Solana price rallies to $193 but is it SOL’s local top?

Solana price has been on a tear lately, but critics say the network’s dependency on memecoins are a warning sign to keep an eye on.

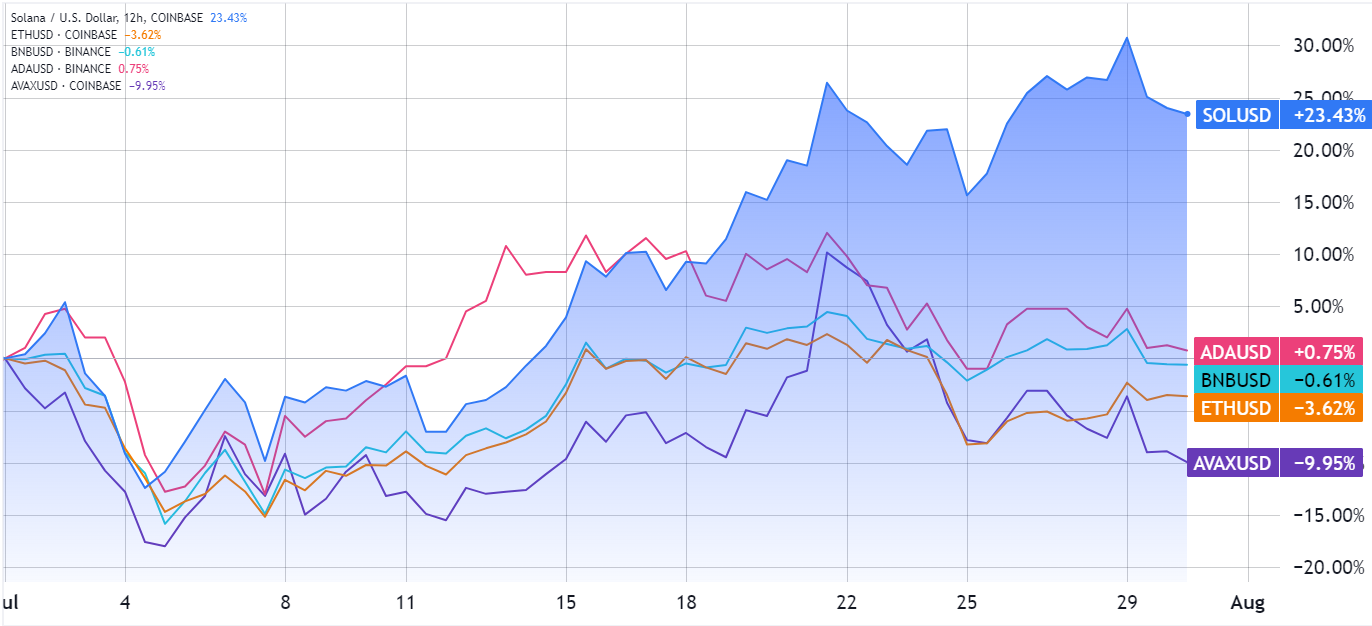

Solana’s native token SOL (SOL) experienced a remarkable 16% surge between July 25 and July 29, reaching $193.92, its highest level in four months. However, the $190 resistance was stronger than anticipated, triggering a 8% correction down to the current $179 level.

Despite this short-term setback, SOL price gained 23.5% in July, though some traders fear that the downtrend may have only just begun.

Are memecoin rallies a sustainable path for Solana’s network growth?

To determine if the SOL price is likely to correct further, it’s important to analyze whether the recent outperformance was justified—whether it was based on fundamentals, hype, or easily inflated metrics. For instance, investors placed significant hope on SOL’s exchange-traded fund (ETF) approval after Ether (ETH) instruments were approved for trading in the United States on July 22. The US Securities and Exchange Commission (SEC) has set the final deadline for the SOL ETF ruling in March 2025.

Speaking at the Bitcoin Conference on July 25 in Nashville, BlackRock’s head of digital assets stated that “there is very little interest today” beyond Bitcoin and Ether among their client base. This opinion is not unanimous, as asset manager Franklin Templeton offers a very optimistic view for a SOL ETF based on “major adoption” and successful overcoming of “technological growing pains.” While it may be premature to bet on the outcome of the SEC’s decision, traders’ anticipation explains part of SOL’s recent gains.

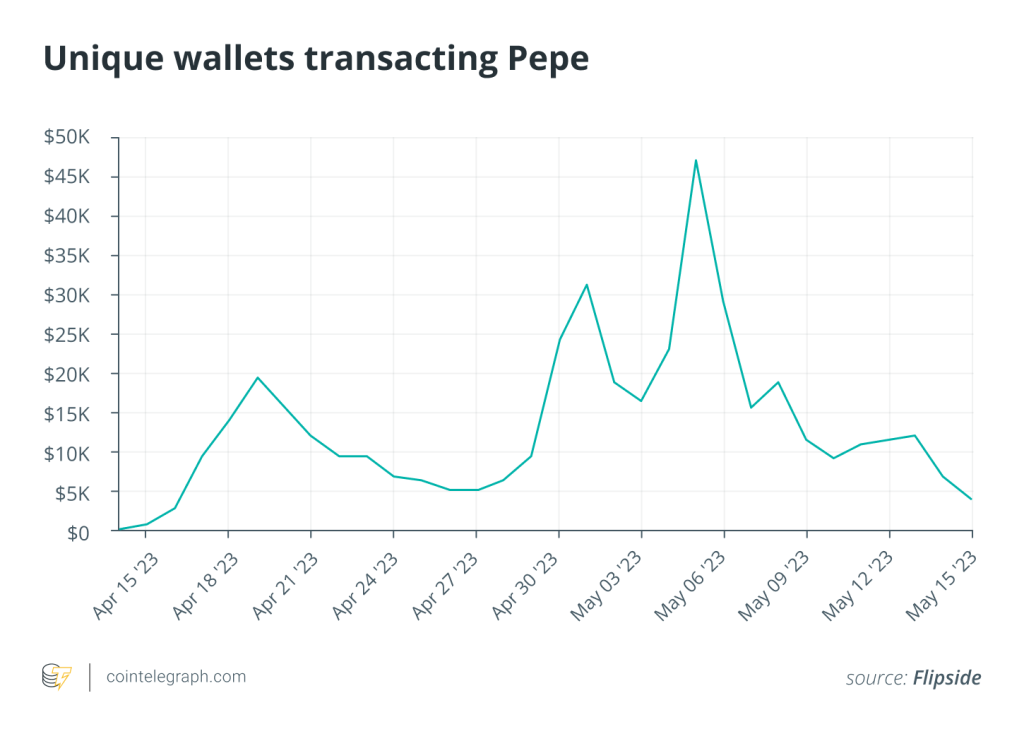

Memecoins, particularly those using incentivized-liquidity and trading platforms like Pump.fun, have also driven Solana network’s volumes and revenue gains. The platform promises an easy and instant way to launch tradable tokens using a “fair-launch” methodology with no presale or team allocation, automated market making, and incentivized burn mechanisms.

Pump.fun fees totaled $25.8 million in the past 30 days, according to DefiLlama, surpassing Bitcoin’s protocol $24.4 million paid to miners in the same period. Additionally, the number of unique addresses engaging with Pump.fun reached an impressive 219,070 over the past week, compared to BNB Chain’s PancakeSwap with 118,750 and Ethereum’s Uniswap at 132,010 users in the same period, according to DappRadar data.

Investors question Solana’s heavy dependence on memecoins, including Dogwifhat (WIF), Bonk (BONK), Book of Meme (BOME), and Cat in a Dog’s World (MEW). However, this criticism overlooks Solana’s SPL tokens like Jupiter (JUP), Lido DAO (LDO), Helium (HNT), and Raydium (RAY), which showcase the network’s benefits based on validators that require significantly more technology to support the high-output base layer.

Solana stagnant TVL and excessive power on validators’ hands pose a risk

Some other concerns about Solana might have caused investors to reconsider if the $190 SOL price was justified. The network’s total value locked (TVL) has stagnated near 30.5 million SOL for the past two weeks after peaking at 32.1 million SOL on July 5, the highest level since October 2022, according to DefiLlama data. Competitors such as Ethereum face a similar issue, with its current 18.0 million ETH TVL flat since July 14. Additionally, BNB Chain’s TVL has stagnated at 8.5 million BNB (BNB) over the same period.

Lastly, there is valid criticism regarding the maximal extractable value (MEV) problem affecting the Solana network. Validators can profit by including, reordering, or excluding transactions when producing a new block. Although competing chains face similar issues, this problem is exacerbated on Solana since it has “no built-in mempool,” forcing players to use “out-of-protocol infrastructure,” according to Flip Research’s article on X.

Related: SEC backs down on claiming SOL, ADA, MATIC, other tokens are securities in Binance suit

Flip Research’s article asserts that Solana decentralized applications metrics “are significantly overstated” because the “vast majority of tokens traded are ultra high volatility, low liquidity memecoins,” creating a “juicy attack surface for MEVs to extract value.” The article concludes that the “vast majority of organic users are losing money onchain to bad actors at a rapid pace,” which seems unsustainable.

While it may be premature to deem SOL “overvalued from a fundamental perspective,” as the research article claims, traders currently in profit will likely reconsider their positions given the excessive uncertainty surrounding the network’s growth potential.

Responses