Bitcoin seen following stocks as BTC price gains 2.5% to attack $61K

Bitcoin stands to gain from increasingly risk-on macro sentiment, but can it shift a stubborn BTC price range?

Bitcoin (BTC) sought weekly highs on Aug. 20 as a push above $61,000 brought hopes of a BTC price comeback.

Macro mood can give Bitcoin new “push”

Data from Cointelegraph Markets Pro and TradingView showed local highs of $61,424 on Bitstamp, with BTC/USD up 2.4% on the day.

Bitcoin struck a clear contrast to the weekly open overnight, and analyzing the broader macro picture, commentators were optimistic.

In its latest market bulletin sent to Telegram channel subscribers, trading firm QCP Capital eyed “re-leveraging” among stocks traders as one ingredient fueling an equities rally.

“Corporate share buybacks have surged to $1.15 trillion this year. Goldman Sachs’ trading unit has seen record client demand for dips,” it reported.

Earlier, Cointelegraph flagged a lack of correlation between crypto and equities, while gold hit fresh all-time highs last week.

“Risk-on sentiment could extend to crypto and gold, pushing BTC higher given the strong demand for topside calls,” QCP suggested.

Further cues on United States financial policy easing are slated to come courtesy of the Federal Reserve at its annual Jackson Hole symposium at the end of the week.

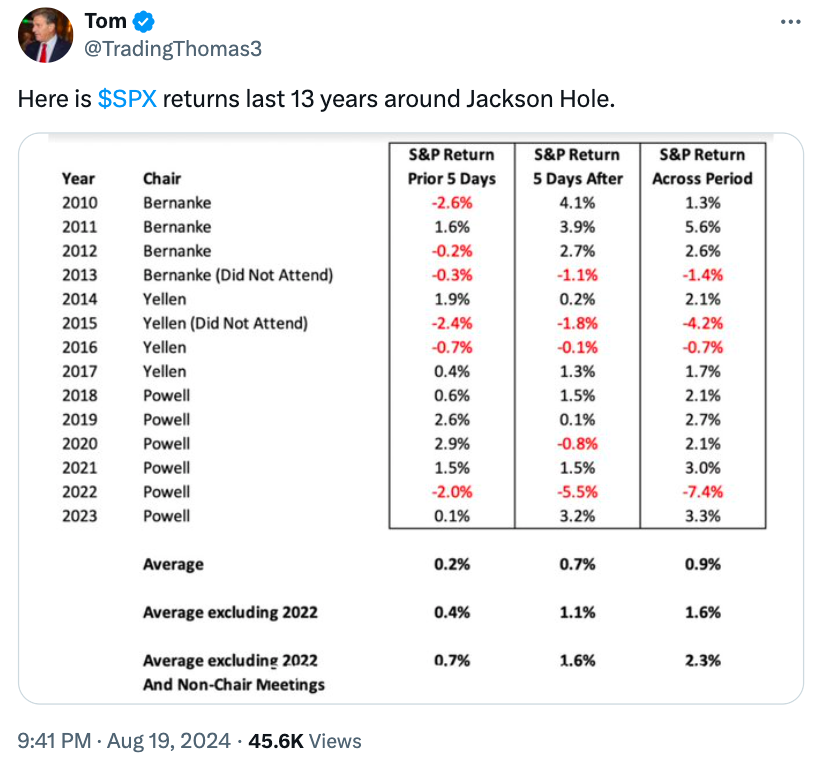

Comparisons circulating on social media show that the S&P 500 in particular tends to rally after Jackson Hole events.

BTC price range reigns supreme

Turning to Bitcoin itself, an air of caution prevailed, with price still lodged in a downward-sloping range, unable to break toward key resistance near $70,000.

Related: 3 reasons why Bitcoin won’t be ‘boring’ in September

“Bitcoin squeezed through the 59.5k level over night, taking liquidity above the weekend highs and hitting the upper trendline,” popular trader Mark Cullen summarized alongside a chart showing the various range elements.

“Can $BTC hold 60K now and make a run for the liquidity above the early Aug highs in the low to mid 60Ks?”

Trader and analyst Rekt Capital eyed ongoing copycat moves by price since March’s record high.

“History has repeated itself,” he wrote about the range.

“Bitcoin is now trying to confirm a reclaim of the Channel Bottom as support. Weekly Candle Close above the Channel Bottom would be bullish.”

Credible Crypto was meanwhile among those seeing sideways price action holding firm in the short term.

“Still expect the green zone to hold for now if we do get that but this range may take a bit longer to play out at the same time,” part of his latest X content read, with a chart featuring support at $56,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses