Why is the crypto market up today?

Investor optimism, macroeconomic factors, and upcoming events like Bitcoin halving and ETFs drive today’s rise in the crypto market.

The market capitalization of all cryptocurrencies has climbed 6.50% to $1.7 trillion in the last 24 hours, with top coins Bitcoin (BTC) and Ether (ETH) rising 6% and 3.5%, respectively.

Bitcoin ETF approval expectations

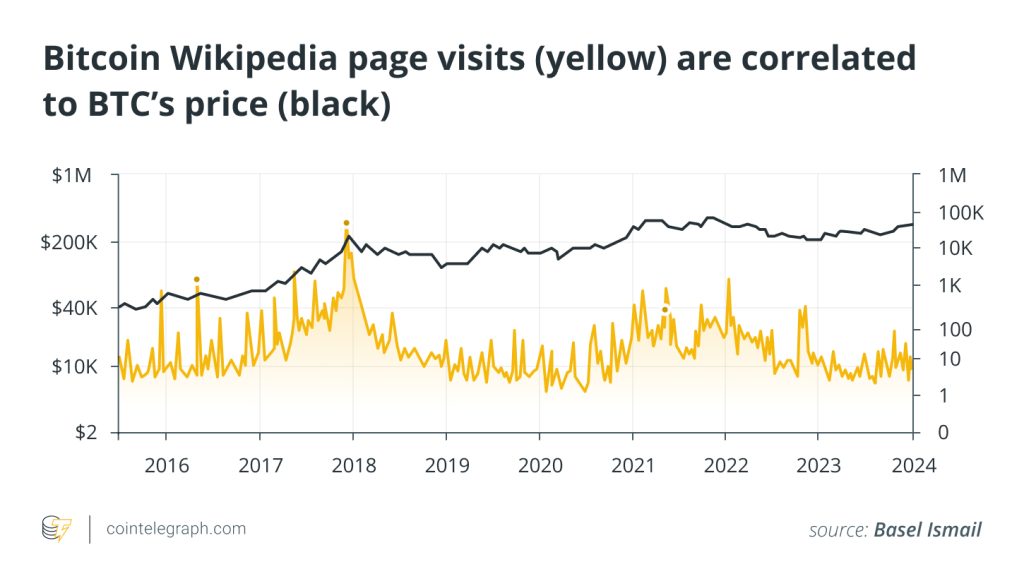

A significant driver behind today’s rise in the crypto market is the anticipation of the U.S. Securities and Exchange Commission’s (SEC) approval of the first spot-based Bitcoin ETFs. The market thinks of approval as a sign of an expanding investor base, with Standard Chartered projecting it to prompt a Bitcoin price rally to $200,000 by late 2025.

Regardless of long term plans, the intensity of this bitcoin ETF bidding war is telling me the issuers believe that the winner’s low fees will be compensated by HUGE $$ inflows. pic.twitter.com/tzEmHzPsWU

— Tuur Demeester (@TuurDemeester) January 9, 2024

For instance, there has been an upward momentum in digital assets investment funds in 2024, with $151 million inflows.

Tech stock rally, dollar’s decline

Another contributing factor behind the crypto market’s rise today is a rally in tech stocks coupled with a decline in the U.S. dollar. This has sparked a “risk-on” mood, making cryptocurrencies more attractive as an investment.

The daily correlation between the crypto market and the tech-heavy Nasdaq Composite Index (IXIC) has been positive since November 2023. Since then, these markets have risen 40% and 18.5%, respectively. Meanwhile, the U.S. dollar Index (DXY) has dropped 4.45%.

