those around. For example, crypto structured products could be one potential avenue to explore to maximize returns without taking on excessive additional risk. These vehicles offer enhanced annual percentage yields (APYs), often come with an element of downside protection, and can be suitable for all market conditions, including flat markets. And the good news is that there is a growing choice of these investment vehicles in crypto, whose origins can be traced deep into the history of traditional investing.

Related: This is why Bitcoin won’t crash 30% after the ETF decision

So what does this U.S. monetary policy outlook mean for both crypto and TradFi markets for the rest of 2024? Unfortunately, those who expected an explosive bull market in the first half of the year will likely be sorely disappointed, because the lack of volatility we’ve seen in the markets this week is a sign of things to come. Indeed, until the Fed finally pulls the trigger on interest rate cuts, we’re unlikely to see the much-anticipated injection of liquidity needed to lift the markets to new highs. Despite the hype around the spot Bitcoin ETF approval and Bitcoin’s upcoming halving in April, it’s likely crypto and TradFi will remain flat as a pancake at least until the second half of 2024.

And then, of course, there’s also the tried and tested method of dollar cost averaging. When volatility in crypto is high, many investors try to time market entry points. But it’s worth remembering the old adage: “Time in the market beats timing the market.” A wealth of research proves market timing to be, by and large, a losing strategy compared to dollar-cost averaging (DCA), especially for investors with little experience.

Related: An Ethereum ETF is coming sooner than you expect

The beauty of a market that has come to a standstill is that there is no temptation to attempt entry and exit timing. Psychologically, it’s much easier to trickle regular small amounts into a chosen few assets and await a breakout to higher levels.

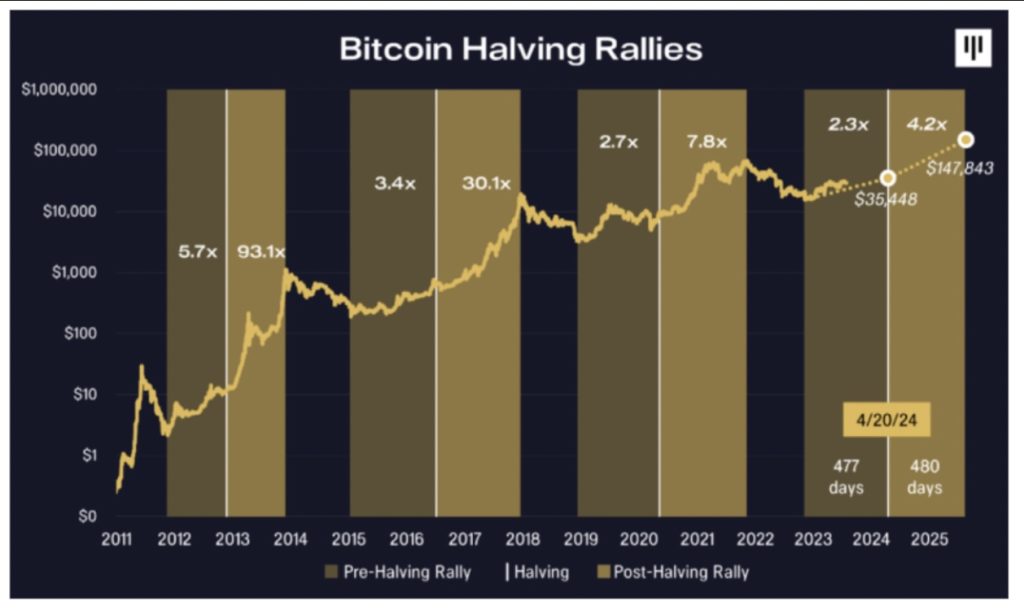

That is not to say that the only way is up from here. Volatility will likely return in the foreseeable future and, as in previous halving cycles, we may well see another “sell the news” event in crypto following the Bitcoin halving itself, which is now expected around April 18. But this is exactly the reason why choosing a strategy and sticking to it will be more important than ever in 2024.

Previous halving cycles show that it takes between 220 and 240 days for Bitcoin to reach a new all-time high after a halving, which means we may not see the next all-time high until the end of the year. This means nearly 11 months, or 46 weeks of DCA opportunities from here, or perhaps a chance to explore a more sophisticated strategy. When you think of it that way, a flat crypto market may well be a blessing in disguise. Let the Fed navigate the choppy waters of its first interest rate cut decision of the cycle and be positioned well when the bull market gets into full swing.

Lucas Kiely is the chief investment officer for Yield App, where he oversees investment portfolio allocations and leads the expansion of a diversified investment product range. He was previously the chief investment officer at Diginex Asset Management, and a senior trader and managing director at Credit Suisse in Hong Kong, where he managed QIS and Structured Derivatives trading. He was also the head of exotic derivatives at UBS in Australia.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] There you will find 10969 additional Information on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] There you will find 93045 additional Info on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Here you can find 95799 additional Information to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Here you can find 6970 more Information to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Here you will find 37934 more Information to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Here you can find 27341 additional Information on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/4224/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/4224/ […]