This is why Bitcoin won’t crash 30% after the ETF decision

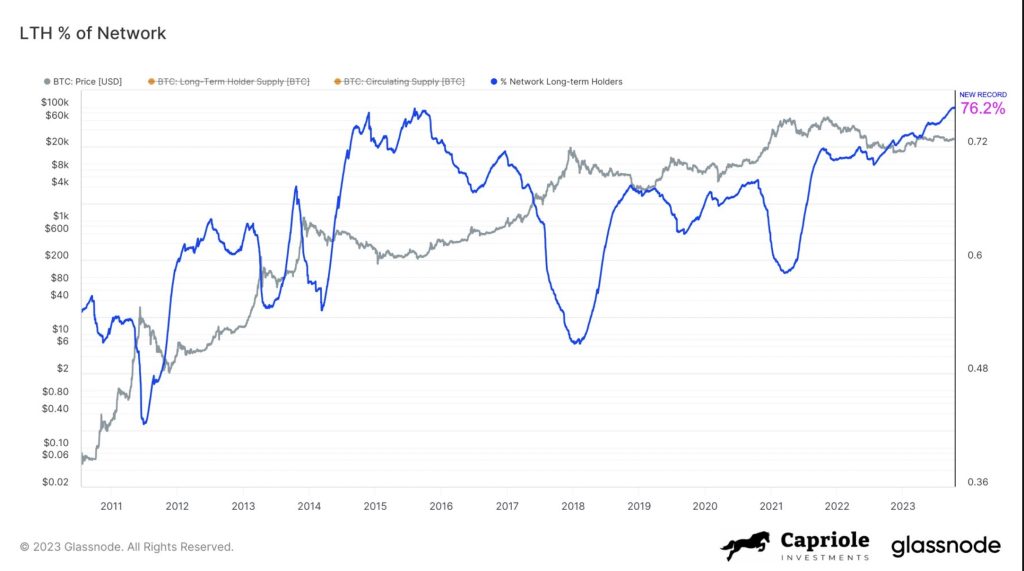

The percentage of long-term Bitcoin holders is sitting at about 70%. If you’re counting on them to jettison their supply at $46,000, you might be disappointed.

Amid the Bitcoin exchange-traded fund (ETF) mania, wild price predictions have flown around. Even if the Securities and Exchange Commission approves the ETFs, many anticipate a “sell the news” event that will drive Bitcoin’s (BTC) price 30% below current levels.

However, I don’t see this scenario playing out. In fact, there’s a convincing argument to predict Bitcoin will rally another 10% from current levels above the $50,000 mark, before pulling back slightly in the short term.

Having spent several decades working in traditional asset management, I know that when BlackRock publicly states something, the market should pay attention. BlackRock appeared certain in the days leading to Jan. 10 that approval would be granted.

Related: History tells us we’re in for a strong bull market with a hard landing

Indeed, the applicants have revealed key details of their product offerings, most notably the fees they plan to charge for their ETFs. And in the ETF world, these fees are very reasonable. BlackRock intends to charge just 0.2% for the first 12 months or until the fund reaches $5 billion in assets, increasing the fee to 0.3% thereafter. Invesco is waiving its fee entirely for the first six months or until it hits the $5 billion milestone, and then charging 0.59%. ARK Invest and VanEck have set their fees at 0.25%, with ARK waiving the fee for the first six months or until the product hits $1 billion. To put this in perspective, the biggest Bitcoin futures ETF, ProShares Bitcoin Strategy ETF, charges 0.95%.

These disclosures make it clear that the providers are prepared and laser-focused on asset acquisition. Indeed, the level of competition is reminiscent of the famous fee wars among providers of broad-market index ETFs — in particular, the S&P 500 ETFs — which continued throughout the early 2010s. With so much momentum and anticipation building, there is little chance of a rejection this late in the game.

What’s more, the ambitious asset acquisition goals reveal an expectation that this launch will bring billions into Bitcoin in a short space of time. The ETF providers have done their research and spoken to multiple clients over the past few months, so their estimates may be the most reliable of all. As such, if BlackRock, Invesco and ARK meet their targets, the three of them alone could bring $11 billion into Bitcoin within 12 months.

It’s entirely plausible that we will see much more money pouring into Bitcoin via these investment vehicles. After all, this marks the recognition of Bitcoin as a legitimate, regulated investment asset, on par with gold, whose market cap is more than 10 times that of Bitcoin. As such, we can expect billions of dollars of inflows into the ETFs, along with increased interest from more crypto-savvy investors, who will access Bitcoin via exchanges. Top players like Coinbase will benefit from this increased interest, as will the wider cryptocurrency market, which tends to follow Bitcoin’s price action.

Related: Don’t get excited about Fed ‘dovishness’ — another rate hike is in the cards

Given the tailwinds the ETF approval provides, I don’t anticipate the strong selling pressure that some are predicting. We need only take a look at the current Bitcoin investment dynamics to see that a 30% sell-off doesn’t make sense. As of October, the percentage of long-term Bitcoin hodlers is at 76% — the highest level in history. They will not be selling at this point. This is exactly what they have been waiting for, and most are anticipating an all-time high of $100,000 or more. It’s simply the wrong time in the cycle for them to sell.

So, the only selling pressure will come from short-term traders, who have orders with strike prices in place. Once these strikes are hit, we can expect a pullback in the short term, which is typical for Bitcoin rallies. However, as we have seen time and time again over the past few months, these tend to be short-lived and only a precursor to a rebound in prices. This won’t be driven by the ETF alone, either, because of course this year also marks the Bitcoin halving. In the past, these events have always been followed by significant BTC rallies to new all-time highs, and it’s reasonable to expect that this year will not be an exception.

With all this in mind, we could easily see Bitcoin’s price soar 25% to 30% in 2024 from its current level of $46,000 to around $60,000.

Of course, that’s not to say there are no threats to this rally. With the ETF approval, the regulatory pressure on the crypto ecosystem is only set to intensify, and this could put downward pressure on prices. The global macroeconomic backdrop will also play its part, and it remains to be seen whether this will be a positive or negative one. However, overall, 2024 is one year where the fear-mongering around Bitcoin isn’t particularly warranted. After all, this is the year Bitcoin finally goes mainstream.

Lucas Kiely is the chief investment officer for Yield App, where he oversees investment portfolio allocations and leads the expansion of a diversified investment product range. He was previously the chief investment officer at Diginex Asset Management, and a senior trader and managing director at Credit Suisse in Hong Kong, where he managed QIS and Structured Derivatives trading. He was also the head of exotic derivatives at UBS in Australia.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Here you can find 54801 more Info on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] There you can find 18806 additional Information on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] There you can find 57279 additional Info to that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] There you will find 74915 additional Information on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/markets/2210/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/markets/2210/ […]