Bitcoin braces for Fed’s Powell as $61K BTC price eyes next breakout

BTC price frustration may find some relief as Bitcoin traders’ hopes increase of the Fed cementing interest rate cuts at the Jackson Hole summit.

Bitcoin (BTC) circled intraday highs on Aug. 23 as markets braced for the week’s key macro event.

Bitcoin seeks liquidity cues from Jackson Hole speech

Data from Cointelegraph Markets Pro and TradingView showed $61,000 returning in the hours before the United States Federal Reserve’s Jackson Hole annual symposium.

The centerpiece of this will be a speech by Chair Jerome Powell. Set for 10am Eastern Time, the address is being closely watched by traders for signals over financial policy easing.

As Cointelegraph reported, markets continue to price in a 100% chance of interest rate cuts — a key bullish event for crypto and risk assets — beginning in September.

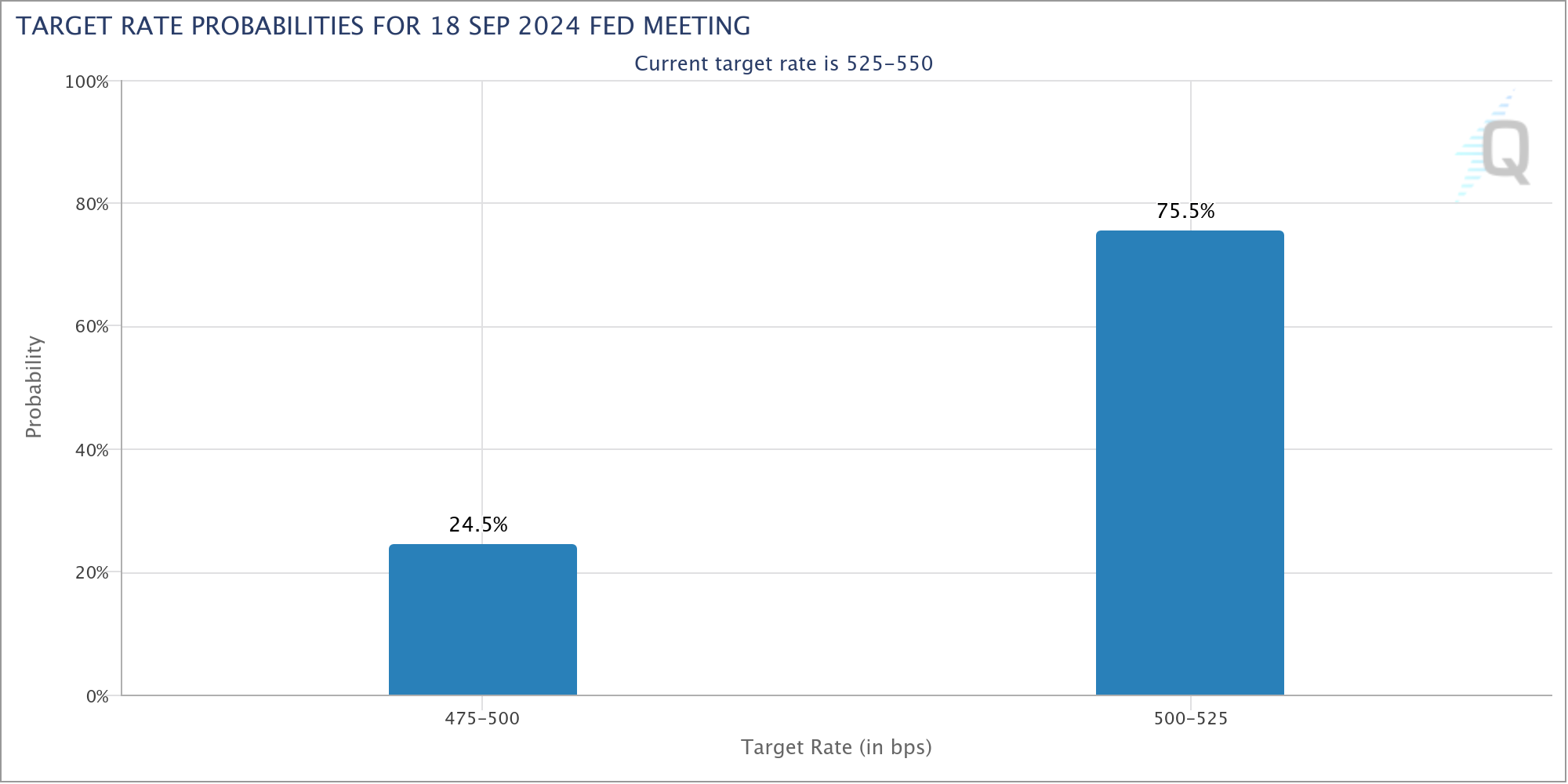

“The question is no longer whether the Fed will cut rates or not,” trading resource The Kobeissi Letter wrote in part of its recent X commentary.

