Mt. Gox just moved $3B in Bitcoin; here’s why the price barely blipped

Crypto analysts say Mt. Gox holders are more likely committed to HODLing, and the market thinks so too.

Bitcoin traders may have finally grown tired of Mt. Gox Bitcoin “FUD,” with markets barely reacting to a new $3 billion transfer from a Mt. Gox-affiliated wallet.

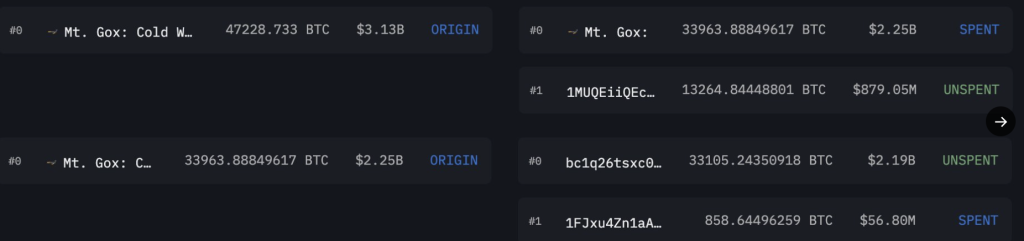

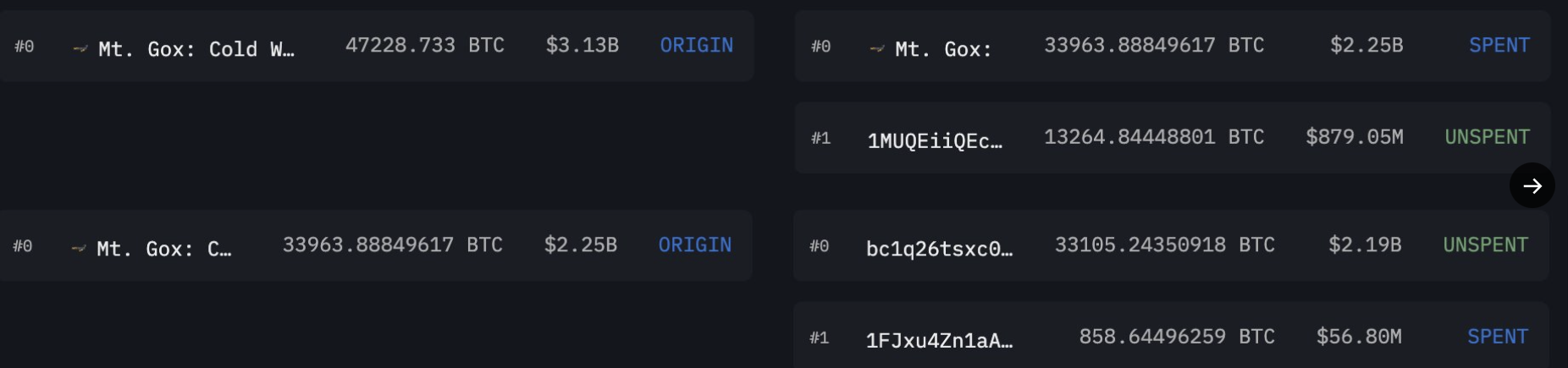

On July 30, Mt. Gox moved around 47,229 Bitcoin (BTC) to 3 “unknown wallets” over a three-hour period, according to Lookonchain. Over the period, Bitcoin stayed above $66,000 but briefly fell into the $65,000 range.

At the time of publication, Bitcoin is trading at $66,105, as per CoinMarketCap data.

Crypto commentators told Cointelegraph they hadn’t seen any signs of increased sell pressure, suggesting that Mt. Gox credits are likely “here to HODL.”

“If you think about the users that were owed Bitcoin from Mt. Gox these were OG Bitcoiners, these were the people buying Bitcoin 5 to 10 years ago, that believed in the industry and believed in the asset,” Collective Shift founder Ben Simpson told Cointelegraph.

“The Mt. Gox holders are here to HODL,” Simpson added.

“These Mt gox moves became so usual that market doesn’t give a flying fuck lmao,” pseudonymous crypto trader “exit pump” wrote in a July 30 X post.

Swyftx lead market analyst Pav Hundal told Cointelegraph that “the next few weeks will be very interesting to see unfold.”

“It seems like the market is taking the news well so far,” Hundal added.

Related: ‘Feels surreal’ — Bitcoin sticks to $68K as market ignores 200K BTC US election pledge

Over 41.5%, or 59,000 Bitcoin of the total of 141,686 BTC, has been redistributed to creditors of Mt. Gox since July 5.

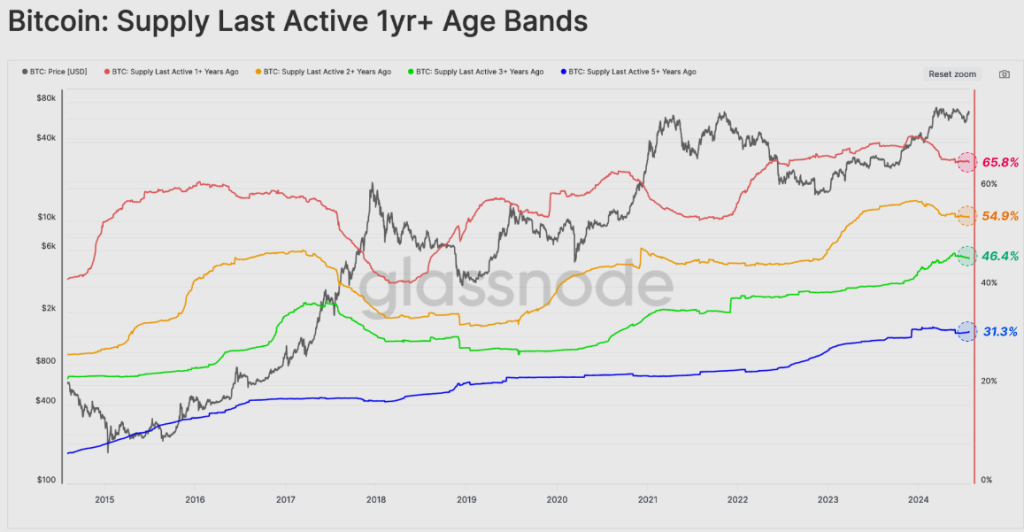

Crypto analysis firm Glassnode is also under the impression that only a small portion of Mt. Gox creditors are planning to sell.

“Creditors opted to receive BTC, rather than fiat, which was new in Japanese bankruptcy law […] As such, it is relatively likely that only a subset of these distributed coins will be truly sold onto the market,” Glassnode stated.

Simpson explained that the market had already “priced in the fact that these Mt. Gox holders would get their assets back and most likely not sell.”

“Unlike recent events like the German government forcing all their Bitcoin, they don’t need Bitcoin, they need cash, so two completely different scenarios so yeah the Mt. Gox holders are here to HODL,” Simpson added.

Responses