Bitcoin price risks $30K over ‘supercharged’ inflation — Arthur Hayes

Bitcoin is flashing red because of upcoming turbulence in the U.S. and global economy, the crypto OG concludes in his latest BTC price forecast.

Bitcoin (BTC) has a date with $35,000 or lower at the hands of fresh global macro turmoil, Arthur Hayes says.

In his latest blog post, “Yellen or Talkin’?” on Jan. 24, the former CEO of crypto exchange BitMEX makes a grim short-term BTC price forecast.

Hayes: Bitcoin appreciates 2024 inflation risk

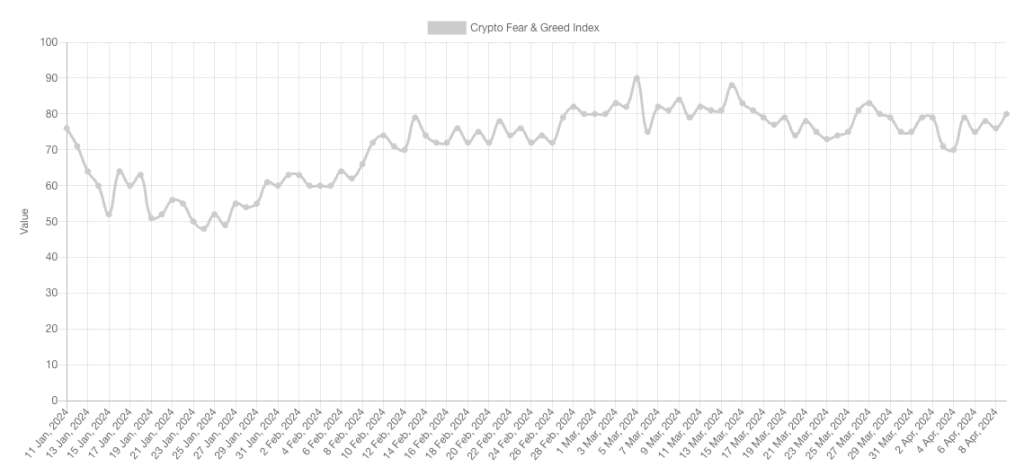

Bitcoin may still be 75% up versus a year ago, but it faces a perfect storm of downside volatility catalysts this quarter.

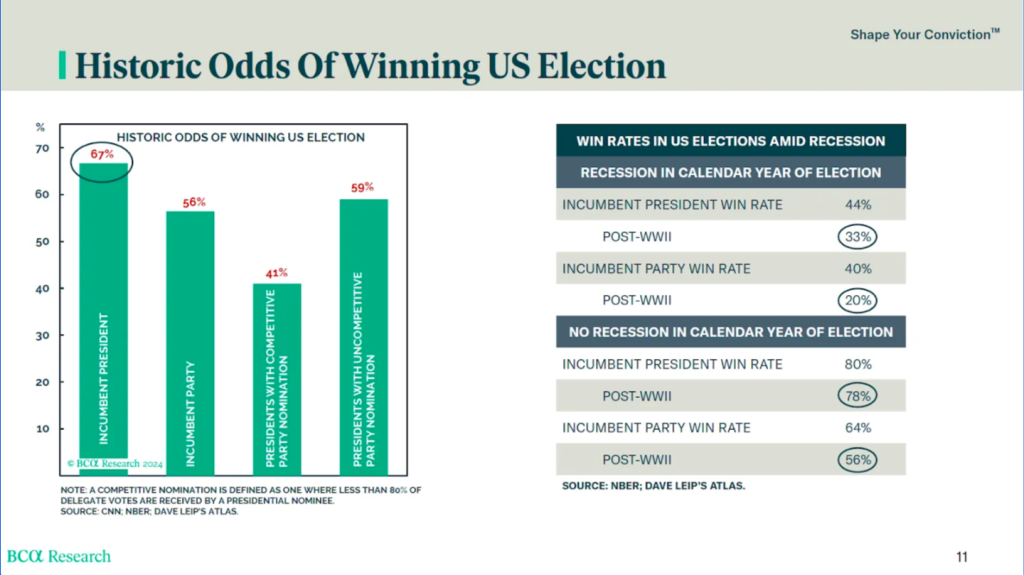

For Hayes, these come in several guises: the Red Sea conflict between the United States and the Houthis with its impact on global shipping, the U.S. presidential election race and Federal Reserve policy.