“The question is will they cut rates by 25 or 50 basis points in September.”

The latest data from CME Group’s FedWatch Tool confirm the odds favoring a smaller 0.25% rate cut.

Some, however, see little chance of a surprise from Powell himself, with expectations for Jackson Hole baked in.

“Even though I think the Fed’s base case is they’ll move a quarter, and my base case is they’ll move a quarter, I don’t think they’ll feel the need to provide any guidance around that this far out,” former Fed official Lou Crandall told CNBC on Aug. 22.

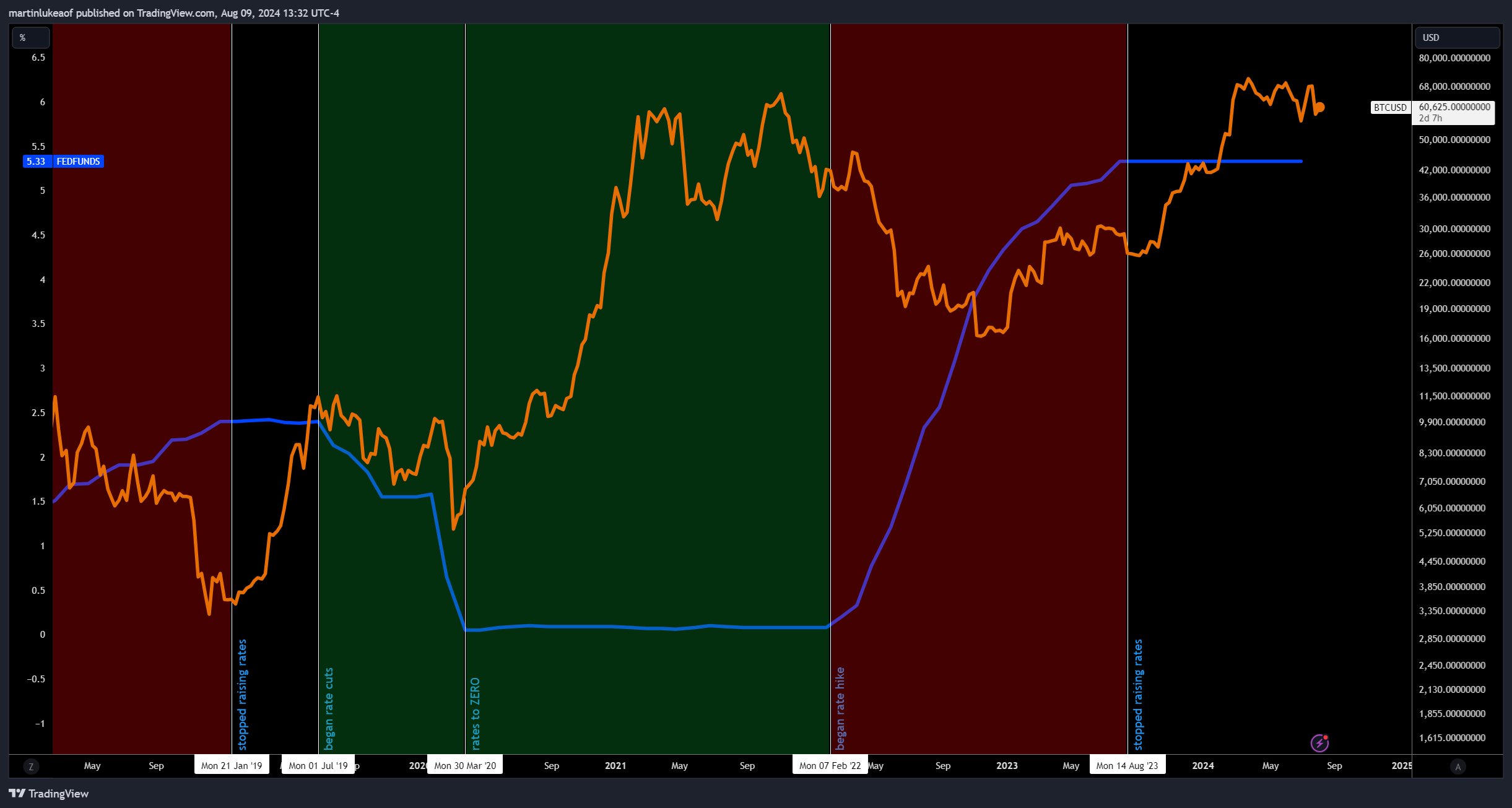

While ostensibly a catalyst for risk-asset liquidity, rate cuts do not guarantee a knee-jerk BTC price reaction, historical data shows.