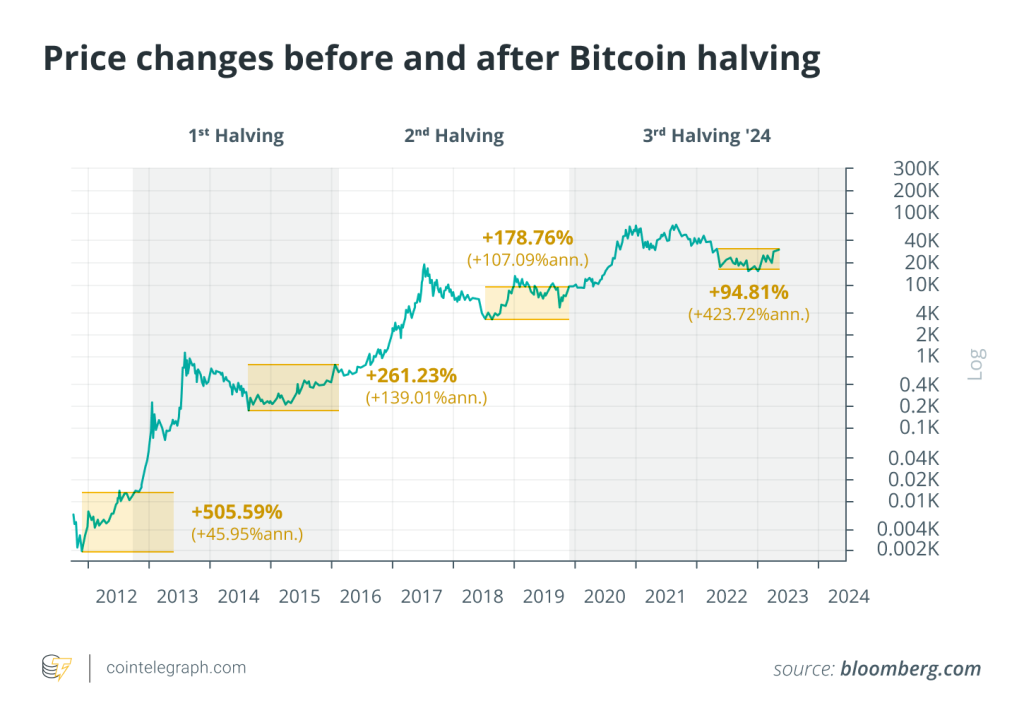

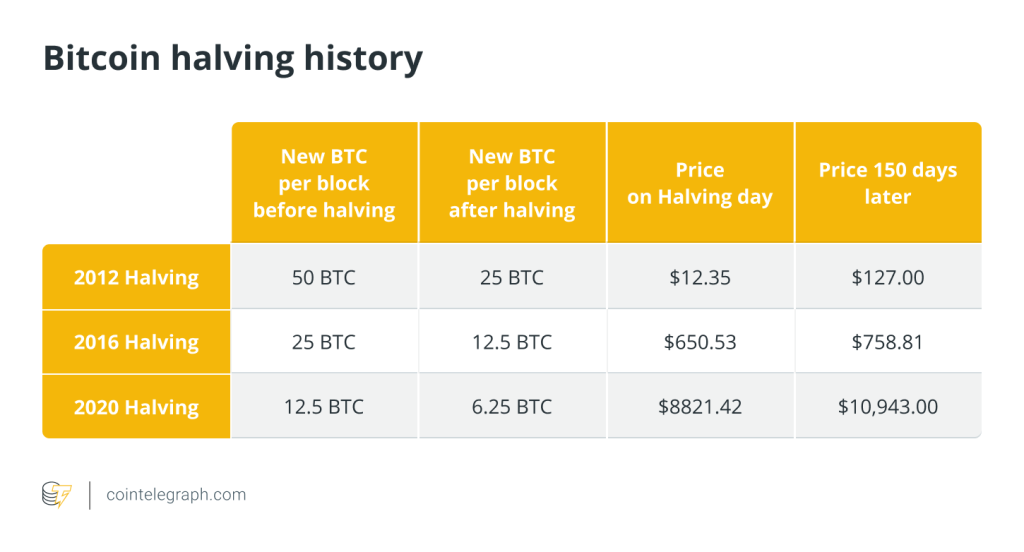

Bitcoin halving less than 100 days away

The market mood is also increasingly bullish because of Bitcoin’s halving that’s now less than 100 days away. It will cut the new BTC supply rate by half, which has resulted in higher prices historically.

Related: Gary Gensler issues warning on crypto ahead of potential spot Bitcoin ETF approval

These factors collectively suggest a multifaceted impetus behind the current rally in the cryptocurrency market. The anticipated SEC decision on Bitcoin ETFs is particularly pivotal, with potential long-term implications for the market’s dynamics and investor base.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Here you can find 64837 more Information on that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Here you can find 89671 additional Info to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] There you can find 37522 additional Info to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Here you will find 98047 more Information on that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Here you will find 96230 more Information on that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Here you will find 98530 additional Info on that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Here you will find 44522 more Information to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/1808/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/markets/1808/ […]