Bitcoin futures lose their appeal as investors anticipate spot BTC ETF approval

Bloomberg’s ETF specialists remain convinced that the SEC will approve all spot BTC ETFs, so why are BTC derivatives losing their appeal?

Bitcoin (BTC) price oscillated between $44,745 and $47,910 in less than 30 minutes on Jan. 9 as market participants tried to validate the United States Securities and Exchange Commission’s post on X (formerly Twitter) that suggested all spot BTC exchange-traded funds (ETFs) were approved.

Bitcoin’s price eventually stabilized near $46,000 after SEC Chair Gary Gensler denied the news, but investors became increasingly suspicious that the situation could reduce the approval odds of the ETF decision by Jan. 10.

The impact of SEC’s debacle on Bitcoin’s spot ETF approval odds

As explained by Jesse Berger, the author of Magic Internet Money, on X, the “unauthorized” post by the SEC could be used as an excuse to delay the spot Bitcoin ETF.

Somehow they’ll use the hack of @SECGov account as hack excuse to delay the ETF https://t.co/IXUOd3L403

— Jesse Berger (@jayberjay) January 9, 2024

One should note that the only ETF with a Jan. 10 deadline is the ARK 21Shares Bitcoin ETF, while other issuers such as BlackRock, Bitwise, Fidelity and VanEck only expect a final decision by March 15. This difference explains why senior Bloomberg ETF analysts are unable to estimate approval odds above 90%, given that the regulator could demand additional time.

Other factors cited by Bloomberg’s James Seyffart include a spot ETF denial by the SEC, although it is unlikely in his view. The potential base for the negative outcome could include other reasons than the previously cited market manipulation risks or even some kind of direct order from the administration of U.S. President Joe Biden.

Going one step further, Hoeem, author of the “Seven C Newsletter,” explained that the event exposes how Bitcoin’s price can be “manipulated” by a mere post on a social network, which could be used as an argument to deny the ETF, although the author does not have such a scenario as a base case.

:

– SEC had no grounds to deny ETF.

– SEC doesn’t want to approve ETF.

– SEC account gets “hacked”.

– Gary says tweet was “unauthorised”.

– Bitcoins price has been “manipulated”.

– Gary’s main proponent against ETF is…

— hoeem (@crypthoem) January 10, 2024

Hoeem’s hypothesis is much closer to reality than one might imagine, at least from the price perspective, as Bitcoin is struggling to sustain $45,000, down 4.3% from the previous day’s $47,000 level. But, more importantly, the Bitcoin futures premium has plunged to its lowest level in three weeks, indicating lower demand for leverage longs (buyers).

Bitcoin derivatives show reduced demand for bullish positions

Professional traders prefer monthly futures contracts due to the absence of a funding rate, which causes these instruments to trade 5% to 10% higher relative to regular spot markets, justifying the longer settlement period.

Data reveals that the two-month Bitcoin futures premium (basis rate) has declined to 12% on Jan. 10, matching its lowest level in three weeks. Despite remaining above the 10% threshold, the indicator reflects much lower demand for leverage longs (buyers) in comparison to the Jan. 2 levels above 20%. That’s certainly not what one should expect if approval odds for the spot Bitcoin ETF stand at 80%.

The Bitcoin futures premium could have been impacted by the increased demand to hedge Grayscale Bitcoin Trust (GBTC) fund exposure. The shares have been trading at a discount relative to the Bitcoin equivalent holdings since February 2021, but that will change if Grayscale’s spot ETF fund conversion gets approved by the SEC. GBTC holders would finally be able to redeem their shares at face value, so the arbitrage opportunity exists in buying the fund shares and selling the equivalent in BTC futures to hedge the exposure.

Related: US senators seek Gary Gensler’s report on X breach, deadline Monday

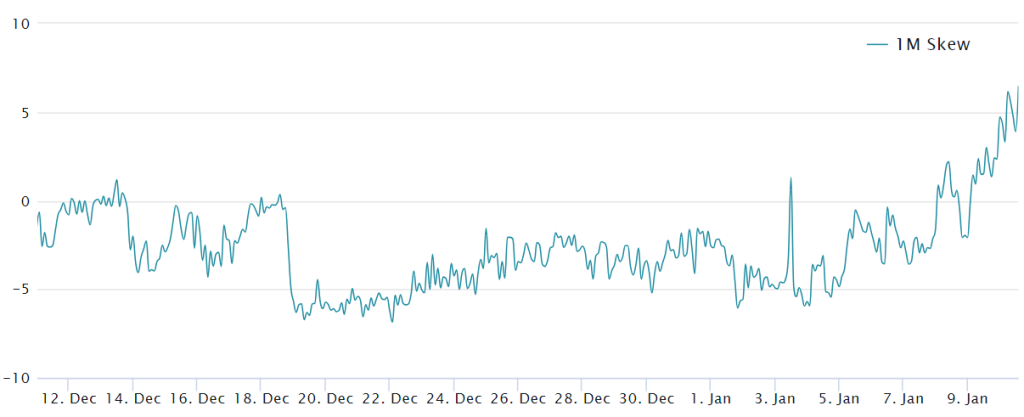

Traders should also analyze options markets to understand whether the recent price correction has caused investors to become less optimistic. The 25% delta skew is a telling sign when arbitrage desks and market makers overcharge for upside or downside protection. In short, if traders anticipate a Bitcoin price drop, the skew metric will rise above 7%, and phases of excitement tend to have a negative 7% skew.

As displayed above, Bitcoin options delta 25% skew remained within the neutral range, although it moved closer to the 7% threshold for bearish markets. In essence, both BTC futures and options signal that any excessive optimism has been wiped out after the unexpected volatility on Jan. 9.

It would be far-fetched to infer that market approval odds have gone below 80% given Bitcoin derivatives markets, but it is certainly less bullish in comparison to the previous week.

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] There you will find 47286 additional Information on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Here you can find 82480 more Information on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] There you can find 40199 additional Information on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] There you will find 45230 more Info on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Here you will find 47100 more Information to that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/2214/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/markets/2214/ […]