Analyzing Bitcoin’s behavior during the Fed’s last cutting cycle in 2019, trader Luke Martin, host of the Stacks Podcast, noted that it took the subsequent COVID-19 cross-market crash to spark a bull market.

“Last time Fed cut rates was 2019 which actually coincided with slight price decline. Then came the Covid crash, cuts to zero, and money printer fueled bull run,” he summarized.

Waiting on a BTC price breakout

BTC/USD meanwhile continued to range within an increasingly narrow zone with $62,000 as key resistance.

Related: Bitcoin macro top due in 2025 despite ‘confusing’ March all-time high

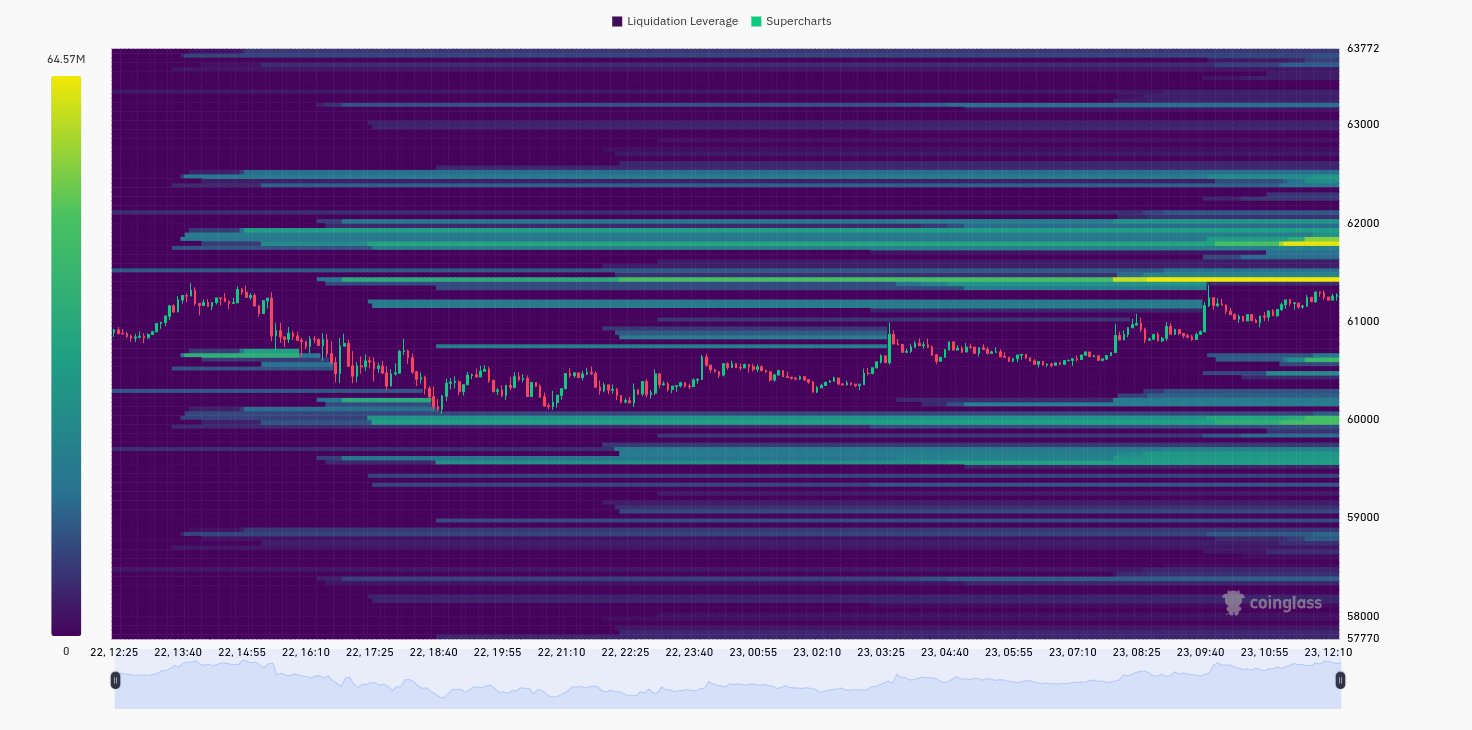

Data from monitoring resource CoinGlass shows an additional block of ask liquidity at $61,435 appearing on the day, keeping the price flat.

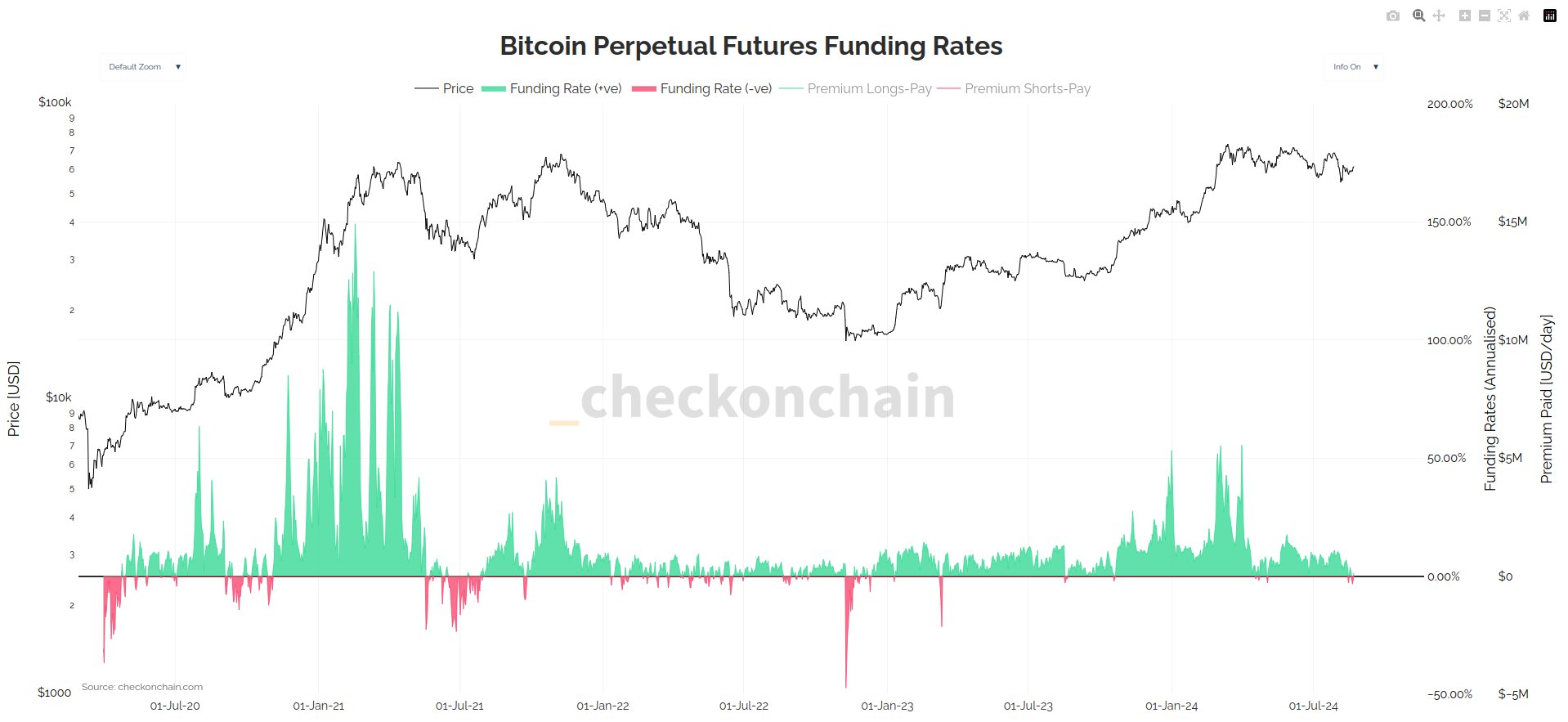

“This is not what an over-leveraged, long-biased, degenerate Bitcoin market looks like,” Checkmate, the pseudonymous creator of onchain analytics resource Checkonchain, commented on X this week.

On 4-hour timeframes, traders noted, BTC/USD nonetheless sought to overcome resistance in the form of the 200-period simple moving average.

“A close above this level and Bitcoin will pump to $64K-$65K If it gets rejected, expect some consolidation,” popular trader Elja forecast in part of an X post on the topic.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses