Chainlink (LINK) rebounds toward multi-month high — What’s behind the move?

Traders are turning bullish on Chainlink again, but what’s driving the price move?

Chainlink’s LINK (LINK) token experienced a 7% surge on Jan. 17 to trade at $16, a level last seen on Dec. 29, 2023. This solidified its position as the 11th largest cryptocurrency (excluding stablecoins) by market capitalization.

It is worth noting that as LINK gains value, Bitcoin’s (BTC) price trades 2% down over the same period. LINK’s performance also stands out compared with Ether’s (ETH) 0.65% decrease and SOL’s (SOL) 5.5% increase.

A quick flip through the news and Chainlink’s roadmap shows that the project’s oracle and decentralized computing solutions are driven by expectations of real-world asset (RWA) tokenization and signs of institutional adoption.

However, can LINK sustain the current rally? Let’s find out.

Chainlink partnerships and collaborations back LINK’s upside

Several recent developments have contributed to LINK’s outperformance of its peers. Notably, the announcement of Chainlink Lab’s partnerships with SingularityDAO, a decentralized platform and Swift have supported its presence in the RWA sector for months, contributing to its bullishness.

7. Chainlink’s robust partnership with SWIFT will unlock huge capital flows from tradfi markets into blockchain industry, streamlining the transfer of tokenized value globally and enhancing the fluidity and accessibility of cross-border txns. In the experiment with SWIFT,… pic.twitter.com/hDhQvhOoh2

— DeFi Cheetah ¤ (@DeFi_Cheetah) January 13, 2024

Moreover, Redacted’s recent integration of Chainlink CCIP for cross-chain transfers of Pirex ETH (pxETH) further underscores Chainlink’s growing influence in the Web3 space. The integration aims to make pxETH accessible across various blockchains for cross-chain interoperability.

LINK’s decreasing supply on exchanges

More clues that could explain Chainlink’s recent upside come from data tracking LINK supply across crypto exchanges (the yellow wave in the Santiment chart below).

Notably, LINK’s supply on exchanges hit a four-year low, below 15%. A diminishing supply across exchanges hints at traders’ preference for holding LINK tokens over selling them for other assets. So, LINK’s potential to continue its ongoing run increases if demand doesn’t diminish.

This coincides with a 6% increase in the number of wallets holding more than 0 LINK “nearing its all-time high once again, sitting at 713,560,” says crypto data intelligence Santiment in a Jan. 15 post on X.

Simply put, Chainlink’s smallholders could believe its value will rise further in the near future.

Related: 3 reasons why Chainlink price can rally another 20% by New Year’s

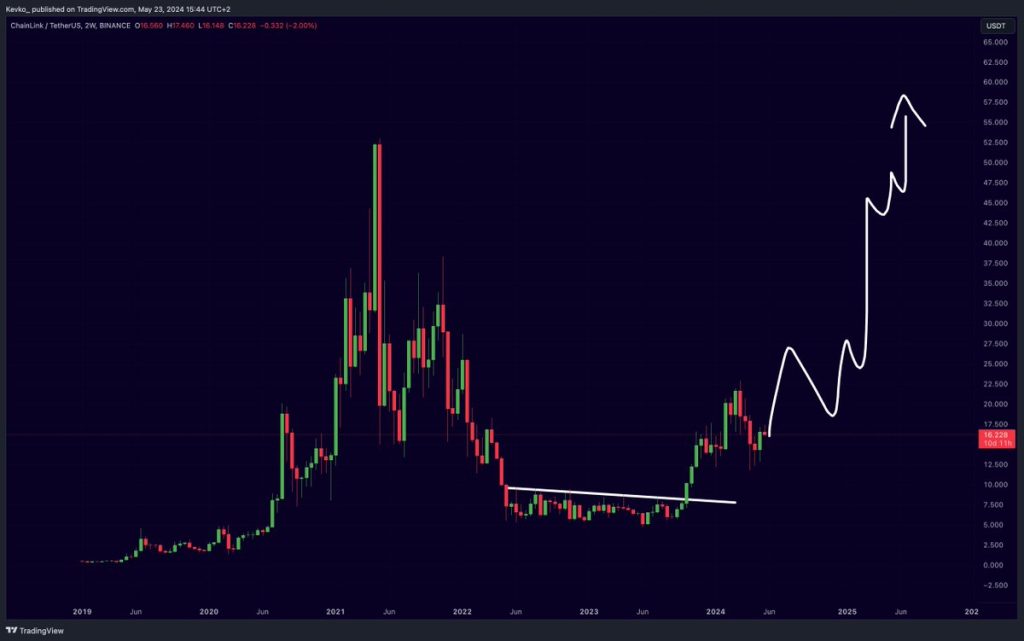

LINK price aims for a V-shaped recovery

LINK’s price action since Dec. 27, 2023, has formed a V-shaped recovery chart pattern on the daily chart.

A V-shaped recovery is a bullish pattern formed when an asset experiences a sharp price increase after a steep decline. It is completed when the price moves up to the resistance at the top of the V formation.

LINK appears to be on a similar trajectory as it currently trades close to the pattern’s resistance line at $17.

The rising moving averages and the positive moving average convergence divergence (MACD) indicator also provide insight into the bullish momentum building in the LINK price.

Note that the bullish cross sent by the MACD on Jan. 14 when the 12-day exponential moving average (EMA) (blue line) crossed above the 26-day EMA (orange line) was still in play suggesting that the market conditions continue to favor the upside.

Chainlink’s LINK (LINK) token experienced a 7% surge on Jan. 17 to trade at $16, a level last seen on Dec. 29, 2023. This solidified its position as the 11th largest cryptocurrency (excluding stablecoins) by market capitalization.

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Here you can find 59991 more Information to that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Here you will find 32886 additional Information to that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] There you can find 45980 more Information on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] There you can find 41442 more Information on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] There you will find 42140 additional Information on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] There you will find 45859 additional Information on that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/2840/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/markets/2840/ […]