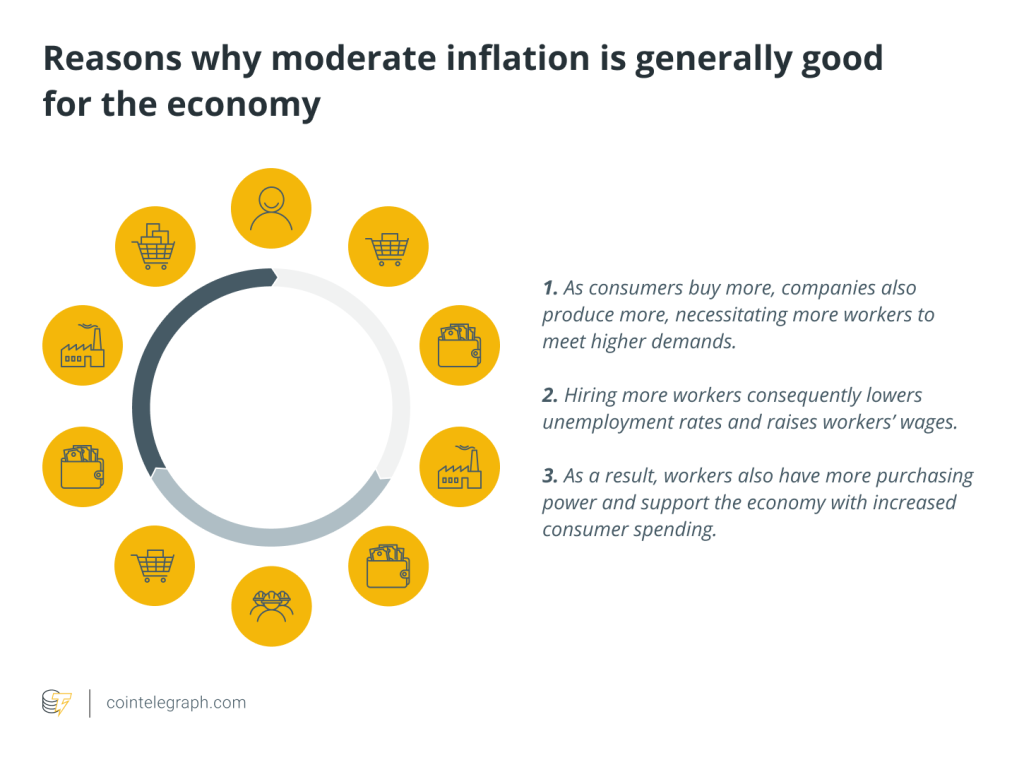

The first of these has clear implications for inflation. Risk assets, including crypto, are looking for a “pivot” by the Fed as soon as March — lowering interest rates and attracting liquidity back to the market.

Higher shipping costs, however, could mean a spike in prices later in the year — something the Fed and Chair Jerome Powell will be keen to mitigate, Hayes explains.

“Due to weather and geopolitics, higher shipping costs could cause a surge in inflation in the third and fourth quarter of this year. As Powell is undoubtedly aware of these issues, he will do everything he can to talk a big game about rate cuts without having to actually cut them,” he writes.

“What might be a mild increase in the rate of inflation due to increased shipping costs could be supercharged by rate cuts and the resumption of QE. The market doesn’t appreciate this fact yet, but Bitcoin does.”

Hayes touches on the second piece of the puzzle: the strength of the U.S. regional banking sector.

As Cointelegraph reported, since the meltdown of March 2023, the U.S. government has offered support in the form of the Bank Term Funding Program (BTFP) — a lifeline that is now due to expire.

Hayes thinks that this will come to pass despite the fact that banks’ financial predicaments have not gone anywhere. This and other questions over liquidity, however, depend on Treasury Secretary Janet Yellen’s next moves.

“The only thing that trumps fighting inflation is a financial crisis,” the blog post continues.

“That is why, to get the cuts, QT taper, and the possible resumption of QE the market believes is already in the bag come March, we first need a few banks to fail when the BTFP is not renewed.”

Bitcoin should “form support” below $35,000

Turning to Bitcoin, the writing may be on the wall, with turmoil over liquidity and the BTFP, combined with geopolitical risk, meaning that the 20% BTC price dip is the tip of the iceberg.

Related: All eyes are on $40K Bitcoin price leading into Friday’s $4.5B BTC options expiry

“A 30% correction from the ETF approval high of $48,000 is $33,600,” Hayes predicts.

“Therefore, I believe Bitcoin forms support between $30,0000 to $35,000. That is why I purchased 29 March 2024 $35,000 strike puts.”

He adds that sub-$35,000 levels now represent an opportunity to buy the dip.

BTC/USD hit $38,500 on Bitstamp on Jan. 23, its lowest since the start of December, before rebounding around $1,700 higher, per data from Cointelegraph Markets Pro and TradingView.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Here you will find 79570 additional Information on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Here you will find 54147 more Information on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] There you can find 97432 more Info to that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/markets/3486/ […]

… [Trackback]

[…] There you will find 49071 more Information on that Topic: x.superex.com/academys/markets/3486/ […]