Good news means bad news? Bitcoin shrugs off weakest US dollar of 2024

Bitcoin price action seems uninterested in rapidly declining US dollar strength, as a shock payroll revision adds to DXY pressures.

Bitcoin (BTC) refused to budge at the Aug. 21 Wall Street open while a “massive” United States employment revision boosted bullish risk-asset bets.

US employment drawdown puts focus on Fed

Data from Cointelegraph Markets Pro and TradingView showed flat BTC price action continuing despite a bombshell drawdown in US nonfarm payroll figures.

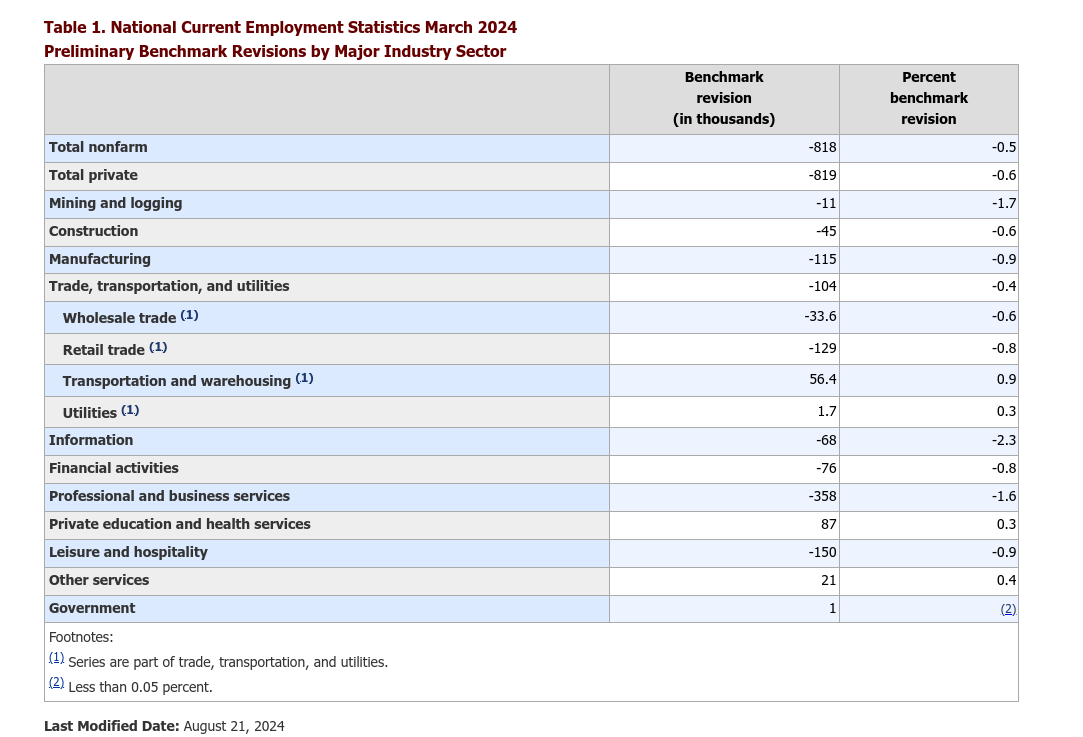

According to data from the US Bureau of Labor Statistics (BLS), these were revised down by 818,000 on the day. The period from April 2023 through March 2024 thus overstated payrolls by an average of 68,000 per month.

“Eyes on $DXY, Bond Yields and the indexes to see how the market (and Crypto) like this,” popular trader Daan Crypto Trades wrote in part of a reaction on X.

The implication of the changes is that the US jobs market performed worse than originally stated, with weakness feeding the need for the Federal Reserve to ease policy faster and sooner.

As Cointelegraph reported, Aug. 23 will see Fed Chair Jerome Powell likely address the topic during his speech at the annual Jackson Hole symposium.

The US dollar provided an early taste of the repercussions, meanwhile, dropping to its lowest levels of 2024 yet in what should be a boon for crypto and risk assets.

“The last time the Dollar Index was trading this low was Dec. 2023. But the Dollar Index is actually still relatively high,” Peter Schiff, chief economist and global strategist at Europac, noted in part of a recent X post.

The US dollar Index (DXY) to which Schiff referred stood at 101.18 at the time of writing, down 0.2% on the day and 3% in August so far.

Traditionally, DXY is inversely correlated with BTC/USD, making the current market setup all the more frustrating for Bitcoin bulls.

“Against this weak dollar backdrop BTC has fallen from 70k to 59k currently. The USD cycle peak was in Q3 2023, its down 12% since,” X account Tom Capital summarized to followers, adding that the drop in DXY echoed the Global Financial Crisis of 2008.

Bitcoin remains the sick man of risk assets

Rangebound BTC/USD meanwhile offered traders little to go on.

Related: Bitcoin macro top due in 2025 despite ‘confusing’ March all-time high

Stuck below $60,000 on daily timeframes, Bitcoin struggled on the day, with gold and equities still outperforming.

Analyzing Bitcoin’s ratio to gold, popular trader Peter Brandt underscored just how much more strength was needed to flip the status quo in bulls’ favor.

“The ratio is presently at 23.4. BTC remains below the 2021 high,” part of accompanying commentary on an X post explained.

“Ratio has room to decline to sub 20. An advance above 32.5 is needed to declare BTC/GC in bull trend.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses