Solana price hits a wall at $150 as several headwinds intensify

SOL price struggles to gain upward traction as DApp volumes plunge, spot ETF odds dwindle, and memecoins fail to rally.

Solana’s native token, SOL (SOL), has struggled to close above $150 since Aug. 11. Despite showing consistent buying activity each time it tests the $125 support, SOL remains largely flat compared to four months ago.

Even more troubling is the fact that the Solana network has experienced significant growth in deposits and activity during this period, but this expansion has yet to be reflected in SOL price. Let’s examine the factors keeping SOL’s price below $150 and what needs to occur for it to surpass this level.

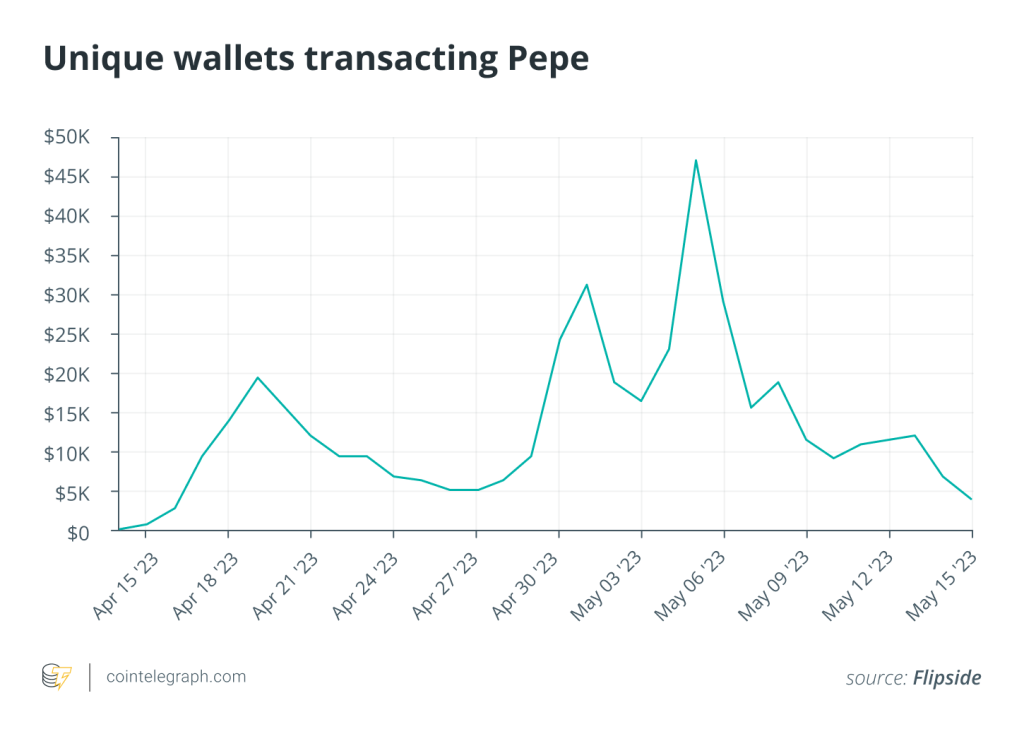

Solana’s memecoin frenzy seems to have faded

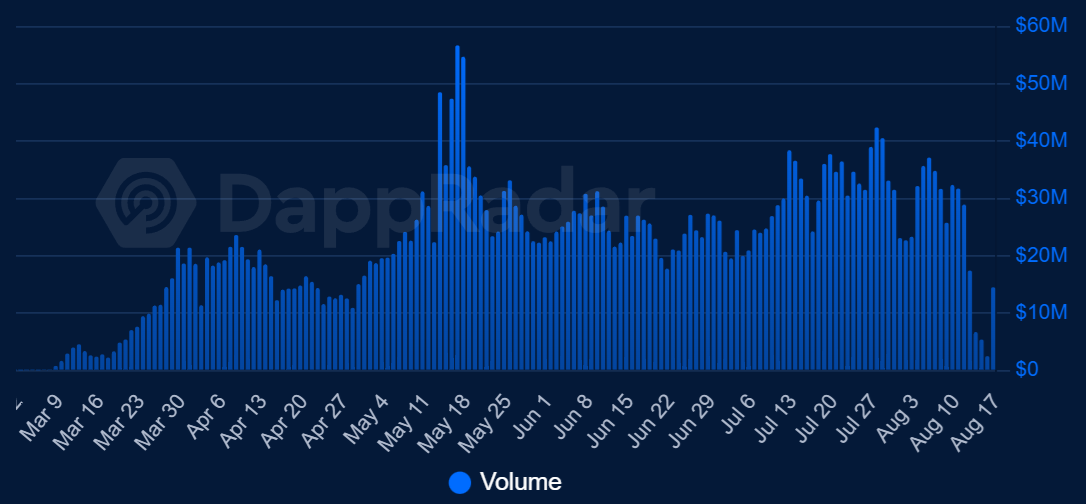

Some market participants argue that SOL’s recent hype was driven by a few airdrops, memecoins, and pump.tun activity, which proved unsustainable. Over the past thirty days, notable price corrections include Dogwifhat (WIF) with a 38% drop, BONK losing 39%, Lido (LDO) declining 43%, POPCAT falling 48%, and Wormhole (W) decreasing 31%. According to DappRadar, pump.fun volume has dropped 44% over the past week, now totaling $133.5 million.

Pump.fun daily volume, USD. Source: DappRadar

Data from Dune Analytics shows that 98.6% of pump.fun memecoins failed to list on a decentralized exchange, which requires a minimum of $69,000 in liquidity. Nevertheless, this has not deterred investors as the pump.fun activities have generated $6.3 million in fees over the past week. In comparison, AAVE accumulated $4.4 million in fees during the same period, despite holding $11.72 billion in total value locked (TVL).

Indeed, only 3% of traders have made more than $1,000 from memecoin trading, according to a recent analysis by @Adam_Tehc. Messari data engineer Mike Kremer argues that memecoins are “far more destructive” due to their “lack of real value or utility,” unlike decentralized finance (DeFi) tokens. Kremer adds that “insiders or cartels create tokens, […] hype them up, and lure retail investors.” Essentially, memecoins, a significant driver of SOL demand, are now being scrutinized.

However, it would be shortsighted to evaluate investor interest in SOL solely based on memecoin activity. The Jito liquid staking application and the decentralized exchange Raydium have seen increased fees over the last 30 days. In terms of TVL, the Solana Network leaderboard also includes the lending and liquidity platform Kamino, the Marinade staking solution, and Jupiter, a decentralized exchange that offers perpetual contracts.

Declining Solana network activity and reduced spot ETF odds

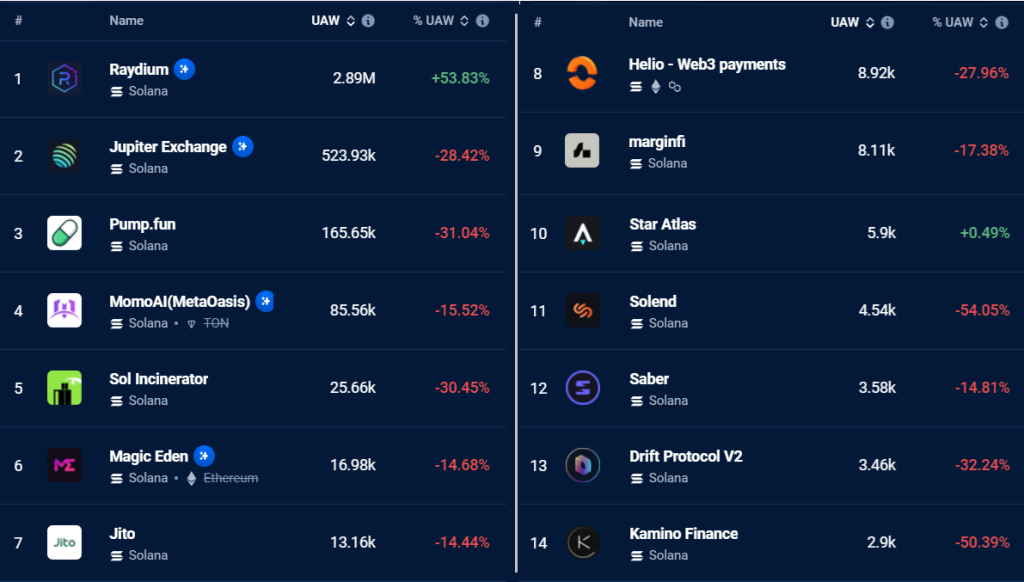

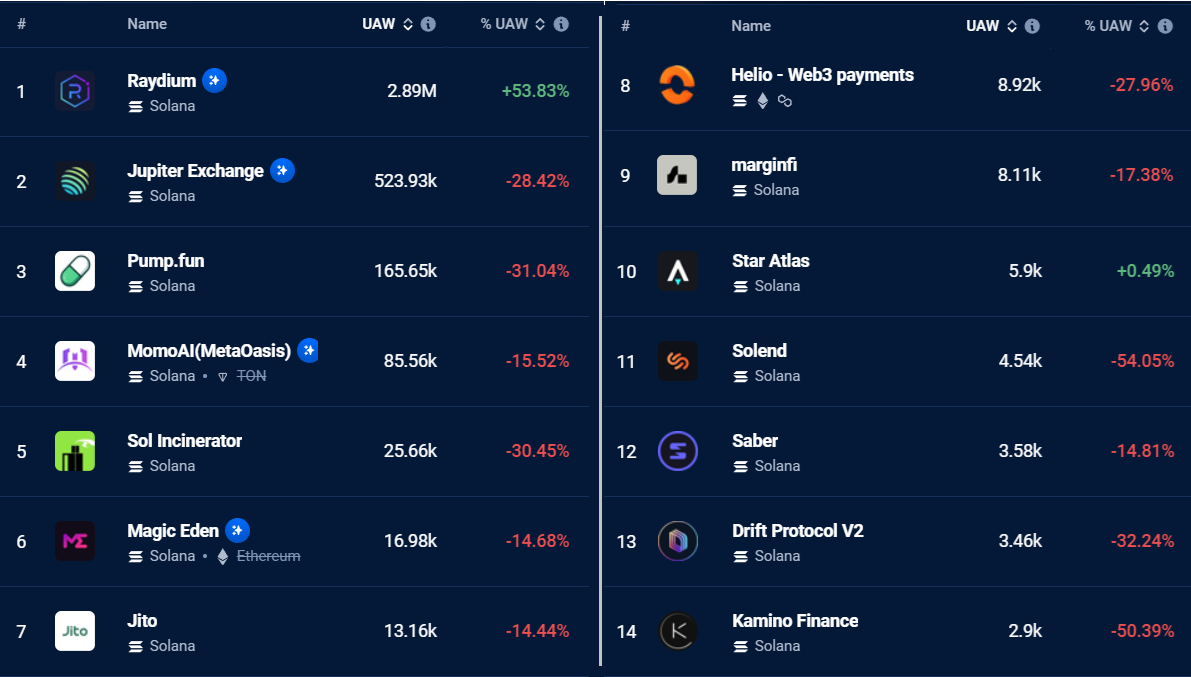

Solana top DApps in terms of 7-day active addresses. Source: DappRadar

Unfortunately for Solana, data reveals that the decline in activity has affected all sectors, including DeFi, NFT marketplaces, Web3 infrastructure, gaming, gambling, and collectibles. In contrast, the top three DApps on BNB Chain—Treasure Ship Game, Move Stake, and PancakeSwap—gained 7% more users over the same 7-day period. This evidence suggests that Solana network activity is waning, which negatively impacts SOL token performance.

Related: Malicious ‘bull checker’ Chrome extension found targeting Solana users

Additionally, part of the recent surge that pushed SOL’s price above $185 in late July was fueled by anticipation surrounding multiple requests for spot exchange-traded fund (ETF) listings in the United States. However, excitement diminished after the US Securities and Exchange Commission (SEC) reportedly raised concerns about SOL’s potential classification as a security, according to The Block. As a result, Cboe Global Markets decided not to proceed with the 19b-4 forms, although this does not definitively close the door on Solana ETF prospects.

Nate Geraci, President of the ETFStore, doubts that a spot Solana ETF will be approved under the current US government, citing the need for a “legitimate crypto regulatory framework.” Consequently, despite Cboe’s discussions with the SEC, analysts remain skeptical about the approval of other crypto ETFs in the US due to the lack of clear regulatory guidelines. As a result, a major potential catalyst for SOL’s price has been postponed.

Responses