Why is Bitcoin price up today?

Bitcoin price is up today as traders’ bullish optimism over a potential spot ETF approval sends BTC over $45,000.

Bitcoin (BTC) price is up today, topping over $45,250, before retracting slightly and hovering around the key $45,000 level. The rally highlights traders’ continued bullish bias for Bitcoin, which seeks a continuation of a positive 4-month price trend.

Let’s look into the reasons why Bitcoin price is up today.

Spot BTC ETF momentum boosts market sentiment

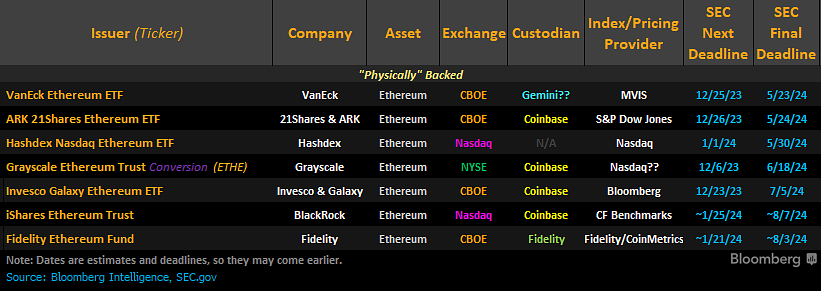

Despite a bevy of macro headwinds, Bitcoin price continues to push higher, with volatility and open interest increasing. On Jan. 8, all spot Bitcoin ETF applicants officially filed the final step in the process. Now the Securities and Exchange Commission (SEC) is free to potentially approve the spot Bitcoin ETFs.

We’re now past the official @SECGov submission deadline of 8AM and all issuers aside from @hashdex have submitted their updated S-1’s (S-3 in Grayscale’s case).

So unless there’s a last minute filing from them today, these are the issuers that have handed in all their homework…

— Eleanor Terrett (@EleanorTerrett) January 8, 2024

While some analysts believe the Bitcoin price is pointing toward a breakout to $50,000, BTC has more than doubled the 2023 returns of gold and the momentum has continued in 2024. MicroStrategy CEO and Bitcoin bull Michael Saylor believes a spot Bitcoin ETF would be the biggest to happen to all finance since the S&P 500 launched.

The positive sentiment around Bitcoin led the BTC market cap to surpass Berkshire Hathaway on Dec. 5, 2023 and it has remained the 10th-biggest asset by that measure. Despite BTC’s strength, the SEC continues to proceed cautiously, reissuing a crypto FOMO warning on Jan. 6.

Related: Cory Klippsten’s warning for ‘shitcoin traders’ in the bull market: X Hall of Flame

According to reports, an approval may generate $600 billion in new demand. CryptoQuant analysts believe that an ETF approval will lead to a $1 trillion increase in Bitcoin’s market capitalization. Galaxy Digital predicts a 74% price increase in the first year after a spot BTC ETF launch. Even traditional banks are seemingly bullish on Bitcoin price, with one estimating $200,000 per BTC by the end of 2025.

Standard Chartered just put out a note saying that we could see $50-100B of spot Bitcoin ETF inflows in 2024 and a BTC price of $200,000 by the end of 2025. This is a big traditional bank, folks. The whole world is about to wake up on this.

— Mike Alfred (@mikealfred) January 8, 2024

The final filings required by the spot Bitcoin ETF applicants have highlighted a potential “fee war” emerging, with the institutions all trying to be the lowest. The lowest filed fee sits at 0.25% on Jan. 8.

Bitcoin dominated 2023 institutional investor inflows

While some investors may be awaiting increased liquidity and clarity from a spot ETF approval, institutional investors have already begun deploying funds to Bitcoin and crypto. According to CoinShares, institutional investors pushed $2.25 billion into crypto in 2023, which is a 2.7 times increase over 2022. The total year institutional inflow was the 3rd largest on record.

Related: How will Ethereum price react to Bitcoin ETF approval?

Of the $2.25 billion pushed to crypto assets in 2023, over $1.93 billion has flowed to Bitcoin specifically. The total assets under management (AUM) for Bitcoin dwarfs other digital assets with $36.17 billion currently deployed.

Retail Bitcoin interest increases

Institutional investors are not the only investor cohort showing increased interest in Bitcoin. The number of Bitcoin wallets holding non-zero amounts of BTC hit an all-time high on Jan. 2. There are over 51.6 million Bitcoin wallets holding non-zero amounts.

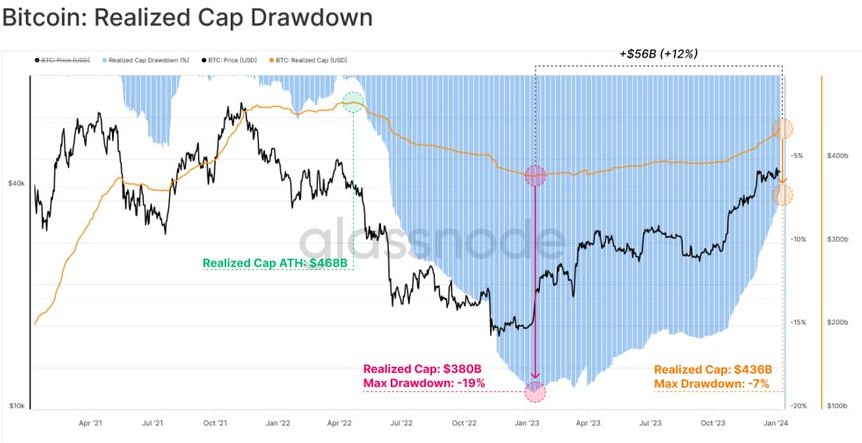

Not only are there more Bitcoin wallets than ever before, but because of consistent month-over-month price growth, BTC’s realized cap increased. The realized cap value on Jan. 8 was $436 billion, which is only 7% shy of the all-time high.

The spike in non-zero wallets and increased realized cap highlights renewed bullish optimism.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] There you can find 8096 additional Info to that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Here you can find 17343 more Info to that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Here you can find 15808 additional Info on that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] There you will find 94757 additional Information to that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/markets/1804/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/markets/1804/ […]